More on Technology

Al Anany

3 years ago

Notion AI Might Destroy Grammarly and Jasper

The trick Notion could use is simply Facebook-ing the hell out of them.

*Time travel to fifteen years ago.* Future-Me: “Hey! What are you up to?” Old-Me: “I am proofreading an article. It’s taking a few hours, but I will be done soon.” Future-Me: “You know, in the future, you will be using a google chrome plugin called Grammarly that will help you easily proofread articles in half that time.” Old-Me: “What is… Google Chrome?” Future-Me: “Gosh…”

I love Grammarly. It’s one of those products that I personally feel the effects of. I mean, Space X is a great company. But I am not a rocket writing this article in space (or am I?)…

No, I’m not. So I don’t personally feel a connection to Space X. So, if a company collapse occurs in the morning, I might write about it. But I will have zero emotions regarding it.

Yet, if Grammarly fails tomorrow, I will feel 1% emotionally distressed. So looking at the title of this article, you’d realize that I am betting against them. This is how much I believe in the critical business model that’s taking over the world, the one of Notion.

Notion How frequently do you go through your notes?

Grammarly is everywhere, which helps its success. Grammarly is available when you update LinkedIn on Chrome. Grammarly prevents errors in Google Docs.

My internal concentration isn't apparent in the previous paragraph. Not Grammarly. I should have used Chrome to make a Google doc and LinkedIn update. Without this base, Grammarly will be useless.

So, welcome to this business essay.

Grammarly provides a solution.

Another issue is resolved by Jasper.

Your entire existence is supposed to be contained within Notion.

New Google Chrome is offline. It's an all-purpose notepad (in the near future.)

How should I start my blog? Enter it in Note.

an update on LinkedIn? If you mention it, it might be automatically uploaded there (with little help from another app.)

An advanced thesis? You can brainstorm it with your coworkers.

This ad sounds great! I won't cry if Notion dies tomorrow.

I'll reread the following passages to illustrate why I think Notion could kill Grammarly and Jasper.

Notion is a fantastic app that incubates your work.

Smartly, they began with note-taking.

Hopefully, your work will be on Notion. Grammarly and Jasper are still must-haves.

Grammarly will proofread your typing while Jasper helps with copywriting and AI picture development.

They're the best, therefore you'll need them. Correct? Nah.

Notion might bombard them with Facebook posts.

Notion: “Hi Grammarly, do you want to sell your product to us?” Grammarly: “Dude, we are more valuable than you are. We’ve even raised $400m, while you raised $342m. Our last valuation round put us at $13 billion, while yours put you at $10 billion. Go to hell.” Notion: “Okay, we’ll speak again in five years.”

Notion: “Jasper, wanna sell?” Jasper: “Nah, we’re deep into AI and the field. You can’t compete with our people.” Notion: “How about you either sell or you turn into a Snapchat case?” Jasper: “…”

Notion is your home. Grammarly is your neighbor. Your track is Jasper.

What if you grew enough vegetables in your backyard to avoid the supermarket? No more visits.

What if your home had a beautiful treadmill? You won't rush outside as much (I disagree with my own metaphor). (You get it.)

It's Facebooking. Instagram Stories reduced your Snapchat usage. Notion will reduce your need to use Grammarly.

The Final Piece of the AI Puzzle

Let's talk about Notion first, since you've probably read about it everywhere.

They raised $343 million, as I previously reported, and bought four businesses

According to Forbes, Notion will have more than 20 million users by 2022. The number of users is up from 4 million in 2020.

If raising $1.8 billion was impressive, FTX wouldn't have fallen.

This article compares the basic product to two others. Notion is a day-long app.

Notion has released Notion AI to support writers. It's early, so it's not as good as Jasper. Then-Jasper isn't now-Jasper. In five years, Notion AI will be different.

With hard work, they may construct a Jasper-like writing assistant. They have resources and users.

At this point, it's all speculation. Jasper's copywriting is top-notch. Grammarly's proofreading is top-notch. Businesses are constrained by user activities.

If Notion's future business movements are strategic, they might become a blue ocean shark (or get acquired by an unbelievable amount.)

