More on Technology

Mark Schaefer

3 years ago

20 Fun Uses for ChatGPT

Our RISE community is stoked on ChatGPT. ChatGPT has countless uses.

Early on. Companies are figuring out the legal and ethical implications of AI's content revolution. Using AI for everyday tasks is cool.

So I challenged RISE friends... Let's have fun and share non-obvious uses.

Onward!

1. Tweet

Jim MacLeod requested a design-themed Twitter thread from ChatGPT.

2. Novelize

Giuseppe Fratoni writes novels.

"This is amazing!" Impotent. I asked about writing, mystery novels, and jazz.

"Develop a mystery novel plot in which a disillusioned homicide detective hunts a serial killer who targets jazz musicians who play Autumn Leaves."

"I have:

Detective James Thompson is a seasoned veteran of the Homicide department, but lately he’s been feeling burnt out and disillusioned. His latest case, the murder of a young jazz pianist who was found brutally killed in his home, only serves to deepen his sense of despair … (much more provided)

3. Question-and-answer sessions

Bliss recommends:

You have a guest speaker and want to ask audience questions.

Pre-generate questions with ChatGPT. "And here's a question from our AI?"

The conference is about Western water scarcity. Water management expert. My AI question was...

Which desalination-related questions should I ask an expert?

ChatGPT said...

How is desalination currently being used around the world, and in what types of locations is it most effective?

What are the potential advantages and disadvantages of using desalination to provide fresh water?

What are some of the key challenges and limitations of desalination technology, and how are they being addressed?

4. Game-making

Richard's a board game expert. He suggests using ChatGPT to plan games. Note: Some people have started getting help solving crossword puzzle clues.

5. Matchmaking

Tanya Thompson thinks it helps dating. ChatGPT:

Here are some flirty first-message ideas for dating apps:

I noticed you from afar. I had to say hi and see if we clicked.

Your profile picture is gorgeous. I'm obsessed with your [Feature] and want to know you better.

I don't usually message first, but I had to. You're [Attractive Quality] and I can't wait to talk.”

Hello. Your profile intimidates me. I'm starstruck by your [Attractiveness]. (Many instances)

5. Solitude/anxiety

ChatGPT excels at one-on-one conversations.

PepperBrooks: "I'm sad and lonely."

ChatGPT: I’m sorry to hear that you’re feeling sad and lonely. It’s natural to feel down sometimes, but it’s important to remember that you’re not alone. There are many people who care about you and want to help you. It can be helpful to talk to someone about your feelings, whether it’s a close friend, family member, or mental health professional.

Sometimes, just expressing your thoughts and emotions to someone else can help to alleviate your sadness and loneliness. It’s also important to take care of yourself and do things that make you happy, such as spending time with loved ones, pursuing a hobby, or exercising. These things can help to improve your mood and make you feel more connected to others. Remember that you are strong and capable, and that you can get through this difficult time.

Daniel Nestle asked ChatGPT to generate journal prompts to help him deal with anxiety.

Write down the things that are causing you anxiety at the moment.

Describe a situation in which you felt anxious and how you coped with it.

Reflect on how your thoughts and beliefs contribute to your anxiety.

Write a letter to your anxiety, expressing your feelings and concerns

Imagine yourself in a calm and peaceful place, and describe it in detail.

(many more items followed)

6. Names

Continued Daniel:

Also, naming ideas.

Me: Name this drink. Japanese gin, unsweetened tonic, lime, Szechuan pepper, grapefruit.

ChatGPT: How about “Sakura Sunrise?” The name incorporates the Japanese gin and the citrus flavors of grapefruit and lime, and the word “sunrise” suggests a fresh and invigorating start to the day. Alternatively, you could go with something like “Peppered Grapefruit Gin Fizz” to emphasize the unique flavor combination of Szechuan pepper and grapefruit.

7. Translation on the go

Monks recommends: ChatGPT is a perfect mobile translation tool. Say you need help in Italy.

