More on Marketing

Jon Brosio

3 years ago

This Landing Page is a (Legal) Money-Printing Machine

and it’s easy to build.

A landing page with good copy is a money-maker.

Let's be honest, page-builder templates are garbage.

They can help you create a nice-looking landing page, but not persuasive writing.

Over the previous 90 days, I've examined 200+ landing pages.

What's crazy?

Top digital entrepreneurs use a 7-part strategy to bring in email subscribers, generate prospects, and (passively) sell their digital courses.

Steal this 7-part landing page architecture to maximize digital product sales.

The offer

Landing pages require offers.

Newsletter, cohort, or course offer.

Your reader should see this offer first. Includind:

Headline

Imagery

Call-to-action

Clear, persuasive, and simplicity are key. Example: the Linkedin OS course home page of digital entrepreneur Justin Welsh offers:

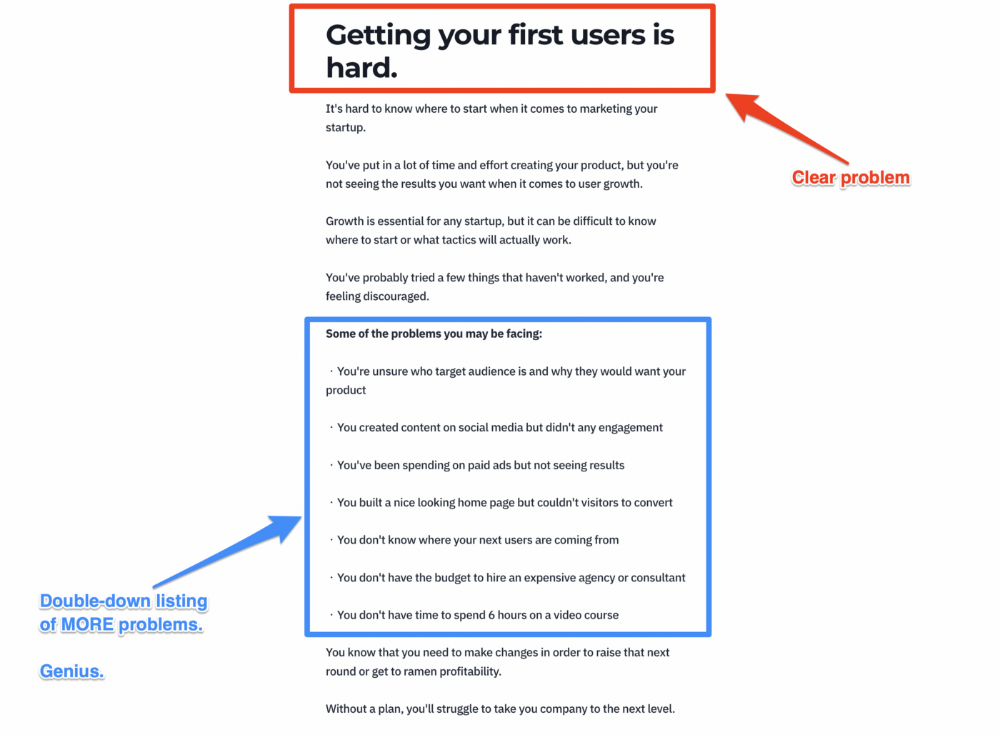

A distinctly defined problem

Everyone needs an enemy.

You need an opponent on your landing page. Problematic.

Next, employ psychology to create a struggle in your visitor's thoughts.

Don't be clever here; label your customer's problem. The more particular you are, the bigger the situation will seem.

When you build a clear monster, you invite defeat. I appreciate Theo Ohene's Growth Roadmaps landing page.

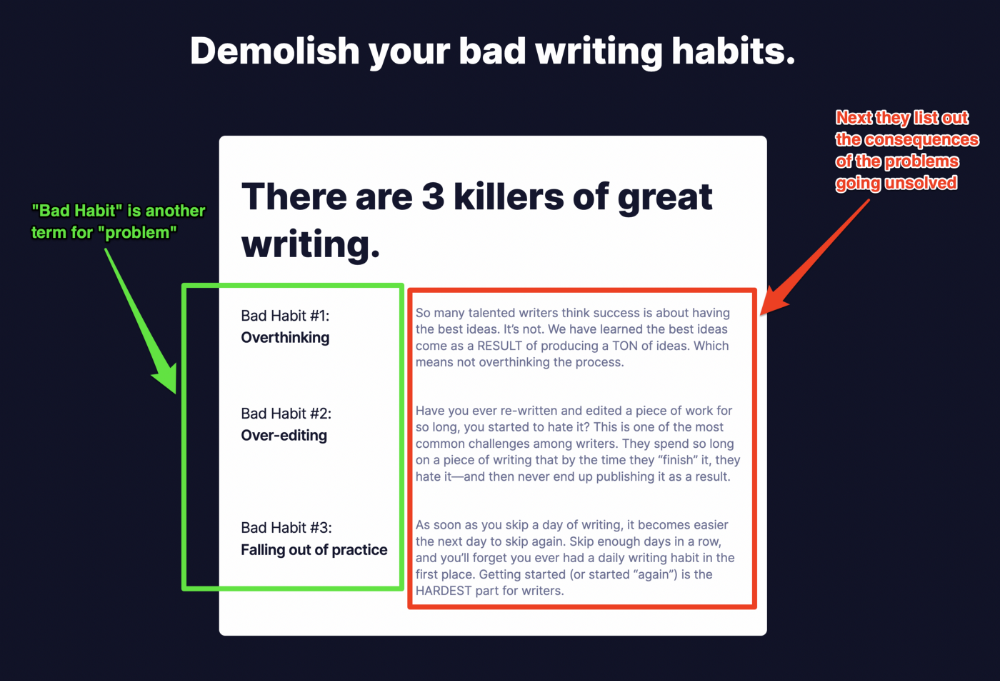

Exacerbation of the effects

Problem identification doesn't motivate action.

What would an unresolved problem mean?

This is landing page copy. When you describe the unsolved problem's repercussions, you accomplish several things:

You write a narrative (and stories are remembered better than stats)

You cause the reader to feel something.

You help the reader relate to the issue

Important!

My favorite script is:

"Sure, you can let [problem] go untreated. But what will happen if you do? Soon, you'll begin to notice [new problem 1] will start to arise. That might bring up [problem 2], etc."

Take the copywriting course, digital writer and entrepreneur Dickie Bush illustrates below when he labels the problem (see: "poor habit") and then illustrates the repercussions.