I love business mental teasers, so tell me:

How do you feel? Are you a frequent Notion user?

Do you dispute my position? I enjoy hearing opposing viewpoints.

Ironically, I proofread this with Grammarly.

Clive Thompson

3 years ago

Small Pieces of Code That Revolutionized the World

Few sentences can have global significance.

Ethan Zuckerman invented the pop-up commercial in 1997.

He was working for Tripod.com, an online service that let people make little web pages for free. Tripod offered advertising to make money. Advertisers didn't enjoy seeing their advertising next to filthy content, like a user's anal sex website.

Zuckerman's boss wanted a solution. Wasn't there a way to move the ads away from user-generated content?

When you visited a Tripod page, a pop-up ad page appeared. So, the ad isn't officially tied to any user page. It'd float onscreen.

Here’s the thing, though: Zuckerman’s bit of Javascript, that created the popup ad? It was incredibly short — a single line of code:

window.open('http://tripod.com/navbar.html'

"width=200, height=400, toolbar=no, scrollbars=no, resizable=no, target=_top");Javascript tells the browser to open a 200-by-400-pixel window on top of any other open web pages, without a scrollbar or toolbar.

Simple yet harmful! Soon, commercial websites mimicked Zuckerman's concept, infesting the Internet with pop-up advertising. In the early 2000s, a coder for a download site told me that most of their revenue came from porn pop-up ads.

Pop-up advertising are everywhere. You despise them. Hopefully, your browser blocks them.

Zuckerman wrote a single line of code that made the world worse.

I read Zuckerman's story in How 26 Lines of Code Changed the World. Torie Bosch compiled a humorous anthology of short writings about code that tipped the world.

Most of these samples are quite short. Pop-cultural preconceptions about coding say that important code is vast and expansive. Hollywood depicts programmers as blurs spouting out Niagaras of code. Google's success was formerly attributed to its 2 billion lines of code.

It's usually not true. Google's original breakthrough, the piece of code that propelled Google above its search-engine counterparts, was its PageRank algorithm, which determined a web page's value based on how many other pages connected to it and the quality of those connecting pages. People have written their own Python versions; it's only a few dozen lines.

Google's operations, like any large tech company's, comprise thousands of procedures. So their code base grows. The most impactful code can be brief.