ME: Translate to Italian

Where is the nearest gas station?

ChatGPT: “La mia auto sta per esaurire il carburante, mi puoi dire dove si trova la stazione di servizio più vicina?”

8. Fitness

Monks added:

ME: In 3 months, I want to run 5km. Plan out how I can do this.

ChatGPT: Here's a 3-month plan to run 5km.

Start by walking for 15–20 minutes each day to build up your endurance and get your body used to regular exercise.

After a week of walking, begin incorporating short jogs into your routine. Start by jogging for 1–2 minutes at a time, with walking breaks in between. Gradually increase the length of your jogs and reduce the amount of time you spend walking.

Once you can jog for 10 minutes without stopping, start increasing the distance of your runs. Aim to run 1km without stopping and then gradually increase the distance over time.

In addition to your regular runs, incorporate strength training and stretching into your routine to improve your overall fitness and reduce the risk of injury.

(more details continued on)

9. Integrations and coding

10. Teacher lesson plans

Spencer Crandall saved time.

This morning, I wondered who has the hardest job. Teachers.

Many students, little time. ChatGPT could handle lesson planning. I tried it and got this.

Lesson Title: The History and Impact of Artificial Intelligence

Students will understand the history and development of AI and the potential positive and negative impacts on society.

AI timeline AI technologies and applications

Overview:

Introduce the topic of artificial intelligence, and explain that it refers to the development of computer systems and algorithms that can simulate human intelligence and behavior.

Show the timeline of significant events in the history of AI, and discuss the key milestones and developments in the field.

Show examples of AI technologies and applications, and explain how they are used in various industries and fields.

Discuss the potential positive and negative impacts of AI on society, including its potential to improve productivity, efficiency, and safety, as well as its potential to create new challenges and concerns, such as job displacement and ethical issues.

(many more details followed)

11. Find podcast guests.

Joeri Billast suggested:

Who should be on my Web3 podcast?

ChatGPT: Web3 marketing experts, influencers, and thought leaders make great podcast guests. These include Web3 marketers, content creators, business owners, entrepreneurs, and technologists. You could invite Web3 startups and organizations to your podcast.

Please give examples.

ChatGPT: Ideal Web3 marketing podcast guests include:

Tim Berner-Lee, inventor of the World Wide Web

Chris Dixon, general partner at Andreessen Horowitz

Vitalik Buterin, founder of Ethereum

Joe Lubin, founder of ConsenSys

Susan Fowler, author of Whistleblower

(many other suggestions)

12. Comments and reviews on social media

Lisa Monk thinks ChatGPT can help retail staff with social media.

She asked ChatGPT to "review this restaurant"

POSITIVE CUSTOMER REVIEW: I absolutely love this place. We eat out a lot however this place has topped it all. Perfect meals, amazing staff and the timing for it all was great! Special thanks to Sophie B (you rock) From your guests all the way from the Gold Coast, THANK YOU

ChatGPT REPLY: Thank you so much for your kind words and for taking the time to write a review. We are delighted to hear that you had such a great experience at our restaurant. We are thrilled that you enjoyed your meal and the service provided by Sophie. It’s always a pleasure to serve guests visiting from the Gold Coast and we are grateful for your support. We look forward to welcoming you back again soon. Thank you again for your positive review.

CUSTOMER REVIEW: Most average food, there is a nice view, But that’s about it

ChatGPT: Thank you for your review. We apologize if your dining experience was not up to your expectations. We strive to provide top-quality food and service to all of our customers, and we will take your feedback into consideration as we continue to improve. Thank you for letting us know about your experience.

13. Crime-fighting

Zack Seipert said, "I researched some famous unsolved murders, and ChatGPT laid out the crime, suspects, clues, and more." I bet experienced detectives could solve some of these cold cases.

14. Reduce bias

Joanne Taylor struggles to remove biases from her writing. She asked ChatGPT for ideas.

