Howey Test and Cryptocurrencies: 'Every ICO Is a Security'

What Is the Howey Test?

To determine whether a transaction qualifies as a "investment contract" and thus qualifies as a security, the Howey Test refers to the U.S. Supreme Court cass: the Securities Act of 1933 and the Securities Exchange Act of 1934. According to the Howey Test, an investment contract exists when "money is invested in a common enterprise with a reasonable expectation of profits from others' efforts."

The test applies to any contract, scheme, or transaction. The Howey Test helps investors and project backers understand blockchain and digital currency projects. ICOs and certain cryptocurrencies may be found to be "investment contracts" under the test.

Understanding the Howey Test

The Howey Test comes from the 1946 Supreme Court case SEC v. W.J. Howey Co. The Howey Company sold citrus groves to Florida buyers who leased them back to Howey. The company would maintain the groves and sell the fruit for the owners. Both parties benefited. Most buyers had no farming experience and were not required to farm the land.

The SEC intervened because Howey failed to register the transactions. The court ruled that the leaseback agreements were investment contracts.

This established four criteria for determining an investment contract. Investing contract:

- An investment of money

- n a common enterprise

- With the expectation of profit

- To be derived from the efforts of others

In the case of Howey, the buyers saw the transactions as valuable because others provided the labor and expertise. An income stream was obtained by only investing capital. As a result of the Howey Test, the transaction had to be registered with the SEC.

Howey Test and Cryptocurrencies

Bitcoin is notoriously difficult to categorize. Decentralized, they evade regulation in many ways. Regardless, the SEC is looking into digital assets and determining when their sale qualifies as an investment contract.

The SEC claims that selling digital assets meets the "investment of money" test because fiat money or other digital assets are being exchanged. Like the "common enterprise" test.

Whether a digital asset qualifies as an investment contract depends on whether there is a "expectation of profit from others' efforts."

For example, buyers of digital assets may be relying on others' efforts if they expect the project's backers to build and maintain the digital network, rather than a dispersed community of unaffiliated users. Also, if the project's backers create scarcity by burning tokens, the test is met. Another way the "efforts of others" test is met is if the project's backers continue to act in a managerial role.

These are just a few examples given by the SEC. If a project's success is dependent on ongoing support from backers, the buyer of the digital asset is likely relying on "others' efforts."

Special Considerations

If the SEC determines a cryptocurrency token is a security, many issues arise. It means the SEC can decide whether a token can be sold to US investors and forces the project to register.

In 2017, the SEC ruled that selling DAO tokens for Ether violated federal securities laws. Instead of enforcing securities laws, the SEC issued a warning to the cryptocurrency industry.

Due to the Howey Test, most ICOs today are likely inaccessible to US investors. After a year of ICOs, then-SEC Chair Jay Clayton declared them all securities.

SEC Chairman Gensler Agrees With Predecessor: 'Every ICO Is a Security'

Howey Test FAQs

How Do You Determine If Something Is a Security?

The Howey Test determines whether certain transactions are "investment contracts." Securities are transactions that qualify as "investment contracts" under the Securities Act of 1933 and the Securities Exchange Act of 1934.

The Howey Test looks for a "investment of money in a common enterprise with a reasonable expectation of profits from others' efforts." If so, the Securities Act of 1933 and the Securities Exchange Act of 1934 require disclosure and registration.

Why Is Bitcoin Not a Security?

Former SEC Chair Jay Clayton clarified in June 2018 that bitcoin is not a security: "Cryptocurrencies: Replace the dollar, euro, and yen with bitcoin. That type of currency is not a security," said Clayton.

Bitcoin, which has never sought public funding to develop its technology, fails the SEC's Howey Test. However, according to Clayton, ICO tokens are securities.

A Security Defined by the SEC

In the public and private markets, securities are fungible and tradeable financial instruments. The SEC regulates public securities sales.

The Supreme Court defined a security offering in SEC v. W.J. Howey Co. In its judgment, the court defines a security using four criteria:

- An investment contract's existence

- The formation of a common enterprise

- The issuer's profit promise

- Third-party promotion of the offering

Read original post.

More on Web3 & Crypto

Olga Kharif

3 years ago

A month after freezing customer withdrawals, Celsius files for bankruptcy.

Alex Mashinsky, CEO of Celsius, speaks at Web Summit 2021 in Lisbon.

