More on Entrepreneurship/Creators

Sammy Abdullah

24 years ago

How to properly price SaaS

Price Intelligently put out amazing content on pricing your SaaS product. This blog's link to the whole report is worth reading. Our key takeaways are below.

Don't base prices on the competition. Competitor-based pricing has clear drawbacks. Their pricing approach is yours. Your company offers customers something unique. Otherwise, you wouldn't create it. This strategy is static, therefore you can't add value by raising prices without outpricing competitors. Look, but don't touch is the competitor-based moral. You want to know your competitors' prices so you're in the same ballpark, but they shouldn't guide your selections. Competitor-based pricing also drives down prices.

Value-based pricing wins. This is customer-based pricing. Value-based pricing looks outward, not inward or laterally at competitors. Your clients are the best source of pricing information. By valuing customer comments, you're focusing on buyers. They'll decide if your pricing and packaging are right. In addition to asking consumers about cost savings or revenue increases, look at data like number of users, usage per user, etc.

Value-based pricing increases prices. As you learn more about the client and your worth, you'll know when and how much to boost rates. Every 6 months, examine pricing.

Cloning top customers. You clone your consumers by learning as much as you can about them and then reaching out to comparable people or organizations. You can't accomplish this without knowing your customers. Segmenting and reproducing them requires as much detail as feasible. Offer pricing plans and feature packages for 4 personas. The top plan should state Contact Us. Your highest-value customers want more advice and support.

Question your 4 personas. What's the one item you can't live without? Which integrations matter most? Do you do analytics? Is support important or does your company self-solve? What's too cheap? What's too expensive?

Not everyone likes per-user pricing. SaaS organizations often default to per-user analytics. About 80% of companies utilizing per-user pricing should use an alternative value metric because their goods don't give more value with more users, so charging for them doesn't make sense.

At least 3:1 LTV/CAC. Break even on the customer within 2 years, and LTV to CAC is greater than 3:1. Because customer acquisition costs are paid upfront but SaaS revenues accrue over time, SaaS companies face an early financial shortfall while paying back the CAC.

ROI should be >20:1. Indeed. Ensure the customer's ROI is 20x the product's cost. Microsoft Office costs $80 a year, but consumers would pay much more to maintain it.

A/B Testing. A/B testing is guessing. When your pricing page varies based on assumptions, you'll upset customers. You don't have enough customers anyway. A/B testing optimizes landing pages, design decisions, and other site features when you know the problem but not pricing.

Don't discount. It cheapens the product, makes it permanent, and increases churn. By discounting, you're ruining your pricing analysis.

Benjamin Lin

3 years ago

I sold my side project for $20,000: 6 lessons I learned

How I monetized and sold an abandoned side project for $20,000

The Origin Story

I've always wanted to be an entrepreneur but never succeeded. I often had business ideas, made a landing page, and told my buddies. Never got customers.

In April 2021, I decided to try again with a new strategy. I noticed that I had trouble acquiring an initial set of customers, so I wanted to start by acquiring a product that had a small user base that I could grow.

I found a SaaS marketplace called MicroAcquire.com where you could buy and sell SaaS products. I liked Shareit.video, an online Loom-like screen recorder.

Shareit.video didn't generate revenue, but 50 people visited daily to record screencasts.

Purchasing a Failed Side Project

I eventually bought Shareit.video for $12,000 from its owner.

$12,000 was probably too much for a website without revenue or registered users.

I thought time was most important. I could have recreated the website, but it would take months. $12,000 would give me an organized code base and a working product with a few users to monetize.

I considered buying a screen recording website and trying to grow it versus buying a new car or investing in crypto with the $12K.

Buying the website would make me a real entrepreneur, which I wanted more than anything.

Putting down so much money would force me to commit to the project and prevent me from quitting too soon.

A Year of Development

I rebranded the website to be called RecordJoy and worked on it with my cousin for about a year. Within a year, we made $5000 and had 3000 users.

We spent $3500 on ads, hosting, and software to run the business.

AppSumo promoted our $120 Life Time Deal in exchange for 30% of the revenue.

We put RecordJoy on maintenance mode after 6 months because we couldn't find a scalable user acquisition channel.

We improved SEO and redesigned our landing page, but nothing worked.