I asked ChatGPT to check a text for racial bias, and it did well.

15. Furnishings

I designed a small, unique table using ChatGPT and MidJourney. I edited ChatGPT's idea for clarity and brevity before entering it in MidJourney.

Results:

16. Serialize a novel

Scott Scowcoft led ChatCPT through iterations of a story text to create serialized novel frames. You can view this here.

17. Interview preparation

I was on a sales podcast. Although this is marketing-related, it's not my forte. I asked ChatGPT for help with a sales interview. Response:

Here are some interview questions about the future of sales and how to answer them.

How will technology affect sales in the future?

Technology will impact sales in the coming years. Automation and AI could be used to handle routine tasks, and data analysis and CRM could become more important. E-commerce and online sales channels are also reshaping the sales landscape.

How will the salesperson's role change?

Future sales roles may change in response to changing customer needs and expectations. Salespeople must be knowledgeable and consultative to help customers navigate complex products and services. Increasing importance of data analysis and CRM tools will require salespeople to understand and use technology effectively.

Future sales professionals will need what skills?

Future salespeople will need many skills. Sales professionals must have strong communication and interpersonal skills, as well as product and service knowledge and the ability to use data analysis and CRM tools effectively. Adapting to changing customer needs and staying current on industry trends will also be important for sales success.

18. Gift ideas

I need Christmas gift ideas for my wife. I asked:

Suggest a gift idea under $200 for a middle-aged woman who loves The Eagles.

A middle-aged woman who loves The Eagles might like a vinyl record of "Hotel California" or "The Long Run." Many music fans enjoy the unique sound and experience of vinyl records.

Pair the record with a high-quality record player for a complete gift. The vinyl record and record player should fit within your $200 budget for an Eagles fan.

19. Explaining complex concepts

I entered: Explain quantum physics to me as if I were 10 years old.

Quantum physics is a branch of science that studies how tiny particles, like atoms and subatomic particles, behave. These particles are so small that they don’t always follow the same rules as the things we can see and touch every day.

For example, sometimes they can be in two places at the same time, or they can be friends with each other even if they are far apart. This might sound strange, but it’s what scientists have learned from studying these tiny particles. Quantum physics helps us understand how the world works at a very small scale, and it can also help us make new technologies, like computers that are much faster than the ones we have today.

20. AP-style editing

Blogs, journals, and books follow AP Style. I asked ChatGPT to "edit using AP Style" and it did a great job.

And then... "Write a catchy headline for a blog post about 16 ChatGPT uses"

Here are some possible blog post titles for 20 creative ChatGPT uses:

“20 Fun and Creative Ways to Use ChatGPT: From Games to Quizzes and More”

“The Ultimate Guide to Using ChatGPT for Entertainment and Creativity”

“20 Reasons to Use ChatGPT: How it Can Enhance Your Gaming, Storytelling, and More”

20 Entertaining Uses for ChatGPT You Never Knew Were Possible”

“Unleash Your Imagination with ChatGPT: 16 Creative and Fun Ways to Use it”

In a previous post, I said ChatGPT will change marketing careers forever. I have never made a statement like that in my life. Even in the early days of the internet, people were cautious.

This technology was just released two weeks ago, and over a million people are already using it. This is the fastest technology adoption in history.

Today's post offers inventive and entertaining ideas, but it's just the beginning. ChatGPT writes code, music, and papers.

Farhad Malik

3 years ago

How This Python Script Makes Me Money Every Day

Starting a passive income stream with data science and programming

My website is fresh. But how do I monetize it?

Creating a passive-income website is difficult. Advertise first. But what useful are ads without traffic?

Let’s Generate Traffic And Put Our Programming Skills To Use

SEO boosts traffic (Search Engine Optimisation). Traffic generation is complex. Keywords matter more than text, URL, photos, etc.