Celsius Network filed for Chapter 11 bankruptcy a month after freezing customer withdrawals, joining other crypto casualties.

Celsius took the step to stabilize its business and restructure for all stakeholders. The filing was done in the Southern District of New York.

The company, which amassed more than $20 billion by offering 18% interest on cryptocurrency deposits, paused withdrawals and other functions in mid-June, citing "extreme market conditions."

As the Fed raises interest rates aggressively, it hurts risk sentiment and squeezes funding costs. Voyager Digital Ltd. filed for Chapter 11 bankruptcy this month, and Three Arrows Capital has called in liquidators.

Celsius called the pause "difficult but necessary." Without the halt, "the acceleration of withdrawals would have allowed certain customers to be paid in full while leaving others to wait for Celsius to harvest value from illiquid or longer-term asset deployment activities," it said.

Celsius declined to comment. CEO Alex Mashinsky said the move will strengthen the company's future.

The company wants to keep operating. It's not requesting permission to allow customer withdrawals right now; Chapter 11 will handle customer claims. The filing estimates assets and liabilities between $1 billion and $10 billion.

Celsius is advised by Kirkland & Ellis, Centerview Partners, and Alvarez & Marsal.

Yield-promises

Celsius promised 18% returns on crypto loans. It lent those coins to institutional investors and participated in decentralized-finance apps.

When TerraUSD (UST) and Luna collapsed in May, Celsius pulled its funds from Terra's Anchor Protocol, which offered 20% returns on UST deposits. Recently, another large holding, staked ETH, or stETH, which is tied to Ether, became illiquid and discounted to Ether.

The lender is one of many crypto companies hurt by risky bets in the bear market. Also, Babel halted withdrawals. Voyager Digital filed for bankruptcy, and crypto hedge fund Three Arrows Capital filed for Chapter 15 bankruptcy.

According to blockchain data and tracker Zapper, Celsius repaid all of its debt in Aave, Compound, and MakerDAO last month.

Celsius charged Symbolic Capital Partners Ltd. 2,000 Ether as collateral for a cash loan on June 13. According to company filings, Symbolic was charged 2,545.25 Ether on June 11.

In July 6 filings, it said it reshuffled its board, appointing two new members and firing others.

Rishi Dean

3 years ago

Coinbase's web3 app

Use popular Ethereum dapps with Coinbase’s new dapp wallet and browser

Tl;dr: This post highlights the ability to access web3 directly from your Coinbase app using our new dapp wallet and browser.

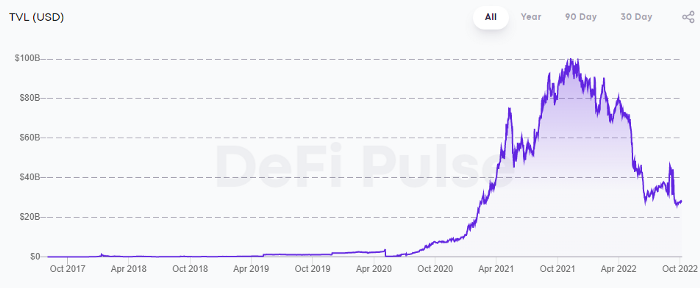

Decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) have gained popularity in the last year (DAOs). The total value locked (TVL) of DeFi investments on the Ethereum blockchain has grown to over $110B USD, while NFTs sales have grown to over $30B USD in the last 12 months (LTM). New innovative real-world applications are emerging every day.

Today, a small group of Coinbase app users can access Ethereum-based dapps. Buying NFTs on Coinbase NFT and OpenSea, trading on Uniswap and Sushiswap, and borrowing and lending on Curve and Compound are examples.

Our new dapp wallet and dapp browser enable you to access and explore web3 directly from your Coinbase app.

Web3 in the Coinbase app

Users can now access dapps without a recovery phrase. This innovative dapp wallet experience uses Multi-Party Computation (MPC) technology to secure your on-chain wallet. This wallet's design allows you and Coinbase to share the 'key.' If you lose access to your device, the key to your dapp wallet is still safe and Coinbase can help recover it.

Set up your new dapp wallet by clicking the "Browser" tab in the Android app's navigation bar. Once set up, the Coinbase app's new dapp browser lets you search, discover, and use Ethereum-based dapps.

Looking forward

We want to enable everyone to seamlessly and safely participate in web3, and today’s launch is another step on that journey. We're rolling out the new dapp wallet and browser in the US on Android first to a small subset of users and plan to expand soon. Stay tuned!

