More on Marketing

Jon Brosio

3 years ago

You can learn more about marketing from these 8 copywriting frameworks than from a college education.

Email, landing pages, and digital content

Today's most significant skill:

Copywriting.

Unfortunately, most people don't know how to write successful copy because they weren't taught in school.

I've been obsessed with copywriting for two years. I've read 15 books, completed 3 courses, and studied internet's best digital entrepreneurs.

Here are 8 copywriting frameworks that educate more than a four-year degree.

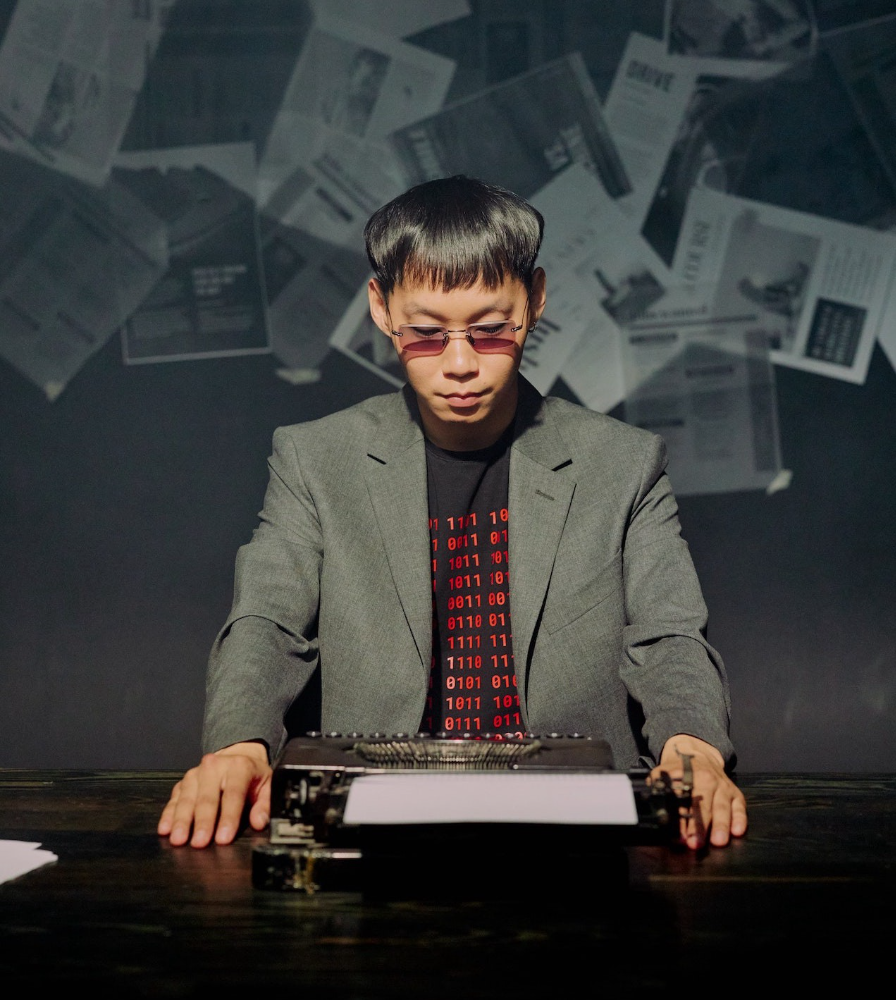

1. Feature — Advantage — Benefit (F.A.B)

This is the most basic copywriting foundation. Email marketing, landing page copy, and digital video ads can use it.

F.A.B says:

How it works (feature)

which is helpful (advantage)

What's at stake (benefit)

The Hustle uses this framework on their landing page to convince people to sign up:

2. P. A. S. T. O. R.

This framework is for longer-form copywriting. PASTOR uses stories to engage with prospects. It explains why people should buy this offer.

PASTOR means:

Problem

Amplify

Story

Testimonial

Offer

Response

Dan Koe's landing page is a great example. It shows PASTOR frame-by-frame.

3. Before — After — Bridge

Before-after-bridge is a copywriting framework that draws attention and shows value quickly.

This framework highlights:

where you are

where you want to be

how to get there

Works great for: Email threads/landing pages

Zain Kahn utilizes this framework to write viral threads.

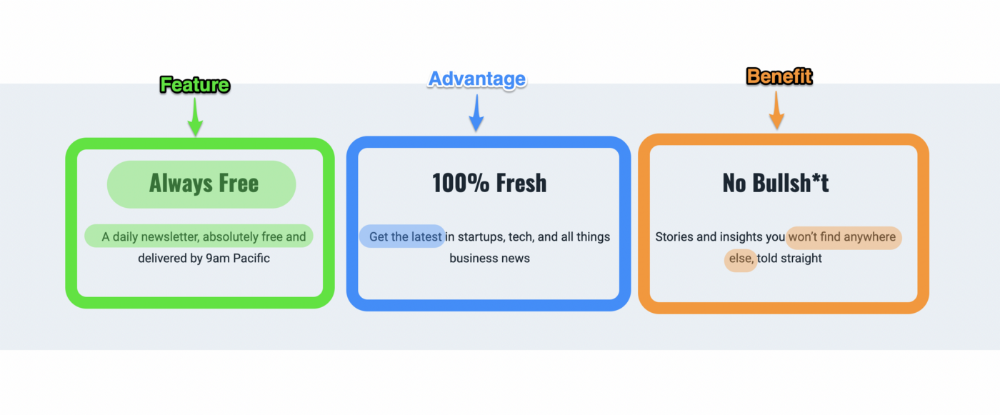

4. Q.U.E.S.T

QUEST is about empathetic writing. You know their issues, obstacles, and headaches. This allows coverups.

QUEST:

Qualifies

Understands

Educates

Stimulates

Transitions

Tom Hirst's landing page uses the QUEST framework.

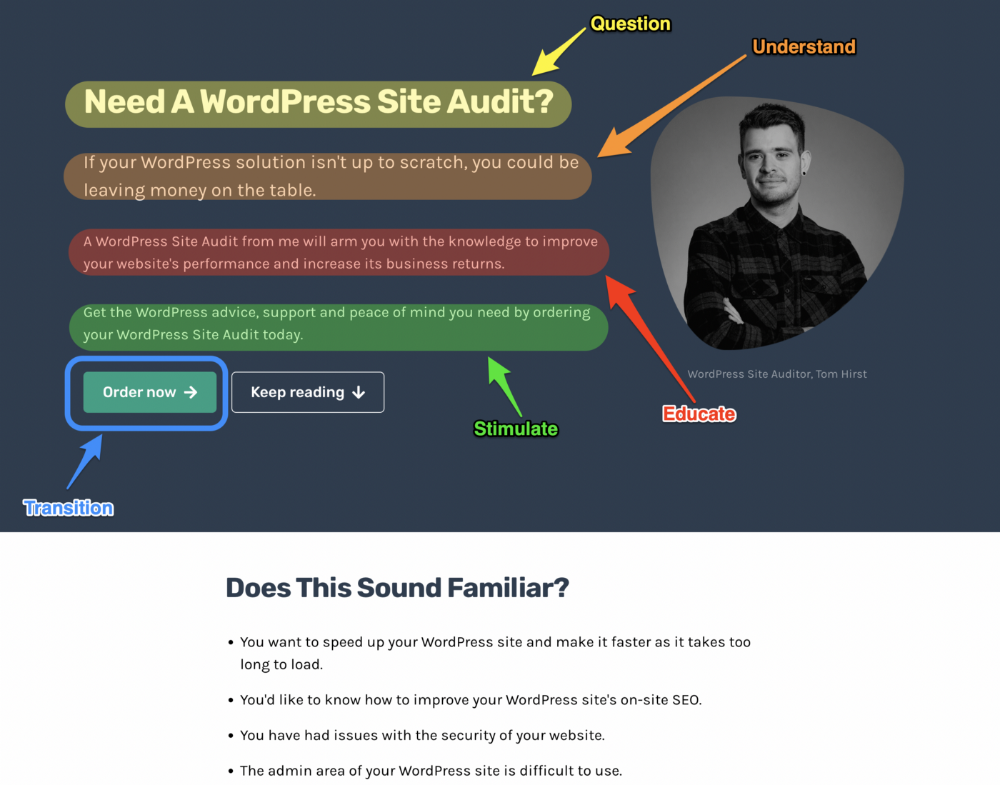

5. The 4P’s model

The 4P’s approach pushes your prospect to action. It educates and persuades quickly.

4Ps:

The problem the visitor is dealing with

The promise that will help them

The proof the promise works

A push towards action

Mark Manson is a bestselling author, digital creator, and pop-philosopher. He's also a great copywriter, and his membership offer uses the 4P’s framework.

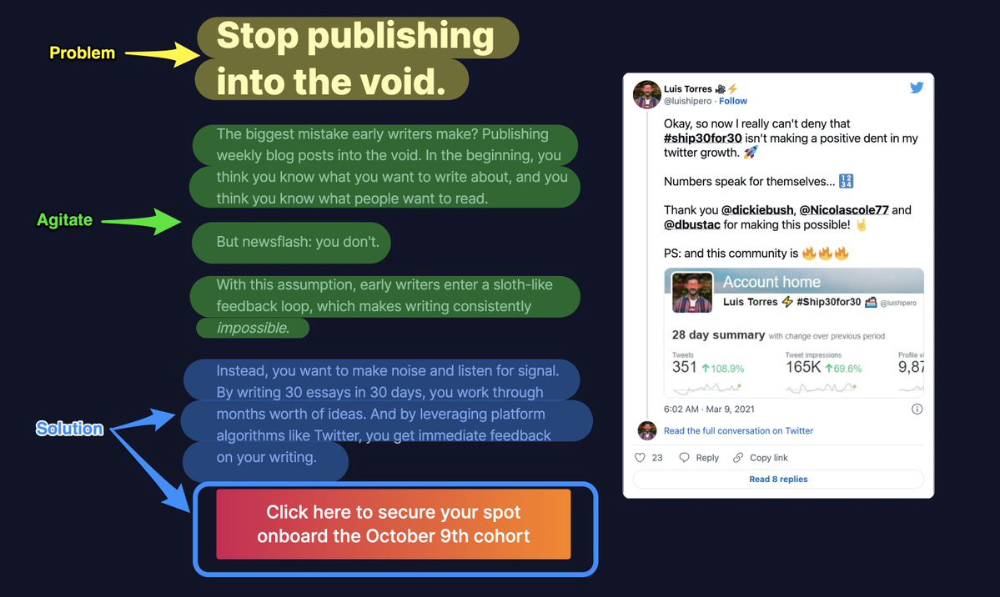

6. Problem — Agitate — Solution (P.A.S)

Up-and-coming marketers should understand problem-agitate-solution copywriting. Once you understand one structure, others are easier. It drives passion and presents a clear solution.

PAS outlines:

The issue the visitor is having

It then intensifies this issue through emotion.

finally offers an answer to that issue (the offer)

The customer's story loops. Nicolas Cole and Dickie Bush use PAS to promote Ship 30 for 30.

