More on Entrepreneurship/Creators

Jenn Leach

3 years ago

How Much I Got Paid by YouTube for a 68 Million Views Video

My nameless, faceless channel case study

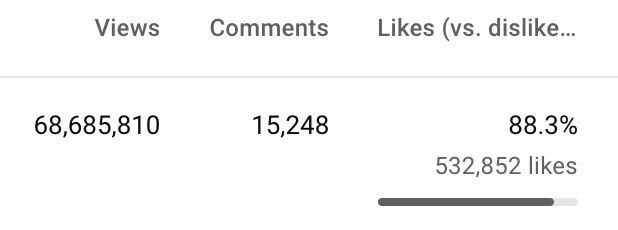

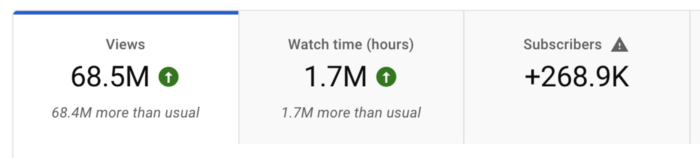

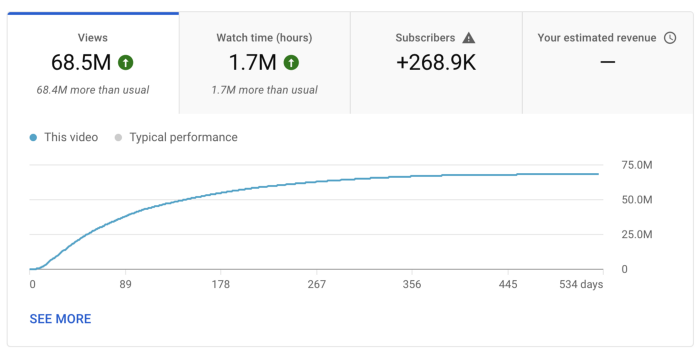

The Numbers

I anonymize this YouTube channel.

It's in a trendy, crowded niche. Sharing it publicly will likely enhance competition.

I'll still share my dashboard numbers:

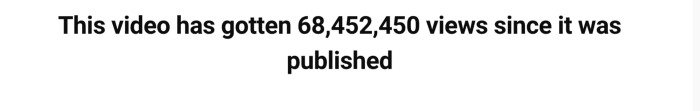

A year ago, the video was released.

What I earned

I'll stop stalling. Here's a screenshot of my YouTube statistics page displaying Adsense profits.

YouTube Adsense made me ZERO dollars.

OMG!

How is this possible?

YouTube Adsense can't monetize my niche. This is typical in faceless niches like TikTok's rain videos. If they were started a while ago, I'm sure certain rain accounts are monetized, but not today.

I actually started a soothing sounds faceless YouTube channel. This was another account of mine.

I looped Pexels films for hours. No background music, just wind, rain, etc.

People could watch these videos to relax or get ready for bed. They're ideal for background noise and relaxation.

They're long-lasting, too. It's easy to make a lot from YouTube Adsense if you insert ads.

Anyway, I tried to monetize it and couldn’t. This was about a year ago. That’s why I doubt new accounts in this genre would be able to get approved for ads.

Back to my faceless channel with 68 million views.

I received nothing from YouTube Adsense, but I made money elsewhere.

Getting paid by the gods of affiliate marketing

Place links in the video and other videos on the channel to get money. Visitors that buy through your affiliate link earn you a commission.

This video earned many clicks on my affiliate links.

I linked to a couple of Amazon products, a YouTube creator tool, my kofi link, and my subscribe link.

Sponsorships

Brands pay you to include ads in your videos.

This video led to many sponsorships.

I've done dozens of sponsorship campaigns that paid $40 to $50 for an end screen to $450 for a preroll ad.

Last word

Overall, I made less than $3,000.

If I had time, I'd be more proactive with sponsorships. You can pitch brand sponsorships. This actually works.

I'd do that if I could rewind time.

I still can, but I think the reaction rate would be higher closer to the viral video's premiere date.

Sarah Bird

3 years ago

Memes Help This YouTube Channel Earn Over $12k Per Month

Take a look at a YouTube channel making anything up to over $12k a month from making very simple videos.