Jeff Scallop

3 years ago

The Age of Decentralized Capitalism and DeFi

DeCap is DeFi's killer app.

“Software is eating the world.” Marc Andreesen, venture capitalist

DeFi. Imagine a blockchain-based alternative financial system that offers the same products and services as traditional finance, but with more variety, faster, more secure, lower cost, and simpler access.

Decentralised finance (DeFi) is a marketplace without gatekeepers or central authority managing the flow of money, where customers engage directly with smart contracts running on a blockchain.

DeFi grew exponentially in 2020/21, with Total Value Locked (an inadequate estimate for market size) topping at $100 billion. After that, it crashed.

The accumulation of funds by individuals with high discretionary income during the epidemic, the novelty of crypto trading, and the high yields given (5% APY for stablecoins on established platforms to 100%+ for risky assets) are among the primary elements explaining this exponential increase.

No longer your older brothers DeFi

Since transactions are anonymous, borrowers had to overcollateralize DeFi 1.0. To borrow $100 in stablecoins, you must deposit $150 in ETH. DeFi 1.0's business strategy raises two problems.

Why does DeFi offer interest rates that are higher than those of the conventional financial system?;

Why would somebody put down more cash than they intended to borrow?

Maxed out on their own resources, investors took loans to acquire more crypto; the demand for those loans raised DeFi yields, which kept crypto prices increasing; as crypto prices rose, investors made a return on their positions, allowing them to deposit more money and borrow more crypto.

This is a bull market game. DeFi 1.0's overcollateralization speculation is dead. Cryptocrash sank it.

The “speculation by overcollateralisation” world of DeFi 1.0 is dead

At a JP Morgan digital assets conference, institutional investors were more interested in DeFi than crypto or fintech. To me, that shows DeFi 2.0's institutional future.

DeFi 2.0 protocols must handle KYC/AML, tax compliance, market abuse, and cybersecurity problems to be institutional-ready.

Stablecoins gaining market share under benign regulation and more CBDCs coming online in the next couple of years could help DeFi 2.0 separate from crypto volatility.

DeFi 2.0 will have a better footing to finally decouple from crypto volatility

Then we can transition from speculation through overcollateralization to DeFi's genuine comparative advantages: cheaper transaction costs, near-instant settlement, more efficient price discovery, faster time-to-market for financial innovation, and a superior audit trail.

Akin to Amazon for financial goods

Amazon decimated brick-and-mortar shops by offering millions of things online, warehouses by keeping just-in-time inventory, and back-offices by automating invoicing and payments. Software devoured retail. DeFi will eat banking with software.

DeFi is the Amazon for financial items that will replace fintech. Even the most advanced internet brokers offer only 100 currency pairings and limited bonds, equities, and ETFs.

Old banks settlement systems and inefficient, hard-to-upgrade outdated software harm them. For advanced gamers, it's like driving an F1 vehicle on dirt.

It is like driving a F1 car on a dirt road, for the most sophisticated players

Central bankers throughout the world know how expensive and difficult it is to handle cross-border payments using the US dollar as the reserve currency, which is vulnerable to the economic cycle and geopolitical tensions.

Decentralization is the only method to deliver 24h global financial markets. DeFi 2.0 lets you buy and sell startup shares like Google or Tesla. VC funds will trade like mutual funds. Or create a bundle coverage for your car, house, and NFTs. Defi 2.0 consumes banking and creates Global Wall Street.

Defi 2.0 is how software eats banking and delivers the global Wall Street

Decentralized Capitalism is Emerging

90% of markets are digital. 10% is hardest to digitalize. That's money creation, ID, and asset tokenization.

90% of financial markets are already digital. The only problem is that the 10% left is the hardest to digitalize

Debt helped Athens construct a powerful navy that secured trade routes. Bonds financed the Renaissance's wars and supply chains. Equity fueled industrial growth. FX drove globalization's payments system. DeFi's plans:

If the 20th century was a conflict between governments and markets over economic drivers, the 21st century will be between centralized and decentralized corporate structures.

Offices vs. telecommuting. China vs. onshoring/friendshoring. Oil & gas vs. diverse energy matrix. National vs. multilateral policymaking. DAOs vs. corporations Fiat vs. crypto. TradFi vs.

