More on Leadership

Jano le Roux

3 years ago

The Real Reason Adobe Just Paid $20 billion for Figma

Sketch or Figma?

Designers are pissed.

The beast ate the beauty.

Figma deserves $20B.

Do designers deserve Adobe?

Adobe devours new creative tools and spits them out with a slimy Adobe aftertaste.

Frame.io — $1.3B

Magento — $1.7B

Macromedia — $3.6B

Nothing compares to the risky $20B acquisition.

If they can't be beaten, buy them.

And then make them boring.

Adobe's everywhere.

Like that friend who dabbles in everything creatively, there's not enough time to master one thing.

Figma was Adobe's thigh-mounted battle axe.

a UX design instrument with a sizable free tier.

a UX design tool with a simple and quick user interface.

a tool for fluid collaboration in user experience design.

a web-based UX design tool that functions well.

a UX design tool with a singular goal of perfection.

UX design software that replaced Adobe XD.

Adobe XD could do many of Figma's things, but it didn't focus on the details. This is a major issue when working with detail-oriented professionals.

UX designers.

Design enthusiasts first used Figma. More professionals used it. Institutions taught it. Finally, major brands adopted Figma.

Adobe hated that.

Adobe dispatched a team of lawyers to resolve the Figma issue, as big companies do. Figma didn’t bite for months.

Oh no.

Figma resisted.

Figma helped designers leave Adobe. Figma couldn't replace Photoshop, but most designers used it to remove backgrounds.

Online background removal tools improved.

The Figma problem grew into a thorn, a knife, and a battle ax in Adobe's soft inner thigh.

Figma appeared to be going public. Adobe couldn’t allow that. It bought Figma for $20B during the IPO drought.

Adobe has a new issue—investors are upset.

The actual cause of investors' ire toward Adobe

Spoiler: The math just doesn’t add up.

According to Adobe's press release, Figma's annual recurring revenue (ARR) is $400M and growing rapidly.

The $20B valuation requires a 50X revenue multiple, which is unheard of.

Venture capitalists typically use:

10% to 29% growth per year: ARR multiplied by 1 to 5

30% to 99% growth per year: ARR multiplied by 6 to 10

100% to 400% growth per year: ARR multiplied by 10 to 20

Showing an investor a 50x multiple is like telling friends you saw a UFO. They'll think you're crazy.

Adobe's stock fell immediately after the acquisition because it didn't make sense to a number-cruncher.

Designers started a Tweet storm in the digital town hall where VCs and designers often meet.

Adobe acquired Workfront for $1.5 billion at the end of 2020. This purchase made sense for investors.

Many investors missed the fact that Adobe is acquiring Figma not only for its ARR but also for its brilliant collaboration tech.

Adobe could use Figmas web app technology to make more products web-based to compete with Canva.

Figma's high-profile clients could switch to Adobe's enterprise software.

However, questions arise:

Will Adobe make Figma boring?

Will Adobe tone down Figma to boost XD?

Would you ditch Adobe and Figma for Sketch?

Trevor Stark

3 years ago

Peter Thiels's Multi-Billion Dollar Net Worth's Unknown Philosopher

Peter Thiel studied philosophy as an undergraduate.

Peter Thiel has $7.36 billion.

Peter is a world-ranked chess player, has a legal degree, and has written profitable novels.

In 1999, he co-founded PayPal with Max Levchin, which merged with X.com.

Peter Thiel made $55 million after selling the company to eBay for $1.5 billion in 2002.

You may be wondering…

How did Peter turn $55 million into his now multi-billion dollar net worth?

One amazing investment?

Facebook.

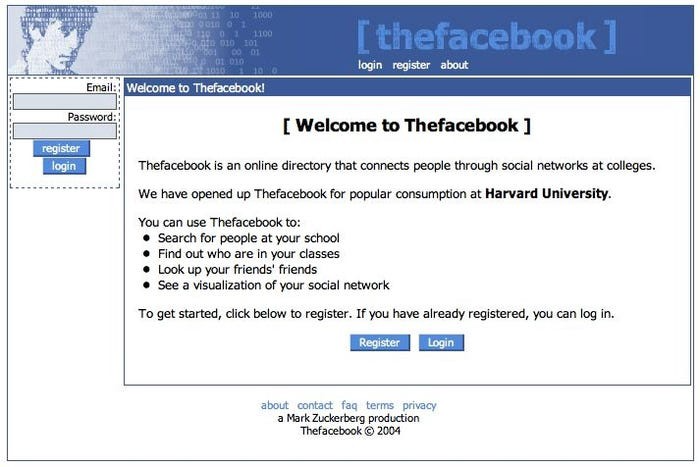

Thiel was Facebook's first external investor. He bought 10% of the company for $500,000 in 2004.