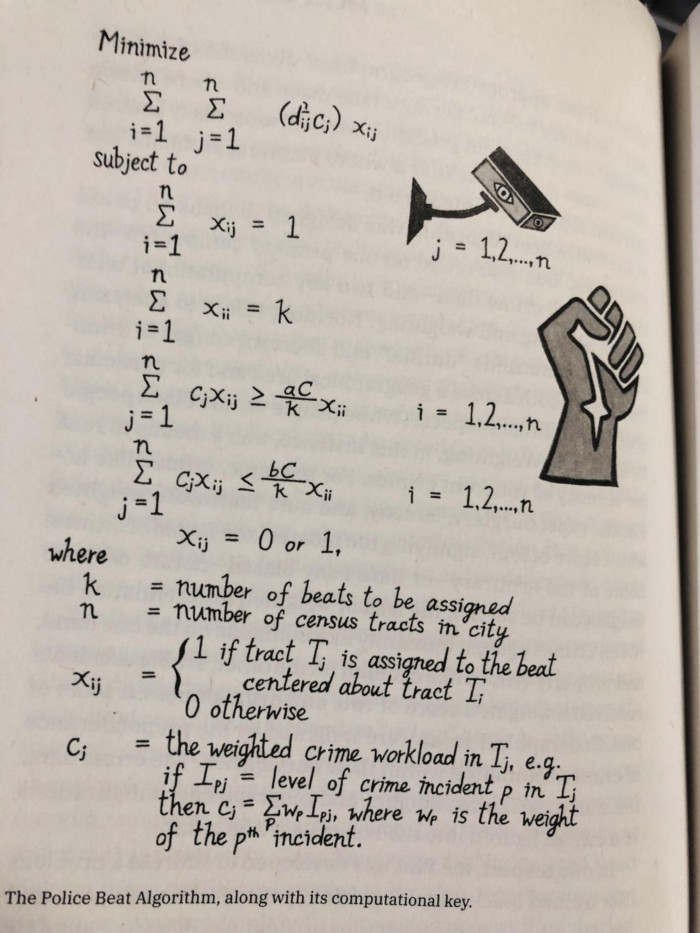

The examples are fascinating and wide-ranging, so read the whole book (or give it to nerds as a present). Charlton McIlwain wrote a chapter on the police beat algorithm developed in the late 1960s to anticipate crime hotspots so law enforcement could dispatch more officers there. It created a racial feedback loop. Since poor Black neighborhoods were already overpoliced compared to white ones, the algorithm directed more policing there, resulting in more arrests, which convinced it to send more police; rinse and repeat.

Kelly Chudler's You Are Not Expected To Understand This depicts the police-beat algorithm.

Even shorter code changed the world: the tracking pixel.

Lily Hay Newman's chapter on monitoring pixels says you probably interact with this code every day. It's a snippet of HTML that embeds a single tiny pixel in an email. Getting an email with a tracking code spies on me. As follows: My browser requests the single-pixel image as soon as I open the mail. My email sender checks to see if Clives browser has requested that pixel. My email sender can tell when I open it.

Adding a tracking pixel to an email is easy:

<img src="URL LINKING TO THE PIXEL ONLINE" width="0" height="0">An older example: Ellen R. Stofan and Nick Partridge wrote a chapter on Apollo 11's lunar module bailout code. This bailout code operated on the lunar module's tiny on-board computer and was designed to prioritize: If the computer grew overloaded, it would discard all but the most vital work.

When the lunar module approached the moon, the computer became overloaded. The bailout code shut down anything non-essential to landing the module. It shut down certain lunar module display systems, scaring the astronauts. Module landed safely.

22-line code

POODOO INHINT

CA Q

TS ALMCADR

TC BANKCALL

CADR VAC5STOR # STORE ERASABLES FOR DEBUGGING PURPOSES.

INDEX ALMCADR

CAF 0

ABORT2 TC BORTENT

OCT77770 OCT 77770 # DONT MOVE

CA V37FLBIT # IS AVERAGE G ON

MASK FLAGWRD7

CCS A

TC WHIMPER -1 # YES. DONT DO POODOO. DO BAILOUT.

TC DOWNFLAG

ADRES STATEFLG

TC DOWNFLAG

ADRES REINTFLG

TC DOWNFLAG

ADRES NODOFLAG

TC BANKCALL

CADR MR.KLEAN

TC WHIMPERThis fun book is worth reading.

I'm a contributor to the New York Times Magazine, Wired, and Mother Jones. I've also written Coders: The Making of a New Tribe and the Remaking of the World and Smarter Than You Think: How Technology is Changing Our Minds. Twitter and Instagram: @pomeranian99; Mastodon: @clive@saturation.social.

Gajus Kuizinas

3 years ago

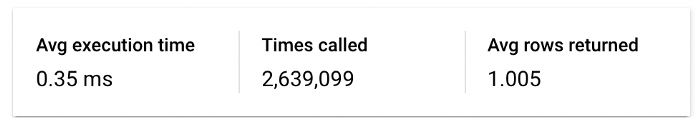

How a few lines of code were able to eliminate a few million queries from the database

I was entering tens of millions of records per hour when I first published Slonik PostgreSQL client for Node.js. The data being entered was usually flat, making it straightforward to use INSERT INTO ... SELECT * FROM unnset() pattern. I advocated the unnest approach for inserting rows in groups (that was part I).

However, today I’ve found a better way: jsonb_to_recordset.

jsonb_to_recordsetexpands the top-level JSON array of objects to a set of rows having the composite type defined by an AS clause.

jsonb_to_recordset allows us to query and insert records from arbitrary JSON, like unnest. Since we're giving JSON to PostgreSQL instead of unnest, the final format is more expressive and powerful.

SELECT *

FROM json_to_recordset('[{"name":"John","tags":["foo","bar"]},{"name":"Jane","tags":["baz"]}]')

AS t1(name text, tags text[]);

name | tags

------+-----------

John | {foo,bar}

Jane | {baz}

(2 rows)Let’s demonstrate how you would use it to insert data.