Despite not being able to grow RecordJoy any further, I had already learned so much from working on the project so I was fine with putting it on maintenance mode. RecordJoy still made $500 a month, which was great lunch money.

Getting Taken Over

One of our customers emailed me asking for some feature requests and I replied that we weren’t going to add any more features in the near future. They asked if we'd sell.

We got on a call with the customer and I asked if he would be interested in buying RecordJoy for 15k. The customer wanted around $8k but would consider it.

Since we were negotiating with one buyer, we put RecordJoy on MicroAcquire to see if there were other offers.

We quickly received 10+ offers. We got 18.5k. There was also about $1000 in AppSumo that we could not withdraw, so we agreed to transfer that over for $600 since about 40% of our sales on AppSumo usually end up being refunded.

Lessons Learned

First, create an acquisition channel

We couldn't discover a scalable acquisition route for RecordJoy. If I had to start another project, I'd develop a robust acquisition channel first. It might be LinkedIn, Medium, or YouTube.

Purchase Power of the Buyer Affects Acquisition Price

Some of the buyers we spoke to were individuals looking to buy side projects, as well as companies looking to launch a new product category. Individual buyers had less budgets than organizations.

Customers of AppSumo vary.

AppSumo customers value lifetime deals and low prices, which may not be a good way to build a business with recurring revenue. Designed for AppSumo users, your product may not connect with other users.

Try to increase acquisition trust

Acquisition often fails. The buyer can go cold feet, cease communicating, or run away with your stuff. Trusting the buyer ensures a smooth asset exchange. First acquisition meeting was unpleasant and price negotiation was tight. In later meetings, we spent the first few minutes trying to get to know the buyer’s motivations and background before jumping into the negotiation, which helped build trust.

Operating expenses can reduce your earnings.

Monitor operating costs. We were really happy when we withdrew the $5000 we made from AppSumo and Stripe until we realized that we had spent $3500 in operating fees. Spend money on software and consultants to help you understand what to build.

Don't overspend on advertising

We invested $1500 on Google Ads but made little money. For a side project, it’s better to focus on organic traffic from SEO rather than paid ads unless you know your ads are going to have a positive ROI.

Athirah Syamimi

3 years ago

Here's How I Built A Business Offering Unlimited Design Services in Just One Weekend.

Weekend project: limitless design service. It was fun to see whether I could start a business quickly.

I use no-code apps to save time and resources.

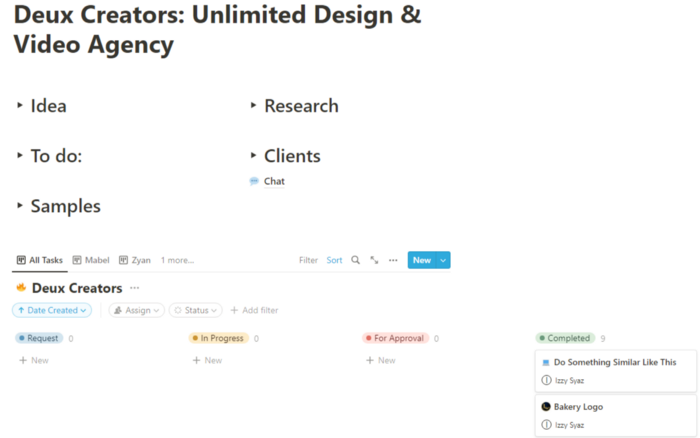

TL;DR I started a business utilizing EditorX for my website, Notion for client project management, and a few favors to finish my portfolio.

First step: research (Day 1)

I got this concept from a Kimp Instagram ad. The Minimalist Hustler Daily newsletter mentioned a similar and cheaper service (Graphically).

I Googled other unlimited design companies. Many provide different costs and services. Some supplied solely graphic design, web development, or copywriting.

Step 2: Brainstorming (Day 1)

I did something simple.

What benefits and services to provide

Price to charge

Since it's a one-person performance (for now), I'm focusing on graphic design. I can charge less.

So I don't overwhelm myself and can accommodate budget-conscious clientele.

Step 3: Construction (Day 1 & 2)

This project includes a management tool, a website, and a team procedure.

I built a project management tool and flow first. Once I had the flow and a Notion board, I tested it with design volunteers. They fake-designed while I built the website.

Tool for Project Management

I modified a Notion template. My goal is to keep clients and designers happy.