This investment returned 159% annually, 200x in 8 years.

By 2012, Thiel sold almost all his Facebook shares, becoming a billionaire.

What was the investment thesis of Peter?

This investment appeared ridiculous. Facebook was an innovative startup.

Thiel's $500,000 contribution transformed Facebook.

Harvard students have access to Facebook's 8 features and 1 photo per profile.

How did Peter determine that this would be a wise investment, then?

Facebook is a mimetic desire machine.

Social media's popularity is odd. Why peek at strangers' images on a computer?

Peter Thiel studied under French thinker Rene Girard at Stanford.

Mimetic Desire explains social media's success.

Mimetic Desire is the idea that humans desire things simply because other people do.

If nobody wanted it, would you?

Would you desire a family, a luxury car, or expensive clothes if no one else did? Girard says no.

People we admire affect our aspirations because we're social animals. Every person has a role model.

Our nonreligious culture implies role models are increasingly other humans, not God.

The idea explains why social media influencers are so powerful.

Why would Andrew Tate or Kim Kardashian matter if people weren't mimetic?

Humanity is fundamentally motivated by social comparison.

Facebook takes advantage of this need for social comparison, and puts it on a global scale.

It aggregates photographs and updates from millions of individuals.

Facebook mobile allows 24/7 social comparison.

Thiel studied mimetic desire with Girard and realized Facebook exploits the urge for social comparison to gain money.

Social media is more significant and influential than ever, despite Facebook's decline.

Thiel and Girard show that applied philosophy (particularly in business) can be immensely profitable.

Caspar Mahoney

3 years ago

Changing Your Mindset From a Project to a Product

Product game mindsets? How do these vary from Project mindset?

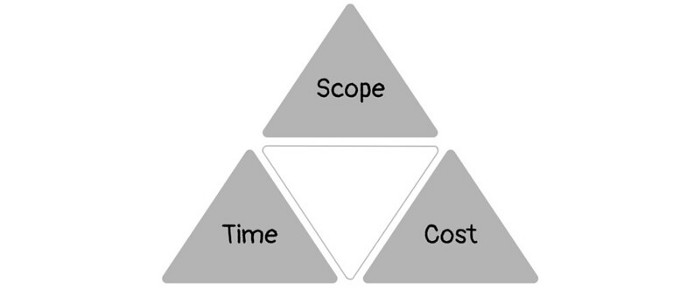

1950s spawned the Iron Triangle. Project people everywhere know and live by it. In stakeholder meetings, it is used to stretch the timeframe, request additional money, or reduce scope.

Quality was added to this triangle as things matured.

Quality was intended to be transformative, but none of these principles addressed why we conduct projects.

Value and benefits are key.

Product value is quantified by ROI, revenue, profit, savings, or other metrics. For me, every project or product delivery is about value.

Most project managers, especially those schooled 5-10 years or more ago (thousands working in huge corporations worldwide), understand the world in terms of the iron triangle. What does that imply? They worry about:

a) enough time to get the thing done.

b) have enough resources (budget) to get the thing done.

c) have enough scope to fit within (a) and (b) >> note, they never have too little scope, not that I have ever seen! although, theoretically, this could happen.

Boom—iron triangle.

To make the triangle function, project managers will utilize formal governance (Steering) to move those things. Increase money, scope, or both if time is short. Lacking funds? Increase time, scope, or both.

In current product development, shifting each item considerably may not yield value/benefit.

Even terrible. This approach will fail because it deprioritizes Value/Benefit by focusing the major stakeholders (Steering participants) and delivery team(s) on Time, Scope, and Budget restrictions.

Pre-agile, this problem was terrible. IT projects failed wildly. History is here.

