More on Personal Growth

Simon Ash

2 years ago

The Three Most Effective Questions for Ongoing Development

The Traffic Light Approach to Reviewing Personal, Team and Project Development

What needs improvement? If you want to improve, you need to practice your sport, musical instrument, habit, or work project. You need to assess your progress.

Continuous improvement is the foundation of focused practice and a growth mentality. Not just individually. High-performing teams pursue improvement. Right? Why is it hard?

As a leadership coach, senior manager, and high-level athlete, I've found three key questions that may unlock high performance in individuals and teams.

Problems with Reviews

Reviewing and improving performance is crucial, however I hate seeing review sessions in my diary. I rarely respond to questionnaire pop-ups or emails. Why?

Time constrains. Requests to fill out questionnaires often state they will take 10–15 minutes, but I can think of a million other things to do with that time. Next, review overload. Businesses can easily request comments online. No matter what you buy, someone will ask for your opinion. This bombardment might make feedback seem bad, which is bad.

The problem is that we might feel that way about important things like personal growth and work performance. Managers and team leaders face a greater challenge.

When to Conduct a Review

We must be wise about reviewing things that matter to us. Timing and duration matter. Reviewing the experience as quickly as possible preserves information and sentiments. Time must be brief. The review's importance and size will determine its length. We might only take a few seconds to review our morning coffee, but we might require more time for that six-month work project.

These post-event reviews should be supplemented by periodic reflection. Journaling can help with daily reflections, but I also like to undertake personal reviews every six months on vacation or at a retreat.

As an employee or line manager, you don't want to wait a year for a performance assessment. Little and frequently is best, with a more formal and in-depth assessment (typically with a written report) in 6 and 12 months.

The Easiest Method to Conduct a Review Session

I follow Einstein's review process:

“Make things as simple as possible but no simpler.”

Thus, it should be brief but deliver the necessary feedback. Quality critique is hard to receive if the process is overly complicated or long.

I have led or participated in many review processes, from strategic overhauls of big organizations to personal goal coaching. Three key questions guide the process at either end:

What ought to stop being done?

What should we do going forward?

What should we do first?

Following the Rule of 3, I compare it to traffic lights. Red, amber, and green lights:

Red What ought should we stop?

Amber What ought to we keep up?

Green Where should we begin?

This approach is easy to understand and self-explanatory, however below are some examples under each area.

Red What ought should we stop?

As a team or individually, we must stop doing things to improve.

Sometimes they're bad. If we want to lose weight, we should avoid sweets. If a team culture is bad, we may need to stop unpleasant behavior like gossiping instead of having difficult conversations.

Not all things we should stop are wrong. Time matters. Since it is finite, we sometimes have to stop nice things to focus on the most important. Good to Great author Jim Collins famously said:

“Don’t let the good be the enemy of the great.”

Prioritizing requires this idea. Thus, decide what to stop to prioritize.

Amber What ought to we keep up?

Should we continue with the amber light? It helps us decide what to keep doing during review. Many items fall into this category, so focus on those that make the most progress.

Which activities have the most impact? Which behaviors create the best culture? Success-building habits?

Use these questions to find positive momentum. These are the fly-wheel motions, according to Jim Collins. The Compound Effect author Darren Hardy says:

“Consistency is the key to achieving and maintaining momentum.”

What can you do consistently to reach your goal?

Green Where should we begin?

Finally, green lights indicate new beginnings. Red/amber difficulties may be involved. Stopping a red issue may give you more time to do something helpful (in the amber).

This green space inspires creativity. Kolbs learning cycle requires active exploration to progress. Thus, it's crucial to think of new approaches, try them out, and fail if required.

This notion underpins lean start-build, up's measure, learn approach and agile's trying, testing, and reviewing. Try new things until you find what works. Thomas Edison, the lighting legend, exclaimed:

“There is a way to do it better — find it!”

Failure is acceptable, but if you want to fail forward, look back on what you've done.

John Maxwell concurred with Edison:

“Fail early, fail often, but always fail forward”

A good review procedure lets us accomplish that. To avoid failure, we must act, experiment, and reflect.

Use the traffic light system to prioritize queries. Ask:

Red What needs to stop?

Amber What should continue to occur?

Green What might be initiated?

Take a moment to reflect on your day. Check your priorities with these three questions. Even if merely to confirm your direction, it's a terrific exercise!