Inserting data using json_to_recordset

Say you need to insert a list of people with attributes into the database.

const persons = [

{

name: 'John',

tags: ['foo', 'bar']

},

{

name: 'Jane',

tags: ['baz']

}

];You may be tempted to traverse through the array and insert each record separately, e.g.

for (const person of persons) {

await pool.query(sql`

INSERT INTO person (name, tags)

VALUES (

${person.name},

${sql.array(person.tags, 'text[]')}

)

`);

}It's easier to read and grasp when working with a few records. If you're like me and troubleshoot a 2M+ insert query per day, batching inserts may be beneficial.

What prompted the search for better alternatives.

Inserting using unnest pattern might look like this:

await pool.query(sql`

INSERT INTO public.person (name, tags)

SELECT t1.name, t1.tags::text[]

FROM unnest(

${sql.array(['John', 'Jane'], 'text')},

${sql.array(['{foo,bar}', '{baz}'], 'text')}

) AS t1.(name, tags);

`);You must convert arrays into PostgreSQL array strings and provide them as text arguments, which is unsightly. Iterating the array to create slices for each column is likewise unattractive.

However, with jsonb_to_recordset, we can:

await pool.query(sql`

INSERT INTO person (name, tags)

SELECT *

FROM jsonb_to_recordset(${sql.jsonb(persons)}) AS t(name text, tags text[])

`);In contrast to the unnest approach, using jsonb_to_recordset we can easily insert complex nested data structures, and we can pass the original JSON document to the query without needing to manipulate it.

In terms of performance they are also exactly the same. As such, my current recommendation is to prefer jsonb_to_recordset whenever inserting lots of rows or nested data structures.

You might also like

ANTHONY P.

3 years ago

Startups are difficult. Streamlining the procedure for creating the following unicorn.

New ventures are exciting. It's fun to imagine yourself rich, successful, and famous (if that's your thing). How you'll help others and make your family proud. This excitement can pull you forward for years, even when you intuitively realize that the path you're on may not lead to your desired success.

Know when to change course. Switching course can mean pivoting or changing direction.

In this not-so-short blog, I'll describe the journey of building your dream. And how the journey might look when you think you're building your dream, but fall short of that vision. Both can feel similar in the beginning, but there are subtle differences.

Let’s dive in.

How an exciting journey to a dead end looks and feels.

You want to help many people. You're business-minded, creative, and ambitious. You jump into entrepreneurship. You're excited, free, and in control.

I'll use tech as an example because that's what I know best, but this applies to any entrepreneurial endeavor.

So you start learning the basics of your field, say coding/software development. You read books, take courses, and may even join a bootcamp. You start practicing, and the journey begins. Once you reach a certain level of skill (which can take months, usually 12-24), you gain the confidence to speak with others in the field and find common ground. You might attract a co-founder this way with time. You and this person embark on a journey (Tip: the idea you start with is rarely the idea you end with).

Amateur mistake #1: You spend months building a product before speaking to customers.

Building something pulls you forward blindly. You make mistakes, avoid customers, and build with your co-founder or small team in the dark for months, usually 6-12 months.

You're excited when the product launches. We'll be billionaires! The market won't believe it. This excites you and the team. Launch.

….

Nothing happens.

Some people may sign up out of pity, only to never use the product or service again.

You and the team are confused, discouraged and in denial. They don't get what we've built yet. We need to market it better, we need to talk to more investors, someone will understand our vision.

This is a hopeless path, and your denial could last another 6 months. If you're lucky, while talking to consumers and investors (which you should have done from the start), someone who has been there before would pity you and give you an idea to pivot into that can create income.

Suppose you get this idea and pivot your business. Again, you've just pivoted into something limited by what you've already built. It may be a revenue-generating idea, but it's rarely new. Now you're playing catch-up, doing something others are doing but you can do better. (Tip #2: Don't be late.) Your chances of winning are slim, and you'll likely never catch up.