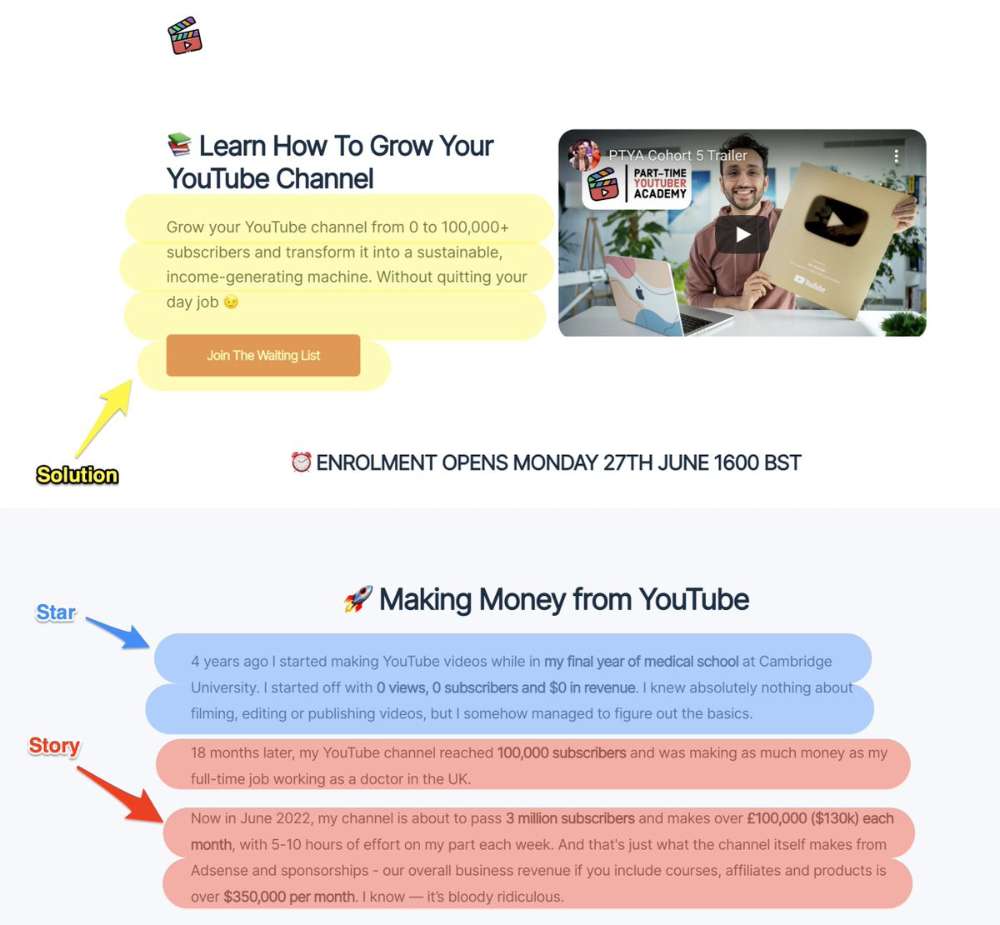

7. Star — Story — Solution (S.S.S)

PASTOR + PAS = star-solution-story. Like PAS, it employs stories to persuade.

S.S.S. is effective storytelling:

Star: (Person had a problem)

Story: (until they had a breakthrough)

Solution: (That created a transformation)

Ali Abdaal is a YouTuber with a great S.S.S copy.

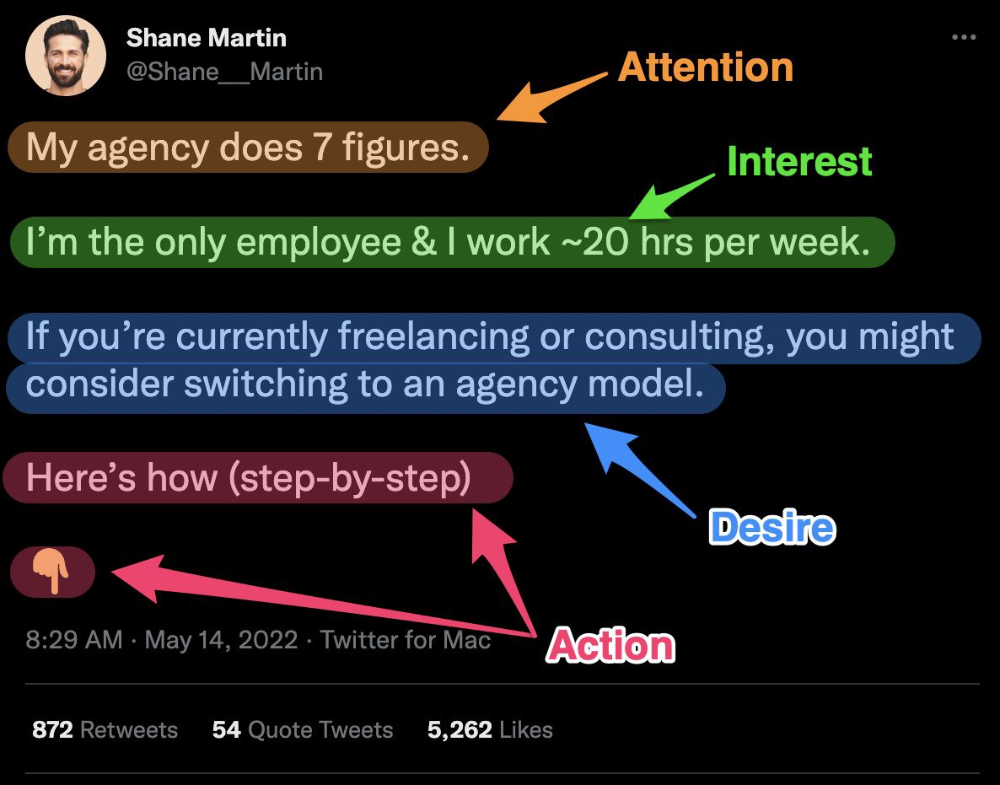

8. Attention — Interest — Desire — Action

AIDA is another classic. This copywriting framework is great for fast-paced environments (think all digital content on Linkedin, Twitter, Medium, etc.).

It works with:

Page landings

writing on thread

Email

It's a good structure since it's concise, attention-grabbing, and action-oriented.

Shane Martin, Twitter's creator, uses this approach to create viral content.

TL;DR

8 copywriting frameworks that teach marketing better than a four-year degree

Feature-advantage-benefit

Before-after-bridge

Star-story-solution

P.A.S.T.O.R

Q.U.E.S.T

A.I.D.A

P.A.S

4P’s

Jon Brosio

3 years ago

This Landing Page is a (Legal) Money-Printing Machine

and it’s easy to build.

A landing page with good copy is a money-maker.

Let's be honest, page-builder templates are garbage.

They can help you create a nice-looking landing page, but not persuasive writing.

Over the previous 90 days, I've examined 200+ landing pages.

What's crazy?

Top digital entrepreneurs use a 7-part strategy to bring in email subscribers, generate prospects, and (passively) sell their digital courses.

Steal this 7-part landing page architecture to maximize digital product sales.

The offer

Landing pages require offers.

Newsletter, cohort, or course offer.

Your reader should see this offer first. Includind:

Headline

Imagery

Call-to-action

Clear, persuasive, and simplicity are key. Example: the Linkedin OS course home page of digital entrepreneur Justin Welsh offers:

A distinctly defined problem

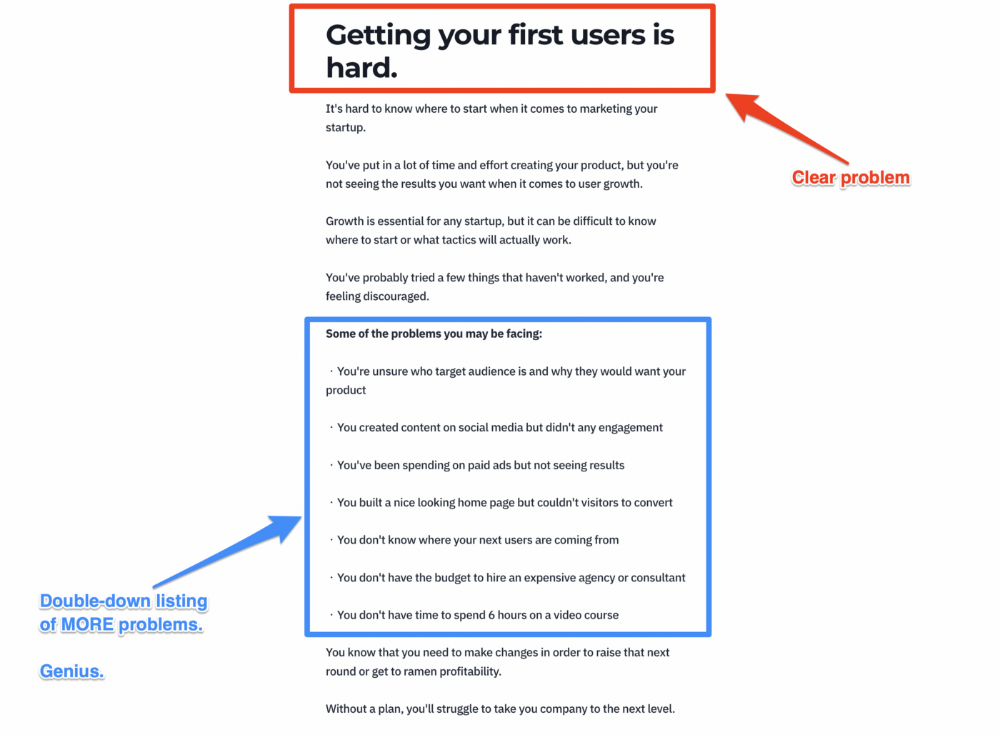

Everyone needs an enemy.

You need an opponent on your landing page. Problematic.

Next, employ psychology to create a struggle in your visitor's thoughts.

Don't be clever here; label your customer's problem. The more particular you are, the bigger the situation will seem.

When you build a clear monster, you invite defeat. I appreciate Theo Ohene's Growth Roadmaps landing page.

Exacerbation of the effects

Problem identification doesn't motivate action.

What would an unresolved problem mean?

This is landing page copy. When you describe the unsolved problem's repercussions, you accomplish several things:

You write a narrative (and stories are remembered better than stats)

You cause the reader to feel something.

You help the reader relate to the issue

Important!

My favorite script is:

"Sure, you can let [problem] go untreated. But what will happen if you do? Soon, you'll begin to notice [new problem 1] will start to arise. That might bring up [problem 2], etc."

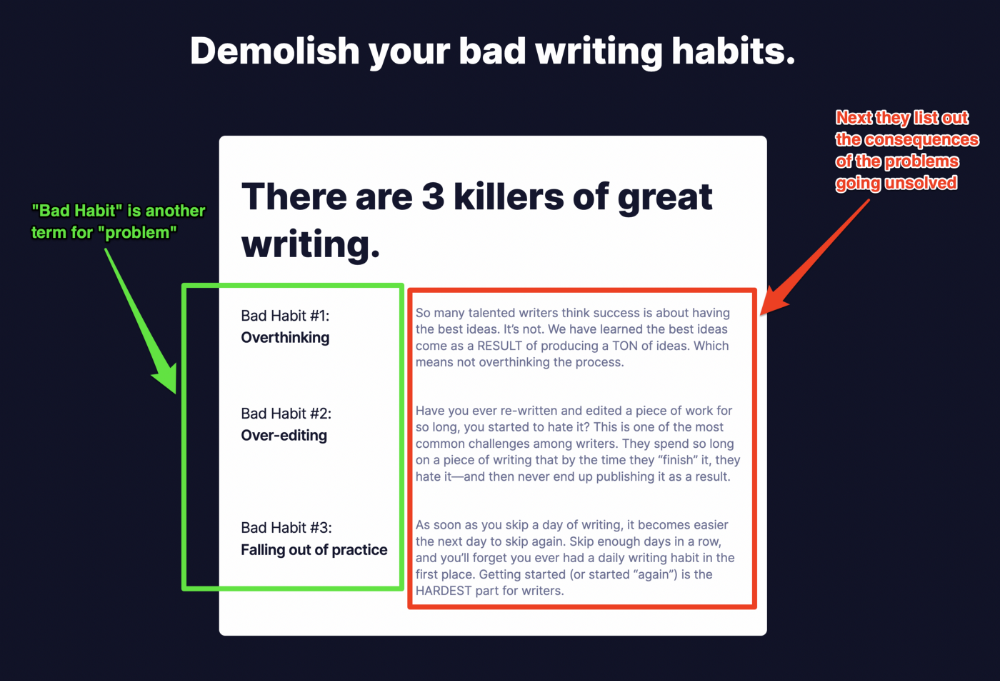

Take the copywriting course, digital writer and entrepreneur Dickie Bush illustrates below when he labels the problem (see: "poor habit") and then illustrates the repercussions.