An age where the network effects of the sharing economy will overtake the gains of scale of the monopolistic competition economy

This is the dawn of Decentralized Capitalism (or DeCap), an age where the network effects of the sharing economy will reach a tipping point and surpass the scale gains of the monopolistic competition economy, further eliminating inefficiencies and creating a more robust economy through better data and automation. DeFi 2.0 enables this.

DeFi needs to pay the piper now.

DeCap won't be Web3.0's Shangri-La, though. That's too much for an ailing Atlas. When push comes to shove, DeFi folks want to survive and fight another day for the revolution. If feasible, make a tidy profit.

Decentralization wasn't meant to circumvent regulation. It circumvents censorship. On-ramp, off-ramp measures (control DeFi's entry and exit points, not what happens in between) sound like a good compromise for DeFi 2.0.

The sooner authorities realize that DeFi regulation is made ex-ante by writing code and constructing smart contracts with rules, the faster DeFi 2.0 will become the more efficient and safe financial marketplace.

More crucially, we must boost system liquidity. DeFi's financial stability risks are downplayed. DeFi must improve its liquidity management if it's to become mainstream, just as banks rely on capital constraints.

This reveals the complex and, frankly, inadequate governance arrangements for DeFi protocols. They redistribute control from tokenholders to developers, which is bad governance regardless of the economic model.

But crypto can only ride the existing banking system for so long before forming its own economy. DeFi will upgrade web2.0's financial rails till then.

You might also like

Aparna Jain

3 years ago

Negative Effects of Working for a FAANG Company

Consider yourself lucky if your last FAANG interview was rejected.

FAANG—Facebook, Apple, Amazon, Netflix, Google

(I know its manga now, but watch me not care)

These big companies offer many benefits.

large salaries and benefits

Prestige

high expectations for both you and your coworkers.

However, these jobs may have major drawbacks that only become apparent when you're thrown to the wolves, so it's up to you whether you see them as drawbacks or opportunities.

I know most college graduates start working at big tech companies because of their perceived coolness.

I've worked in these companies for years and can tell you what to expect if you get a job here.

Little fish in a vast ocean

The most obvious. Most billion/trillion-dollar companies employ thousands.

You may work on a small, unnoticed product part.

Directors and higher will sometimes make you redo projects they didn't communicate well without respecting your time, talent, or will to work on trivial stuff that doesn't move company needles.

Peers will only say, "Someone has to take out the trash," even though you know company resources are being wasted.

The power imbalance is frustrating.

What you can do about it

Know your WHY. Consider long-term priorities. Though riskier, I stayed in customer-facing teams because I loved building user-facing products.

This increased my impact. However, if you enjoy helping coworkers build products, you may be better suited for an internal team.

I told the Directors and Vice Presidents that their actions could waste Engineering time, even though it was unpopular. Some were receptive, some not.

I kept having tough conversations because they were good for me and the company.

However, some of my coworkers praised my candor but said they'd rather follow the boss.

An outdated piece of technology can take years to update.

Apple introduced Swift for iOS development in 2014. Most large tech companies adopted the new language after five years.

This is frustrating if you want to learn new skills and increase your market value.

Knowing that my lack of Swift practice could hurt me if I changed jobs made writing verbose Objective C painful.

What you can do about it

Work on the new technology in side projects; one engineer rewrote the Lyft app in Swift over the course of a weekend and promoted its adoption throughout the entire organization.

To integrate new technologies and determine how to combine legacy and modern code, suggest minor changes to the existing codebase.

Most managers spend their entire day in consecutive meetings.

After their last meeting, the last thing they want is another meeting to discuss your career goals.

Sometimes a manager has 15-20 reports, making it hard to communicate your impact.

Misunderstandings and stress can result.

Especially when the manager should focus on selfish parts of the team. Success won't concern them.

What you can do about it

Tell your manager that you are a self-starter and that you will pro-actively update them on your progress, especially if they aren't present at the meetings you regularly attend.

Keep being proactive and look for mentorship elsewhere if you believe your boss doesn't have enough time to work on your career goals.

Alternately, look for a team where the manager has more authority to assist you in making career decisions.

After a certain point, company loyalty can become quite harmful.

Because big tech companies create brand loyalty, too many colleagues stayed in unhealthy environments.

When you work for a well-known company and strangers compliment you, it's fun to tell your friends.

Work defines you. This can make you stay too long even though your career isn't progressing and you're unhappy.

Google may become your surname.

Workplaces are not families.