And the best part? Its replicable by anyone. Basic videos can be generated for free without design abilities.

Join me as I deconstruct the channel to estimate how much they make, how they do it, and how you can too.

What Do They Do Exactly?

Happy Land posts memes with a simple caption they wrote. So, it's new. The videos are a slideshow of meme photos with stock music.

The site posts 12 times a day.

8-10-minute videos show 10 second images. Thus, each video needs 48-60 memes.

Memes are video titles (e.g. times a boyfriend was hilarious, back to school fails, funny restaurant signs).

Some stats about the channel:

Founded on October 30, 2020

873 videos were added.

81.8k subscribers

67,244,196 views of the video

What Value Are They Adding?

Everyone can find free memes online. This channel collects similar memes into a single video so you don't have to scroll or click for more. It’s right there, you just keep watching and more will come.

By theming it, the audience is prepared for the video's content.

If you want hilarious animal memes or restaurant signs, choose the video and you'll get up to 60 memes without having to look for them. Genius!

How much money do they make?

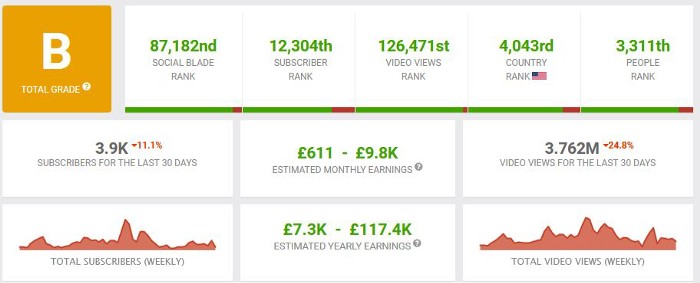

According to www.socialblade.com, the channel earns $800-12.8k (image shown in my home currency of GBP).

That's a crazy estimate, but it highlights the unbelievable potential of a channel that presents memes.

This channel thrives on quantity, thus putting out videos is necessary to keep the flow continuing and capture its audience's attention.

How Are the Videos Made?

Straightforward. Memes are added to a presentation without editing (so you could make this in PowerPoint or Keynote).

Each slide should include a unique image and caption. Set 10 seconds per slide.

Add music and post the video.

Finding enough memes for the material and theming is difficult, but if you enjoy memes, this is a fun job.

This case study should have shown you that you don't need expensive software or design expertise to make entertaining videos. Why not try fresh, easy-to-do ideas and see where they lead?

Bastian Hasslinger

3 years ago

Before 2021, most startups had excessive valuations. It is currently causing issues.

Higher startup valuations are often favorable for all parties. High valuations show a business's potential. New customers and talent are attracted. They earn respect.

Everyone benefits if a company's valuation rises.

Founders and investors have always been incentivized to overestimate a company's value.

Post-money valuations were inflated by 2021 market expectations and the valuation model's mechanisms.

Founders must understand both levers to handle a normalizing market.

2021, the year of miracles

2021 must've seemed miraculous to entrepreneurs, employees, and VCs. Valuations rose, and funding resumed after the first Covid-19 epidemic caution.

In 2021, VC investments increased from $335B to $643B. 518 new worldwide unicorns vs. 134 in 2020; 951 US IPOs vs. 431.

Things can change quickly, as 2020-21 showed.

Rising interest rates, geopolitical developments, and normalizing technology conditions drive down share prices and tech company market caps in 2022. Zoom, the poster-child of early lockdown success, is down 37% since 1st Jan.

Once-inflated valuations can become a problem in a normalizing market, especially for founders, employees, and early investors.

the reason why startups are always overvalued

To see why inflated valuations are a problem, consider one of its causes.

Private company values only fluctuate following a new investment round, unlike publicly-traded corporations. The startup's new value is calculated simply:

(Latest round share price) x (total number of company shares)

This is the industry standard Post-Money Valuation model.

Let’s illustrate how it works with an example. If a VC invests $10M for 1M shares (at $10/share), and the company has 10M shares after the round, its Post-Money Valuation is $100M (10/share x 10M shares).

This approach might seem like the most natural way to assess a business, but the model often unintentionally overstates the underlying value of the company even if the share price paid by the investor is fair. All shares aren't equal.