You're finally seeing revenue and feel successful. You can compete, but if you're not a first mover, you won't earn enough over time. You'll get by or work harder than ever to earn what a skilled trade could provide. You didn't go into business to stress out and make $100,000 or $200,000 a year. When you can make the same amount by becoming a great software developer, electrician, etc.

You become stuck. Either your firm continues this way for years until you realize there isn't enough growth to recruit a strong team and remove yourself from day-to-day operations due to competition. Or a catastrophic economic event forces you to admit that what you were building wasn't new and unique and wouldn't get you where you wanted to be.

This realization could take 6-10 years. No kidding.

The good news is, you’ve learned a lot along the way and this information can be used towards your next venture (if you have the energy).

Key Lesson: Don’t build something if you aren’t one of the first in the space building it just for the sake of building something.

-

Let's discuss what it's like to build something that can make your dream come true.

Case 2: Building something the market loves is difficult but rewarding.

It starts with a problem that hasn't been adequately solved for a long time but is now solvable due to technology. Or a new problem due to a change in how things are done.

Let's examine each example.

Example #1: Mass communication. The problem is now solvable due to some technological breakthrough.

Twitter — One of the first web 2 companies that became successful with the rise of smart mobile computing.

People can share their real-time activities via mobile device with friends, family, and strangers. Web 2 and smartphones made it easy and fun.

Example #2: A new problem has emerged due to some change in the way things are conducted.

Zoom- A web-conferencing company that reached massive success due to the movement towards “work from home”, remote/hybrid work forces.

Online web conferencing allows for face-to-face communication.

-

These two examples show how to build a unicorn-type company. It's a mix of solving the right problem at the right time, either through a technological breakthrough that opens up new opportunities or by fundamentally changing how people do things.

Let's find these opportunities.

Start by examining problems, such as how the world has changed and how we can help it adapt. It can also be both. Start team brainstorming. Research technologies, current world-trends, use common sense, and make a list. Then, choose the top 3 that you're most excited about and seem most workable based on your skillsets, values, and passion.

Once you have this list, create the simplest MVP you can and test it with customers. The prototype can be as simple as a picture or diagram of user flow and end-user value. No coding required. Market-test. Twitter's version 1 was simple. It was a web form that asked, "What are you doing?" Then publish it from your phone. A global status update, wherever you are. Currently, this company has a $50 billion market cap.

Here's their MVP screenshot.

Small things grow. Tiny. Simplify.

Remember Frequency and Value when brainstorming. Your product is high frequency (Twitter, Instagram, Snapchat, TikTok) or high value (Airbnb for renting travel accommodations), or both (Gmail).

Once you've identified product ideas that meet the above criteria, they're simple, have a high frequency of use, or provide deep value. You then bring it to market in the simplest, most cost-effective way. You can sell a half-working prototype with imagination and sales skills. You need just enough of a prototype to convey your vision to a user or customer.

With this, you can approach real people. This will do one of three things: give you a green light to continue on your vision as is, show you that there is no opportunity and people won't use it, or point you in a direction that is a blend of what you've come up with and what the customer / user really wants, and you update the prototype and go back to the maze. Repeat until you have enough yeses and conviction to build an MVP.

Ray Dalio

3 years ago

The latest “bubble indicator” readings.

As you know, I like to turn my intuition into decision rules (principles) that can be back-tested and automated to create a portfolio of alpha bets. I use one for bubbles. Having seen many bubbles in my 50+ years of investing, I described what makes a bubble and how to identify them in markets—not just stocks.

A bubble market has a high degree of the following:

- High prices compared to traditional values (e.g., by taking the present value of their cash flows for the duration of the asset and comparing it with their interest rates).

- Conditons incompatible with long-term growth (e.g., extrapolating past revenue and earnings growth rates late in the cycle).

- Many new and inexperienced buyers were drawn in by the perceived hot market.

- Broad bullish sentiment.

- Debt financing a large portion of purchases.

- Lots of forward and speculative purchases to profit from price rises (e.g., inventories that are more than needed, contracted forward purchases, etc.).

I use these criteria to assess all markets for bubbles. I have periodically shown you these for stocks and the stock market.