Team Approach

My sister, my partner, and I kept this business lean. I tweaked the Notion board to make the process smooth. By the end of Sunday, I’d say it’s perfect!

Website

I created the website after they finished the fake design demands. EditorX's drag-and-drop builder attracted me. I didn't need to learn code, and there are templates.

I used a template wireframe.

This project's hardest aspect is developing the site. It's my first time using EditorX and I'm no developer.

People answer all your inquiries in a large community forum.

As a first-time user developing a site in two days, I think I performed OK. Here's the site for feedback.

4th step: testing (Day 2)

Testing is frustrating because it works or doesn't. My testing day was split in two.

testing the workflow from payment to onboarding to the website

the demand being tested

It's working so far. If someone gets the trial, they can request design work.

I've gotten a couple of inquiries about demand. I’ll be working with them as a start.

Completion

Finally! I built my side project in one weekend. It's too early to tell if this is successful. I liked that I didn't squander months of resources testing out an idea.

You might also like

Theresa W. Carey

3 years ago

How Payment for Order Flow (PFOF) Works

What is PFOF?

PFOF is a brokerage firm's compensation for directing orders to different parties for trade execution. The brokerage firm receives fractions of a penny per share for directing the order to a market maker.

Each optionable stock could have thousands of contracts, so market makers dominate options trades. Order flow payments average less than $0.50 per option contract.

Order Flow Payments (PFOF) Explained

The proliferation of exchanges and electronic communication networks has complicated equity and options trading (ECNs) Ironically, Bernard Madoff, the Ponzi schemer, pioneered pay-for-order-flow.

In a December 2000 study on PFOF, the SEC said, "Payment for order flow is a method of transferring trading profits from market making to brokers who route customer orders to specialists for execution."

Given the complexity of trading thousands of stocks on multiple exchanges, market making has grown. Market makers are large firms that specialize in a set of stocks and options, maintaining an inventory of shares and contracts for buyers and sellers. Market makers are paid the bid-ask spread. Spreads have narrowed since 2001, when exchanges switched to decimals. A market maker's ability to play both sides of trades is key to profitability.

Benefits, requirements

A broker receives fees from a third party for order flow, sometimes without a client's knowledge. This invites conflicts of interest and criticism. Regulation NMS from 2005 requires brokers to disclose their policies and financial relationships with market makers.

Your broker must tell you if it's paid to send your orders to specific parties. This must be done at account opening and annually. The firm must disclose whether it participates in payment-for-order-flow and, upon request, every paid order. Brokerage clients can request payment data on specific transactions, but the response takes weeks.

Order flow payments save money. Smaller brokerage firms can benefit from routing orders through market makers and getting paid. This allows brokerage firms to send their orders to another firm to be executed with other orders, reducing costs. The market maker or exchange benefits from additional share volume, so it pays brokerage firms to direct traffic.

Retail investors, who lack bargaining power, may benefit from order-filling competition. Arrangements to steer the business in one direction invite wrongdoing, which can erode investor confidence in financial markets and their players.

Pay-for-order-flow criticism

It has always been controversial. Several firms offering zero-commission trades in the late 1990s routed orders to untrustworthy market makers. During the end of fractional pricing, the smallest stock spread was $0.125. Options spreads widened. Traders found that some of their "free" trades cost them a lot because they weren't getting the best price.

The SEC then studied the issue, focusing on options trades, and nearly decided to ban PFOF. The proliferation of options exchanges narrowed spreads because there was more competition for executing orders. Options market makers said their services provided liquidity. In its conclusion, the report said, "While increased multiple-listing produced immediate economic benefits to investors in the form of narrower quotes and effective spreads, these improvements have been muted with the spread of payment for order flow and internalization."

The SEC allowed payment for order flow to continue to prevent exchanges from gaining monopoly power. What would happen to trades if the practice was outlawed was also unclear. SEC requires brokers to disclose financial arrangements with market makers. Since then, the SEC has watched closely.

2020 Order Flow Payment

Rule 605 and Rule 606 show execution quality and order flow payment statistics on a broker's website. Despite being required by the SEC, these reports can be hard to find. The SEC mandated these reports in 2005, but the format and reporting requirements have changed over the years, most recently in 2018.