New investors in a corporation will always try to minimize their downside risk, or the amount they lose if things go wrong. New investors will try to negotiate better terms and pay a premium.

How the value of a struggling SpaceX increased

SpaceX's 2008 Series D is an example. Despite the financial crisis and unsuccessful rocket launches, the company's Post-Money Valuation was 36% higher after the investment round. Why?

Series D SpaceX shares were protected. In case of liquidation, Series D investors were guaranteed a 2x return before other shareholders.

Due to downside protection, investors were willing to pay a higher price for this new share class.

The Post-Money Valuation model overpriced SpaceX because it viewed all the shares as equal (they weren't).

Why entrepreneurs, workers, and early investors stand to lose the most

Post-Money Valuation is an effective and sufficient method for assessing a startup's valuation, despite not taking share class disparities into consideration.

In a robust market, where the firm valuation will certainly expand with the next fundraising round or exit, the inflated value is of little significance.

Fairness endures. If a corporation leaves at a greater valuation, each stakeholder will receive a proportional distribution. (i.e., 5% of a $100M corporation yields $5M).

SpaceX's inherent overvaluation was never a problem. Had it been sold for less than its Post-Money Valuation, some shareholders, including founders, staff, and early investors, would have seen their ownership drop.

The unforgiving world of 2022

In 2022, founders, employees, and investors who benefited from inflated values will face below-valuation exits and down-rounds.

For them, 2021 will be a curse, not a blessing.

Some tech giants are worried. Klarna's valuation fell from $45B (Oct 21) to $30B (Jun 22), Canvas from $40B to $27B, and GoPuffs from $17B to $8.3B.

Shazam and Blue Apron have to exit or IPO at a cheaper price. Premium share classes are protected, while others receive less. The same goes for bankrupts.

Those who continue at lower valuations will lose reputation and talent. When their value declines by half, generous employee stock options become less enticing, and their ability to return anything is questioned.

What can we infer about the present situation?

Such techniques to enhance your company's value or stop a normalizing market are fiction.

The current situation is a painful reminder for entrepreneurs and a crucial lesson for future firms.

The devastating market fall of the previous six months has taught us one thing:

Keep in mind that any valuation is speculative. Money Post A startup's valuation is a highly simplified approximation of its true value, particularly in the early phases when it lacks significant income or a cutting-edge product. It is merely a projection of the future and a hypothetical meter. Until it is achieved by an exit, a valuation is nothing more than a number on paper.

Assume the value of your company is lower than it was in the past. Your previous valuation might not be accurate now due to substantial changes in the startup financing markets. There is little reason to think that your company's value will remain the same given the 50%+ decline in many newly listed IT companies. Recognize how the market situation is changing and use caution.

Recognize the importance of the stake you hold. Each share class has a unique value that varies. Know the sort of share class you own and how additional contractual provisions affect the market value of your security. Frameworks have been provided by Metrick and Yasuda (Yale & UC) and Gornall and Strebulaev (Stanford) for comprehending the terms that affect investors' cash-flow rights upon withdrawal. As a result, you will be able to more accurately evaluate your firm and determine the worth of each share class.

Be wary of approving excessively protective share terms.

The trade-offs should be considered while negotiating subsequent rounds. Accepting punitive contractual terms could first seem like a smart option in order to uphold your inflated worth, but you should proceed with caution. Such provisions ALWAYS result in misaligned shareholders, with common shareholders (such as you and your staff) at the bottom of the list.

You might also like

Tora Northman

3 years ago

Pixelmon NFTs are so bad, they are almost good!

Bored Apes prices continue to rise, HAPEBEAST launches, Invisible Friends hype continues to grow. Sadly, not all projects are as successful.

Of course, there are many factors to consider when buying an NFT. Is the project a scam? Will the reveal derail the project? Possibly, but when Pixelmon first teased its launch, it generated a lot of buzz.

With a primary sale mint price of 3 ETH ($8,100 USD), it started as an expensive project, with plenty of fans willing to invest in what was sold as a game. After it was revealed, it fell rapidly.

Why? It was overpromised and under delivered.