What Was Shown in January Versus Now

I will first describe the picture in words, then show it in charts, and compare it to the last update in January.

As of January, the bubble indicator showed that a) the US equity market was in a moderate bubble, but not an extreme one (ie., 70 percent of way toward the highest bubble, which occurred in the late 1990s and late 1920s), and b) the emerging tech companies (ie. As well, the unprecedented flood of liquidity post-COVID financed other bubbly behavior (e.g. SPACs, IPO boom, big pickup in options activity), making things bubbly. I showed which stocks were in bubbles and created an index of those stocks, which I call “bubble stocks.”

Those bubble stocks have popped. They fell by a third last year, while the S&P 500 remained flat. In light of these and other market developments, it is not necessarily true that now is a good time to buy emerging tech stocks.

The fact that they aren't at a bubble extreme doesn't mean they are safe or that it's a good time to get long. Our metrics still show that US stocks are overvalued. Once popped, bubbles tend to overcorrect to the downside rather than settle at “normal” prices.

The following charts paint the picture. The first shows the US equity market bubble gauge/indicator going back to 1900, currently at the 40% percentile. The charts also zoom in on the gauge in recent years, as well as the late 1920s and late 1990s bubbles (during both of these cases the gauge reached 100 percent ).

The chart below depicts the average bubble gauge for the most bubbly companies in 2020. Those readings are down significantly.

The charts below compare the performance of a basket of emerging tech bubble stocks to the S&P 500. Prices have fallen noticeably, giving up most of their post-COVID gains.

The following charts show the price action of the bubble slice today and in the 1920s and 1990s. These charts show the same market dynamics and two key indicators. These are just two examples of how a lot of debt financing stock ownership coupled with a tightening typically leads to a bubble popping.

Everything driving the bubbles in this market segment is classic—the same drivers that drove the 1920s bubble and the 1990s bubble. For instance, in the last couple months, it was how tightening can act to prick the bubble. Review this case study of the 1920s stock bubble (starting on page 49) from my book Principles for Navigating Big Debt Crises to grasp these dynamics.

The following charts show the components of the US stock market bubble gauge. Since this is a proprietary indicator, I will only show you some of the sub-aggregate readings and some indicators.

Each of these six influences is measured using a number of stats. This is how I approach the stock market. These gauges are combined into aggregate indices by security and then for the market as a whole. The table below shows the current readings of these US equity market indicators. It compares current conditions for US equities to historical conditions. These readings suggest that we’re out of a bubble.

1. How High Are Prices Relatively?

This price gauge for US equities is currently around the 50th percentile.

2. Is price reduction unsustainable?

This measure calculates the earnings growth rate required to outperform bonds. This is calculated by adding up the readings of individual securities. This indicator is currently near the 60th percentile for the overall market, higher than some of our other readings. Profit growth discounted in stocks remains high.

Even more so in the US software sector. Analysts' earnings growth expectations for this sector have slowed, but remain high historically. P/Es have reversed COVID gains but remain high historical.

3. How many new buyers (i.e., non-existing buyers) entered the market?

Expansion of new entrants is often indicative of a bubble. According to historical accounts, this was true in the 1990s equity bubble and the 1929 bubble (though our data for this and other gauges doesn't go back that far). A flood of new retail investors into popular stocks, which by other measures appeared to be in a bubble, pushed this gauge above the 90% mark in 2020. The pace of retail activity in the markets has recently slowed to pre-COVID levels.

4. How Broadly Bullish Is Sentiment?

The more people who have invested, the less resources they have to keep investing, and the more likely they are to sell. Market sentiment is now significantly negative.

5. Are Purchases Being Financed by High Leverage?

Leveraged purchases weaken the buying foundation and expose it to forced selling in a downturn. The leverage gauge, which considers option positions as a form of leverage, is now around the 50% mark.

6. To What Extent Have Buyers Made Exceptionally Extended Forward Purchases?

Looking at future purchases can help assess whether expectations have become overly optimistic. This indicator is particularly useful in commodity and real estate markets, where forward purchases are most obvious. In the equity markets, I look at indicators like capital expenditure, or how much businesses (and governments) invest in infrastructure, factories, etc. It reflects whether businesses are projecting future demand growth. Like other gauges, this one is at the 40th percentile.