The tale of transformation

Every landing page needs that "ah-ha!" moment.

Transformation stories do this.

Did you find a solution? Someone else made the discovery? Have you tested your theory?

Next, describe your (or your subject's) metamorphosis.

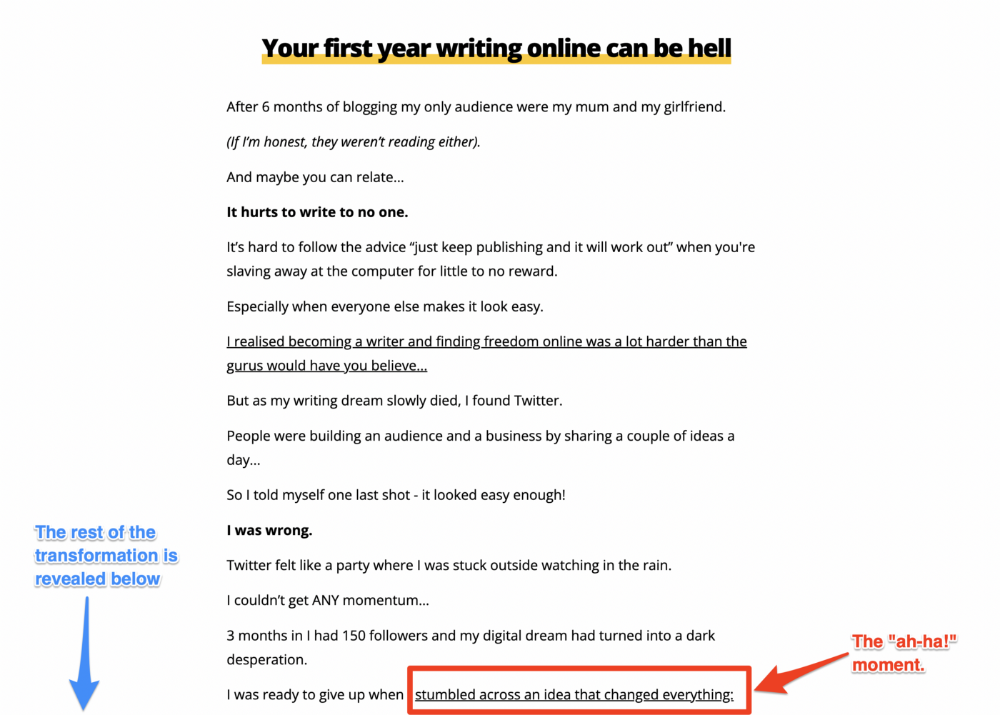

Kieran Drew nails his narrative (and revelation) here. Right before the disclosure, he introduces his "ah-ha!" moment:

Testimonials

Social proof completes any landing page.

Social proof tells the reader, "If others do it, it must be worthwhile."

This is your argument.

Positive social proof helps (obviously).

Offer "free" training in exchange for a testimonial if you need social evidence. This builds social proof.

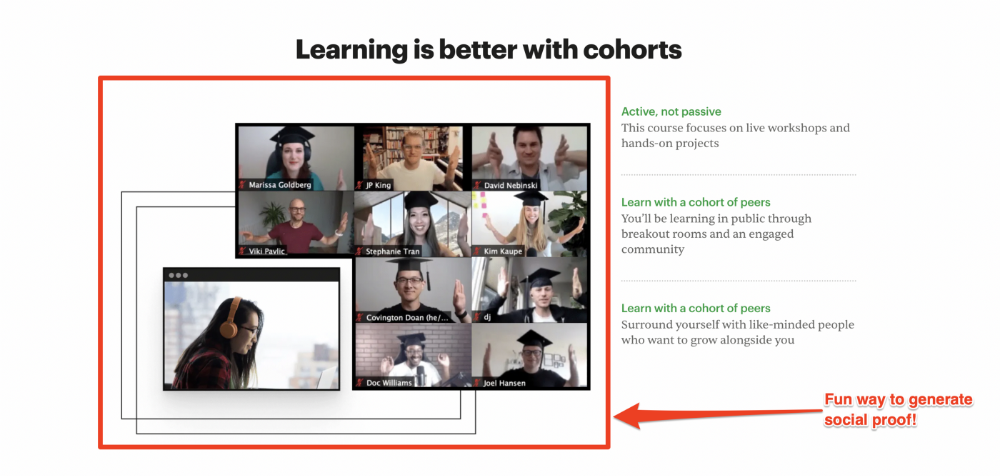

Most social proof is testimonies (recommended). Kurtis Hanni's creative take on social proof (using a screenshot of his colleague) is entertaining.

Bravo.

Reveal your offer

Now's the moment to act.

Describe the "bundle" that provides the transformation.

Here's:

Course

Cohort

Ebook

Whatever you're selling.

Include a product or service image, what the consumer is getting ("how it works"), the price, any "free" bonuses (preferred), and a CTA ("buy now").

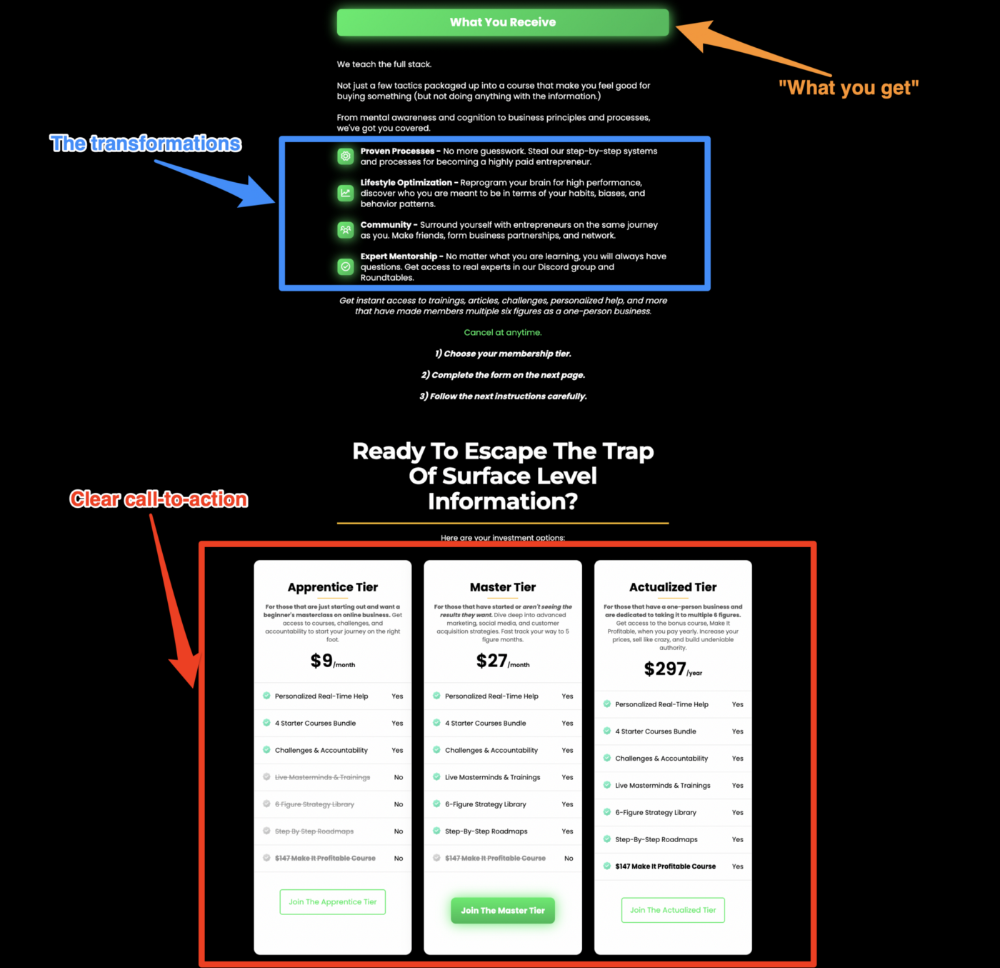

Clarity is key. Don't make a cunning offer. Make sure your presentation emphasizes customer change (benefits). Dan Koe's Modern Mastery landing page makes an offer. Consider:

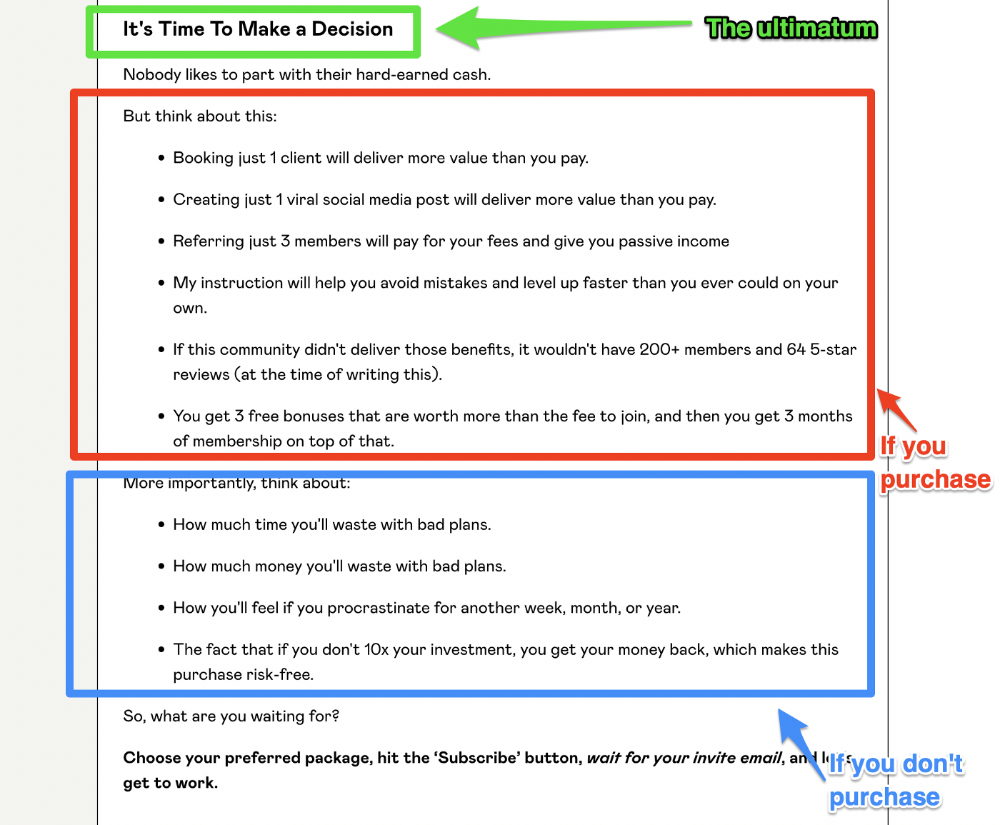

An ultimatum

Offering isn't enough.

You must give your prospect an ultimatum.

They can buy your merchandise from you.

They may exit the webpage.

That’s it.

It's crucial to show what happens if the reader does either. Stress the consequences of not buying (again, a little consequence amplification). Remind them of the benefits of buying.

I appreciate Charles Miller's product offer ending:

The top online creators use a 7-part landing page structure:

Offer the service

Describe the problem

Amplify the consequences

Tell the transformational story

Include testimonials and social proof.