Alex Mathers

3 years ago Draft

12 practices of the zenith individuals I know

Calmness is a vital life skill.

It aids communication. It boosts creativity and performance.

I've studied calm people's habits for years. Commonalities:

Have learned to laugh at themselves.

Those who have something to protect can’t help but make it a very serious business, which drains the energy out of the room.

They are fixated on positive pursuits like making cool things, building a strong physique, and having fun with others rather than on depressing influences like the news and gossip.

Every day, spend at least 20 minutes moving, whether it's walking, yoga, or lifting weights.

Discover ways to take pleasure in life's challenges.

Since perspective is malleable, they change their view.

Set your own needs first.

Stressed people neglect themselves and wonder why they struggle.

Prioritize self-care.

Don't ruin your life to please others.

Make something.

Calm people create more than react.

They love creating beautiful things—paintings, children, relationships, and projects.

Hold your breath, please.

If you're stressed or angry, you may be surprised how much time you spend holding your breath and tightening your belly.

Release, breathe, and relax to find calm.

Stopped rushing.

Rushing is disadvantageous.

Calm people handle life better.

Are attuned to their personal dietary needs.

They avoid junk food and eat foods that keep them healthy, happy, and calm.

Don’t take anything personally.

Stressed people control everything.

Self-conscious.

Calm people put others and their work first.

Keep their surroundings neat.

Maintaining an uplifting and clutter-free environment daily calms the mind.

Minimise negative people.

Calm people are ruthless with their boundaries and avoid negative and drama-prone people.

Tim Denning

3 years ago

I gave up climbing the corporate ladder once I realized how deeply unhappy everyone at the top was.

Restructuring and layoffs cause career reevaluation. Your career can benefit.

Once you become institutionalized, the corporate ladder is all you know.

You're bubbled. Extremists term it the corporate Matrix. I'm not so severe because the business world brainwashed me, too.

This boosted my corporate career.

Until I hit bottom.

15 months later, I view my corporate life differently. You may wish to advance professionally. Read this before you do.

Your happiness in the workplace may be deceptive.

I've been fortunate to spend time with corporate aces.

Working for 2.5 years in banking social media gave me some of these experiences. Earlier in my career, I recorded interviews with business leaders.

These people have titles like Chief General Manager and Head Of. New titles brought life-changing salaries.

They seemed happy.

I’d pass them in the hallway and they’d smile or shake my hand. I dreamt of having their life.

The ominous pattern

Unfiltered talks with some of them revealed a different world.

They acted well. They were skilled at smiling and saying the correct things. All had the same dark pattern, though.

Something felt off.

I found my conversations with them were generally for their benefit. They hoped my online antics as a writer/coach would shed light on their dilemma.

They'd tell me they wanted more. When you're one position away from CEO, it's hard not to wonder if this next move will matter.

What really displeased corporate ladder chasers

Before ascending further, consider these.

Zero autonomy

As you rise in a company, your days get busier.

Many people and initiatives need supervision. Everyone expects you to know business details. Weak when you don't. A poor leader is fired during the next restructuring and left to pursue their corporate ambition.

Full calendars leave no time for reflection. You can't have a coffee with a friend or waste a day.

You’re always on call. It’s a roll call kinda life.

Unable to express oneself freely

My 8 years of LinkedIn writing helped me meet these leaders.

I didn't think they'd care. Mistake.

Corporate leaders envied me because they wanted to talk freely again without corporate comms or a PR firm directing them what to say.

They couldn't share their flaws or inspiring experiences.

They wanted to.

Every day they were muzzled eroded by their business dream.

Limited family time

Top leaders had families.

They've climbed the corporate ladder. Nothing excellent happens overnight.

Corporate dreamers rarely saw their families.

Late meetings, customer functions, expos, training, leadership days, team days, town halls, and product demos regularly occurred after work.

Or they had to travel interstate or internationally for work events. They used bags and motel showers.

Initially, they said business class flights and hotels were nice. They'd get bored. 5-star hotels become monotonous.

No hotel beats home.

One leader said he hadn't seen his daughter much. They used to Facetime, but now that he's been gone so long, she rarely wants to talk to him.

So they iPad-parented.

You're miserable without your family.

Held captive by other job titles

Going up the business ladder seems like a battle.

Leaders compete for business gains and corporate advancement.

I saw shocking filthy tricks. Leaders would lie to seem nice.

Captives included top officials.