According to the project's creator[^1], the funds generated will be used to develop the artwork. "The Pixelmon reveal was wrong. This is what our Pixelmon look like in-game. "Despite the fud, I will not go anywhere," he wrote on Twitter. The goal remains. The funds will still be used to build our game. I will finish this project."

The project raised $70 million USD, but the NFTs buyers received were not the project's original teasers. Some call it "the worst NFT project ever," while others call it a complete scam.

But there's hope for some buyers. Kevin emerged from the ashes as the project was roasted over the fire.

A Minecraft character meets Salad Fingers - that's Kevin. He's a frog-like creature whose reveal was such a terrible NFT that it became part of history – and a meme.

If you're laughing at people paying $8K for a silly pixelated image, you might need to take it back. Precisely because of this, lucky holders who minted Kevin have been able to sell the now-memed NFT for over 8 ETH (around $24,000 USD), with some currently listed for 100 ETH.

Of course, Twitter has been awash in memes mocking those who invested in the project, because what else can you do when so many people lose money?

It's still unclear if the NFT project is a scam, but the team behind it was hired on Upwork. There's still hope for redemption, but Kevin's rise to fame appears to be the only positive outcome so far.

[^1] This is not the first time the creator (A 20-yo New Zealanders) has sought money via an online platform and had people claiming he under-delivered. He raised $74,000 on Kickstarter for a card game called Psycho Chicken. There are hundreds of comments on the Kickstarter project saying they haven't received the product and pleading for a refund or an update.

Victoria Kurichenko

3 years ago

My Blog Is in Google's Top 10—Here's How to Compete

"Competition" is beautiful and hateful.

Some people bury their dreams because they are afraid of competition. Others challenge themselves, shaping our world.

Competition is normal.

It spurs innovation and progress.

I wish more people agreed.

As a marketer, content writer, and solopreneur, my readers often ask:

"I want to create a niche website, but I have no ideas. Everything's done"

"Is a website worthwhile?"

I can't count how many times I said, "Yes, it makes sense, and you can succeed in a competitive market."

I encourage and share examples, but it's not enough to overcome competition anxiety.

I launched an SEO writing website for content creators a year ago, knowing it wouldn't beat Ahrefs, Semrush, Backlinko, etc.

Not needed.

Many of my website's pages rank highly on Google.

Everyone can eat the pie.

In a competitive niche, I took a different approach.

Look farther

When chatting with bloggers that want a website, I discovered something fascinating.

They want to launch a website but have no ideas. As a next step, they start listing the interests they believe they should work on, like wellness, lifestyle, investments, etc. I could keep going.

Too many generalists who claim to know everything confuse many.

Generalists aren't trusted.

We want someone to fix our problems immediately.

I don't think broad-spectrum experts are undervalued. People have many demands that go beyond generalists' work. Narrow-niche experts can help.

I've done SEO for three years. I learned from experts and courses. I couldn't find a comprehensive SEO writing resource.

I read tons of articles before realizing that wasn't it. I took courses that covered SEO basics eventually.

I had a demand for learning SEO writing, but there was no solution on the market. My website fills this micro-niche.

Have you ever had trouble online?

Professional courses too general, boring, etc.?

You've bought off-topic books, right?

You're not alone.

Niche ideas!

Big players often disregard new opportunities. Too small. Individual content creators can succeed here.

In a competitive market:

Never choose wide subjects

Think about issues you can relate to and have direct experience with.

Be a consumer to discover both the positive and negative aspects of a good or service.

Merchandise your annoyances.

Consider ways to transform your frustrations into opportunities.

The right niche is half-success. Here is what else I did to hit the Google front page with my website.

An innovative method for choosing subjects

Why publish on social media and websites?

Want likes, shares, followers, or fame?

Some people do it for fun. No judgment.

I bet you want more.

You want to make decent money from blogging.

Writing about random topics, even if they are related to your niche, won’t help you attract an audience from organic search. I'm a marketer and writer.

I worked at companies with dead blogs because they posted for themselves, not readers. They did not follow SEO writing rules; that’s why most of their content flopped.