My Python skills helped here. I wanted to find relevant, Google-trending keywords (tags) for my topic.

First The Code

I wrote the script below here.

import re

from string import punctuation

import nltk

from nltk import TreebankWordTokenizer, sent_tokenize

from nltk.corpus import stopwords

class KeywordsGenerator:

def __init__(self, pytrends):

self._pytrends = pytrends

def generate_tags(self, file_path, top_words=30):

file_text = self._get_file_contents(file_path)

clean_text = self._remove_noise(file_text)

top_words = self._get_top_words(clean_text, top_words)

suggestions = []

for top_word in top_words:

suggestions.extend(self.get_suggestions(top_word))

suggestions.extend(top_words)

tags = self._clean_tokens(suggestions)

return ",".join(list(set(tags)))

def _remove_noise(self, text):

#1. Convert Text To Lowercase and remove numbers

lower_case_text = str.lower(text)

just_text = re.sub(r'\d+', '', lower_case_text)

#2. Tokenise Paragraphs To words

list = sent_tokenize(just_text)

tokenizer = TreebankWordTokenizer()

tokens = tokenizer.tokenize(just_text)

#3. Clean text

clean = self._clean_tokens(tokens)

return clean

def _clean_tokens(self, tokens):

clean_words = [w for w in tokens if w not in punctuation]

stopwords_to_remove = stopwords.words('english')

clean = [w for w in clean_words if w not in stopwords_to_remove and not w.isnumeric()]

return clean

def get_suggestions(self, keyword):

print(f'Searching pytrends for {keyword}')

result = []

self._pytrends.build_payload([keyword], cat=0, timeframe='today 12-m')

data = self._pytrends.related_queries()[keyword]['top']

if data is None or data.values is None:

return result

result.extend([x[0] for x in data.values.tolist()][:2])

return result

def _get_file_contents(self, file_path):

return open(file_path, "r", encoding='utf-8',errors='ignore').read()

def _get_top_words(self, words, top):

counts = dict()

for word in words:

if word in counts:

counts[word] += 1

else:

counts[word] = 1

return list({k: v for k, v in sorted(counts.items(), key=lambda item: item[1])}.keys())[:top]

if __name__ == "1__main__":

from pytrends.request import TrendReq

nltk.download('punkt')

nltk.download('stopwords')

pytrends = TrendReq(hl='en-GB', tz=360)

tags = KeywordsGenerator(pytrends)\

.generate_tags('text_file.txt')

print(tags)Then The Dependencies

This script requires:

nltk==3.7

pytrends==4.8.0

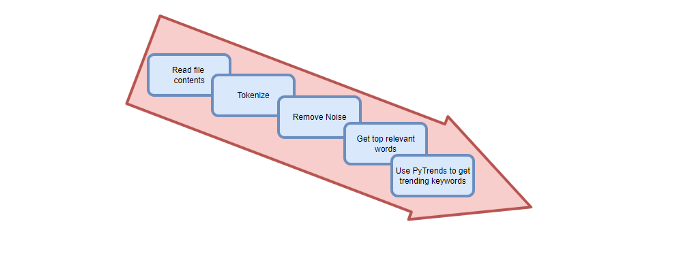

Analysis of the Script

I copy and paste my article into text file.txt, and the code returns the keywords as a comma-separated string.

To achieve this:

A class I made is called KeywordsGenerator.

This class has a function:

generate_tagsThe function

generate_tagsperforms the following tasks:

retrieves text file contents

uses NLP to clean the text by tokenizing sentences into words, removing punctuation, and other elements.

identifies the most frequent words that are relevant.

The

pytrendsAPI is then used to retrieve related phrases that are trending for each word from Google.finally adds a comma to the end of the word list.

4. I then use the keywords and paste them into the SEO area of my website.

These terms are trending on Google and relevant to my topic. My site's rankings and traffic have improved since I added new keywords. This little script puts our knowledge to work. I shared the script in case anyone faces similar issues.