If you're unhappy, don't stay just because they gave you the paycheck to buy your first home and make you feel like you owe your life to them.

Many employees stayed too long. Though depressed and suicidal.

What you can do about it

Your life is not worth a company.

Do you want your job title and workplace to be listed on your gravestone? If not, leave if conditions deteriorate.

Recognize that change can be challenging. It's difficult to leave a job you've held for a number of years.

Ask those who have experienced this change how they handled it.

You still have a bright future if you were rejected from FAANG interviews.

Rejections only lead to amazing opportunities. If you're young and childless, work for a startup.

Companies may pay more than FAANGs. Do your research.

Ask recruiters and hiring managers tough questions about how the company and teams prioritize respectful working hours and boundaries for workers.

I know many 15-year-olds who have a lifelong dream of working at Google, and it saddens me that they're chasing a name on their resume instead of excellence.

This article is not meant to discourage you from working at these companies, but to share my experience about what HR/managers will never mention in interviews.

Read both sides before signing the big offer letter.

Sanjay Priyadarshi

3 years ago

A 19-year-old dropped out of college to build a $2,300,000,000 company in 2 years.

His success was unforeseeable.

2014 saw Facebook's $2.3 billion purchase of Oculus VR.

19-year-old Palmer Luckey founded Oculus. He quit journalism school. His parents worried about his college dropout.

Facebook bought Oculus VR in less than 2 years.

Palmer Luckey started Anduril Industries. Palmer has raised $385 million with Anduril.

The Oculus journey began in a trailer

Palmer Luckey, 19, owned the trailer.

Luckey had his trailer customized. The trailer had all six of Luckey's screens. In the trailer's remaining area, Luckey conducted hardware tests.

At 16, he became obsessed with virtual reality. Virtual reality was rare at the time.

Luckey didn't know about VR when he started.

Previously, he liked "portabilizing" mods. Hacking ancient game consoles into handhelds.

In his city, fewer portabilizers actively traded.

Luckey started "ModRetro" for other portabilizers. Luckey was exposed to VR headsets online.

Luckey:

“Man, ModRetro days were the best.”

Palmer Luckey used VR headsets for three years. His design had 50 prototypes.

Luckey used to work at the Long Beach Sailing Center for minimum salary, servicing diesel engines and cleaning boats.

Luckey worked in a USC Institute for Creative Technologies mixed reality lab in July 2011. (ICT).

Luckey cleaned the lab, did reports, and helped other students with VR projects.

Luckey's lab job was dull.

Luckey chose to work in the lab because he wanted to engage with like-minded folks.

By 2012, Luckey had a prototype he hoped to share globally. He made cheaper headsets than others.

Luckey wanted to sell an easy-to-assemble virtual reality kit on Kickstarter.

He realized he needed a corporation to do these sales legally. He started looking for names. "Virtuality," "virtual," and "VR" are all taken.

Hence, Oculus.

If Luckey sold a hundred prototypes, he would be thrilled since it would boost his future possibilities.

John Carmack, legendary game designer

Carmack has liked sci-fi and fantasy since infancy.

Carmack loved imagining intricate gaming worlds.

His interest in programming and computer science grew with age.

He liked graphics. He liked how mismatching 0 and 1 might create new colors and visuals.

Carmack played computer games as a teen. He created Shadowforge in high school.

He founded Id software in 1991. When Carmack created id software, console games were the best-sellers.

Old computer games have weak graphics. John Carmack and id software developed "adaptive tile refresh."

This technique smoothed PC game scrolling. id software launched 3-D, Quake, and Doom using "adaptive tile refresh."

These games made John Carmack a gaming star. Later, he sold Id software to ZeniMax Media.

How Palmer Luckey met Carmack

In 2011, Carmack was thinking a lot about 3-D space and virtual reality.

He was underwhelmed by the greatest HMD on the market. Because of their flimsiness and latency.

His disappointment was partly due to the view (FOV). Best HMD had 40-degree field of view.

Poor. The best VR headset is useless with a 40-degree FOV.

Carmack intended to show the press Doom 3 in VR. He explored VR headsets and internet groups for this reason.

Carmack identified a VR enthusiast in the comments section of "LEEP on the Cheap." "PalmerTech" was the name.

Carmack approached PalmerTech about his prototype. He told Luckey about his VR demos, so he wanted to see his prototype.

Carmack got a Rift prototype. Here's his May 17 tweet.