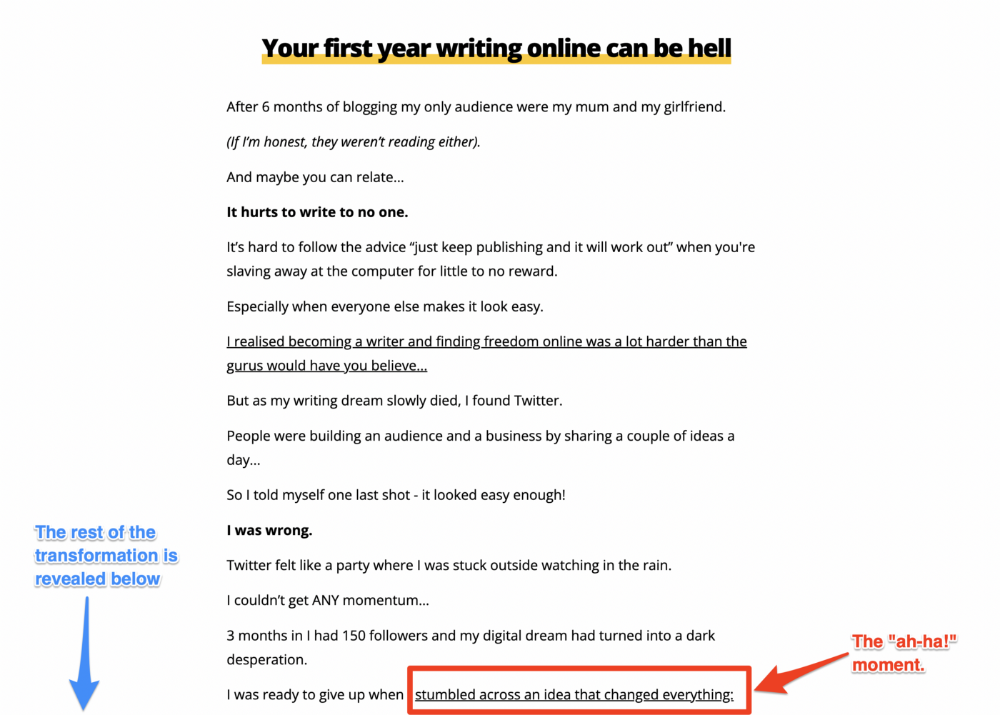

The tale of transformation

Every landing page needs that "ah-ha!" moment.

Transformation stories do this.

Did you find a solution? Someone else made the discovery? Have you tested your theory?

Next, describe your (or your subject's) metamorphosis.

Kieran Drew nails his narrative (and revelation) here. Right before the disclosure, he introduces his "ah-ha!" moment:

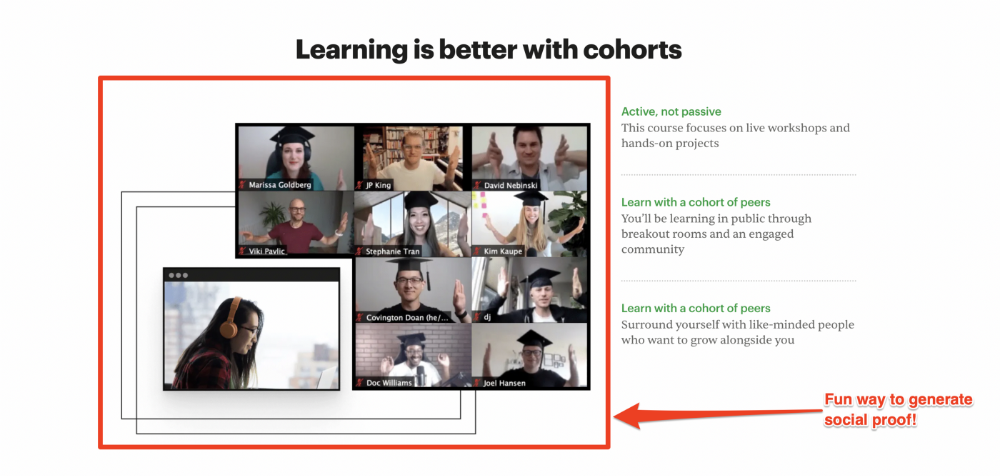

Testimonials

Social proof completes any landing page.

Social proof tells the reader, "If others do it, it must be worthwhile."

This is your argument.

Positive social proof helps (obviously).

Offer "free" training in exchange for a testimonial if you need social evidence. This builds social proof.

Most social proof is testimonies (recommended). Kurtis Hanni's creative take on social proof (using a screenshot of his colleague) is entertaining.

Bravo.

Reveal your offer

Now's the moment to act.

Describe the "bundle" that provides the transformation.

Here's:

Course

Cohort

Ebook

Whatever you're selling.

Include a product or service image, what the consumer is getting ("how it works"), the price, any "free" bonuses (preferred), and a CTA ("buy now").