A different section every week. If they ran technology, the Head of Sales would argue their CRM cost millions. Or an Operations chief would battle a product team over support requests.

After one conflict, another began.

Corporate echelons are antagonistic. Huge pay and bonuses guarantee bad behavior.

Overly centered on revenue

As you rise, revenue becomes more prevalent. Most days, you'd believe revenue was everything. Here’s the problem…

Numbers drain us.

Unless you're a closet math nerd, contemplating and talking about numbers drains your creativity.

Revenue will never substitute impact.

Incapable of taking risks

Corporate success requires taking fewer risks.

Risks can cause dismissal. Risks can interrupt business. Keep things moving so you may keep getting paid your enormous salary and bonus.

Restructuring or layoffs are inevitable. All corporate climbers experience it.

On this fateful day, a small few realize the game they’ve been trapped in and escape. Most return to play for a new company, but it takes time.

Addiction keeps them trapped. You know nothing else. The rest is strange.

You start to think “I’m getting old” or “it’s nearly retirement.” So you settle yet again for the trappings of the corporate ladder game to nowhere.

Should you climb the corporate ladder?

Let me end on a surprising note.

Young people should ascend the corporate ladder. It teaches you business skills and helps support your side gig and (potential) online business.

Don't get trapped, shackled, or muzzled.

Your ideas and creativity become stifled after too much gaming play.

Corporate success won't bring happiness.

Find fulfilling employment that matters. That's it.

You might also like

Jano le Roux

3 years ago

Never Heard Of: The Apple Of Email Marketing Tools

Unlimited everything for $19 monthly!?

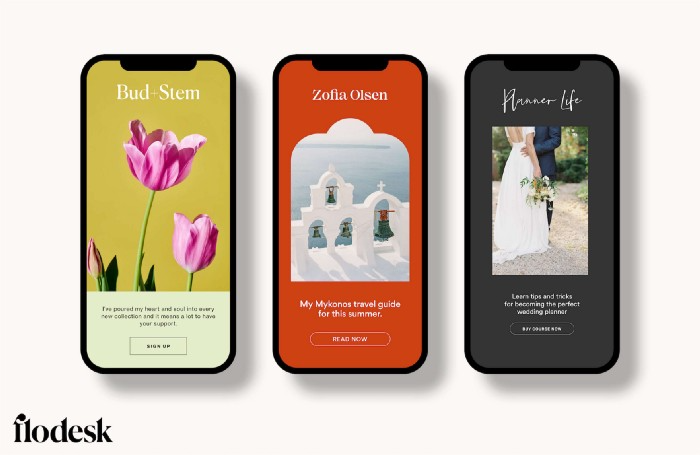

Even with pretty words, no one wants to read an ugly email.

Not Gen Z

Not Millennials

Not Gen X

Not Boomers

I am a minimalist.

I like Mozart. I like avos. I love Apple.

When I hear seamlessly, effortlessly, or Apple's new adverb fluidly, my toes curl.

No email marketing tool gave me that feeling.

As a marketing consultant helping high-growth brands create marketing that doesn't feel like marketing, I've worked with every email marketing platform imaginable, including that naughty monkey and the expensive platform whose sales teams don't stop calling.

Most email marketing platforms are flawed.

They are overpriced.

They use dreadful templates.

They employ a poor visual designer.

The user experience there is awful.

Too many useless buttons are present. (Similar to the TV remote!)

I may have finally found the perfect email marketing tool. It creates strong flows. It helps me focus on storytelling.

It’s called Flodesk.

It’s effortless. It’s seamless. It’s fluid.

Here’s why it excites me.

Unlimited everything for $19 per month

Sends unlimited. Emails unlimited. Signups unlimited.

Most email platforms penalize success.

Pay for performance?

$87 for 10k contacts

$605 for 100K contacts

$1,300+ for 200K contacts

In the 1990s, this made sense, but not now. It reminds me of when ISPs capped internet usage at 5 GB per month.

Flodesk made unlimited email for a low price a reality. Affordable, attractive email marketing isn't just for big companies.

Flodesk doesn't penalize you for growing your list. Price stays the same as lists grow.

Flodesk plans cost $38 per month, but I'll give you a 30-day trial for $19.

Amazingly strong flows

Foster different people's flows.

Email marketing isn't one-size-fits-all.

Different times require different emails.

People don't open emails because they're irrelevant, in my experience. A colder audience needs a nurturing sequence.