Value, or benefit, is central to the product method. Product managers spend most of their time planning value-delivery paths.

Product people consider risk, schedules, scope, and budget, but value comes first. Let me illustrate.

Imagine managing internal products in an enterprise. Your core customer team needs a rapid text record of a chat to fix a problem. The consumer wants a feature/features added to a product you're producing because they think it's the greatest spot.

Project-minded, I may say;

Ok, I have budget as this is an existing project, due to run for a year. This is a new requirement to add to the features we’re already building. I think I can keep the deadline, and include this scope, as it sounds related to the feature set we’re building to give the desired result”.

This attitude repeats Scope, Time, and Budget.

Since it meets those standards, a project manager will likely approve it. If they have a backlog, they may add it and start specking it out assuming it will be built.

Instead, think like a product;

What problem does this feature idea solve? Is that problem relevant to the product I am building? Can that problem be solved quicker/better via another route ? Is it the most valuable problem to solve now? Is the problem space aligned to our current or future strategy? or do I need to alter/update the strategy?

A product mindset allows you to focus on timing, resource/cost, feasibility, feature detail, and so on after answering the aforementioned questions.

The above oversimplifies because

Leadership in discovery

Project managers are facilitators of ideas. This is as far as they normally go in the ‘idea’ space.

Business Requirements collection in classic project delivery requires extensive upfront documentation.

Agile project delivery analyzes requirements iteratively.

However, the project manager is a facilitator/planner first and foremost, therefore topic knowledge is not expected.

I mean business domain, not technical domain (to confuse matters, it is true that in some instances, it can be both technical and business domains that are important for a single individual to master).

Product managers are domain experts. They will become one if they are training/new.

They lead discovery.

Product Manager-led discovery is much more than requirements gathering.

Requirements gathering involves a Business Analyst interviewing people and documenting their requests.

The project manager calculates what fits and what doesn't using their Iron Triangle (presumably in their head) and reports back to Steering.

If this requirements-gathering exercise failed to identify requirements, what would a project manager do? or bewildered by project requirements and scope?

They would tell Steering they need a Business SME or Business Lead assigning or more of their time.

Product discovery requires the Product Manager's subject knowledge and a new mindset.

How should a Product Manager handle confusing requirements?

Product Managers handle these challenges with their talents and tools. They use their own knowledge to fill in ambiguity, but they have the discipline to validate those assumptions.

To define the problem, they may perform qualitative or quantitative primary research.

They might discuss with UX and Engineering on a whiteboard and test assumptions or hypotheses.

Do Product Managers escalate confusing requirements to Steering/Senior leaders? They would fix that themselves.

Product managers raise unclear strategy and outcomes to senior stakeholders. Open talks, soft skills, and data help them do this. They rarely raise requirements since they have their own means of handling them without top stakeholder participation.

Discovery is greenfield, exploratory, research-based, and needs higher-order stakeholder management, user research, and UX expertise.

Product Managers also aid discovery. They lead discovery. They will not leave customer/user engagement to a Business Analyst. Administratively, a business analyst could aid. In fact, many product organizations discourage business analysts (rely on PM, UX, and engineer involvement with end-users instead).

The Product Manager must drive user interaction, research, ideation, and problem analysis, therefore a Product professional must be skilled and confident.

Creating vs. receiving and having an entrepreneurial attitude

Product novices and project managers focus on details rather than the big picture. Project managers prefer spreadsheets to strategy whiteboards and vision statements.

These folks ask their manager or senior stakeholders, "What should we do?"

They then elaborate (in Jira, in XLS, in Confluence or whatever).

They want that plan populated fast because it reduces uncertainty about what's going on and who's supposed to do what.

Skilled Product Managers don't only ask folks Should we?

They're suggesting this, or worse, Senior stakeholders, here are some options. After asking and researching, they determine what value this product adds, what problems it solves, and what behavior it changes.

Therefore, to move into Product, you need to broaden your view and have courage in your ability to discover ideas, find insightful pieces of information, and collate them to form a valuable plan of action. You are constantly defining RoI and building Business Cases, so much so that you no longer create documents called Business Cases, it is simply ingrained in your work through metrics, intelligence, and insights.

Product Management is not a free lunch.

Plateless.

Plates and food must be prepared.