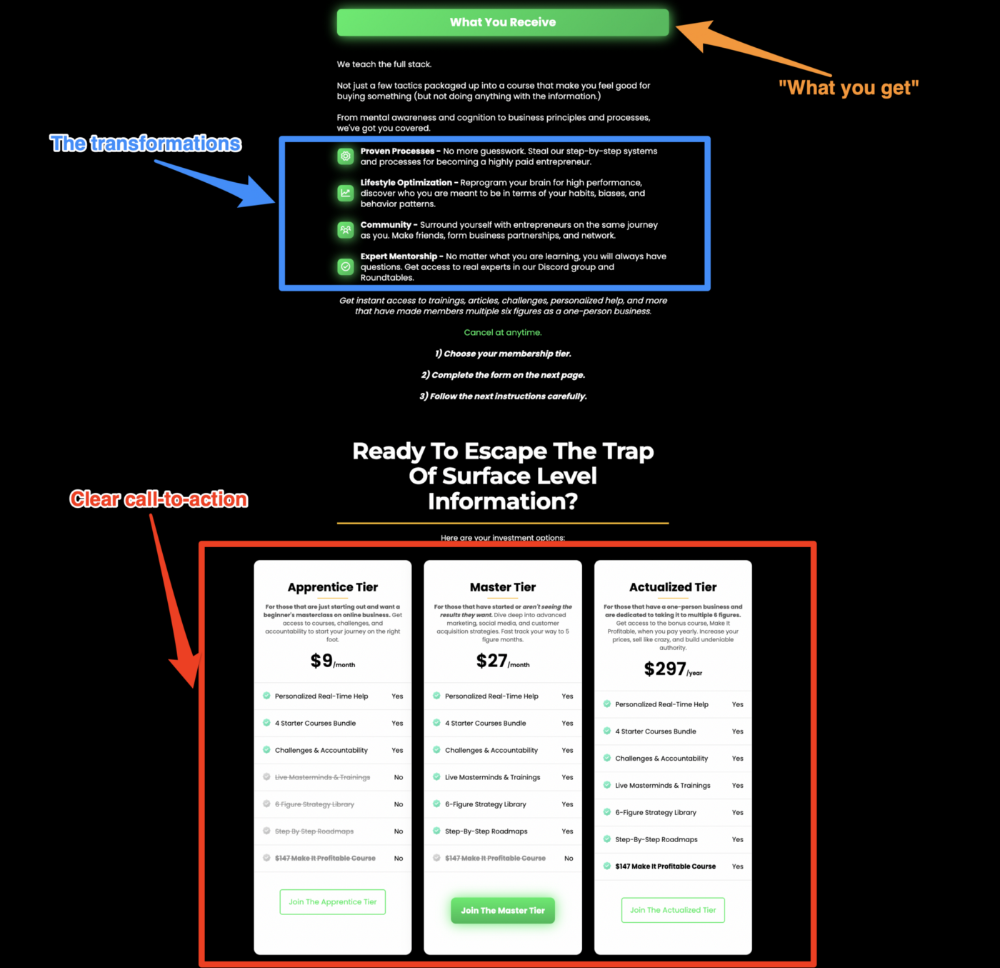

Clarity is key. Don't make a cunning offer. Make sure your presentation emphasizes customer change (benefits). Dan Koe's Modern Mastery landing page makes an offer. Consider:

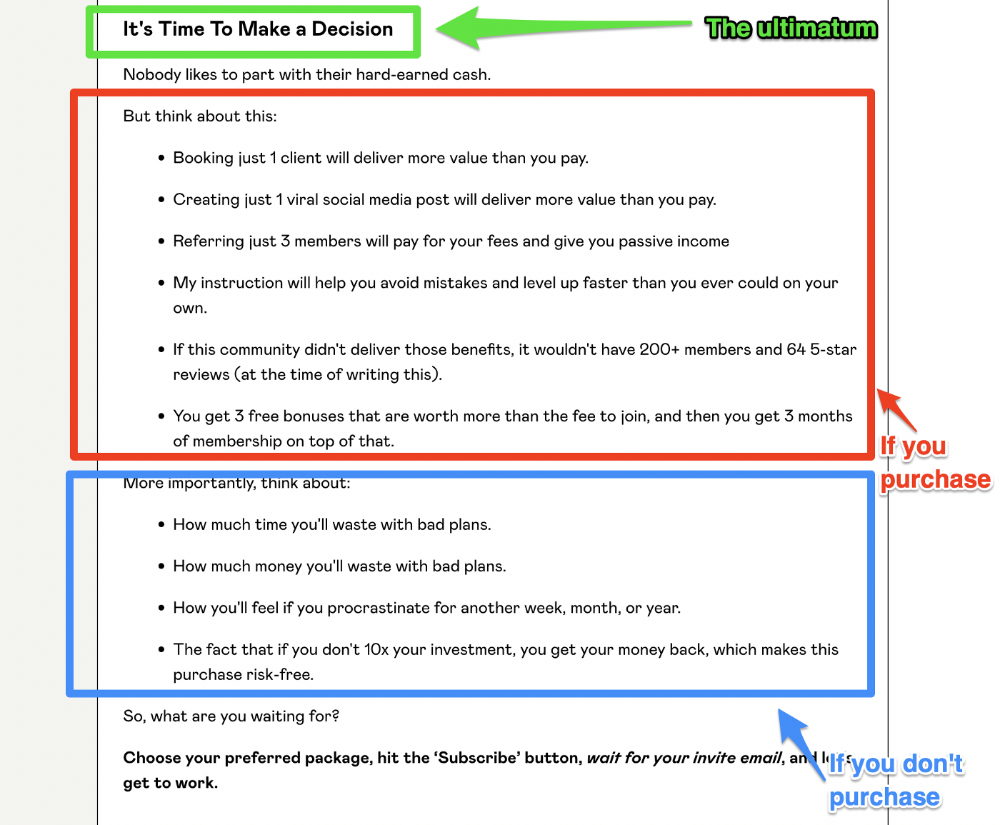

An ultimatum

Offering isn't enough.

You must give your prospect an ultimatum.

They can buy your merchandise from you.

They may exit the webpage.

That’s it.

It's crucial to show what happens if the reader does either. Stress the consequences of not buying (again, a little consequence amplification). Remind them of the benefits of buying.

I appreciate Charles Miller's product offer ending:

The top online creators use a 7-part landing page structure:

Offer the service

Describe the problem

Amplify the consequences

Tell the transformational story

Include testimonials and social proof.

Reveal the offer (with any bonuses if applicable)

Finally, give the reader a deadline to encourage them to take action.

Sequence these sections to develop a landing page that (essentially) prints money.

Ivona Hirschi

3 years ago

7 LinkedIn Tips That Will Help in Audience Growth

In 8 months, I doubled my audience with them.

LinkedIn's buzz isn't over.

People dream of social proof every day. They want clients, interesting jobs, and field recognition.

LinkedIn coaches will benefit greatly. Sell learning? Probably. Can you use it?

Consistency has been key in my eight-month study of LinkedIn. However, I'll share seven of my tips. 700 to 4500 people followed me.

1. Communication, communication, communication

LinkedIn is a social network. I like to think of it as a cafe. Here, you can share your thoughts, meet friends, and discuss life and work.

Do not treat LinkedIn as if it were a board for your post-its.

More socializing improves relationships. It's about people, like any network.

Consider interactions. Three main areas:

Respond to criticism left on your posts.

Comment on other people's posts

Start and maintain conversations through direct messages.

Engage people. You spend too much time on Facebook if you only read your wall. Keeping in touch and having meaningful conversations helps build your network.

Every day, start a new conversation to make new friends.

2. Stick with those you admire

Interact thoughtfully.

Choose your contacts. Build your tribe is a term. Respectful networking.

I only had past colleagues, family, and friends in my network at the start of this year. Not business-friendly. Since then, I've sought out people I admire or can learn from.