Flodesk automates your email funnels so top-funnel prospects fall in love with your brand and values before mid- and bottom-funnel email flows nudge them to take action.

I wish I could save more custom audience fields to further customize the experience.

Dynamic editor

Easy. Effortless.

Flodesk's editor is Apple-like.

You understand how it works almost instantly.

Like many Apple products, it's intentionally limited. No distractions. You can focus on emotional email writing.

Flodesk's inability to add inline HTML to emails is my biggest issue with larger projects. I wish I could upload HTML emails.

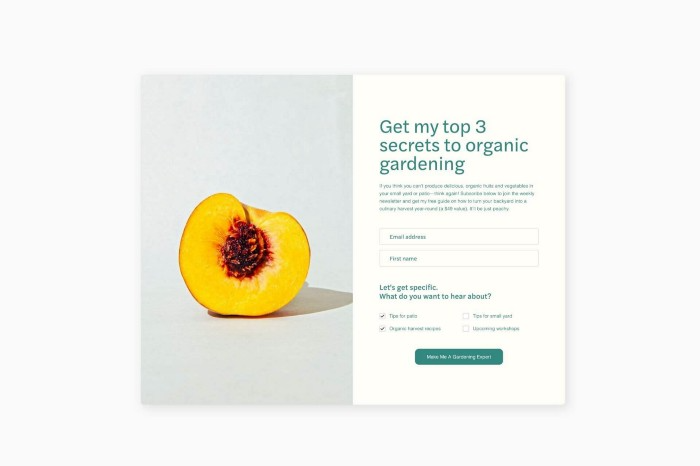

Simple sign-up procedures

Dream up joining.

I like how easy it is to create conversion-focused landing pages. Linkly lets you easily create 5 landing pages and A/B test messaging.

I like that you can use signup forms to ask people what they're interested in so they get relevant emails instead of mindless mass emails nobody opens.

I love how easy it is to embed in-line on a website.

Wonderful designer templates

Beautiful, connecting emails.

Flodesk has calm email templates. My designer's eye felt at rest when I received plain text emails with big impacts.

As a typography nerd, I love Flodesk's handpicked designer fonts. It gives emails a designer feel that is hard to replicate on other platforms without coding and custom font licenses.

Small adjustments can have a big impact

Details matter.

Flodesk remembers your brand colors. Flodesk automatically adds your logo and social handles to emails after signup.

Flodesk uses Zapier. This lets you send emails based on a user's action.

A bad live chat can trigger a series of emails to win back a customer.

Flodesk isn't for everyone.

Flodesk is great for Apple users like me.

Nick Nolan

3 years ago

In five years, starting a business won't be hip.

People are slowly recognizing entrepreneurship's downside.

Growing up, entrepreneurship wasn't common. High school class of 2012 had no entrepreneurs.

Businesses were different.

They had staff and a lengthy history of achievement.

I never wanted a business. It felt unattainable. My friends didn't care.

Weird.

People desired degrees to attain good jobs at big companies.

When graduated high school:

9 out of 10 people attend college

Earn minimum wage (7%) working in a restaurant or retail establishment

Or join the military (3%)

Later, entrepreneurship became a thing.

2014-ish

I was in the military and most of my high school friends were in college, so I didn't hear anything.

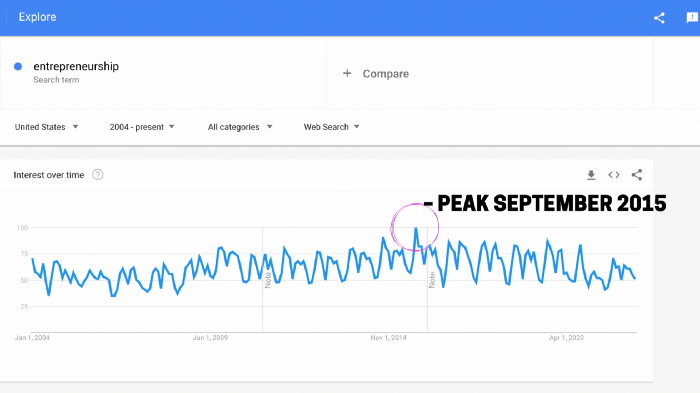

Entrepreneurship soared in 2015, according to Google Trends.

Then more individuals were interested. Entrepreneurship went from unusual to cool.

In 2015, it was easier than ever to build a website, run Facebook advertisements, and achieve organic social media reach.