Brokers and market makers formed a working group with the Financial Information Forum (FIF) to standardize order execution quality reporting. Only one retail brokerage (Fidelity) and one market maker remain (Two Sigma Securities). FIF notes that the 605/606 reports "do not provide the level of information that allows a retail investor to gauge how well a broker-dealer fills a retail order compared to the NBBO (national best bid or offer’) at the time the order was received by the executing broker-dealer."

In the first quarter of 2020, Rule 606 reporting changed to require brokers to report net payments from market makers for S&P 500 and non-S&P 500 equity trades and options trades. Brokers must disclose payment rates per 100 shares by order type (market orders, marketable limit orders, non-marketable limit orders, and other orders).

Richard Repetto, Managing Director of New York-based Piper Sandler & Co., publishes a report on Rule 606 broker reports. Repetto focused on Charles Schwab, TD Ameritrade, E-TRADE, and Robinhood in Q2 2020. Repetto reported that payment for order flow was higher in the second quarter than the first due to increased trading activity, and that options paid more than equities.

Repetto says PFOF contributions rose overall. Schwab has the lowest options rates, while TD Ameritrade and Robinhood have the highest. Robinhood had the highest equity rating. Repetto assumes Robinhood's ability to charge higher PFOF reflects their order flow profitability and that they receive a fixed rate per spread (vs. a fixed rate per share by the other brokers).

Robinhood's PFOF in equities and options grew the most quarter-over-quarter of the four brokers Piper Sandler analyzed, as did their implied volumes. All four brokers saw higher PFOF rates.

TD Ameritrade took the biggest income hit when cutting trading commissions in fall 2019, and this report shows they're trying to make up the shortfall by routing orders for additional PFOF. Robinhood refuses to disclose trading statistics using the same metrics as the rest of the industry, offering only a vague explanation on their website.

Summary

Payment for order flow has become a major source of revenue as brokers offer no-commission equity (stock and ETF) orders. For retail investors, payment for order flow poses a problem because the brokerage may route orders to a market maker for its own benefit, not the investor's.

Infrequent or small-volume traders may not notice their broker's PFOF practices. Frequent traders and those who trade larger quantities should learn about their broker's order routing system to ensure they're not losing out on price improvement due to a broker prioritizing payment for order flow.

This post is a summary. Read full article here

mbvissers.eth

3 years ago

Why does every smart contract seem to implement ERC165?

ERC165 (or EIP-165) is a standard utilized by various open-source smart contracts like Open Zeppelin or Aavegotchi.

What's it? You must implement? Why do we need it? I'll describe the standard and answer any queries.

What is ERC165

ERC165 detects and publishes smart contract interfaces. Meaning? It standardizes how interfaces are recognized, how to detect if they implement ERC165, and how a contract publishes the interfaces it implements. How does it work?

Why use ERC165? Sometimes it's useful to know which interfaces a contract implements, and which version.

Identifying interfaces

An interface function's selector. This verifies an ABI function. XORing all function selectors defines an interface in this standard. The following code demonstrates.

// SPDX-License-Identifier: UNLICENCED

pragma solidity >=0.8.0 <0.9.0;

interface Solidity101 {

function hello() external pure;

function world(int) external pure;

}

contract Selector {

function calculateSelector() public pure returns (bytes4) {

Solidity101 i;

return i.hello.selector ^ i.world.selector;

// Returns 0xc6be8b58

}

function getHelloSelector() public pure returns (bytes4) {

Solidity101 i;

return i.hello.selector;

// Returns 0x19ff1d21

}

function getWorldSelector() public pure returns (bytes4) {

Solidity101 i;

return i.world.selector;

// Returns 0xdf419679

}

}This code isn't necessary to understand function selectors and how an interface's selector can be determined from the functions it implements.

Run that sample in Remix to see how interface function modifications affect contract function output.

Contracts publish their implemented interfaces.

We can identify interfaces. Now we must disclose the interfaces we're implementing. First, import IERC165 like so.

pragma solidity ^0.4.20;

interface ERC165 {

/// @notice Query if a contract implements an interface

/// @param interfaceID The interface identifier, as specified in ERC-165

/// @dev Interface identification is specified in ERC-165.

/// @return `true` if the contract implements `interfaceID` and

/// `interfaceID` is not 0xffffffff, `false` otherwise

function supportsInterface(bytes4 interfaceID) external view returns (bool);

}We still need to build this interface in our smart contract. ERC721 from OpenZeppelin is a good example.