Reveal the offer (with any bonuses if applicable)

Finally, give the reader a deadline to encourage them to take action.

Sequence these sections to develop a landing page that (essentially) prints money.

Michael Salim

3 years ago

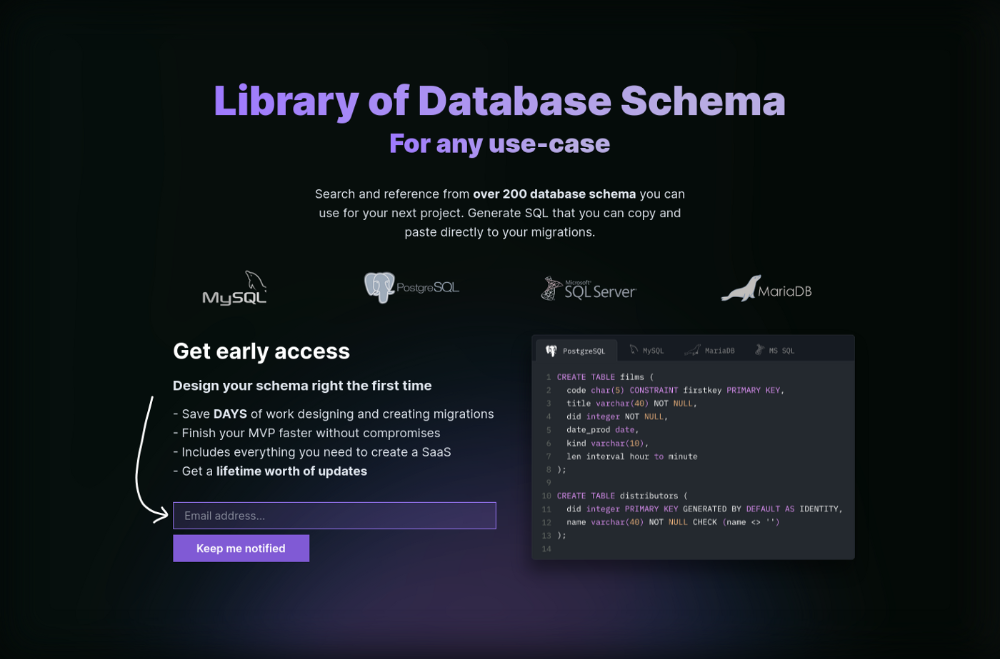

300 Signups, 1 Landing Page, 0 Products

I placed a link on HackerNews and got 300 signups in a week. This post explains what happened.

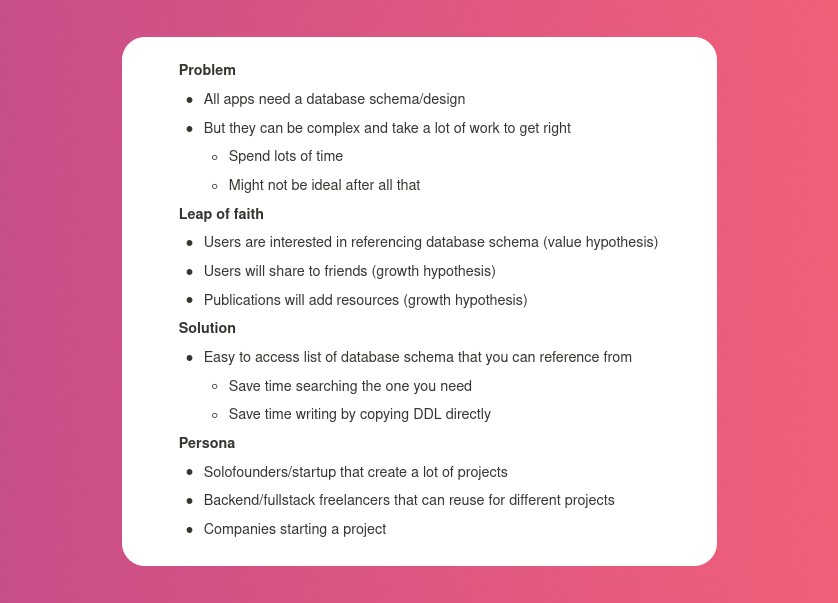

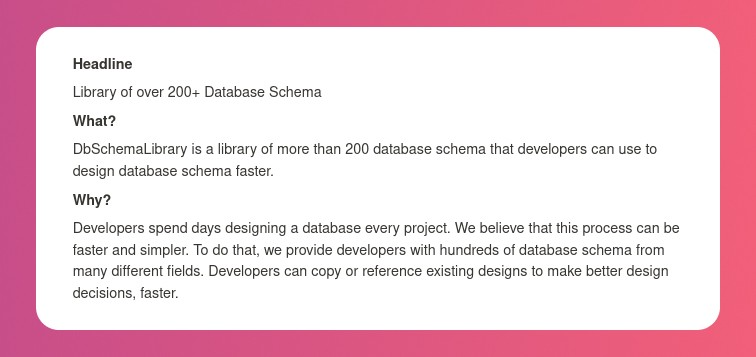

Product Concept

The product is DbSchemaLibrary. A library of Database Schema.

I'm not sure where this idea originated from. Very fast. Build fast, fail fast, test many ideas, and one will be a hit. I tried it. Let's try it anyway, even though it'll probably fail. I finished The Lean Startup book and wanted to use it.

Database job bores me. Important! I get drowsy working on it. Someone must do it. I remember this happening once. I needed examples at the time. Something similar to Recall (my other project) that I can copy — or at least use as a reference.

Frequently googled. Many tabs open. The results were useless. I raised my hand and agreed to construct the database myself.

It resurfaced. I decided to do something.

Due Diligence

Lean Startup emphasizes validated learning. Everything the startup does should result in learning. I may build something nobody wants otherwise. That's what happened to Recall.

So, I wrote a business plan document. This happens before I code. What am I solving? What is my proposed solution? What is the leap of faith between the problem and solution? Who would be my target audience?

My note:

In my previous project, I did the opposite!

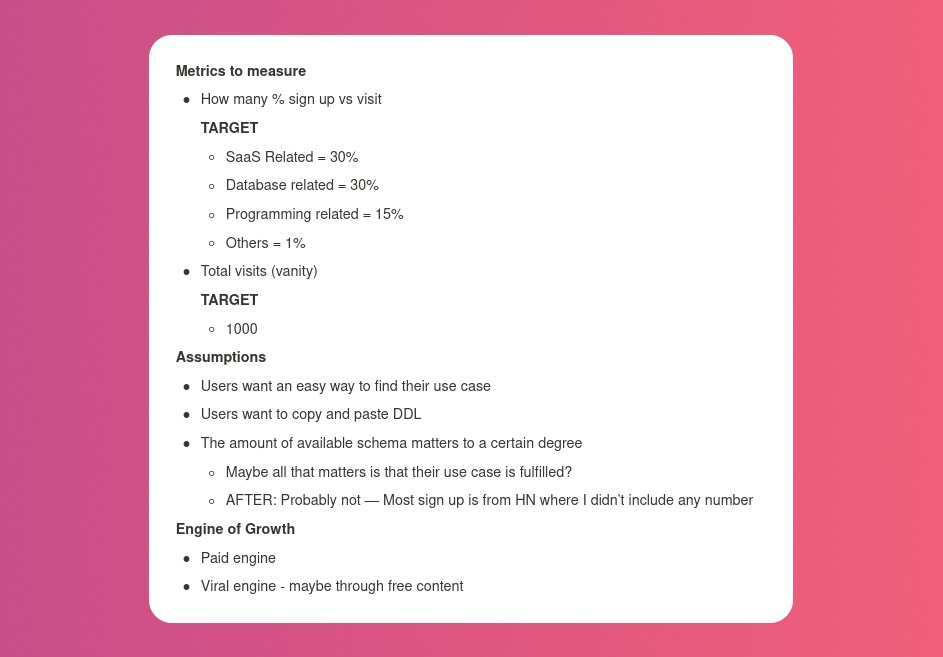

I wrote my expectations after reading the book's advice.

“Failure is a prerequisite to learning. The problem with the notion of shipping a product and then seeing what happens is that you are guaranteed to succeed — at seeing what happens.” — The Lean Startup book

These are successful metrics. If I don't reach them, I'll drop the idea and try another. I didn't understand numbers then. Below are guesses. But it’s a start!

I then wrote the project's What and Why. I'll use this everywhere. Before, I wrote a different pitch each time. I thought certain words would be better. I felt the audience might want something unusual.

Occasionally, this works. I'm unsure if it's a good idea. No stats, just my writing-time opinion. Writing every time is time-consuming and sometimes hazardous. Having a copy saved me duplication.

I can measure and learn from performance.

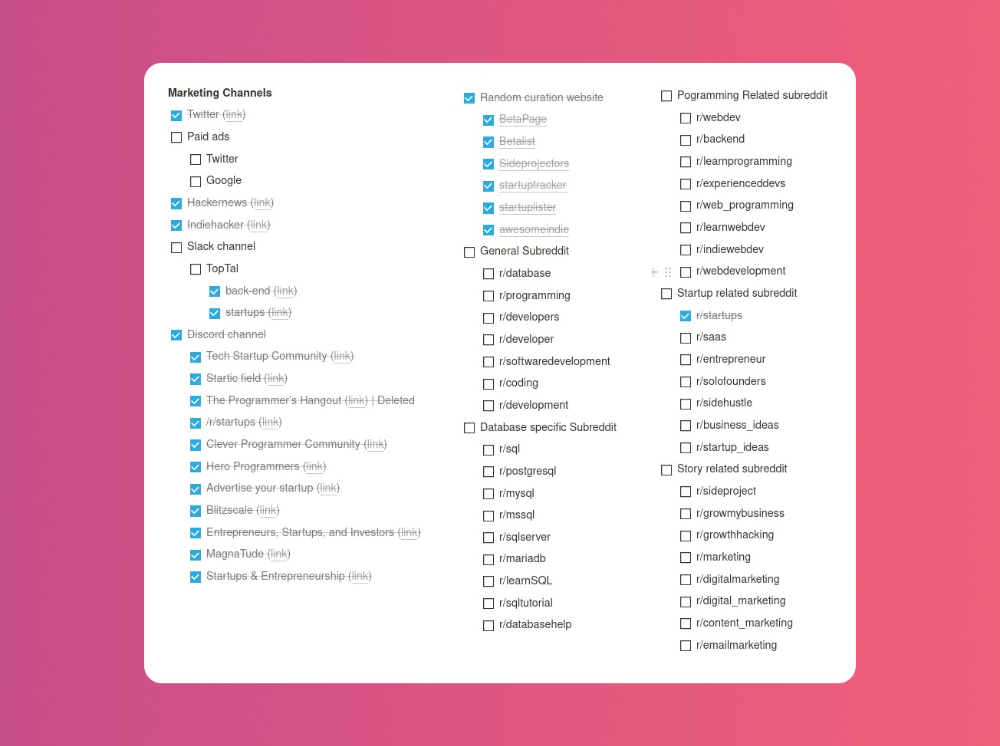

Last, I identified communities that might demand the product. This became an exercise in creativity.

The MVP

So now it’s time to build.

A MVP can test my assumptions. Business may learn from it. Not low-quality. We should learn from the tiniest thing.

I like the example of how Dropbox did theirs. They assumed that if the product works, people will utilize it. How can this be tested without a quality product? They made a movie demonstrating the software's functionality. Who knows how much functionality existed?

So I tested my biggest assumption. Users want schema references. How can I test if users want to reference another schema? I'd love this. Recall taught me that wanting something doesn't mean others do.

I made an email-collection landing page. Describe it briefly. Reference library. Each email sender wants a reference. They're interested in the product. Few other reasons exist.