I hope it helps readers sell their work.

Ben "The Hosk" Hosking

3 years ago

The Yellow Cat Test Is Typically Failed by Software Developers.

Believe what you see, what people say

It’s sad that we never get trained to leave assumptions behind. - Sebastian Thrun

Many problems in software development are not because of code but because developers create the wrong software. This isn't rare because software is emergent and most individuals only realize what they want after it's built.

Inquisitive developers who pass the yellow cat test can improve the process.

Carpenters measure twice and cut the wood once. Developers are rarely so careful.

The Yellow Cat Test

Game of Thrones made dragons cool again, so I am reading The Game of Thrones book.

The yellow cat exam is from Syrio Forel, Arya Stark's fencing instructor.

Syrio tells Arya he'll strike left when fencing. He hits her after she dodges left. Arya says “you lied”. Syrio says his words lied, but his eyes and arm told the truth.

Arya learns how Syrio became Bravos' first sword.

“On the day I am speaking of, the first sword was newly dead, and the Sealord sent for me. Many bravos had come to him, and as many had been sent away, none could say why. When I came into his presence, he was seated, and in his lap was a fat yellow cat. He told me that one of his captains had brought the beast to him, from an island beyond the sunrise. ‘Have you ever seen her like?’ he asked of me.

“And to him I said, ‘Each night in the alleys of Braavos I see a thousand like him,’ and the Sealord laughed, and that day I was named the first sword.”

Arya screwed up her face. “I don’t understand.”

Syrio clicked his teeth together. “The cat was an ordinary cat, no more. The others expected a fabulous beast, so that is what they saw. How large it was, they said. It was no larger than any other cat, only fat from indolence, for the Sealord fed it from his own table. What curious small ears, they said. Its ears had been chewed away in kitten fights. And it was plainly a tomcat, yet the Sealord said ‘her,’ and that is what the others saw. Are you hearing?” Reddit discussion.

Development teams should not believe what they are told.

We created an appointment booking system. We thought it was an appointment-booking system. Later, we realized the software's purpose was to book the right people for appointments and discourage the unneeded ones.

The first 3 months of the project had half-correct requirements and software understanding.

Open your eyes

“Open your eyes is all that is needed. The heart lies and the head plays tricks with us, but the eyes see true. Look with your eyes, hear with your ears. Taste with your mouth. Smell with your nose. Feel with your skin. Then comes the thinking afterwards, and in that way, knowing the truth” Syrio Ferel

We must see what exists, not what individuals tell the development team or how developers think the software should work. Initial criteria cover 50/70% and change.

Developers build assumptions problems by assuming how software should work. Developers must quickly explain assumptions.

When a development team's assumptions are inaccurate, they must alter the code, DevOps, documentation, and tests.

It’s always faster and easier to fix requirements before code is written.

First-draft requirements can be based on old software. Development teams must grasp corporate goals and consider needs from many angles.

Testers help rethink requirements. They look at how software requirements shouldn't operate.

Technical features and benefits might misdirect software projects.

The initiatives that focused on technological possibilities developed hard-to-use software that needed extensive rewriting following user testing.

Software development

High-level criteria are different from detailed ones.

The interpretation of words determines their meaning.

Presentations are lofty, upbeat, and prejudiced.

People's perceptions may be unclear, incorrect, or just based on one perspective (half the story)

Developers can be misled by requirements, circumstances, people, plans, diagrams, designs, documentation, and many other things.

Developers receive misinformation, misunderstandings, and wrong assumptions. The development team must avoid building software with erroneous specifications.

Once code and software are written, the development team changes and fixes them.

Developers create software with incomplete information, they need to fill in the blanks to create the complete picture.

Conclusion

Yellow cats are often inaccurate when communicating requirements.

Before writing code, clarify requirements, assumptions, etc.

Everyone will pressure the development team to generate code rapidly, but this will slow down development.