Finding a few will help you. As they connect you to their networks. Friendships can lead to clients.

Don't underestimate network power. Cafe-style. Meet people at each table. But avoid people who sell SEO, web redesign, VAs, mysterious job opportunities, etc.

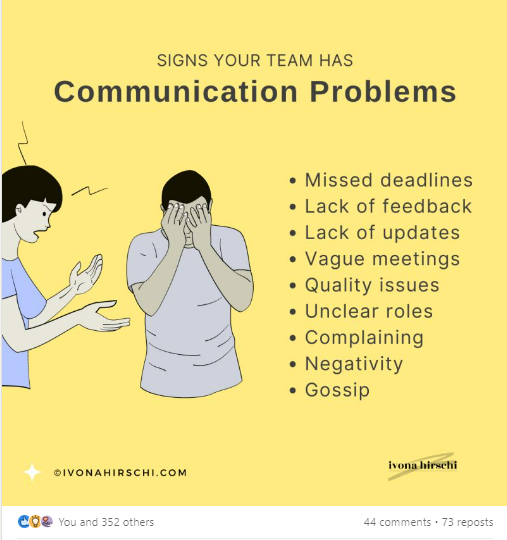

3. Share eye-catching infographics

Daily infographics flood LinkedIn. Visuals are popular. Use Canva's free templates if you can't draw them.

Last week's:

It's a fun way to visualize your topic.

You can repost and comment on infographics. Involve your network. I prefer making my own because I build my brand around certain designs.

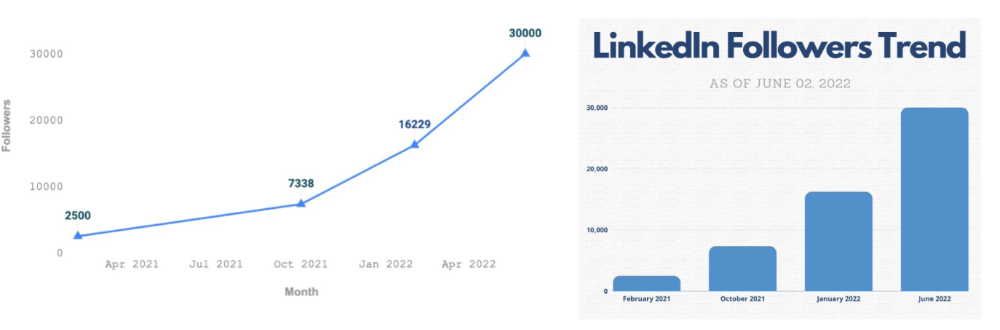

My friend posted infographics consistently for four months and grew his network to 30,000.

If you start, credit the authors. As you steal someone's work.

4. Invite some friends over.

LinkedIn alone can be lonely. Having a few friends who support your work daily will boost your growth.

I was lucky to be invited to a group of networkers. We share knowledge and advice.

Having a few regulars who can discuss your posts is helpful. It's artificial, but it works and engages others.

Consider who you'd support if they were in your shoes.

You can pay for an engagement group, but you risk supporting unrelated people with rubbish posts.

Help each other out.

5. Don't let your feed or algorithm divert you.

LinkedIn's algorithm is magical.

Which time is best? How fast do you need to comment? Which days are best?

Overemphasize algorithms. Consider the user. No need to worry about the best time.

Remember to spend time on LinkedIn actively. Not passively. That is what Facebook is for.

Surely someone would find a LinkedIn recipe. Don't beat the algorithm yet. Consider your audience.

6. The more personal, the better

Personalization isn't limited to selfies. Share your successes and failures.

The more personality you show, the better.

People relate to others, not theories or quotes. Why should they follow you? Everyone posts the same content?

Consider your friends. What's their appeal?

Because they show their work and identity. It's simple. Medium and Linkedin are your platforms. Find out what works.

You can copy others' hooks and structures. You decide how simple to make it, though.

7. Have fun with those who have various post structures.

I like writing, infographics, videos, and carousels. Because you can:

Repurpose your content!

Out of one blog post I make:

Newsletter

Infographics (positive and negative points of view)

Carousel

Personal stories

Listicle

Create less but more variety. Since LinkedIn posts last 24 hours, you can rotate the same topics for weeks without anyone noticing.

Effective!

The final LI snippet to think about

LinkedIn is about consistency. Some say 15 minutes. If you're serious about networking, spend more time there.

The good news is that it is worth it. The bad news is that it takes time.

Victoria Kurichenko

3 years ago

What Happened After I Posted an AI-Generated Post on My Website

This could cost you.

Content creators may have heard about Google's "Helpful content upgrade."

This change is another Google effort to remove low-quality, repetitive, and AI-generated content.

Why should content creators care?

Because too much content manipulates search results.

My experience includes the following.

Website admins seek high-quality guest posts from me. They send me AI-generated text after I say "yes." My readers are irrelevant. Backlinks are needed.

Companies copy high-ranking content to boost their Google rankings. Unfortunately, it's common.

What does this content offer?

Nothing.

Despite Google's updates and efforts to clean search results, webmasters create manipulative content.

As a marketer, I knew about AI-powered content generation tools. However, I've never tried them.

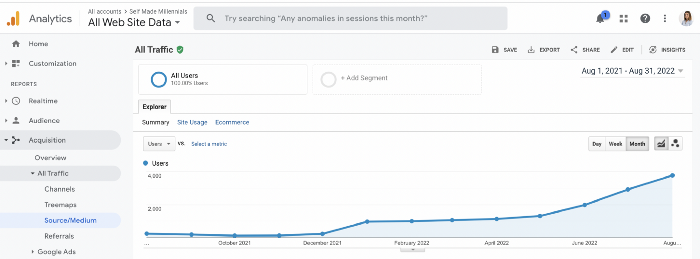

I use old-fashioned content creation methods to grow my website from 0 to 3,000 monthly views in one year.

Last year, I launched a niche website.

I do keyword research, analyze search intent and competitors' content, write an article, proofread it, and then optimize it.

This strategy is time-consuming.

But it yields results!