Header and footer were skipped. No name or logo. DbSchemaLibrary is a name I thought of after the fact. 5-minute logo. I expected a flop. Recall has no users after months of labor. What could happen to a 2-day project?

I didn't compromise learning validation. How many visitors sign up? To draw a conclusion, I must track these results.

Posting Time

Now that the job is done, gauge interest. The next morning, I posted on all my channels. I didn't want to be spammy, therefore it required more time.

I made sure each channel had at least one fan of this product. I also answer people's inquiries in the channel.

My list stinks. Several channels wouldn't work. The product's target market isn't there. Posting there would waste our time. This taught me to create marketing channels depending on my persona.

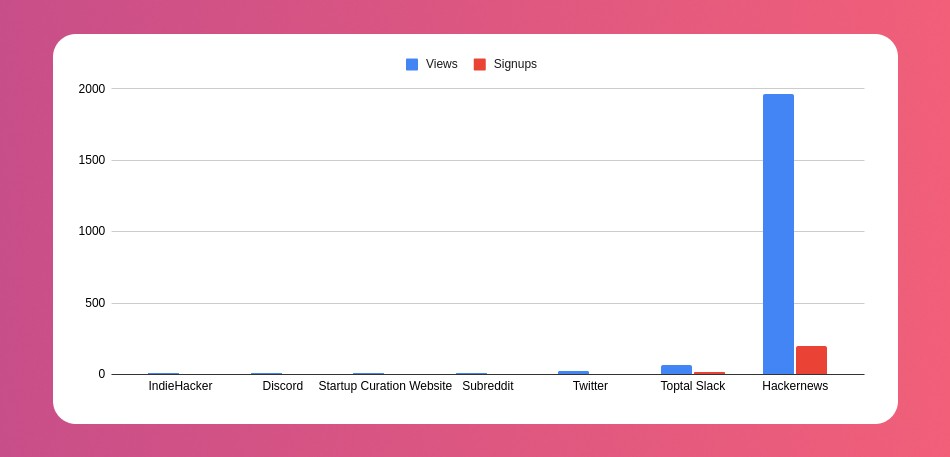

Statistics! What actually happened

My favorite part! 23 channels received the link.

I stopped posting to Discord despite its high conversion rate. I eliminated some channels because they didn't fit. According to the numbers, some users like it. Most users think it's spam.

I was skeptical. And 12 people viewed it.

I didn't expect much attention on a startup subreddit. I'll likely examine Reddit further in the future. As I have enough info, I didn't post much. Time for the next validated learning

No comment. The post had few views, therefore the numbers are low.

The targeted people come next.

I'm a Toptal freelancer. There's a member-only Slack channel. Most people can't use this marketing channel, but you should! It's not as spectacular as discord's 27% conversion rate. But I think the users here are better.

I don’t really have a following anywhere so this isn’t something I can leverage.

The best yet. 10% is converted. With more data, I expect to attain a 10% conversion rate from other channels. Stable number.

This number required some work. Did you know that people use many different clients to read HN?

Unknowns

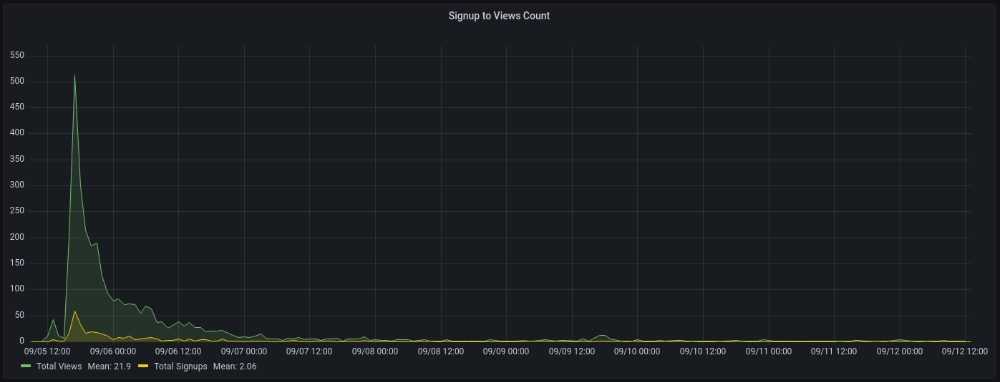

Untrackable views and signups abound. 1136 views and 135 signups are untraceable. It's 11%. I bet much of that came from Hackernews.

Overall Statistics

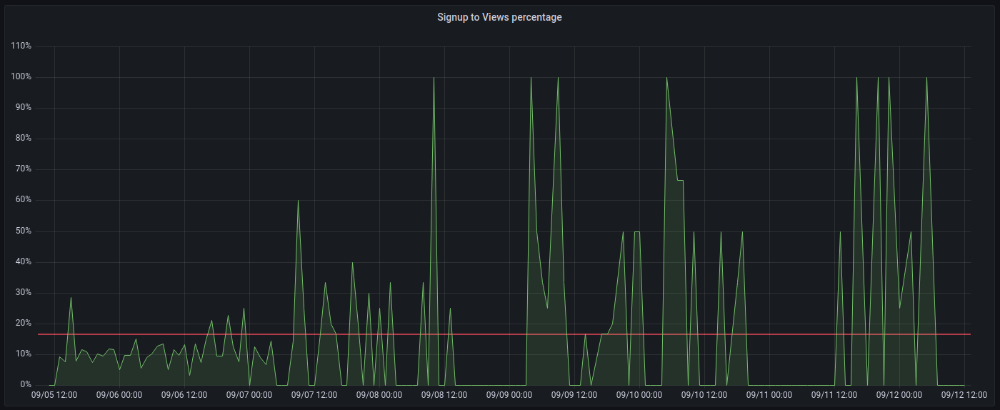

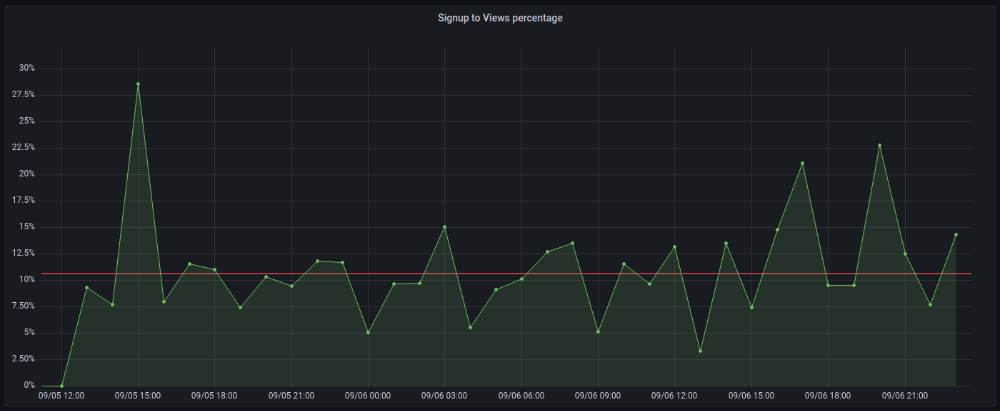

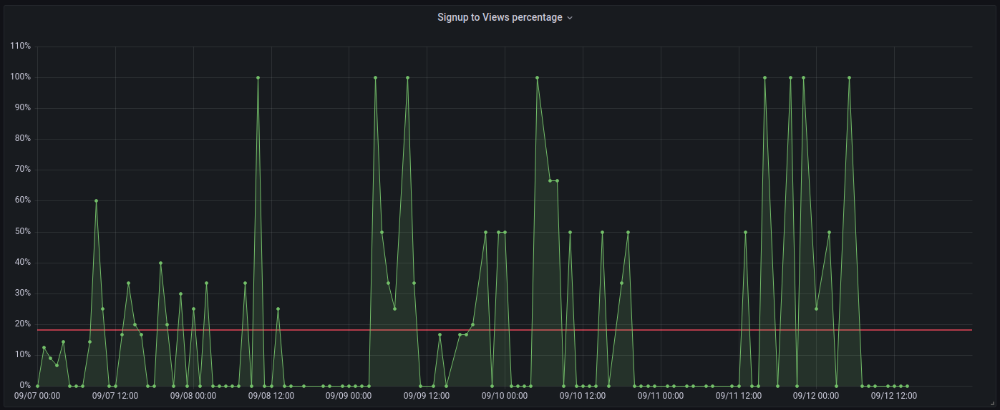

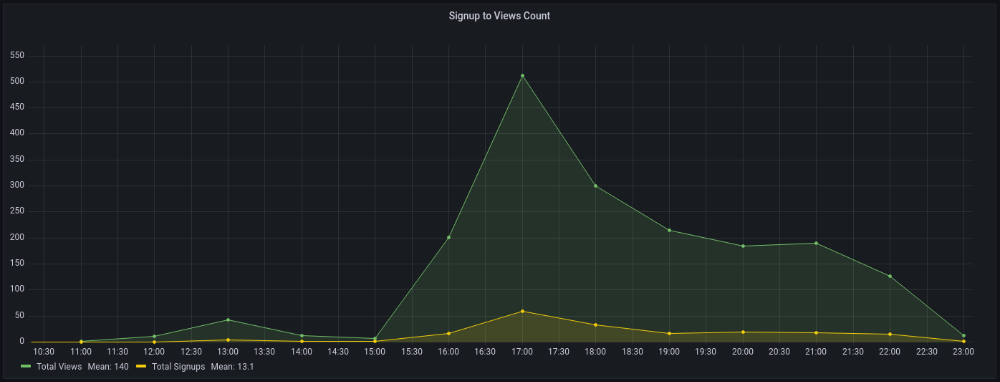

The 7-day signup-to-visit ratio was 17%. (Hourly data points)

First-day percentages were lower, which is noteworthy. Initially, it was little above 10%. The HN post started getting views then.

When traffic drops, the number reaches just around 20%. More individuals are interested in the connection. hn.algolia.com sent 2 visitors. This means people are searching and finding my post.

Interesting discoveries

1. HN post struggled till the US woke up.

11am UTC. After an hour, it lost popularity. It seemed over. 7 signups converted 13%. Not amazing, but I would've thought ahead.

After 4pm UTC, traffic grew again. 4pm UTC is 9am PDT. US awakened. 10am PDT saw 512 views.

2. The product was highlighted in a newsletter.

I found Revue references when gathering data. Newsletter platform. Someone posted the newsletter link. 37 views and 3 registrations.

3. HN numbers are extremely reliable

I don't have a time-lapse graph (yet). The statistics were constant all day.

2717 views later 272 new users, or 10.1%

With 293 signups at 2856 views, 10.25%

At 306 signups at 2965 views, 10.32%

Learnings

1. My initial estimations were wildly inaccurate

I wrote 30% conversion. Reading some articles, looks like 10% is a good number to aim for.

2. Paying attention to what matters rather than vain metrics

The Lean Startup discourages vanity metrics. Feel-good metrics that don't measure growth or traction. Considering the proportion instead of the total visitors made me realize there was something here.

What’s next?

There are lots of work to do. Data aggregation, display, website development, marketing, legal issues. Fun! It's satisfying to solve an issue rather than investigate its cause.

In the meantime, I’ve already written the first project update in another post. Continue reading it if you’d like to know more about the project itself! Shifting from Quantity to Quality — DbSchemaLibrary

You might also like

Abhimanyu Bhargava

3 years ago

VeeFriends Series 2: The Biggest NFT Opportunity Ever

VeeFriends is one NFT project I'm sure will last.

I believe in blockchain technology and JPEGs, aka NFTs. NFTs aren't JPEGs. It's not as it seems.

Gary Vaynerchuk is leading the pack with his new NFT project VeeFriends, I wrote a year ago. I was spot-on. It's the most innovative project I've seen.