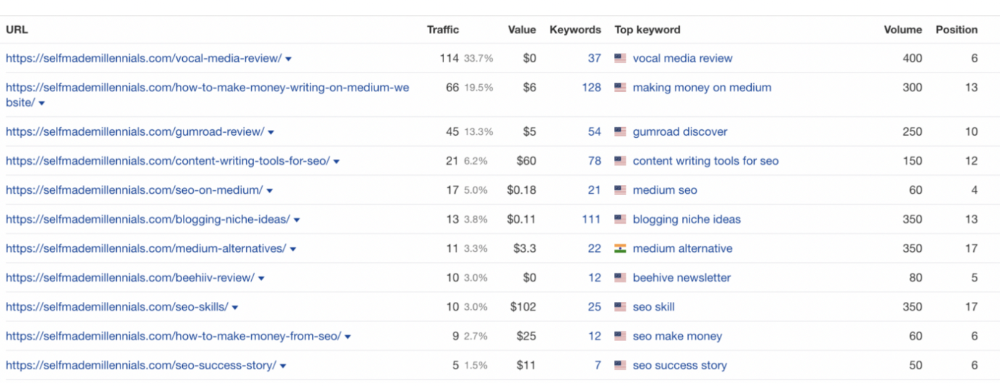

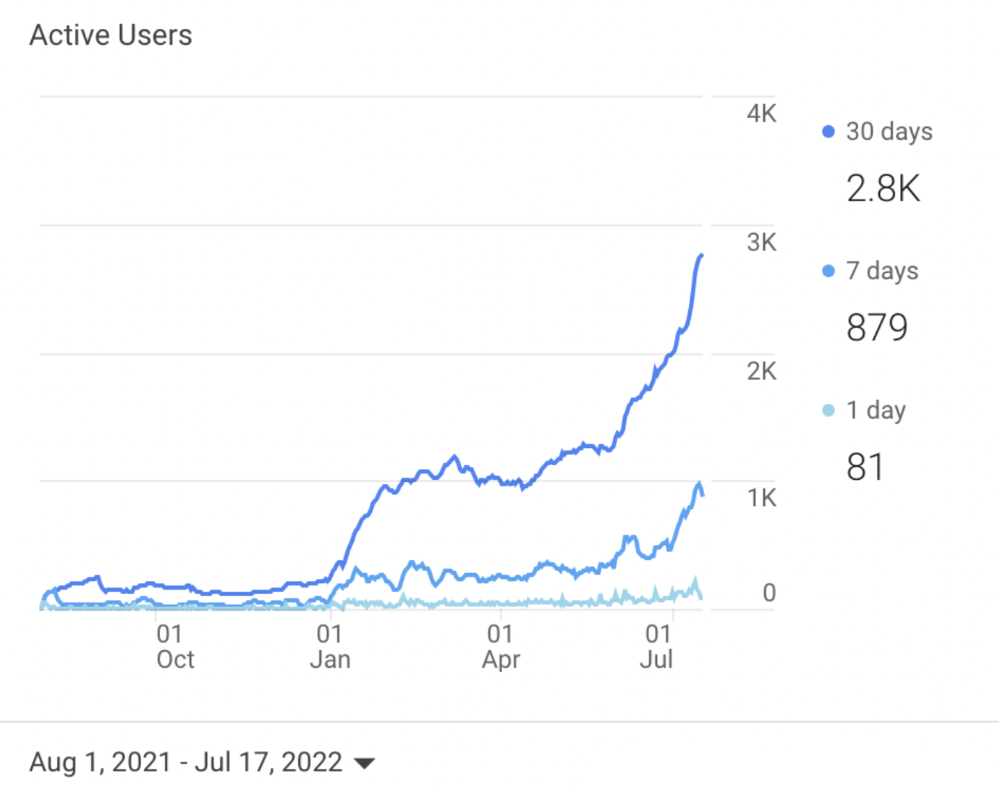

I learned these hard lessons and grew my website from 0 to 3,000+ visitors per month while working on it a few hours a week only. Evidence:

I choose website topics using these criteria:

- Business potential. The information should benefit my audience and generate revenue. There would be no use in having it otherwise.

My topics should help me:

Attract organic search traffic with my "fluff-free" content -> Subscribers > SEO ebook sales.

Simple and effective.

- traffic on search engines. The number of monthly searches reveals how popular my topic is all across the world. If I find that no one is interested in my suggested topic, I don't write a blog article.