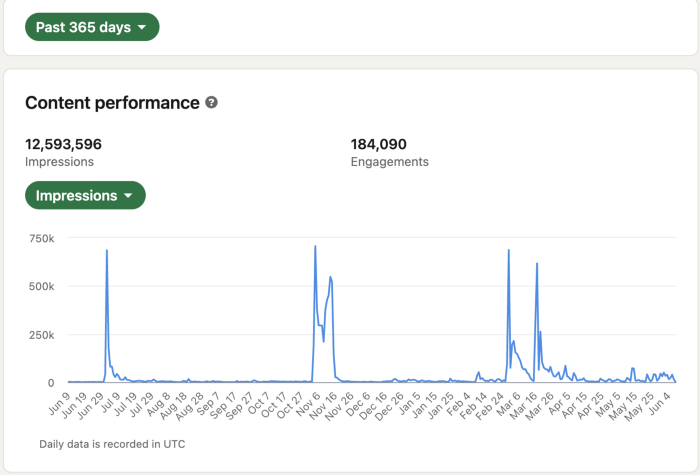

Here's proof from Google Analytics:

Proven strategies yield promising results.

To validate my assumptions and find new strategies, I run many experiments.

I tested an AI-powered content generator.

I used a tool to write this Google-optimized article about SEO for startups.

I wanted to analyze AI-generated content's Google performance.

Here are the outcomes of my test.

First, quality.

I dislike "meh" content. I expect articles to answer my questions. If not, I've wasted my time.

My essays usually include research, personal anecdotes, and what I accomplished and achieved.

AI-generated articles aren't as good because they lack individuality.

Read my AI-generated article about startup SEO to see what I mean.

It's dry and shallow, IMO.

It seems robotic.

I'd use quotes and personal experience to show how SEO for startups is different.

My article paraphrases top-ranked articles on a certain topic.

It's readable but useless. Similar articles abound online. Why read it?

AI-generated content is low-quality.

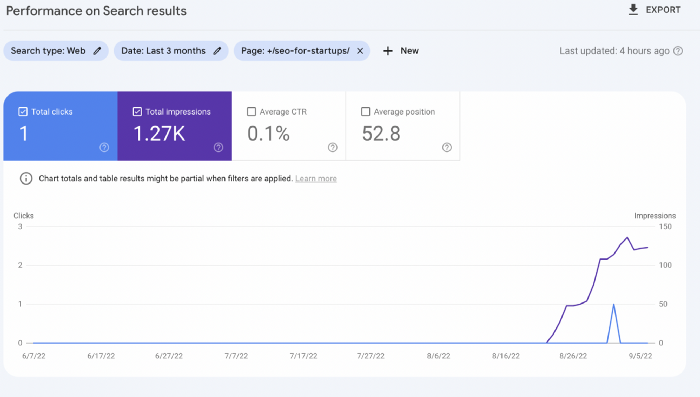

Let me show you how this content ranks on Google.

The Google Search Console report shows impressions, clicks, and average position.

Low numbers.

No one opens the 5th Google search result page to read the article. Too far!

You may say the new article will improve.

Marketing-wise, I doubt it.

This article is shorter and less comprehensive than top-ranking pages. It's unlikely to win because of this.

AI-generated content's terrible reality.

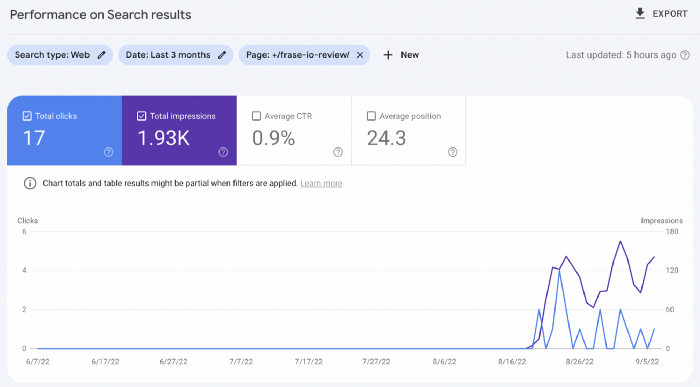

I'll compare how this content I wrote for readers and SEO performs.

Both the AI and my article are fresh, but trends are emerging.

My article's CTR and average position are higher.

I spent a week researching and producing that piece, unlike AI-generated content. My expert perspective and unique consequences make it interesting to read.

Human-made.

In summary

No content generator can duplicate a human's tone, writing style, or creativity. Artificial content is always inferior.

Not "bad," but inferior.

Demand for content production tools will rise despite Google's efforts to eradicate thin content.

Most won't spend hours producing link-building articles. Costly.

As guest and sponsored posts, artificial content will thrive.

Before accepting a new arrangement, content creators and website owners should consider this.

You might also like

Niharikaa Kaur Sodhi

3 years ago

The Only Paid Resources I Turn to as a Solopreneur

4 Pricey Tools That Are Valuable

I pay based on ROI (return on investment).

If a $20/month tool or $500 online course doubles my return, I'm in.

Investing helps me build wealth.

Canva Pro

I initially refused to pay.

My course content needed updating a few months ago. My Google Docs text looked cleaner and more professional in Canva.

I've used it to:

product cover pages

eBook covers

Product page infographics

See my Google Sheets vs. Canva product page graph.

Google Sheets vs Canva

Yesterday, I used it to make a LinkedIn video thumbnail. It took less than 5 minutes and improved my video.

In 30 hours, the video had 39,000 views.

Here's more.

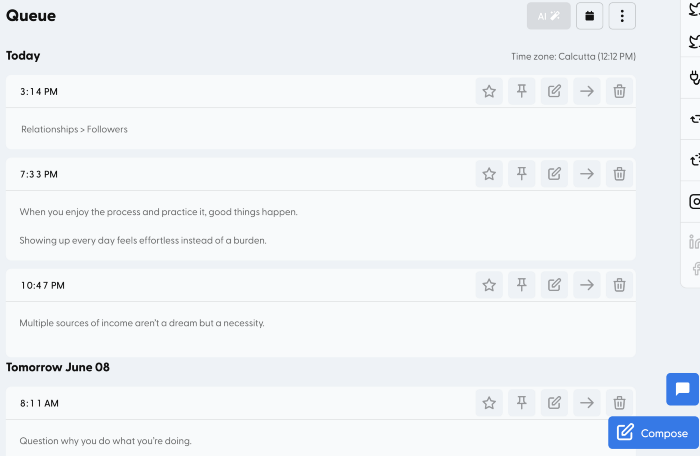

HypeFury

Hypefury rocks!

It builds my brand as I sleep. What else?

Because I'm traveling this weekend, I planned tweets for 10 days. It took me 80 minutes.

So while I travel or am absent, my content mill keeps producing.

Also I like:

I can reach hundreds of people thanks to auto-DMs. I utilize it to advertise freebies; for instance, leave an emoji remark to receive my checklist. And they automatically receive a message in their DM.