There were several online business tools.

You didn't need to spend years or money figuring it out. Most entry barriers were gone.

Everyone wanted a side gig to escape the 95.

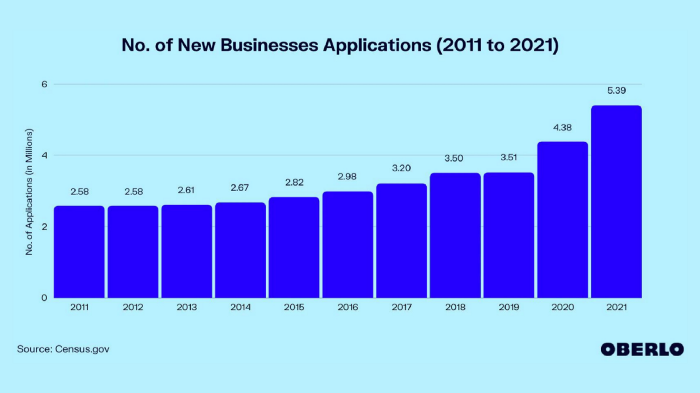

Small company applications have increased during the previous 10 years.

2011-2014 trend continues.

2015 adds 150,000 applications. 2016 adds 200,000. Plus 300,000 in 2017.

The graph makes it look little, but that's a considerable annual spike with no indications of stopping.

By 2021, new business apps had doubled.

Entrepreneurship will return to its early 2010s level.

I think we'll go backward in 5 years.

Entrepreneurship is half as popular as it was in 2015.

In the late 2020s and 30s, entrepreneurship will again be obscure.

Entrepreneurship's decade-long splendor is fading. People will cease escaping 9-5 and launch fewer companies.

That’s not a bad thing.

I think people have a rose-colored vision of entrepreneurship. It's fashionable. People feel that they're missing out if they're not entrepreneurial.

Reality is showing up.

People say on social media, "I knew starting a business would be hard, but not this hard."

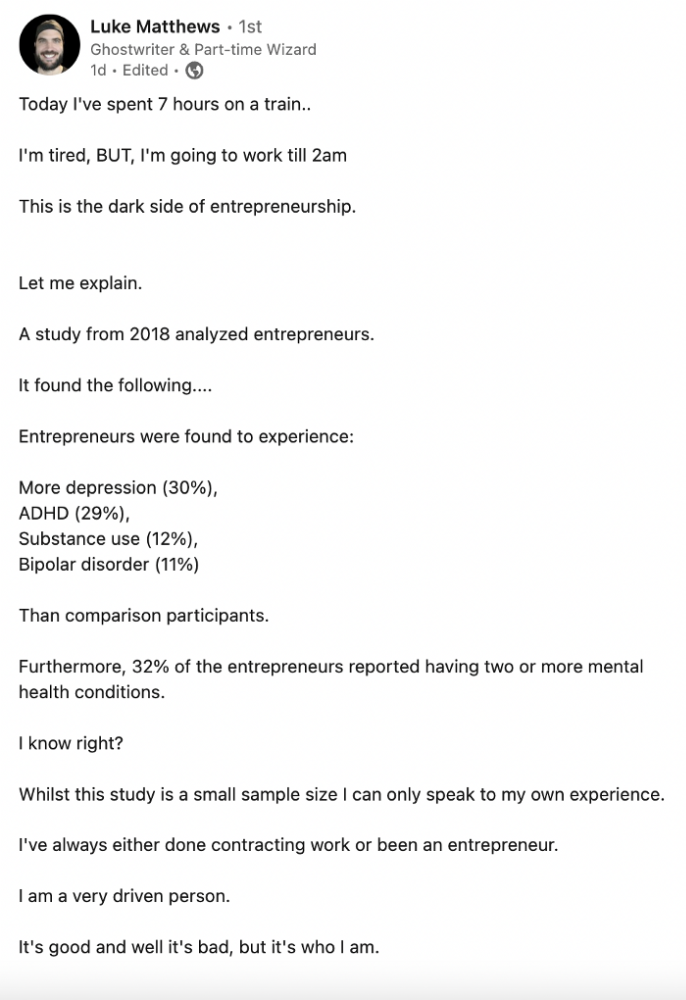

More negative posts on entrepreneurship:

Luke adds:

Is being an entrepreneur ‘healthy’? I don’t really think so. Many like Gary V, are not role models for a well-balanced life. Despite what feel-good LinkedIn tells you the odds are against you as an entrepreneur. You have to work your face off. It’s a tough but rewarding lifestyle. So maybe let’s stop glorifying it because it takes a lot of (bleepin) work to survive a pandemic, mental health battles, and a competitive market.