In conclusion, Product Managers must make at least three mentality shifts:

You put value first in all things. Time, money, and scope are not as important as knowing what is valuable.

You have faith in the field and have the ability to direct the search. YYou facilitate, but you don’t just facilitate. You wouldn't want to limit your domain expertise in that manner.

You develop concepts, strategies, and vision. You are not a waiter or an inbox where other people can post suggestions; you don't merely ask folks for opinion and record it. However, you excel at giving things that aren't clearly spoken or written down physical form.

You might also like

Darius Foroux

2 years ago

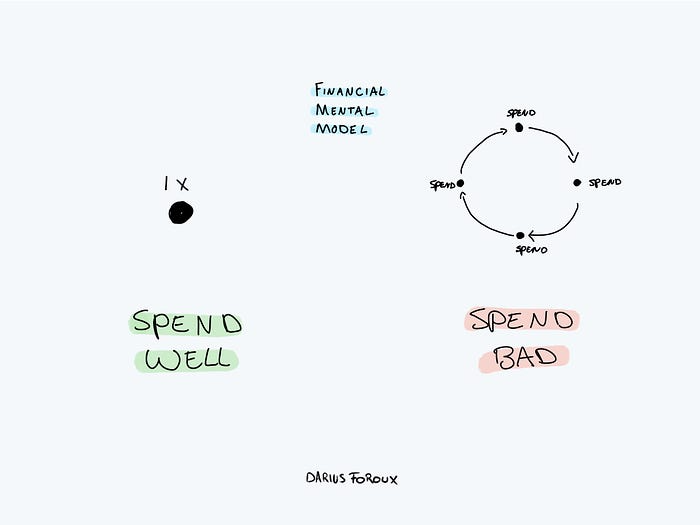

My financial life was changed by a single, straightforward mental model.

Prioritize big-ticket purchases

I've made several spending blunders. I get sick thinking about how much money I spent.

My financial mental model was poor back then.

Stoicism and mindfulness keep me from attaching to those feelings. It still hurts.

Until four or five years ago, I bought a new winter jacket every year.

Ten years ago, I spent twice as much. Now that I have a fantastic, warm winter parka, I don't even consider acquiring another one. No more spending. I'm not looking for jackets either.

Saving time and money by spending well is my thinking paradigm.

The philosophy is expressed in most languages. Cheap is expensive in the Netherlands. This applies beyond shopping.

In this essay, I will offer three examples of how this mental paradigm transformed my financial life.

Publishing books

In 2015, I presented and positioned my first book poorly.

I called the book Huge Life Success and made a funny Canva cover in 30 minutes. This:

That looks nothing like my present books. No logo or style. The book felt amateurish.

The book started bothering me a few weeks after publication. The advice was good, but it didn't appear professional. I studied the book business extensively.

I created a style for all my designs. Branding. Win Your Inner Wars was reissued a year later.

Title, cover, and description changed. Rearranging the chapters improved readability.

Seven years later, the book sells hundreds of copies a month. That taught me a lot.

Rushing to finish a project is enticing. Send it and move forward.

Avoid rushing everything. Relax. Develop your projects. Perform well. Perform the job well.

My first novel was underfunded and underworked. A bad book arrived. I then invested time and money in writing the greatest book I could.

That book still sells.

Traveling

I hate travel. Airports, flights, trains, and lines irritate me.

But, I enjoy traveling to beautiful areas.

I do it strangely. I make up travel rules. I never go to airports in summer. I hate being near airports on holidays. Unworthy.

No vacation packages for me. Those airline packages with a flight, shuttle, and hotel. I've had enough.

I try to avoid crowds and popular spots. July Paris? Nuts and bolts, please. Christmas in NYC? No, please keep me sane.

I fly business class behind. I accept upgrades upon check-in. I prefer driving. I drove from the Netherlands to southern Spain.

Thankfully, no lines. What if travel costs more? Thus? I enjoy it from the start. I start traveling then.

I rarely travel since I'm so difficult. One great excursion beats several average ones.

Personal effectiveness

New apps, tools, and strategies intrigue most productivity professionals.

No.

I researched years ago. I spent years investigating productivity in university.

I bought books, courses, applications, and tools. It was expensive and time-consuming.