Scheduled Retweets: By appearing in a different time zone, they give my tweet a second chance.

It helps me save time and expand my following, so that's my favorite part.

It’s also super neat:

Zoom Pro

My course involves weekly and monthly calls for alumni.

Google Meet isn't great for group calls. The interface isn't great.

Zoom Pro is expensive, and the monthly payments suck, but it's necessary.

It gives my students a smooth experience.

Previously, we'd do 40-minute meetings and then reconvene.

Zoom's free edition limits group calls to 40 minutes.

This wouldn't be a good online course if I paid hundreds of dollars.

So I felt obligated to help.

YouTube Premium

My laptop has an ad blocker.

I bought an iPad recently.

When you're self-employed and work from home, the line between the two blurs. My bed is only 5 steps away!

When I read or watched videos on my laptop, I'd slide into work mode. Only option was to view on phone, which is awkward.

YouTube premium handles it. No more advertisements and I can listen on the move.

3 Expensive Tools That Aren't Valuable

Marketing strategies are sometimes aimed to make you feel you need 38474 cool features when you don’t.

Certain tools are useless.

I found it useless.

Depending on your needs. As a writer and creator, I get no return.

They could for other jobs.

Shield Analytics

It tracks LinkedIn stats, like:

follower growth

trend chart for impressions

Engagement, views, and comment stats for posts

and much more.

Middle-tier creator costs $12/month.

I got a 25% off coupon but canceled my free trial before writing this. It's not worth the discount.

Why?

LinkedIn provides free analytics. See:

Not thorough and won't show top posts.

I don't need to see my top posts because I love experimenting with writing.

Slack Premium

Slack was my classroom. Slack provided me a premium trial during the prior cohort.

I skipped it.

Sure, voice notes are better than a big paragraph. I didn't require pro features.

Marketing methods sometimes make you think you need 38474 amazing features. Don’t fall for it.

Calendly Pro

This may be worth it if you get many calls.

I avoid calls. During my 9-5, I had too many pointless calls.

I don't need:

ability to schedule calls for 15, 30, or 60 minutes: I just distribute each link separately.

I have a Gumroad consultation page with a payment option.

follow-up emails: I hardly ever make calls, so

I just use one calendar, therefore I link to various calendars.

I'll admit, the integrations are cool. Not for me.

If you're a coach or consultant, the features may be helpful. Or book meetings.

Conclusion

Investing is spending to make money.

Use my technique — put money in tools that help you make money. This separates it from being an investment instead of an expense.

Try free versions of these tools before buying them since everyone else is.

Gareth Willey

3 years ago

I've had these five apps on my phone for a long time.

TOP APPS

Who survives spring cleaning?

Relax. Notion is off-limits. This topic is popular.

(I wrote about it 2 years ago, before everyone else did.) So).

These apps are probably new to you. I hope you find a new phone app after reading this.

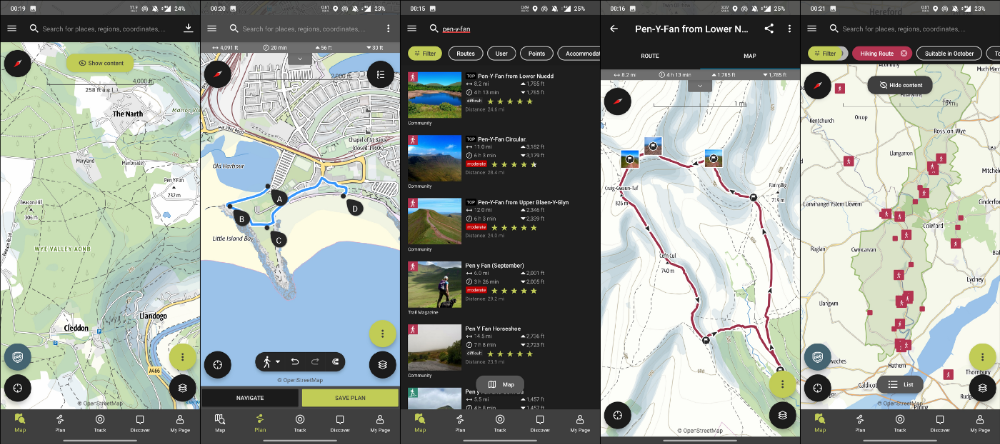

Outdooractive

ViewRanger is Google Maps for outdoor enthusiasts.

This app has been so important to me as a freedom-loving long-distance walker and hiker.

This app shows nearby trails and right-of-ways on top of an Open Street Map.

Helpful detail and data. Any route's distance,

You can download and follow tons of routes planned by app users.

This has helped me find new routes and places a fellow explorer has tried.

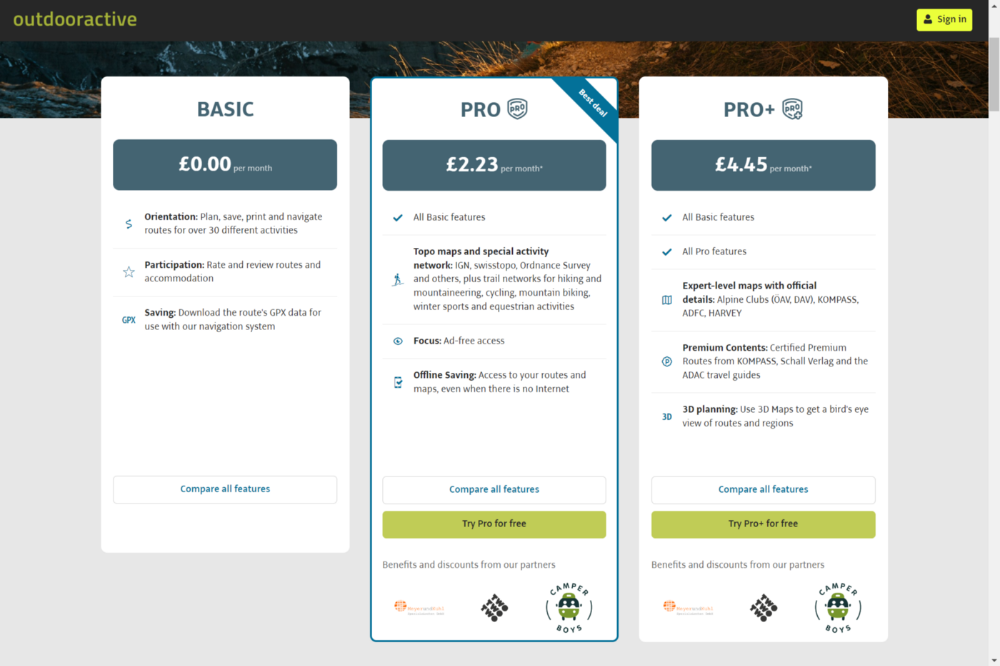

Free with non-intrusive ads. Years passed before I subscribed. Pro costs £2.23/month.