Since its minting in May 2021, it has given its holders enormous value, most notably the first edition of VeeCon, a multi-day superconference featuring iconic and emerging leaders in NFTs and Popular Culture. First-of-its-kind NFT-ticketed Web3 conference to build friendships, share ideas, and learn together.

VeeFriends holders got free VeeCon NFT tickets. Attendees heard iconic keynote speeches, innovative talks, panels, and Q&A sessions.

It was a unique conference that most of us, including me, are looking forward to in 2023. The lineup was epic, and it allowed many to network in new ways. Really memorable learning. Here are a couple of gratitude posts from the attendees.

VeeFriends Series 2

This article explains VeeFriends if you're still confused.

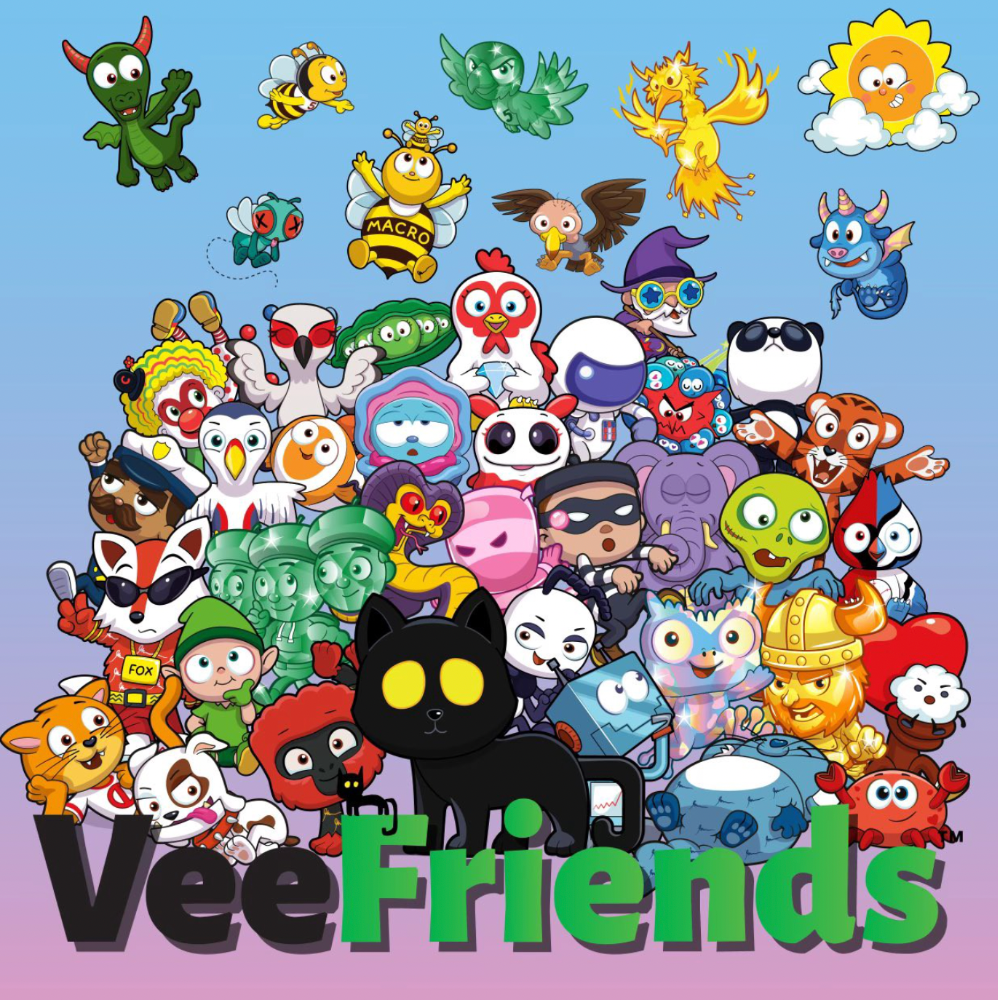

GaryVee's hand-drawn doodles have evolved into wonderful characters. The characters' poses and backgrounds bring the VeeFriends IP to life.

Yes, this is the second edition of VeeFriends, and at current prices, it's one of the best NFT opportunities in years. If you have the funds and risk appetite to invest in NFTs, VeeFriends Series 2 is worth every penny. Even if you can't invest, learn from their journey.

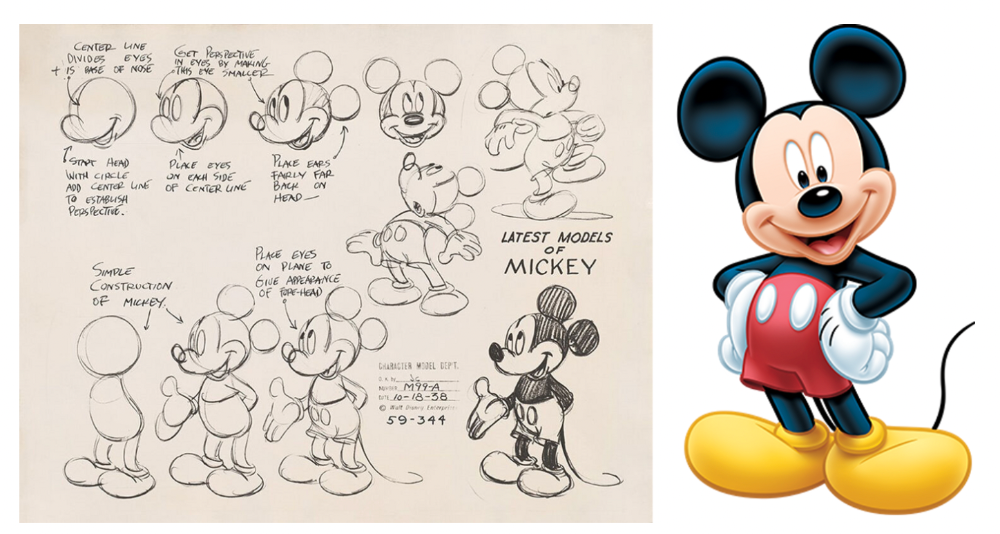

1. Art Is the Start

Many critics say VeeFriends artwork is below average and not by GaryVee. Art is often the key to future success.

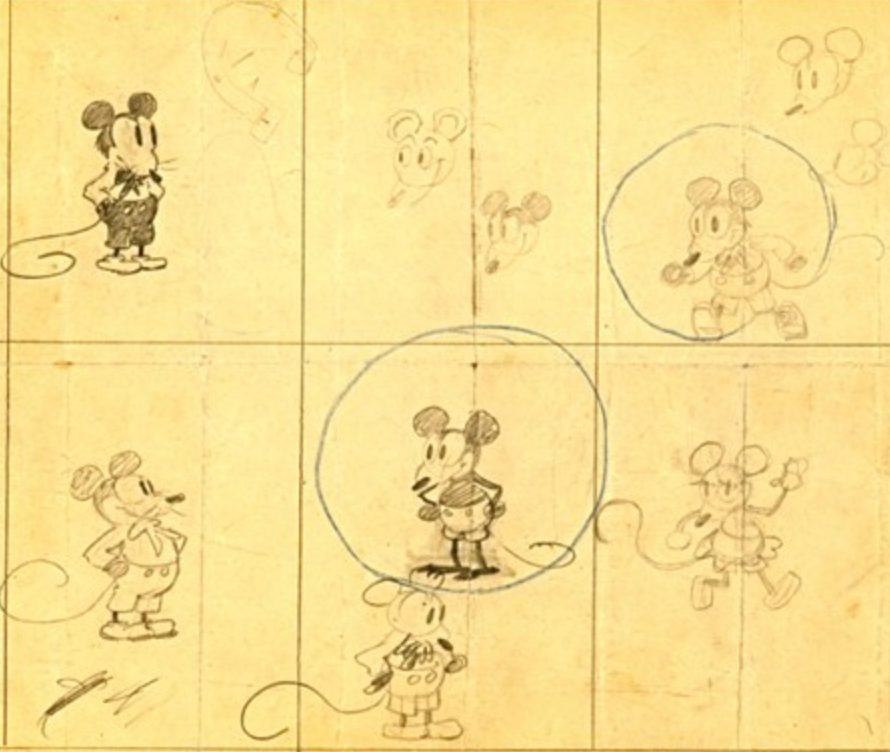

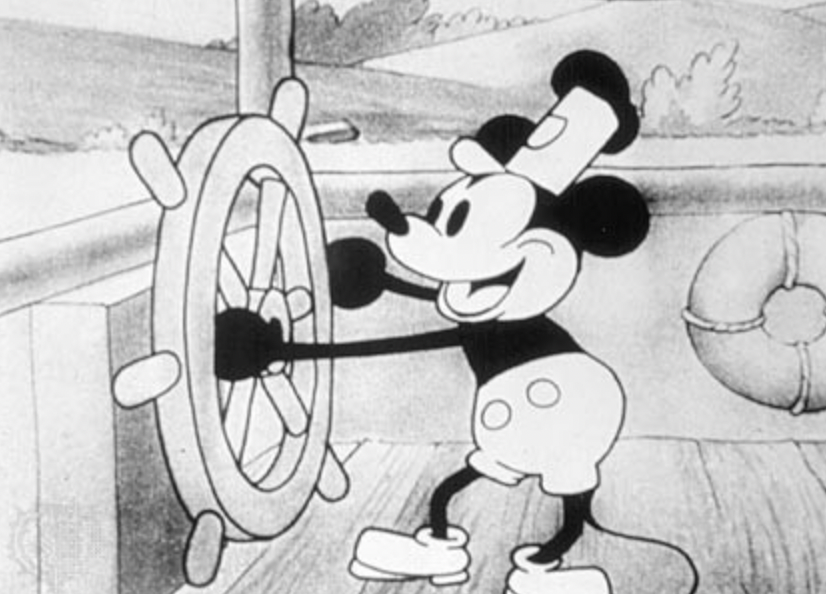

Let's look at one of the first Mickey Mouse drawings. No one would have guessed that this would become one of the most beloved animated short film characters. In Walt Before Mickey, Walt Disney's original mouse Mortimer was less refined.

First came a mouse...

These sketches evolved into Steamboat Willie, Disney's first animated short film.

Fred Moore redesigned the character artwork into what we saw in cartoons as kids. Mickey Mouse's history is here.

Looking at how different cartoon characters have evolved and gained popularity over decades, I believe Series 2 characters like Self-Aware Hare, Kind Kudu, and Patient Pig can do the same.

GaryVee captures this journey on the blockchain and lets early supporters become part of history. Time will tell if it rivals Disney, Pokemon, or Star Wars. Gary has been vocal about this vision.

2. VeeFriends is Intellectual Property for the Coming Generations

Most of us grew up watching cartoons, playing with toys, cards, and video games. Our interactions with fictional characters and the stories we hear shape us.