Im finished. Productivity no longer costs me time or money. OK. I worked on it once and now follow my strategy.

I avoid new programs and systems. My stuff works. Why change winners?

Spending wisely saves time and money.

Spending wisely means spending once. Many people ignore productivity. It's understudied. No classes.

Some assume reading a few articles or a book is enough. Productivity is personal. You need a personal system.

Time invested is one-time. You can trust your system for life once you find it.

Concentrate on the expensive choices.

Life's short. Saving money quickly is enticing.

Spend less on groceries today. True. That won't fix your finances.

Adopt a lifestyle that makes you affluent over time. Consider major choices.

Are they causing long-term poverty? Are you richer?

Leasing cars comes to mind. The automobile costs a fortune today. The premium could accomplish a million nice things.

Focusing on important decisions makes life easier. Consider your future. You want to improve next year.

Web3Lunch

3 years ago

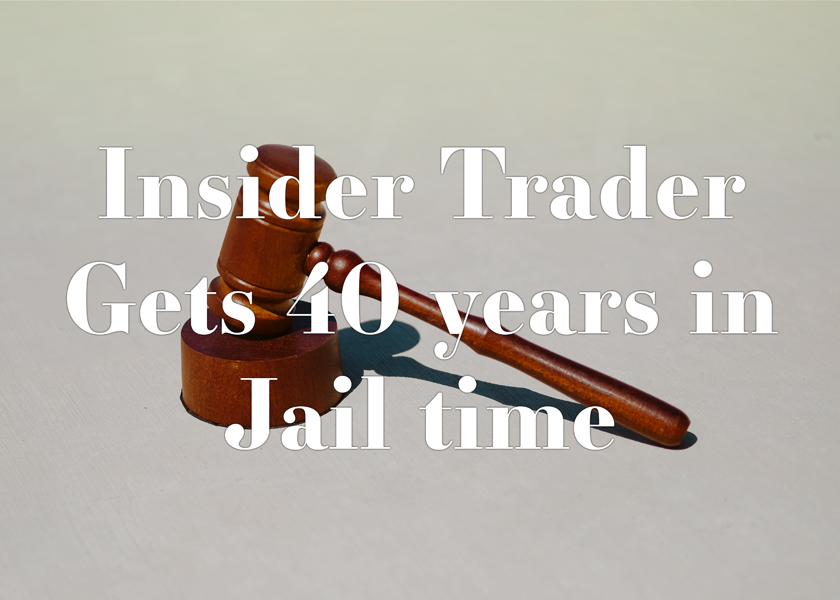

An employee of OpenSea might get a 40-year prison sentence for insider trading using NFTs.

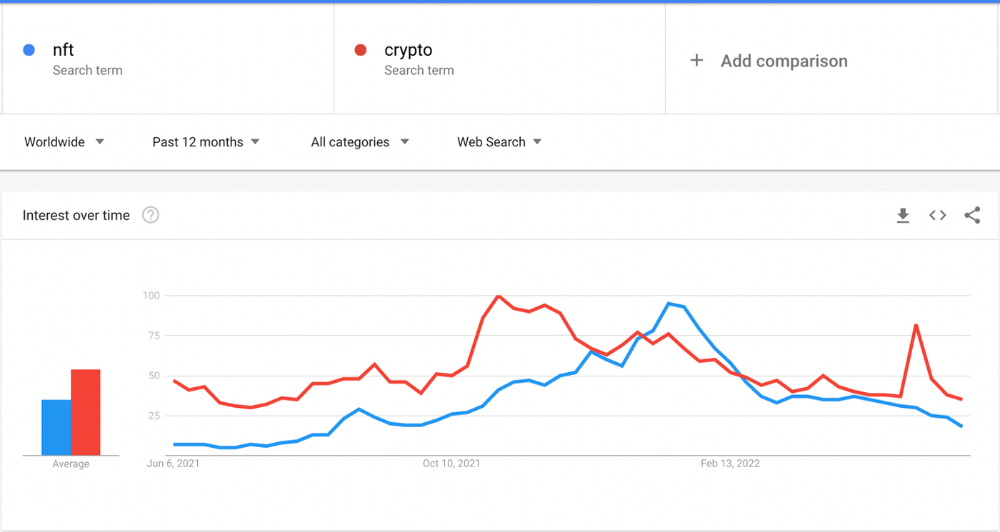

The space had better days. Those greenish spikes...oh wow, haven't felt that in ages. Cryptocurrencies and NFTs have lost popularity. Google agrees. Both are declining.