John Carmack tweeted an evaluation of the Luckey prototype.

Dan Newell, a Valve engineer, and Mick Hocking, a Sony senior director, pre-ordered Oculus Rift prototypes with Carmack's help.

Everyone praised Luckey after Carmack demoed Rift.

Palmer Luckey received a job offer from Sony.

It was a full-time position at Sony Computer Europe.

He would run Sony’s R&D lab.

The salary would be $70k.

Who is Brendan Iribe?

Brendan Iribe started early with Startups. In 2004, he and Mike Antonov founded Scaleform.

Scaleform created high-performance middleware. This package allows 3D Flash games.

In 2011, Iribe sold Scaleform to Autodesk for $36 million.

How Brendan Iribe discovered Palmer Luckey.

Brendan Iribe's friend Laurent Scallie.

Laurent told Iribe about a potential opportunity.

Laurent promised Iribe VR will work this time. Laurent introduced Iribe to Luckey.

Iribe was doubtful after hearing Laurent's statements. He doubted Laurent's VR claims.

But since Laurent took the name John Carmack, Iribe thought he should look at Luckey Innovation. Iribe was hooked on virtual reality after reading Palmer Luckey stories.

He asked Scallie about Palmer Luckey.

Iribe convinced Luckey to start Oculus with him

First meeting between Palmer Luckey and Iribe.

The Iribe team wanted Luckey to feel comfortable.

Iribe sought to convince Luckey that launching a company was easy. Iribe told Luckey anyone could start a business.

Luckey told Iribe's staff he was homeschooled from childhood. Luckey took self-study courses.

Luckey had planned to launch a Kickstarter campaign and sell kits for his prototype. Many companies offered him jobs, nevertheless.

He's considering Sony's offer.

Iribe advised Luckey to stay independent and not join a firm. Iribe asked Luckey how he could raise his child better. No one sees your baby like you do?

Iribe's team pushed Luckey to stay independent and establish a software ecosystem around his device.

After conversing with Iribe, Luckey rejected every job offer and merger option.

Iribe convinced Luckey to provide an SDK for Oculus developers.

After a few months. Brendan Iribe co-founded Oculus with Palmer Luckey. Luckey trusted Iribe and his crew, so he started a corporation with him.

Crowdfunding

Brendan Iribe and Palmer Luckey launched a Kickstarter.

Gabe Newell endorsed Palmer's Kickstarter video.

Gabe Newell wants folks to trust Palmer Luckey since he's doing something fascinating and answering tough questions.

Mark Bolas and David Helgason backed Palmer Luckey's VR Kickstarter video.

Luckey introduced Oculus Rift during the Kickstarter campaign. He introduced virtual reality during press conferences.

Oculus' Kickstarter effort was a success. Palmer Luckey felt he could raise $250,000.

Oculus raised $2.4 million through Kickstarter. Palmer Luckey's virtual reality vision was well-received.

Mark Zuckerberg's Oculus discovery

Brendan Iribe and Palmer Luckey hired the right personnel after a successful Kickstarter campaign.

Oculus needs a lot of money for engineers and hardware. They needed investors' money.

Series A raised $16M.

Next, Andreessen Horowitz partner Brain Cho approached Iribe.

Cho told Iribe that Andreessen Horowitz could invest in Oculus Series B if the company solved motion sickness.

Mark Andreessen was Iribe's dream client.

Marc Andreessen and his partners gave Oculus $75 million.

Andreessen introduced Iribe to Zukerberg. Iribe and Zukerberg discussed the future of games and virtual reality by phone.

Facebook's Oculus demo

Iribe showed Zuckerberg Oculus.

Mark was hooked after using Oculus. The headset impressed him.

The whole Facebook crew who saw the demo said only one thing.

“Holy Crap!”

This surprised them all.

Mark Zuckerberg was impressed by the team's response. Mark Zuckerberg met the Oculus team five days after the demo.

First meeting Palmer Luckey.

Palmer Luckey is one of Mark's biggest supporters and loves Facebook.

Oculus Acquisition

Zuckerberg wanted Oculus.

Brendan Iribe had requested for $4 billion, but Mark wasn't interested.

Facebook bought Oculus for $2.3 billion after months of drama.

After selling his company, how does Palmer view money?

Palmer loves the freedom money gives him. Money frees him from small worries.

Money has allowed him to pursue things he wouldn't have otherwise.