- Competition. Every search term is up against rivals. Some are more popular (thus competitive) since more websites target them in organic search. A new website won't score highly for keywords that are too competitive. On the other side, keywords with moderate to light competition can help you rank higher on Google more quickly.

- Search purpose. The "why" underlying users' search requests is revealed. I analyze search intent to understand what users need when they plug various queries in the search bar and what content can perfectly meet their needs.

My specialty website produces money, ranks well, and attracts the target audience because I handpick high-traffic themes.

Following these guidelines, even a new website can stand out.

I wrote a 50-page SEO writing guide where I detailed topic selection and share my front-page Google strategy.

My guide can help you run a successful niche website.

In summary

You're not late to the niche-website party.

The Internet offers many untapped opportunities.

We need new solutions and are willing to listen.

There are unexplored niches in any topic.

Don't fight giants. They have their piece of the pie. They might overlook new opportunities while trying to keep that piece of the pie. You should act now.

Jim Clyde Monge

3 years ago

Can You Sell Images Created by AI?

Some AI-generated artworks sell for enormous sums of money.

But can you sell AI-Generated Artwork?

Simple answer: yes.

However, not all AI services enable allow usage and redistribution of images.

Let's check some of my favorite AI text-to-image generators:

Dall-E2 by OpenAI

The AI art generator Dall-E2 is powerful. Since it’s still in beta, you can join the waitlist here.

OpenAI DOES NOT allow the use and redistribution of any image for commercial purposes.

Here's the policy as of April 6, 2022.

Here are some images from Dall-E2’s webpage to show its art quality.

Several Reddit users reported receiving pricing surveys from OpenAI.

This suggests the company may bring out a subscription-based tier and a commercial license to sell images soon.