As seen below, crypto interest spiked in May because of the Luna fall. NFT interest is similar to early October last year.

This makes me think NFTs are mostly hype and FOMO. No art or community. I've seen enough initiatives to know that communities stick around if they're profitable. Once it starts falling, they move on to the next project. The space has no long-term investments. Flip everything.

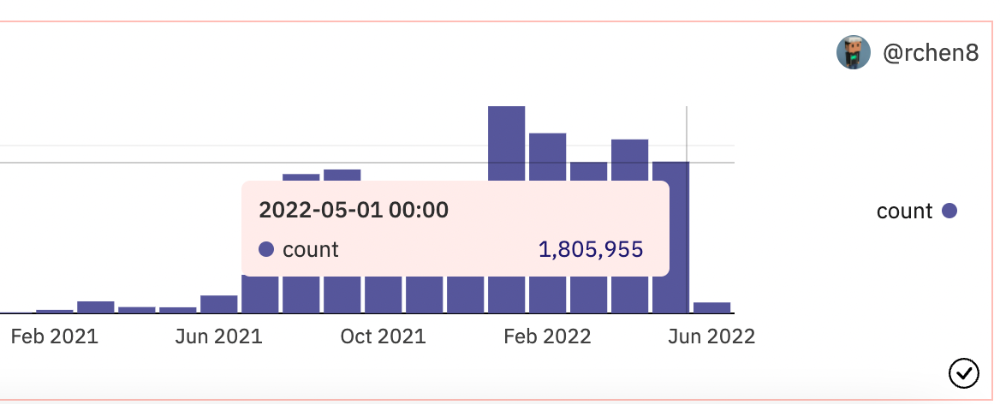

OpenSea trading volume has stayed steady for months. May's volume is 1.8 million ETH ($3.3 billion).

Despite this, I think NFTs and crypto will stick around. In bad markets, builders gain most.

Only 4k developers are active on Ethereum blockchain. It's low. A great chance for the space enthusiasts.

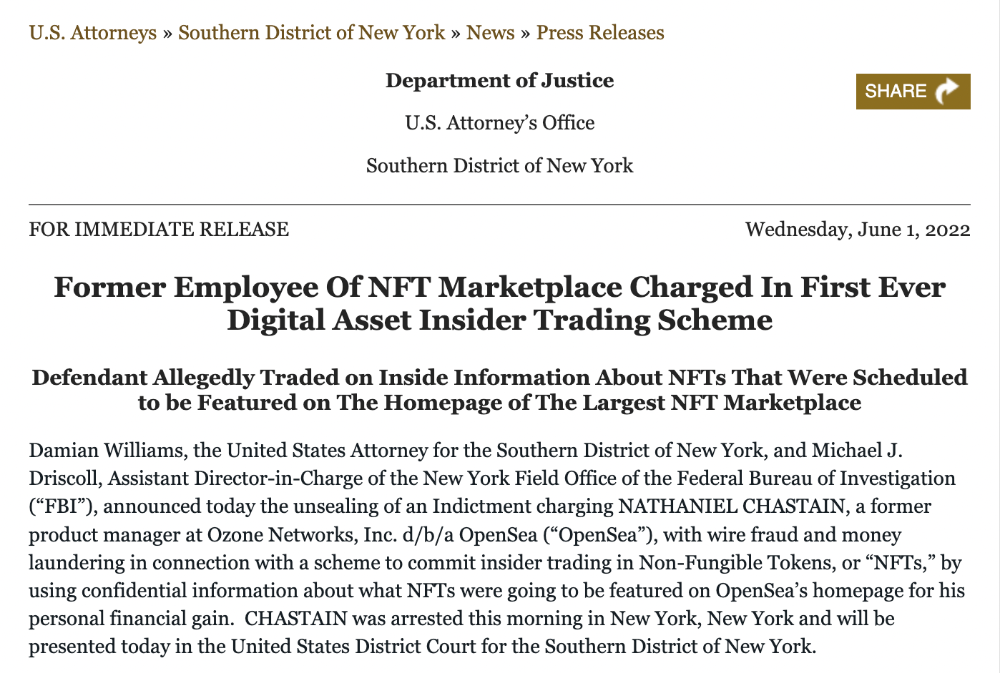

An employee of OpenSea might get a 40-year prison sentence for insider trading using NFTs.