“If I didn’t have money I wouldn’t have a collection of vintage military vehicles…You can have nice hobbies that keep you relaxed when you have money.”

He didn't start Oculus to generate money. His virtual reality passion spanned years.

He didn't have to lie about how virtual reality will transform everything until he needed funding.

The company's success was an unexpected bonus. He was merely passionate about a good cause.

After Oculus' $2.3 billion exit, what changed?

Palmer didn't mind being rich. He did similar things.

After Facebook bought Oculus, he moved to Silicon Valley and lived in a 12-person shared house due to high rents.

Palmer might have afforded a big mansion, but he prefers stability and doing things because he wants to, not because he has to.

“Taco Bell is never tasted so good as when you know you could afford to never eat taco bell again.”

Palmer's leadership shifted.

Palmer changed his leadership after selling Oculus.

When he launched his second company, he couldn't work on his passions.

“When you start a tech company you do it because you want to work on a technology, that is why you are interested in that space in the first place. As the company has grown, he has realized that if he is still doing optical design in the company it’s because he is being negligent about the hiring process.”

Once his startup grows, the founder's responsibilities shift. He must recruit better firm managers.

Recruiting talented people becomes the top priority. The founder must convince others of their influence.

A book that helped me write this:

The History of the Future: Oculus, Facebook, and the Revolution That Swept Virtual Reality — Blake Harris

*This post is a summary. Read the full article here.

Thomas Smith

3 years ago

ChatGPT Is Experiencing a Lightbulb Moment

Why breakthrough technologies must be accessible

ChatGPT has exploded. Over 1 million people have used the app, and coding sites like Stack Overflow have banned its answers. It's huge.

I wouldn't have called that as an AI researcher. ChatGPT uses the same GPT-3 technology that's been around for over two years.

More than impressive technology, ChatGPT 3 shows how access makes breakthroughs usable. OpenAI has finally made people realize the power of AI by packaging GPT-3 for normal users.

We think of Thomas Edison as the inventor of the lightbulb, not because he invented it, but because he popularized it.

Going forward, AI companies that make using AI easy will thrive.

Use-case importance

Most modern AI systems use massive language models. These language models are trained on 6,000+ years of human text.

GPT-3 ate 8 billion pages, almost every book, and Wikipedia. It created an AI that can write sea shanties and solve coding problems.

Nothing new. I began beta testing GPT-3 in 2020, but the system's basics date back further.

Tools like GPT-3 are hidden in many apps. Many of the AI writing assistants on this platform are just wrappers around GPT-3.

Lots of online utilitarian text, like restaurant menu summaries or city guides, is written by AI systems like GPT-3. You've probably read GPT-3 without knowing it.

Accessibility

Why is ChatGPT so popular if the technology is old?

ChatGPT makes the technology accessible. Free to use, people can sign up and text with the chatbot daily. ChatGPT isn't revolutionary. It does it in a way normal people can access and be amazed by.

Accessibility isn't easy. OpenAI's Sam Altman tweeted that opening ChatGPT to the public increased computing costs.

Each chat costs "low-digit cents" to process. OpenAI probably spends several hundred thousand dollars a day to keep ChatGPT running, with no immediate business case.

Academic researchers and others who developed GPT-3 couldn't afford it. Without resources to make technology accessible, it can't be used.

Retrospective

This dynamic is old. In the history of science, a researcher with a breakthrough idea was often overshadowed by an entrepreneur or visionary who made it accessible to the public.

We think of Thomas Edison as the inventor of the lightbulb. But really, Vasilij Petrov, Thomas Wright, and Joseph Swan invented the lightbulb. Edison made technology visible and accessible by electrifying public buildings, building power plants, and wiring.

Edison probably lost a ton of money on stunts like building a power plant to light JP Morgan's home, the NYSE, and several newspaper headquarters.

People wanted electric lights once they saw their benefits. By making the technology accessible and visible, Edison unlocked a hugely profitable market.

Similar things are happening in AI. ChatGPT shows that developing breakthrough technology in the lab or on B2B servers won't change the culture.

AI must engage people's imaginations to become mainstream. Before the tech impacts the world, people must play with it and see its revolutionary power.

As the field evolves, companies that make the technology widely available, even at great cost, will succeed.

OpenAI's compute fees are eye-watering. Revolutions are costly.

:max_bytes(150000):strip_icc():gifv():format(webp)/reiff_headshot-5bfc2a60c9e77c00519a70bd.jpg)