Entrepreneurship is no longer a pipe dream.

It’s hard.

I went full-time in March 2020. I was done by April 2021. I had a good-paying job with perks.

When that fell through (on my start date), I had to continue my entrepreneurial path. I needed money by May 1 to pay rent.

Entrepreneurship isn't as great as many think.

Entrepreneurship is a serious business.

If you have a 9-5, the grass isn't greener here. Most people aren't telling the whole story when they post on social media or quote successful entrepreneurs.

People prefer to communicate their victories than their defeats.

Is this a bad thing?

I don’t think so.

Over the previous decade, entrepreneurship went from impossible to the finest thing ever.

It peaked in 2020-21 and is returning to reality.

Startups aren't for everyone.

If you like your job, don't quit.

Entrepreneurship won't amaze people if you quit your job.

It's irrelevant.

You're doomed.

And you'll probably make less money.

If you hate your job, quit. Change jobs and bosses. Changing jobs could net you a greater pay or better perks.

When you go solo, your paycheck and perks vanish. Did I mention you'll fail, sleep less, and stress more?

Nobody will stop you from pursuing entrepreneurship. You'll face several challenges.

Possibly.

Entrepreneurship may be romanticized for years.

Based on what I see from entrepreneurs on social media and trends, entrepreneurship is challenging and few will succeed.

Dr Mehmet Yildiz

3 years ago

How I train my brain daily for clarity and productivity.

I use a conceptual and practical system I developed decades ago as an example.

Since childhood, I've been interested in the brain-mind connection, so I developed a system using scientific breakthroughs, experiments, and the experiences of successful people in my circles.

This story provides a high-level overview of a custom system to inform and inspire readers. Creating a mind gym was one of my best personal and professional investments.

Such a complex system may not be possible for everyone or appear luxurious at first. However, the process and approach may help you find more accessible and viable solutions.

Visualizing the brain as a muscle, I learned to stimulate it with physical and mental exercises, applying a new mindset and behavioral changes.

My methods and practices may not work for others because we're all different. I focus on the approach's principles and highlights so you can create your own program.

Some create a conceptual and practical system intuitively, and others intellectually. Both worked. I see intellect and intuition as higher selves.

The mental tools I introduce are based on lifestyle changes and can be personalized by anyone, barring physical constraints or underlying health conditions.

Some people can't meditate despite wanting to due to mental constraints. This story lacks exceptions.

People's systems may vary. Many have used my tools successfully. All have scientific backing because their benefits attracted scientists. None are unethical or controversial.

My focus is cognition, which is the neocortex's ability. These practices and tools can affect the limbic and reptilian brain regions.

A previous article discussed brain health's biological aspects. This article focuses on psychology.

Thinking, learning, and remembering are cognitive abilities. Cognitive abilities determine our health and performance.

Cognitive health is the ability to think, concentrate, learn, and remember. Cognitive performance boosting involves various tools and processes. My system and protocols address cognitive health and performance.

As a biological organ, the brain's abilities decline with age, especially if not used regularly. Older people have more neurodegenerative disorders like dementia.

As aging is inevitable, I focus on creating cognitive reserves to remain mentally functional as we age and face mental decline or cognitive impairment.

My protocols focus on neurogenesis, or brain growth and maintenance. Neurons and connections can grow at any age.

Metacognition refers to knowing our cognitive abilities, like thinking about thinking and learning how to learn.

In the following sections, I provide an overview of my system, mental tools, and protocols.

This system summarizes my 50-year career. Some may find it too abstract, so I give examples.

First, explain the system. Section 2 introduces activities. Third, how to measure and maintain mental growth.

1 — Developed a practical mental gym.

The mental gym is a metaphor for the physical fitness gym to improve our mental muscles.

This concept covers brain and mind functionality. Integrated biological and psychological components.

I'll describe my mental gym so my other points make sense. My mental gym has physical and mental tools.

Mindfulness, meditation, visualization, self-conversations, breathing exercises, expressive writing, working in a flow state, reading, music, dance, isometric training, barefoot walking, cold/heat exposure, CBT, and social engagements are regular tools.