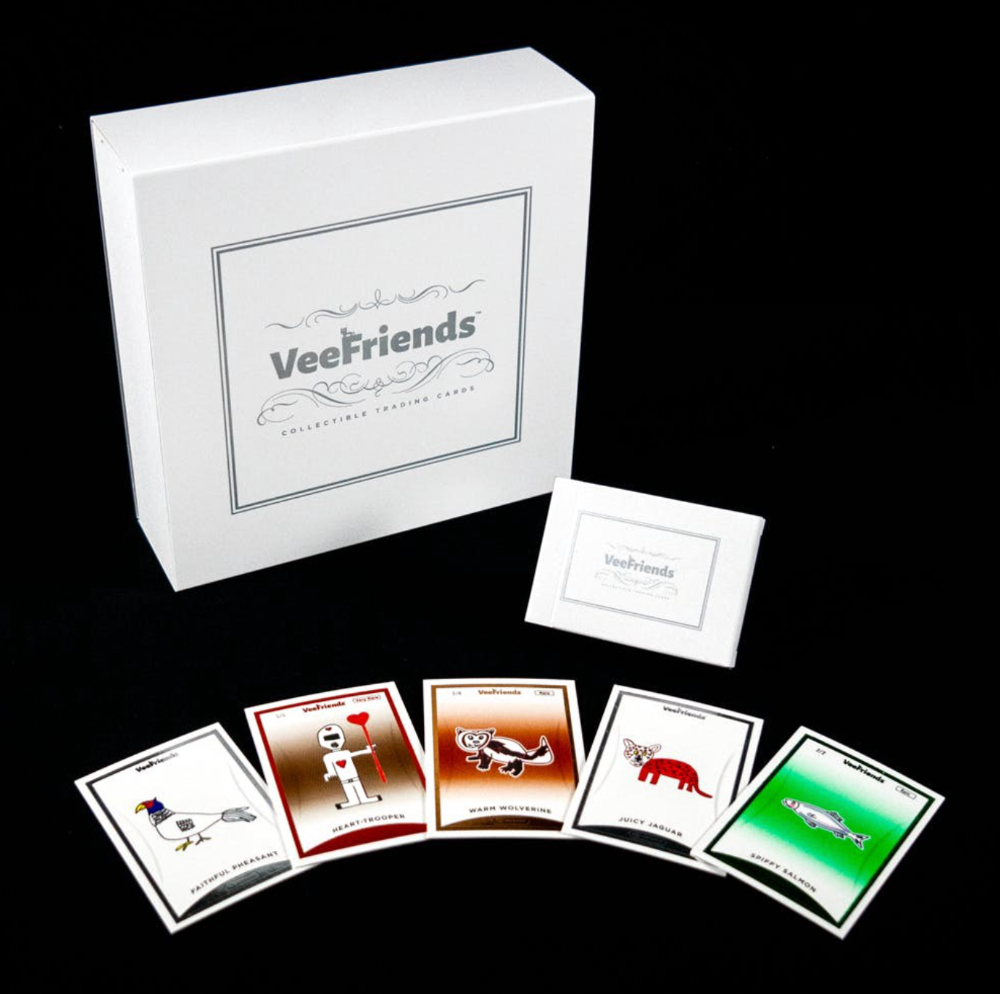

GaryVee is slowly curating an experience for the next generation with animated videos, card games, merchandise, toys, and more.

VeeFriends UNO, a collaboration with Mattel Creations, features 17 VeeFriends characters.

VeeFriends and Zerocool recently released Trading Cards featuring all 268 Series 1 characters and 15 new ones. Another way to build VeeFriends' collectibles brand.

At Veecon, all the characters were collectible toys. Something will soon emerge.

Kids and adults alike enjoy the YouTube channel's animated shorts and VeeFriends Tunes. Here's a song by the holder's Optimistic Otter-loving daughter.

This VeeFriends story is only the beginning. I'm looking forward to animated short film series, coloring books, streetwear, candy, toys, physical collectibles, and other forms of VeeFriends IP.

3. Veefriends will always provide utilities

Smart contracts can be updated at any time and authenticated on a ledger.

VeeFriends Series 2 gives no promise of any utility whatsoever. GaryVee released no project roadmap. In the first few months after launch, many owners of specific characters or scenes received utilities.

Every benefit or perk you receive helps promote the VeeFriends brand.

Recent partnerships are listed below.

MaryRuth's Multivitamin Gummies

Productive Puffin holders from VeeFriends x Primitive

Pickleball Scene & Clown Holders Only

Pickleball & Competitive Clown Exclusive experience, anteater multivitamin gummies, and Puffin x Primitive merch

Considering the price of NFTs, it may not seem like much. It's just the beginning; you never know what the future holds. No other NFT project offers such diverse, ongoing benefits.

4. Garyvee's team is ready

Gary Vaynerchuk's team and record are undisputed. He's a serial entrepreneur and the Chairman & CEO of VaynerX, which includes VaynerMedia, VaynerCommerce, One37pm, and The Sasha Group.

Gary founded VaynerSports, Resy, and Empathy Wines. He's a Candy Digital Board Member, VCR Group Co-Founder, ArtOfficial Co-Founder, and VeeFriends Creator & CEO. Gary was recently named one of Fortune's Top 50 NFT Influencers.

Gary Vayenerchuk aka GaryVee

Gary documents his daily life as a CEO on social media, which has 34 million followers and 272 million monthly views. GaryVee Audio Experience is a top podcast. He's a five-time New York Times best-seller and sought-after speaker.

Gary can observe consumer behavior to predict trends. He understood these trends early and pioneered them.

1997 — Realized e-potential commerce's and started winelibrary.com. In five years, he grew his father's wine business from $3M to $60M.

2006 — Realized content marketing's potential and started Wine Library on YouTube. TV

2009 — Estimated social media's potential (Web2) and invested in Facebook, Twitter, and Tumblr.

2014: Ethereum and Bitcoin investments

2021 — Believed in NFTs and Web3 enough to launch VeeFriends

GaryVee isn't all of VeeFriends. Andy Krainak, Dave DeRosa, Adam Ripps, Tyler Dowdle, and others work tirelessly to make VeeFriends a success.

GaryVee has said he'll let other businesses fail but not VeeFriends. We're just beginning his 40-year vision.

I have more confidence than ever in a company with a strong foundation and team.

5. Humans die, but characters live forever

What if GaryVee dies or can't work?

A writer's books can immortalize them. As long as their books exist, their words are immortal. Socrates, Hemingway, Aristotle, Twain, Fitzgerald, and others have become immortal.

Everyone knows Vincent Van Gogh's The Starry Night.

We all love reading and watching Peter Parker, Thor, or Jessica Jones. Their behavior inspires us. Stan Lee's message and stories live on despite his death.

GaryVee represents VeeFriends. Creating characters to communicate ensures that the message reaches even those who don't listen.

Gary wants his values and messages to be omnipresent in 268 characters. Messengers die, but their messages live on.

Gary envisions VeeFriends creating timeless stories and experiences. Ten years from now, maybe every kid will sing Patient Pig.

6. I love the intent.

Gary planned to create Workplace Warriors three years ago when he began designing Patient Panda, Accountable Ant, and Empathy elephant. The project stalled. When NFTs came along, he knew.

Gary wanted to create characters with traits he values, such as accountability, empathy, patience, kindness, and self-awareness. He wants future generations to find these traits cool. He hopes one or more of his characters will become pop culture icons.

These emotional skills aren't taught in schools or colleges, but they're crucial for business and life success. I love that someone is teaching this at scale.

In the end, intent matters.

Humans Are Collectors

Buy and collect things to communicate. Since the 1700s. Medieval people formed communities around hidden metals and stones. Many people still collect stamps and coins, and luxury and fashion are multi-trillion dollar industries. We're collectors.

The early 2020s NFTs will be remembered in the future. VeeFriends will define a cultural and technological shift in this era. VeeFriends Series 1 is the original hand-drawn art, but it's expensive. VeeFriends Series 2 is a once-in-a-lifetime opportunity at $1,000.

If you are new to NFTs, check out How to Buy a Non Fungible Token (NFT) For Beginners

This is a non-commercial article. Not financial or legal advice. Information isn't always accurate. Before making important financial decisions, consult a pro or do your own research.

This post is a summary. Read the full article here

Shan Vernekar

3 years ago

How the Ethereum blockchain's transactions are carried out

Overview

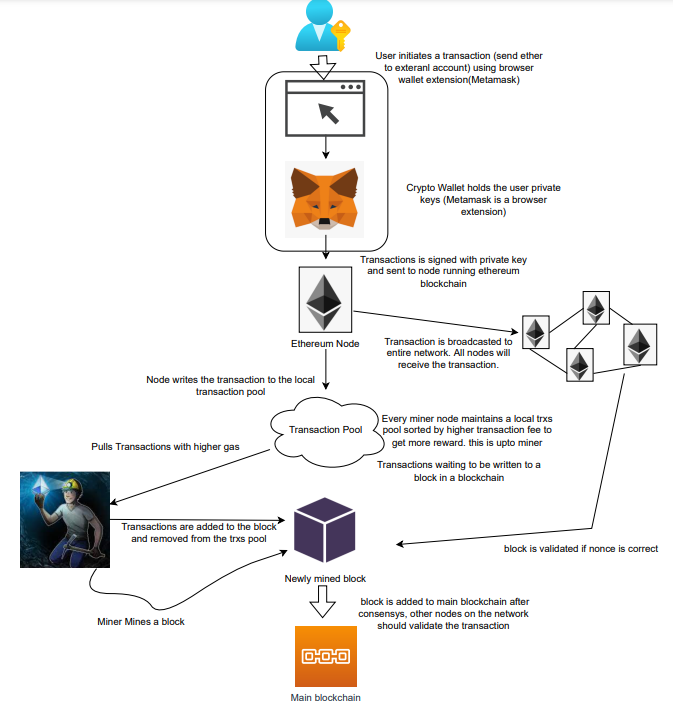

Ethereum blockchain is a network of nodes that validate transactions. Any network node can be queried for blockchain data for free. To write data as a transition requires processing and writing to each network node's storage. Fee is paid in ether and is also called as gas.

We'll examine how user-initiated transactions flow across the network and into the blockchain.

Flow of transactions

A user wishes to move some ether from one external account to another. He utilizes a cryptocurrency wallet for this (like Metamask), which is a browser extension.

The user enters the desired transfer amount and the external account's address. He has the option to choose the transaction cost he is ready to pay.

Wallet makes use of this data, signs it with the user's private key, and writes it to an Ethereum node. Services such as Infura offer APIs that enable writing data to nodes. One of these services is used by Metamask. An example transaction is shown below. Notice the “to” address and value fields.

var rawTxn = {

nonce: web3.toHex(txnCount),

gasPrice: web3.toHex(100000000000),

gasLimit: web3.toHex(140000),

to: '0x633296baebc20f33ac2e1c1b105d7cd1f6a0718b',

value: web3.toHex(0),

data: '0xcc9ab24952616d6100000000000000000000000000000000000000000000000000000000'

};The transaction is written to the target Ethereum node's local TRANSACTION POOL. It informed surrounding nodes of the new transaction, and those nodes reciprocated. Eventually, this transaction is received by and written to each node's local TRANSACTION pool.

The miner who finds the following block first adds pending transactions (with a higher gas cost) from the nearby TRANSACTION POOL to the block.

The transactions written to the new block are verified by other network nodes.

A block is added to the main blockchain after there is consensus and it is determined to be genuine. The local blockchain is updated with the new node by additional nodes as well.

Block mining begins again next.

The image above shows how transactions go via the network and what's needed to submit them to the main block chain.

References

ethereum.org/transactions How Ethereum transactions function, their data structure, and how to send them via app. ethereum.org

Leonardo Castorina

3 years ago

How to Use Obsidian to Boost Research Productivity

Tools for managing your PhD projects, reading lists, notes, and inspiration.

As a researcher, you have to know everything. But knowledge is useless if it cannot be accessed quickly. An easy-to-use method of archiving information makes taking notes effortless and enjoyable.

As a PhD student in Artificial Intelligence, I use Obsidian (https://obsidian.md) to manage my knowledge.

The article has three parts:

- What is a note, how to organize notes, tags, folders, and links? This section is tool-agnostic, so you can use most of these ideas with any note-taking app.

- Instructions for using Obsidian, managing notes, reading lists, and useful plugins. This section demonstrates how I use Obsidian, my preferred knowledge management tool.

- Workflows: How to use Zotero to take notes from papers, manage multiple projects' notes, create MOCs with Dataview, and more. This section explains how to use Obsidian to solve common scientific problems and manage/maintain your knowledge effectively.

This list is not perfect or complete, but it is my current solution to problems I've encountered during my PhD. Please leave additional comments or contact me if you have any feedback. I'll try to update this article.