What one does with it is a tactical choice. While the reversal has been significant, future earnings discounting remains high historically. In either case, bubbles tend to overcorrect (sell off more than the fundamentals suggest) rather than simply deflate. But I wanted to share these updated readings with you in light of recent market activity.

Khoi Ho

3 years ago

After working at seven startups, here are the early-stage characteristics that contributed to profitability, unicorn status or successful acquisition.

I've worked in a People role at seven early-stage firms for over 15 years (I enjoy chasing a dream!). Few of the seven achieved profitability, including unicorn status or acquisition.

Did early-stage startups share anything? Was there a difference between winners and losers? YES.

I support founders and entrepreneurs building financially sustainable enterprises with a compelling cause. This isn't something everyone would do. A company's success demands more than guts. Founders drive startup success.

Six Qualities of Successful Startups

Successful startup founders either innately grasped the correlation between strong team engagement and a well-executed business model, or they knew how to ask and listen to others (executive coaches, other company leaders, the team itself) to learn about it.

Successful startups:

1. Co-founders agreed and got along personally.

Multi-founder startups are common. When co-founders agree on strategic decisions and are buddies, there's less friction and politics at work.

As a co-founder, ask your team if you're aligned. They'll explain.

I've seen C-level leaders harbor personal resentments over disagreements. A co-departure founder's caused volatile leadership and work disruptions that the team struggled to manage during and after.

2. Team stayed.

Successful startups have low turnover. Nobody is leaving. There may be a termination for performance, but other team members will have observed the issues and agreed with the decision.

You don't want organizational turnover of 30%+, with leaders citing performance issues but the team not believing them. This breeds suspicion.

Something is wrong if many employees leave voluntarily or involuntarily. You may hear about lack of empowerment, support, or toxic leadership in exit interviews and from the existing team. Intellectual capital loss and resource instability harm success.

3. Team momentum.

A successful startup's team is excited about its progress. Consistently achieving goals and having trackable performance metrics. Some describe this period of productivity as magical, with great talents joining the team and the right people in the right places. Increasing momentum.

I've also seen short-sighted decisions where only some departments, like sales and engineering, had goals. Lack of a unified goals system created silos and miscommunication. Some employees felt apathetic because they didn't know how they contributed to team goals.

4. Employees advanced in their careers.

Even if you haven't created career pathing or professional development programs, early-stage employees will grow and move into next-level roles. If you hire more experienced talent and leaders, expect them to mentor existing team members. Growing companies need good performers.

New talent shouldn't replace and discard existing talent. This creates animosity and makes existing employees feel unappreciated for their early contributions to the company.

5. The company lived its values.

Culture and identity are built on lived values. A company's values affect hiring, performance management, rewards, and other processes. Identify, practice, and believe in company values. Starting with team values instead of management or consultants helps achieve this. When a company's words and actions match, it builds trust.

When company values are beautifully displayed on a wall but few employees understand them, the opposite is true. If an employee can't name the company values, they're useless.

6. Communication was clear.

When necessary information is shared with the team, they feel included, trusted, and like owners. Transparency means employees have the needed information to do their jobs. Disclosure builds trust. The founders answer employees' questions honestly.

Information accessibility decreases office politics. Without transparency, even basic information is guarded and many decisions are made in secret. I've seen founders who don't share financial, board meeting, or compensation and equity information. The founders' lack of trust in the team wasn't surprising, so it was reciprocated.

The Choices

Finally. All six of the above traits (leadership alignment, minimal turnover, momentum, professional advancement, values, and transparency) were high in the profitable startups I've worked at, including unicorn status or acquisition.

I've seen these as the most common and constant signals of startup success or failure.

These characteristics are the product of founders' choices. These decisions lead to increased team engagement and business execution.

Here's something to consider for startup employees and want-to-bes. 90% of startups fail, despite the allure of building something new and gaining ownership. With the emotional and time investment in startup formation, look for startups with these traits to reduce your risk.

Both you and the startup will thrive in these workplaces.