Dancing, walking, and thermogenesis are body-related tools. As the brain is part of the body and houses the mind, these tools can affect mental abilities such as attention, focus, memory, task switching, and problem-solving.

Different people may like different tools. I chose these tools based on my needs, goals, and lifestyle. They're just examples. You can choose tools that fit your goals and personality.

2 — Performed tasks regularly.

These tools gave me clarity. They became daily hobbies. Some I did alone, others with others.

Some examples: I meditate daily. Even though my overactive mind made daily meditation difficult at first, I now enjoy it. Meditation three times a day sharpens my mind.

Self-talk is used for self-therapy and creativity. Self-talk was initially difficult, but neurogenesis rewired my brain to make it a habit.

Cold showers, warm baths with Epsom salts, fasting, barefoot walks on the beach or grass, dancing, calisthenics, trampoline hopping, and breathing exercises increase my mental clarity, creativity, and productivity.

These exercises can increase BDNF, which promotes nervous system growth. They improve mental capacity and performance by increasing blood flow and brain oxygenation.

I use weekly and occasional activities like dry saunas, talking with others, and community activities.

These activities stimulate the brain and mind, improving performance and cognitive capacity.

3 — Measured progress, set growth goals.

Measuring progress helps us stay on track. Without data, it's hard to stay motivated. When we face inevitable setbacks, we may abandon our dreams.

I created a daily checklist for a spreadsheet with macros. I tracked how often and long I did each activity.

I measured my progress objectively and subjectively. In the progress spreadsheet, I noted my meditation hours and subjective feelings.

In another column, I used good, moderate, and excellent to get qualitative data. It took time and effort. Later, I started benefiting from this automated structure.

Creating a page for each activity, such as meditation, self-talk, cold showers, walking, expressive writing, personal interactions, etc., gave me empirical data I could analyze, modify, and graph to show progress.

Colored charts showed each area's strengths and weaknesses.

Strengths motivate me to continue them. Identifying weaknesses helped me improve them.

As the system matured, data recording became a habit and took less time. I saw the result immediately because I automated the charts when I entered daily data. Early time investment paid off later.

Mind Gym Benefits, Effective Use, and Progress Measuring

This concept helped me move from comfort to risk. I accept things as they are.

Turnarounds were made. I stopped feeling "Fight-Flight-Freeze" and maintained self-control.

I tamed my overactive amygdala by strengthening my brain. Stress and anxiety decreased. With these shifts, I accepted criticism and turned envy into admiration. Clarity improved.

When the cognitive part of the brain became stronger and the primitive part was tamed, managing thoughts and emotions became easier. My AQ increased. I learned to tolerate people, physical, mental, and emotional obstacles.

Accessing vast information sources in my subconscious mind through an improved RAS allowed me to easily tap into my higher self and recognize flaws in my lower self.

Summary

The brain loves patterns and routines, so habits help. Observing, developing, and monitoring habits mindfully can be beneficial. Mindfulness helps us achieve this goal systematically.

As body and mind are connected, we must consider both when building habits. Consistent and joyful practices can strengthen neurons and neural connections.

Habits help us accomplish more with less effort. Regularly using mental tools and processes can improve our cognitive health and performance as we age.

Creating daily habits to improve cognitive abilities can sharpen our minds and boost our well-being.

Some apps monitor our activities and behavior to help build habits. If you can't replicate my system, try these apps. Some smartwatches and fitness devices include them.

Set aside time each day for mental activities you enjoy. Regular scheduling and practice can strengthen brain regions and form habits. Once you form habits, tasks become easy.

Improving our minds is a lifelong journey. It's easier and more sustainable to increase our efforts daily, weekly, monthly, or annually.

Despite life's ups and downs, many want to remain calm and cheerful.

This valuable skill is unrelated to wealth or fame. It's about our mindset, fueled by our biological and psychological needs.

Here are some lessons I've learned about staying calm and composed despite challenges and setbacks.

1 — Tranquillity starts with observing thoughts and feelings.

2 — Clear the mental clutter and emotional entanglements with conscious breathing and gentle movements.

3 — Accept situations and events as they are with no resistance.

4 — Self-love can lead to loving others and increasing compassion.

5 — Count your blessings and cultivate gratitude.

Clear thinking can bring joy and satisfaction. It's a privilege to wake up with a healthy body and clear mind, ready to connect with others and serve them.

Thank you for reading my perspectives. I wish you a healthy and happy life.