Throughout the article, I'll refer to your digital library as your "Obsidian Vault" or "Zettelkasten".

Other useful resources are listed at the end of the article.

1. Philosophy: Taking and organizing notes

Carl Sagan: “To make an apple pie from scratch, you must first create the universe.”

Before diving into Obsidian, let's establish a Personal Knowledge Management System and a Zettelkasten. You can skip to Section 2 if you already know these terms.

Niklas Luhmann, a prolific sociologist who wrote 400 papers and 70 books, inspired this section and much of Zettelkasten. Zettelkasten means “slip box” (or library in this article). His Zettlekasten had around 90000 physical notes, which can be found here.

There are now many tools available to help with this process. Obsidian's website has a good introduction section: https://publish.obsidian.md/hub/

Notes

We'll start with "What is a note?" Although it may seem trivial, the answer depends on the topic or your note-taking style. The idea is that a note is as “atomic” (i.e. You should read the note and get the idea right away.

The resolution of your notes depends on their detail. Deep Learning, for example, could be a general description of Neural Networks, with a few notes on the various architectures (eg. Recurrent Neural Networks, Convolutional Neural Networks etc..).

Limiting length and detail is a good rule of thumb. If you need more detail in a specific section of this note, break it up into smaller notes. Deep Learning now has three notes:

- Deep Learning

- Recurrent Neural Networks

- Convolutional Neural Networks

Repeat this step as needed until you achieve the desired granularity. You might want to put these notes in a “Neural Networks” folder because they are all about the same thing. But there's a better way:

#Tags and [[Links]] over /Folders/

The main issue with folders is that they are not flexible and assume that all notes in the folder belong to a single category. This makes it difficult to make connections between topics.

Deep Learning has been used to predict protein structure (AlphaFold) and classify images (ImageNet). Imagine a folder structure like this:

- /Proteins/

- Protein Folding

- /Deep Learning/

- /Proteins/

Your notes about Protein Folding and Convolutional Neural Networks will be separate, and you won't be able to find them in the same folder.

This can be solved in several ways. The most common one is to use tags rather than folders. A note can be grouped with multiple topics this way. Obsidian tags can also be nested (have subtags).

You can also link two notes together. You can build your “Knowledge Graph” in Obsidian and other note-taking apps like Obsidian.

My Knowledge Graph. Green: Biology, Red: Machine Learning, Yellow: Autoencoders, Blue: Graphs, Brown: Tags.

My Knowledge Graph and the note “Backrpropagation” and its links.

Backpropagation note and all its links

Why use Folders?

Folders help organize your vault as it grows. The main suggestion is to have few folders that "weakly" collect groups of notes or better yet, notes from different sources.

Among my Zettelkasten folders are:

My Zettelkasten's 5 folders

They usually gather data from various sources:

MOC: Map of Contents for the Zettelkasten.

Projects: Contains one note for each side-project of my PhD where I log my progress and ideas. Notes are linked to these.

Bio and ML: These two are the main content of my Zettelkasten and could theoretically be combined.

Papers: All my scientific paper notes go here. A bibliography links the notes. Zotero .bib file

Books: I make a note for each book I read, which I then split into multiple notes.

Keeping images separate from other files can help keep your main folders clean.

I will elaborate on these in the Workflow Section.

My general recommendation is to use tags and links instead of folders.

Maps of Content (MOC)

Making Tables of Contents is a good solution (MOCs).

These are notes that "signposts" your Zettelkasten library, directing you to the right type of notes. It can link to other notes based on common tags. This is usually done with a title, then your notes related to that title. As an example:

An example of a Machine Learning MOC generated with Dataview.

As shown above, my Machine Learning MOC begins with the basics. Then it's on to Variational Auto-Encoders. Not only does this save time, but it also saves scrolling through the tag search section.

So I keep MOCs at the top of my library so I can quickly find information and see my library. These MOCs are generated automatically using an Obsidian Plugin called Dataview (https://github.com/blacksmithgu/obsidian-dataview).

Ideally, MOCs could be expanded to include more information about the notes, their status, and what's left to do. In the absence of this, Dataview does a fantastic job at creating a good structure for your notes.

In the absence of this, Dataview does a fantastic job at creating a good structure for your notes.

2. Tools: Knowing Obsidian

Obsidian is my preferred tool because it is free, all notes are stored in Markdown format, and each panel can be dragged and dropped. You can get it here: https://obsidian.md/

Obsidian interface.

Obsidian is highly customizable, so here is my preferred interface:

The theme is customized from https://github.com/colineckert/obsidian-things

Alternatively, each panel can be collapsed, moved, or removed as desired. To open a panel later, click on the vertical "..." (bottom left of the note panel).

My interface is organized as follows:

How my Obsidian Interface is organized.

Folders/Search:

This is where I keep all relevant folders. I usually use the MOC note to navigate, but sometimes I use the search button to find a note.

Tags:

I use nested tags and look into each one to find specific notes to link.

cMenu:

Easy-to-use menu plugin cMenu (https://github.com/chetachiezikeuzor/cMenu-Plugin)

Global Graph:

The global graph shows all your notes (linked and unlinked). Linked notes will appear closer together. Zoom in to read each note's title. It's a bit overwhelming at first, but as your library grows, you get used to the positions and start thinking of new connections between notes.

Local Graph:

Your current note will be shown in relation to other linked notes in your library. When needed, you can quickly jump to another link and back to the current note.

Links:

Finally, an outline panel and the plugin Obsidian Power Search (https://github.com/aviral-batra/obsidian-power-search) allow me to search my vault by highlighting text.

Start using the tool and worry about panel positioning later. I encourage you to find the best use-case for your library.

Plugins

An additional benefit of using Obsidian is the large plugin library. I use several (Calendar, Citations, Dataview, Templater, Admonition):

Obsidian Calendar Plugin: https://github.com/liamcain

It organizes your notes on a calendar. This is ideal for meeting notes or keeping a journal.

Calendar addon from hans/obsidian-citation-plugin

Obsidian Citation Plugin: https://github.com/hans/

Allows you to cite papers from a.bib file. You can also customize your notes (eg. Title, Authors, Abstract etc..)

Plugin citation from hans/obsidian-citation-plugin

Obsidian Dataview: https://github.com/blacksmithgu/

A powerful plugin that allows you to query your library as a database and generate content automatically. See the MOC section for an example.

Allows you to create notes with specific templates like dates, tags, and headings.

Templater. Obsidian Admonition: https://github.com/valentine195/obsidian-admonition

Blocks allow you to organize your notes.

Plugin warning. Obsidian Admonition (valentine195)

There are many more, but this list should get you started.

3. Workflows: Cool stuff

Here are a few of my workflows for using obsidian for scientific research. This is a list of resources I've found useful for my use-cases. I'll outline and describe them briefly so you can skim them quickly.

3.1 Using Templates to Structure Notes

3.2 Free Note Syncing (Laptop, Phone, Tablet)

3.3 Zotero/Mendeley/JabRef -> Obsidian — Managing Reading Lists

3.4 Projects and Lab Books

3.5 Private Encrypted Diary

3.1 Using Templates to Structure Notes

Plugins: Templater and Dataview (optional).

To take effective notes, you must first make adding new notes as easy as possible. Templates can save you time and give your notes a consistent structure. As an example:

An example of a note using a template.

### [[YOUR MOC]]

# Note Title of your note

**Tags**::

**Links**::

The top line links to your knowledge base's Map of Content (MOC) (see previous sections). After the title, I add tags (and a link between the note and the tag) and links to related notes.

To quickly identify all notes that need to be expanded, I add the tag “#todo”. In the “TODO:” section, I list the tasks within the note.

The rest are notes on the topic.

Templater can help you create these templates. For new books, I use the following template:

### [[Books MOC]]

# Title

**Author**::

**Date::

**Tags::

**Links::

A book template example.

Using a simple query, I can hook Dataview to it.

dataview

table author as Author, date as “Date Finished”, tags as “Tags”, grade as “Grade”

from “4. Books”

SORT grade DESCENDING

using Dataview to query templates.

3.2 Free Note Syncing (Laptop, Phone, Tablet)

No plugins used.

One of my favorite features of Obsidian is the library's self-contained and portable format. Your folder contains everything (plugins included).

Ordinary folders and documents are available as well. There is also a “.obsidian” folder. This contains all your plugins and settings, so you can use it on other devices.

So you can use Google Drive, iCloud, or Dropbox for free as long as you sync your folder (note: your folder should be in your Cloud Folder).

For my iOS and macOS work, I prefer iCloud. You can also use the paid service Obsidian Sync.

3.3 Obsidian — Managing Reading Lists and Notes in Zotero/Mendeley/JabRef

Plugins: Quotes (required).

3.3 Zotero/Mendeley/JabRef -> Obsidian — Taking Notes and Managing Reading Lists of Scientific Papers

My preferred reference manager is Zotero, but this workflow should work with any reference manager that produces a .bib file. This file is exported to my cloud folder so I can access it from any platform.

My Zotero library is tagged as follows:

My reference manager's tags

For readings, I usually search for the tags “!!!” and “To-Read” and select a paper. Annotate the paper next (either on PDF using GoodNotes or on physical paper).

Then I make a paper page using a template in the Citations plugin settings:

An example of my citations template.

Create a new note, open the command list with CMD/CTRL + P, and find the Citations “Insert literature note content in the current pane” to see this lovely view.

Citation generated by the article https://doi.org/10.1101/2022.01.24.22269144

You can then convert your notes to digital. I found that transcribing helped me retain information better.

3.4 Projects and Lab Books

Plugins: Tweaker (required).

PhD students offering advice on thesis writing are common (read as regret). I started asking them what they would have done differently or earlier.

“Deep stuff Leo,” one person said. So my main issue is basic organization, losing track of my tasks and the reasons for them.

As a result, I'd go on other experiments that didn't make sense, and have to reverse engineer my logic for thesis writing. - PhD student now wise Postdoc

Time management requires planning. Keeping track of multiple projects and lab books is difficult during a PhD. How I deal with it:

- One folder for all my projects

- One file for each project

I use a template to create each project

### [[Projects MOC]]

# <% tp.file.title %>

**Tags**::

**Links**::

**URL**::

**Project Description**::## Notes:

### <% tp.file.last_modified_date(“dddd Do MMMM YYYY”) %>

#### Done:

#### TODO:

#### Notes

You can insert a template into a new note with CMD + P and looking for the Templater option.

I then keep adding new days with another template:

### <% tp.file.last_modified_date("dddd Do MMMM YYYY") %>

#### Done:

#### TODO:

#### Notes:

This way you can keep adding days to your project and update with reasonings and things you still have to do and have done. An example below:

Example of project note with timestamped notes.

3.5 Private Encrypted Diary

This is one of my favorite Obsidian uses.

Mini Diary's interface has long frustrated me. After the author archived the project, I looked for a replacement. I had two demands:

- It had to be private, and nobody had to be able to read the entries.

- Cloud syncing was required for editing on multiple devices.

Then I learned about encrypting the Obsidian folder. Then decrypt and open the folder with Obsidian. Sync the folder as usual.

Use CryptoMator (https://cryptomator.org/). Create an encrypted folder in Cryptomator for your Obsidian vault, set a password, and let it do the rest.

If you need a step-by-step video guide, here it is:

Conclusion

So, I hope this was helpful!

In the first section of the article, we discussed notes and note-taking techniques. We discussed when to use tags and links over folders and when to break up larger notes.

Then we learned about Obsidian, its interface, and some useful plugins like Citations for citing papers and Templater for creating note templates.

Finally, we discussed workflows and how to use Zotero to take notes from scientific papers, as well as managing Lab Books and Private Encrypted Diaries.

Thanks for reading and commenting :)

Read original post here