This app is for outdoor lovers.

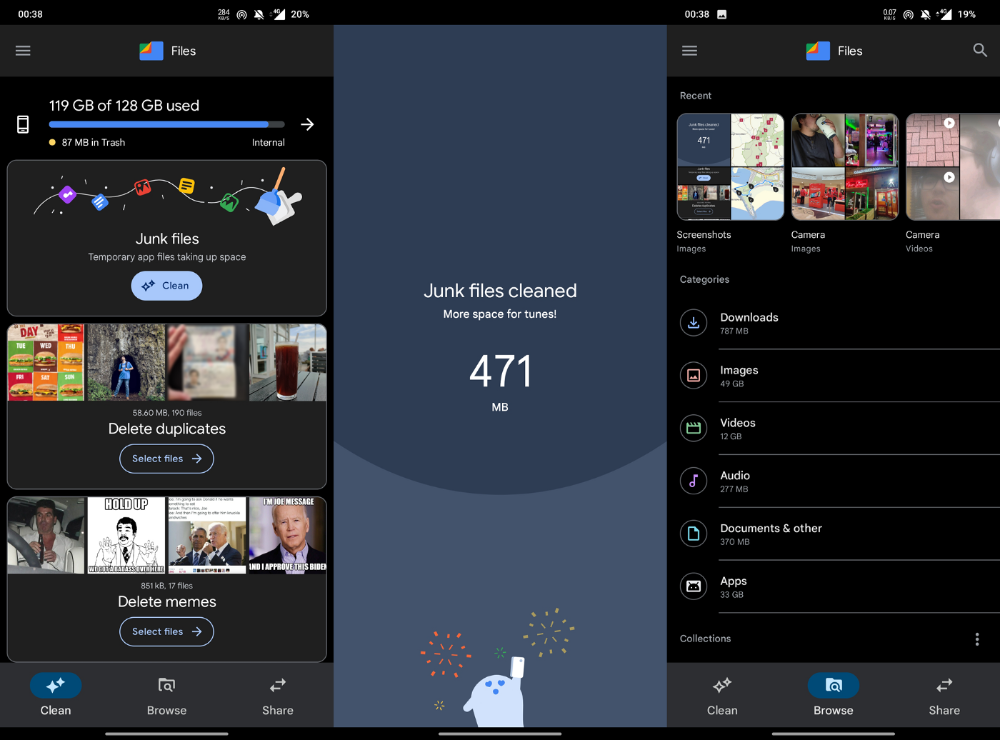

Google Files

New phones come with bloatware. These rushed apps are frustrating.

We must replace these apps. 2017 was Google's year.

Files is a file manager. It's quick, innovative, and clean. They've given people what they want.

It's easy to organize files, clear space, and clear cache.

I recommend Gallery by Google as a gallery app alternative. It's quick and easy.

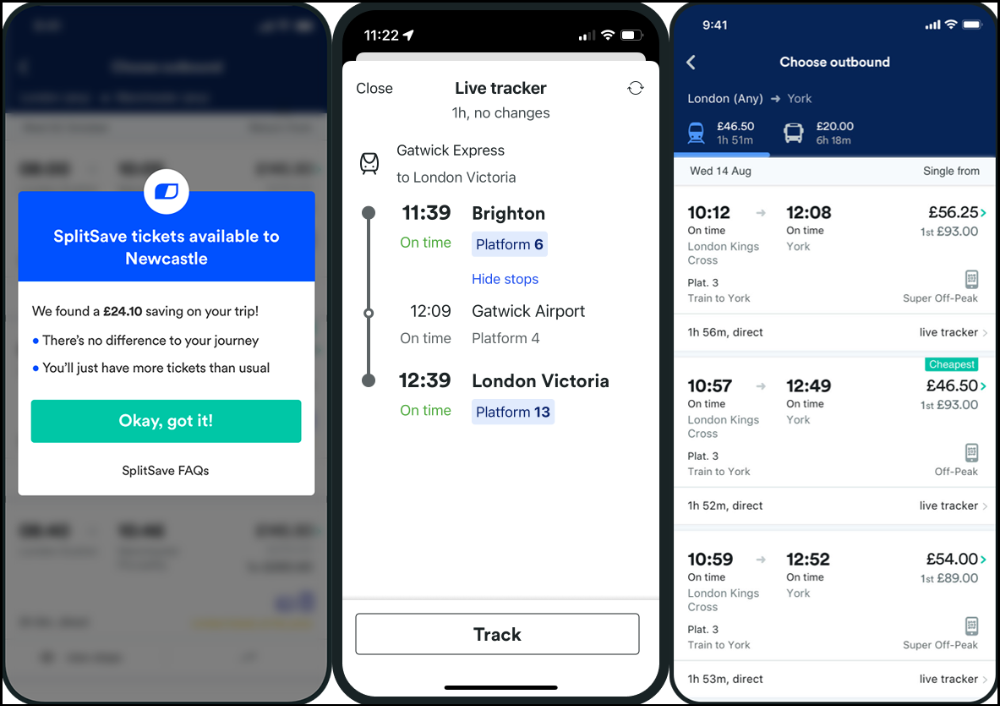

Trainline

App for trains, buses, and coaches.

I've used this app for years. It did the basics well when I first used it.

Since then, it's improved. It's constantly adding features to make traveling easier and less stressful.

Split-ticketing helps me save hundreds a year on train fares. This app is only available in the UK and Europe.

This service doesn't link to a third-party site. Their app handles everything.

Not all train and coach companies use this app. All the big names are there, though.

Here's more on the app.

Battlefield: Mobile

Play Store has 478,000 games. Few can turn my phone into a console.

Call of Duty Mobile and Asphalt 8/9 are examples.

Asphalt's loot boxes and ads make it unplayable. Call of Duty opens with a few ads. Close them to play without hassle.

This game uses all your phone's features to provide a high-quality, seamless experience. If my internet connection is good, I never experience lag or glitches.

The gameplay is energizing and intense, just like on consoles. Sometimes I'm too involved. I've thrown my phone in anger. I'm totally absorbed.