Code changes are harder than requirements.

You might also like

Pat Vieljeux

3 years ago

The three-year business plan is obsolete for startups.

If asked, run.

An entrepreneur asked me about her pitch deck. A Platform as a Service (PaaS).

She told me she hadn't done her 5-year forecasts but would soon.

I said, Don't bother. I added "time-wasting."

“I've been asked”, she said.

“Who asked?”

“a VC”

“5-year forecast?”

“Yes”

“Get another VC. If he asks, it's because he doesn't understand your solution or to waste your time.”

Some VCs are lagging. They're still using steam engines.

10-years ago, 5-year forecasts were requested.

Since then, we've adopted a 3-year plan.

But It's outdated.

Max one year.

What has happened?

Revolutionary technology. NO-CODE.

Revolution's consequences?

Product viability tests are shorter. Hugely. SaaS and PaaS.

Let me explain:

Building a minimum viable product (MVP) that works only takes a few months.

1 to 2 months for practical testing.

Your company plan can be validated or rejected in 4 months as a consequence.

After validation, you can ask for VC money. Even while a prototype can generate revenue, you may not require any.

Good VCs won't ask for a 3-year business plan in that instance.

One-year, though.

If you want, establish a three-year plan, but realize that the second year will be different.

You may have changed your business model by then.

A VC isn't interested in a three-year business plan because your solution may change.

Your ability to create revenue will be key.

But also, to pivot.

They will be interested in your value proposition.

They will want to know what differentiates you from other competitors and why people will buy your product over another.

What will interest them is your resilience, your ability to bounce back.

Not to mention your mindset. The fact that you won’t get discouraged at the slightest setback.

The grit you have when facing adversity, as challenges will surely mark your journey.

The authenticity of your approach. They’ll want to know that you’re not just in it for the money, let alone to show off.

The fact that you put your guts into it and that you are passionate about it. Because entrepreneurship is a leap of faith, a leap into the void.

They’ll want to make sure you are prepared for it because it’s not going to be a walk in the park.

They’ll want to know your background and why you got into it.

They’ll also want to know your family history.

And what you’re like in real life.

So a 5-year plan…. You can bet they won’t give a damn. Like their first pair of shoes.

wordsmithwriter

3 years ago

2023 Will Be the Year of Evernote and Craft Notetaking Apps.

Note-taking is a vital skill. But it's mostly learned.

Recently, innovative note-taking apps have flooded the market.

In the next few years, Evernote and Craft will be important digital note-taking companies.

Evernote is a 2008 note-taking program. It can capture ideas, track tasks, and organize information on numerous platforms.

It's one of the only note-taking app that lets users input text, audio, photos, and videos. It's great for collecting research notes, brainstorming, and remaining organized.

Craft is a popular note-taking app.

Craft is a more concentrated note-taking application than Evernote. It organizes notes into subjects, tags, and relationships, making it ideal for technical or research notes.

Craft's search engine makes it easy to find what you need.

Both Evernote and Craft are likely to be the major players in digital note-taking in the years to come.

Their concentration on gathering and organizing information lets users generate notes quickly and simply. Multimedia elements and a strong search engine make them the note-taking apps of the future.

Evernote and Craft are great note-taking tools for staying organized and tracking ideas and projects.

With their focus on acquiring and organizing information, they'll dominate digital note-taking in 2023.

Pros

Concentrate on gathering and compiling information

special features including a strong search engine and multimedia components

Possibility of subject, tag, and relationship structuring

enables users to incorporate multimedia elements

Excellent tool for maintaining organization, arranging research notes, and brainstorming

Cons

Software may be difficult for folks who are not tech-savvy to utilize.

Limited assistance for hardware running an outdated operating system

Subscriptions could be pricey.

Data loss risk because of security issues

Evernote and Craft both have downsides.

The risk of data loss as a result of security flaws and software defects comes first.