// SPDX-License-Identifier: MIT

// OpenZeppelin Contracts (last updated v4.5.0) (token/ERC721/ERC721.sol)

pragma solidity ^0.8.0;

import "./IERC721.sol";

import "./extensions/IERC721Metadata.sol";

import "../../utils/introspection/ERC165.sol";

// ...

contract ERC721 is Context, ERC165, IERC721, IERC721Metadata {

// ...

function supportsInterface(bytes4 interfaceId) public view virtual override(ERC165, IERC165) returns (bool) {

return

interfaceId == type(IERC721).interfaceId ||

interfaceId == type(IERC721Metadata).interfaceId ||

super.supportsInterface(interfaceId);

}

// ...

}I deleted unnecessary code. The smart contract imports ERC165, IERC721 and IERC721Metadata. The is keyword at smart contract declaration implements all three.

Kind (interface).

Note that type(interface).interfaceId returns the same as the interface selector.

We override supportsInterface in the smart contract to return a boolean that checks if interfaceId is the same as one of the implemented contracts.

Super.supportsInterface() calls ERC165 code. Checks if interfaceId is IERC165.

function supportsInterface(bytes4 interfaceId) public view virtual override returns (bool) {

return interfaceId == type(IERC165).interfaceId;

}So, if we run supportsInterface with an interfaceId, our contract function returns true if it's implemented and false otherwise. True for IERC721, IERC721Metadata, andIERC165.

Conclusion

I hope this post has helped you understand and use ERC165 and why it's employed.

Have a great day, thanks for reading!

The Secret Developer

3 years ago

What Elon Musk's Take on Bitcoin Teaches Us

Tesla Q2 earnings revealed unethical dealings.

As of end of Q2, we have converted approximately 75% of our Bitcoin purchases into fiat currency

That’s OK then, isn’t it?

Elon Musk, Tesla's CEO, is now untrustworthy.

It’s not about infidelity, it’s about doing the right thing

And what can we learn?

The Opening Remark

Musk tweets on his (and Tesla's) future goals.

Don’t worry, I’m not expecting you to read it.

What's crucial?

Tesla will not be selling any Bitcoin

The Situation as It Develops

2021 Tesla spent $1.5 billion on Bitcoin. In 2022, they sold 75% of the ownership for $946 million.

That’s a little bit of a waste of money, right?

Musk predicted the reverse would happen.

What gives? Why would someone say one thing, then do the polar opposite?

The Justification For Change

Tesla's public. They must follow regulations. When a corporation trades, they must record what happens.

At least this keeps Musk some way in line.

We now understand Musk and Tesla's actions.

Musk claimed that Tesla sold bitcoins to maximize cash given the unpredictability of COVID lockdowns in China.

Tesla may buy Bitcoin in the future, he said.

That’s fine then. He’s not knocking the NFT at least.

Tesla has moved investments into cash due to China lockdowns.

That doesn’t explain the 180° though

Musk's Tweet isn't company policy. Therefore, the CEO's change of heart reflects the organization. Look.

That's okay, since

Leaders alter their positions when circumstances change.

Leaders must adapt to their surroundings. This isn't embarrassing; it's a leadership prerequisite.

Yet

The Man

Someone stated if you're not in the office full-time, you need to explain yourself. He doesn't treat his employees like adults.

This is the individual mentioned in the quote.

If Elon was not happy, you knew it. Things could get nasty

also, He fired his helper for requesting a raise.

This public persona isn't good. Without mentioning his disastrous performances on Twitter (pedo dude) or Joe Rogan. This image sums up the odd Podcast appearance:

Which describes the man.

I wouldn’t trust this guy to feed a cat

What we can discover

When Musk's company bet on Bitcoin, what happened?

Exactly what we would expect

The company's position altered without the CEO's awareness. He seems uncaring.

This article is about how something happened, not what happened. Change of thinking requires contrition.

This situation is about a lack of respect- although you might argue that followers on Twitter don’t deserve any

Tesla fans call the sale a great move.

It's absurd.

As you were, then.

Conclusion

Good luck if you gamble.

When they pay off, congrats!

When wrong, admit it.

You must take chances if you want to succeed.

Risks don't always pay off.

Mr. Musk lacks insight and charisma to combine these two attributes.

I don’t like him, if you hadn’t figured.

It’s probably all of the cheating.