Nathaniel Chastian, an OpenSea employee, traded on insider knowledge. He'll serve 40 years for that.

Here's what happened if you're unfamiliar.

OpenSea is a secondary NFT marketplace. Their homepage featured remarkable drops. Whatever gets featured there, NFT prices will rise 5x.

Chastian was at OpenSea. He chose forthcoming NFTs for OpenSeas' webpage.

Using anonymous digital currency wallets and OpenSea accounts, he would buy NFTs before promoting them on the homepage, showcase them, and then sell them for at least 25 times the price he paid.

From June through September 2021, this happened. Later caught, fired. He's charged with wire fraud and money laundering, each carrying a 20-year maximum penalty.

Although web3 space is all about decentralization, a step like this is welcomed since it restores faith in the area. We hope to see more similar examples soon.

Here's the press release.

Understanding smart contracts

@cantino.eth has a Twitter thread on smart contracts. Must-read. Also, he appears educated about the space, so follow him.

Vanessa Karel

3 years ago

10 hard lessons from founding a startup.

Here is the ugly stuff, read this if you have a founder in your life or are trying to become one. Your call.

#1 You'll try to talk yourself to sleep, but it won't always work.

As founders, we're all driven. Good and bad, you're restless. Success requires resistance and discipline. Your startup will be on your mind 24/7, and not everyone will have the patience to listen to your worries, ideas, and coffee runs. You become more self-sufficient than ever before.

#2 No one will understand what you're going through unless they've been a founder.

Some of my closest friends don't understand the work that goes into starting a business, and we can't blame them.

#3 You'll feel alienated.

Your problems aren't common; calling your bestie won't help. You must search hard for the right resources. It alienates you from conversations you no longer relate to. (No 4th of July, no long weekends!)

#4 Since you're your "own boss," people assume you have lots of free time.

Do you agree? I was on a webinar with lots of new entrepreneurs, and one woman said, "I started my own business so I could have more time for myself." This may be true for some lucky people, and you can be flexible with your schedule. If you want your business to succeed, you'll probably be its slave for a while.

#5 No time for illness or family emergencies.

Both last month. Oh, no! Physically and emotionally withdrawing at the worst times will give you perspective. I learned this the hard way because I was too stubborn to postpone an important interview. I thought if I rested all day and only took one call, I'd be fine. Nope. I had a fever and my mind wasn't as sharp, so my performance and audience interaction suffered. Nope. Better to delay than miss out.

Oh, and setting a "OoO" makes you cringe.

#6 Good luck with your mental health, perfectionists.

When building a startup, it's difficult to accept that there won't be enough time to do everything. You can't make them all, not perfectly. You must learn to accept things that are done but not perfect.

#7 As a founder, you'll make mistakes, but you'll want to make them quickly so you can learn.

Hard lessons are learned quicker. You'll need to pivot and try new things often; some won't work, and it's best to discover them sooner rather than later.

#8 Pyramid schemes abound.

I didn't realize how bad it was until I started a company. You must spy and constantly research. As a founder, you'll receive many emails from people claiming to "support" you. Be wary and keep your eyes open. When it's too good to be true. Some "companies" will try to get you to pay for "competitions" to "pitch at events." Don't do it.

#9 Keep your competitor research to a minimum.

Actually, competition is good. It means there's a market for those solutions. However, this can be mentally exhausting too. Learn about their geography and updates, but that's it.

#10 You'll feel guilty taking vacation.

I don't know what to say, but I no longer enjoy watching TV, and that's okay. Pay attention to things that enrich you, bring you joy, and have fun. It boosts creativity.

Being a startup founder may be one of the hardest professional challenges you face, but it's also a great learning experience. Your passion will take you places you never imagined and open doors to opportunities you wouldn't have otherwise. You'll meet amazing people. No regrets, no complaints. It's a roller coaster, but the good days are great.

Miss anything? Comment below