Additionally, their subscription fees could be high, and they might restrict support for hardware that isn't running the newest operating systems.

Finally, folks who need to be tech-savvy may find the software difficult.

Evernote versus. Productivity Titans Evernote will make Notion more useful. medium.com

Jake Prins

3 years ago

What are NFTs 2.0 and what issues are they meant to address?

New standards help NFTs reach their full potential.

NFTs lack interoperability and functionality. They have great potential but are mostly speculative. To maximize NFTs, we need flexible smart contracts.

Current requirements are too restrictive.

Most NFTs are based on ERC-721, which makes exchanging them easy. CryptoKitties, a popular online game, used the 2017 standard to demonstrate NFTs' potential.

This simple standard includes a base URI and incremental IDs for tokens. Add the tokenID to the base URI to get the token's metadata.

This let creators collect NFTs. Many NFT projects store metadata on IPFS, a distributed storage network, but others use Google Drive. NFT buyers often don't realize that if the creators delete or move the files, their NFT is just a pointer.

This isn't the standard's biggest issue. There's no way to validate NFT projects.

Creators are one of the most important aspects of art, but nothing is stored on-chain.

ERC-721 contracts only have a name and symbol.

Most of the data on OpenSea's collection pages isn't from the NFT's smart contract. It was added through a platform input field, so it's in the marketplace's database. Other websites may have different NFT information.

In five years, your NFT will be just a name, symbol, and ID.

Your NFT doesn't mention its creators. Although the smart contract has a public key, it doesn't reveal who created it.

The NFT's creators and their reputation are crucial to its value. Think digital fashion and big brands working with well-known designers when more professionals use NFTs. Don't you want them in your NFT?

Would paintings be as valuable if their artists were unknown? Would you believe it's real?

Buying directly from an on-chain artist would reduce scams. Current standards don't allow this data.

Most creator profiles live on centralized marketplaces and could disappear. Current platforms have outpaced underlying standards. The industry's standards are lagging.

For NFTs to grow beyond pointers to a monkey picture file, we may need to use new Web3-based standards.

Introducing NFTs 2.0

Fabian Vogelsteller, creator of ERC-20, developed new web3 standards. He proposed LSP7 Digital Asset and LSP8 Identifiable Digital Asset, also called NFT 2.0.

NFT and token metadata inputs are extendable. Changes to on-chain metadata inputs allow NFTs to evolve. Instead of public keys, the contract can have Universal Profile addresses attached. These profiles show creators' faces and reputations. NFTs can notify asset receivers, automating smart contracts.

LSP7 and LSP8 use ERC725Y. Using a generic data key-value store gives contracts much-needed features:

The asset can be customized and made to stand out more by allowing for unlimited data attachment.

Recognizing changes to the metadata

using a hash reference for metadata rather than a URL reference

This base will allow more metadata customization and upgradeability. These guidelines are:

Genuine and Verifiable Now, the creation of an NFT by a specific Universal Profile can be confirmed by smart contracts.

Dynamic NFTs can update Flexible & Updatable Metadata, allowing certain things to evolve over time.

Protected metadata Now, secure metadata that is readable by smart contracts can be added indefinitely.

Better NFTS prevent the locking of NFTs by only being sent to Universal Profiles or a smart contract that can interact with them.

Summary

NFTS standards lack standardization and powering features, limiting the industry.

ERC-721 is the most popular NFT standard, but it only represents incremental tokenIDs without metadata or asset representation. No standard sender-receiver interaction or security measures ensure safe asset transfers.

NFT 2.0 refers to the new LSP7-DigitalAsset and LSP8-IdentifiableDigitalAsset standards.

They have new standards for flexible metadata, secure transfers, asset representation, and interactive transfer.

With NFTs 2.0 and Universal Profiles, creators could build on-chain reputations.

NFTs 2.0 could bring the industry's needed innovation if it wants to move beyond trading profile pictures for speculation.