Customizability is my favorite. Since phones have limited screen space, we should only have the buttons we need, placed conveniently.

Size, opacity, and position are modifiable. Adjust audio, graphics, and textures. It's customizable.

This game has been on my phone for three years. It began well and has gotten better. When I think the creators can't do more, they do.

If you play, read my tips for winning a Battle Royale.

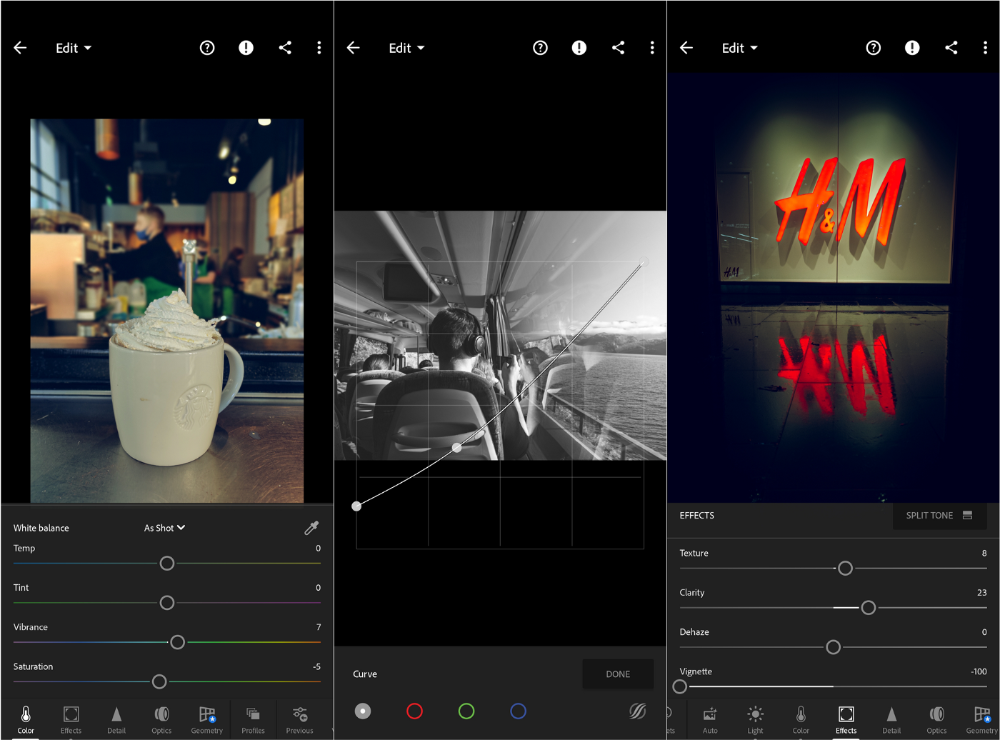

Lightroom

As a photographer, I believe your best camera is on you. The phone.

2017 was a big year for this app. I've tried many photo-editing apps since then. This always wins.

The app is dull. I've never seen better photo editing on a phone.

Adjusting settings and sliders doesn't damage or compress photos. It's detailed.

This is important for phone photos, which are lower quality than professional ones.

Some tools are behind a £4.49/month paywall. Adobe must charge a subscription fee instead of selling licenses. (I'm still bitter about Creative Cloud's price)

Snapseed is my pick. Lightroom is where I do basic editing before moving to Snapseed. Snapseed review:

These apps are great. They cover basic and complex editing needs while traveling.

Final Reflections

I hope you downloaded one of these. Share your favorite apps. These apps are scarce.

joyce shen

4 years ago

Framework to Evaluate Metaverse and Web3

Everywhere we turn, there's a new metaverse or Web3 debut. Microsoft recently announced a $68.7 BILLION cash purchase of Activision.

Like AI in 2013 and blockchain in 2014, NFT growth in 2021 feels like this year's metaverse and Web3 growth. We are all bombarded with information, conflicting signals, and a sensation of FOMO.

How can we evaluate the metaverse and Web3 in a noisy, new world? My framework for evaluating upcoming technologies and themes is shown below. I hope you will also find them helpful.

Understand the “pipes” in a new space.

Whatever people say, Metaverse and Web3 will have to coexist with the current Internet. Companies who host, move, and store data over the Internet have a lot of intriguing use cases in Metaverse and Web3, whether in infrastructure, data analytics, or compliance. Hence the following point.

## Understand the apps layer and their infrastructure.

Gaming, crypto exchanges, and NFT marketplaces would not exist today if not for technology that enables rapid app creation. Yes, according to Chainalysis and other research, 30–40% of Ethereum is self-hosted, with the rest hosted by large cloud providers. For Microsoft to acquire Activision makes strategic sense. It's not only about the games, but also the infrastructure that supports them.

Follow the money

Understanding how money and wealth flow in a complex and dynamic environment helps build clarity. Unless you are exceedingly wealthy, you have limited ability to significantly engage in the Web3 economy today. Few can just buy 10 ETH and spend it in one day. You must comprehend who benefits from the process, and how that 10 ETH circulates now and possibly tomorrow. Major holders and players control supply and liquidity in any market. Today, most Web3 apps are designed to increase capital inflow so existing significant holders can utilize it to create a nascent Web3 economy. When you see a new Metaverse or Web3 application, remember how money flows.

What is the use case?

What does the app do? If there is no clear use case with clear makers and consumers solving a real problem, then the euphoria soon fades, and the only stakeholders who remain enthused are those who have too much to lose.

Time is a major competition that is often overlooked.

We're only busier, but each day is still 24 hours. Using new apps may mean that time is lost doing other things. The user must be eager to learn. Metaverse and Web3 vs. our time? I don't think we know the answer yet (at least for working adults whose cost of time is higher).

I don't think we know the answer yet (at least for working adults whose cost of time is higher).

People and organizations need security and transparency.

For new technologies or apps to be widely used, they must be safe, transparent, and trustworthy. What does secure Metaverse and Web3 mean? This is an intriguing subject for both the business and public sectors. Cloud adoption grew in part due to improved security and data protection regulations.

The following frameworks can help analyze and understand new technologies and emerging technological topics, unless you are a significant investment fund with the financial ability to gamble on numerous initiatives and essentially form your own “index fund”.

I write on VC, startups, and leadership.

More on https://www.linkedin.com/in/joycejshen/ and https://joyceshen.substack.com/

This writing is my own opinion and does not represent investment advice.