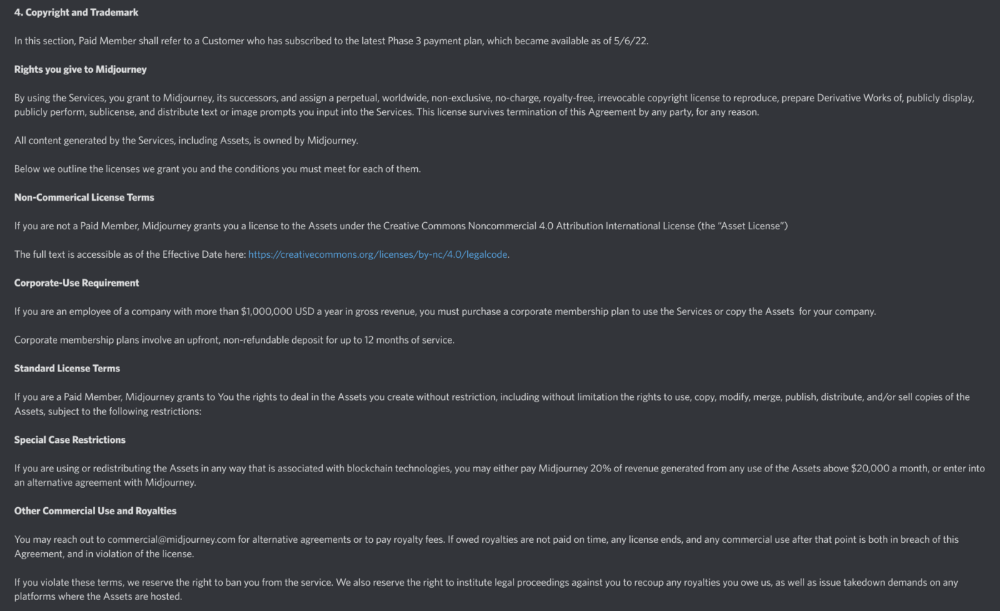

MidJourney

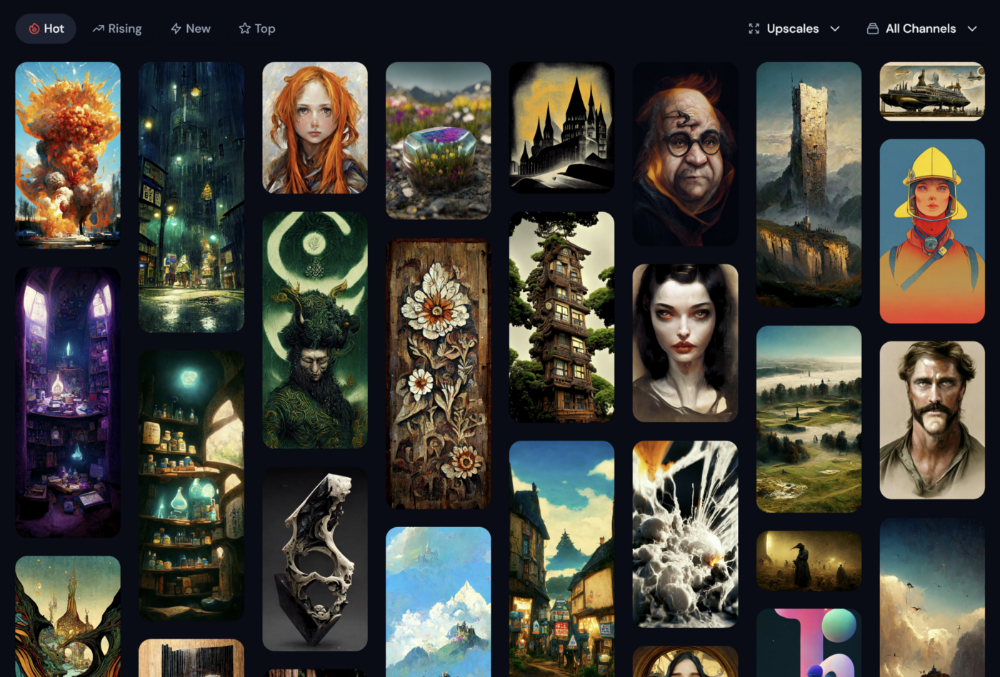

I like Midjourney's art generator. It makes great AI images. Here are some samples:

Standard Licenses are available for $10 per month.

Standard License allows you to use, copy, modify, merge, publish, distribute, and/or sell copies of the images, except for blockchain technologies.

If you utilize or distribute the Assets using blockchain technology, you must pay MidJourney 20% of revenue above $20,000 a month or engage in an alternative agreement.

Here's their copyright and trademark page.

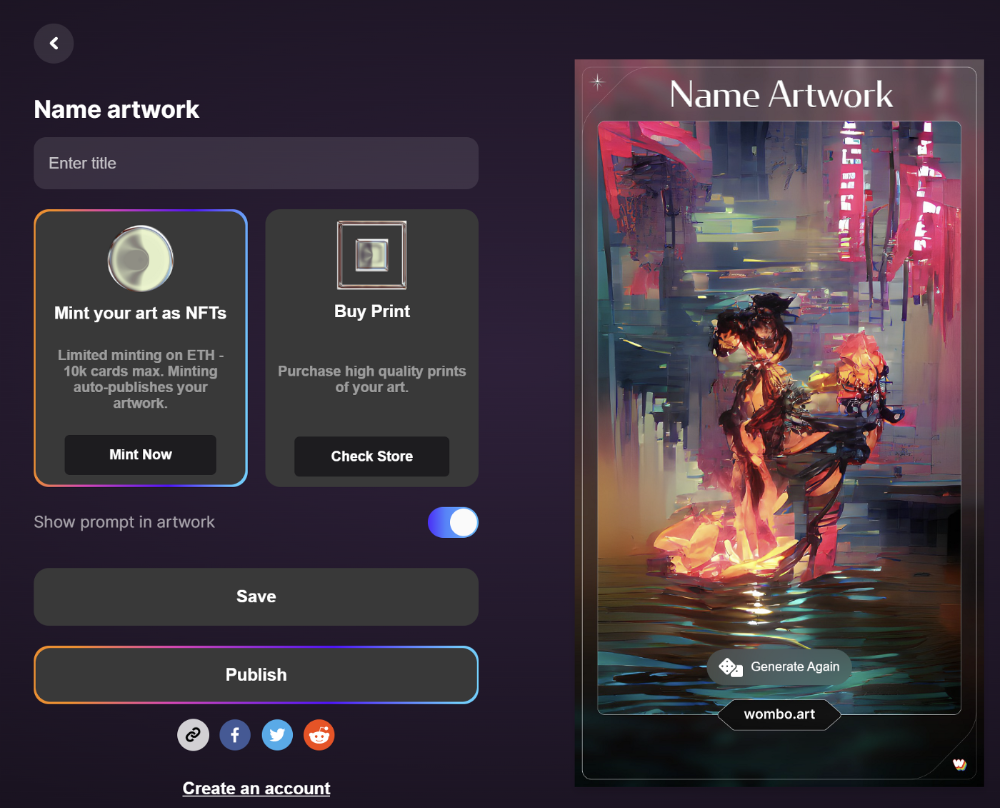

Dream by Wombo

Dream is one of the first public AI art generators.

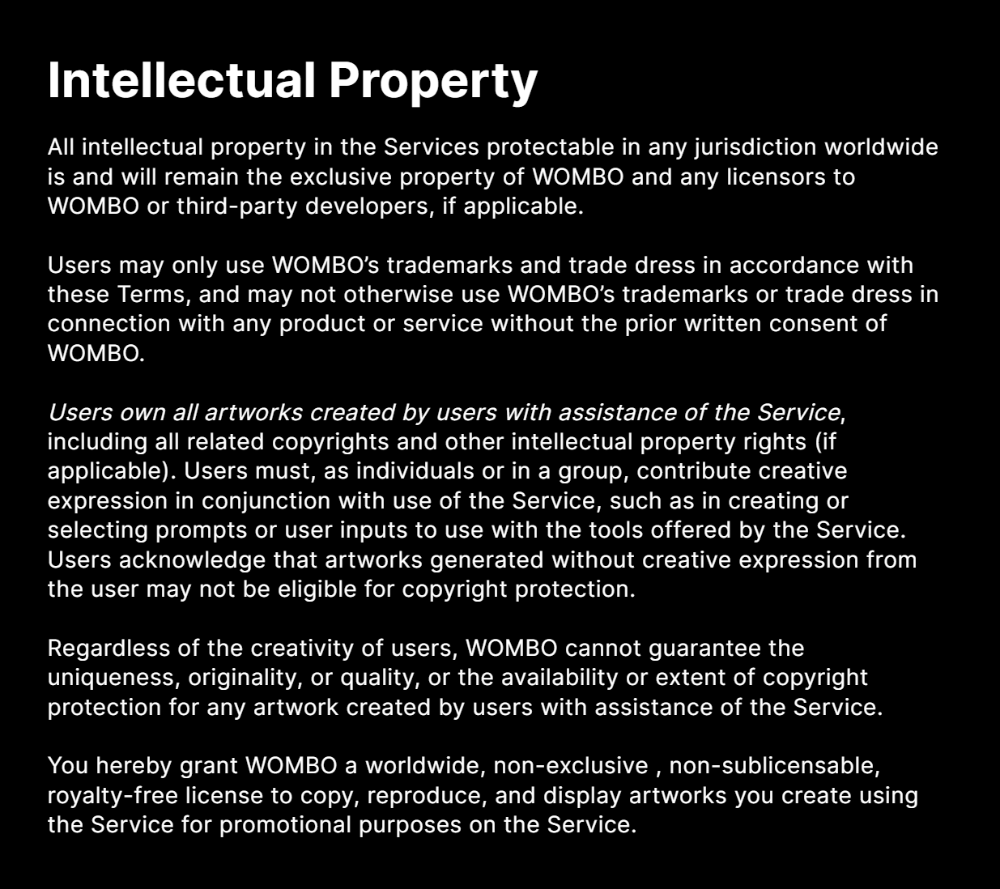

This AI program is free, easy to use, and Wombo gives a royalty-free license to copy or share artworks.

Users own all artworks generated by the tool. Including all related copyrights or intellectual property rights.

Here’s Wombos' intellectual property policy.

Final Reflections

AI is creating a new sort of art that's selling well. It’s becoming popular and valued, despite some skepticism.

Now that you know MidJourney and Wombo let you sell AI-generated art, you need to locate buyers. There are several ways to achieve this, but that’s for another story.