More on Technology

Jano le Roux

3 years ago

Apple Quietly Introduces A Revolutionary Savings Account That Kills Banks

Would you abandon your bank for Apple?

Banks are struggling.

not as a result of inflation

not due to the economic downturn.

not due to the conflict in Ukraine.

But because they’re underestimating Apple.

Slowly but surely, Apple is looking more like a bank.

An easy new savings account like Apple

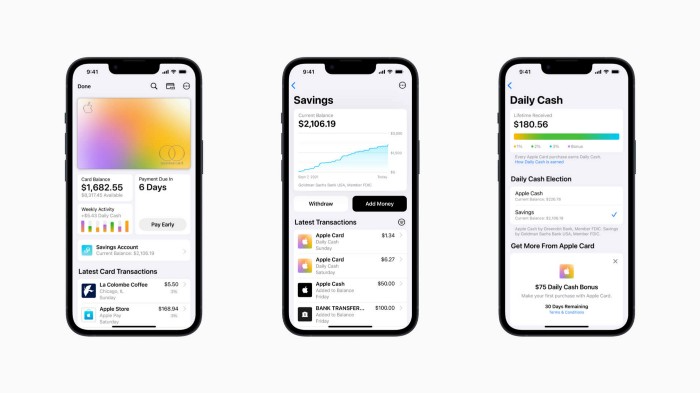

Apple has a new savings account.

Apple says Apple Card users may set up and manage savings straight in Wallet.

No more charges

Colorfully high yields

With no minimum balance

No minimal down payments

Most consumer-facing banks will have to match Apple's offer or suffer disruption.

Users may set it up from their iPhones without traveling to a bank or filling out paperwork.

It’s built into the iPhone in your pocket.

So now more waiting for slow approval processes.

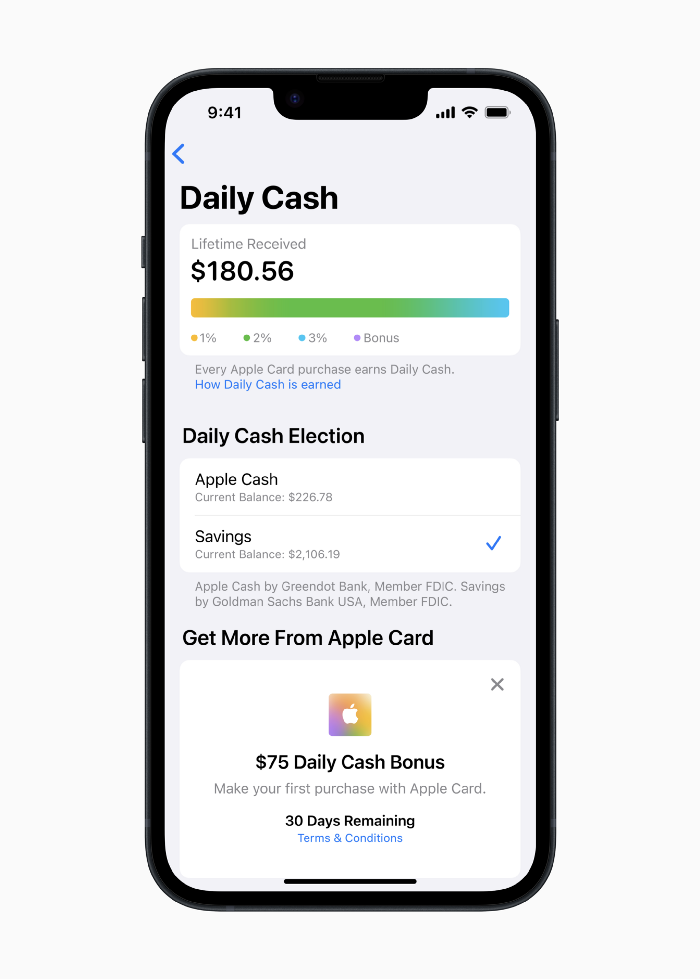

Once the savings account is set up, Apple will automatically transfer all future Daily Cash into it. Users may also add these cash to an Apple Cash card in their Apple Wallet app and adjust where Daily Cash is paid at any time.

Apple Pay and Apple Wallet VP Jennifer Bailey:

Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future.

Bailey says Savings adds value to Apple Card's Daily Cash benefit and offers another easy-to-use tool to help people lead healthier financial lives.

Transfer money from a linked bank account or Apple Cash to a Savings account. Users can withdraw monies to a connected bank account or Apple Cash card without costs.

Once set up, Apple Card customers can track their earnings via Wallet's Savings dashboard. This dashboard shows their account balance and interest.

This product targets younger people as the easiest way to start a savings account on the iPhone.

Why would a Gen Z account holder travel to the bank if their iPhone could be their bank?

Using this concept, Apple will transform the way we think about banking by 2030.

Two other nightmares keep bankers awake at night

Apple revealed two new features in early 2022 that banks and payment gateways hated.

Tap to Pay with Apple

Late Apple Pay

They startled the industry.

Tap To Pay converts iPhones into mobile POS card readers. Apple Pay Later is pushing the BNPL business in a consumer-friendly direction, hopefully ending dodgy lending practices.

Tap to Pay with Apple

iPhone POS

Millions of US merchants, from tiny shops to huge establishments, will be able to accept Apple Pay, contactless credit and debit cards, and other digital wallets with a tap.

No hardware or payment terminal is needed.

Revolutionary!

Stripe has previously launched this feature.

Tap to Pay on iPhone will provide companies with a secure, private, and quick option to take contactless payments and unleash new checkout experiences, said Bailey.

Apple's solution is ingenious. Brilliant!

Bailey says that payment platforms, app developers, and payment networks are making it easier than ever for businesses of all sizes to accept contactless payments and thrive.

I admire that Apple is offering this up to third-party services instead of closing off other functionalities.

Slow POS terminals, farewell.

Late Apple Pay

Pay Apple later.

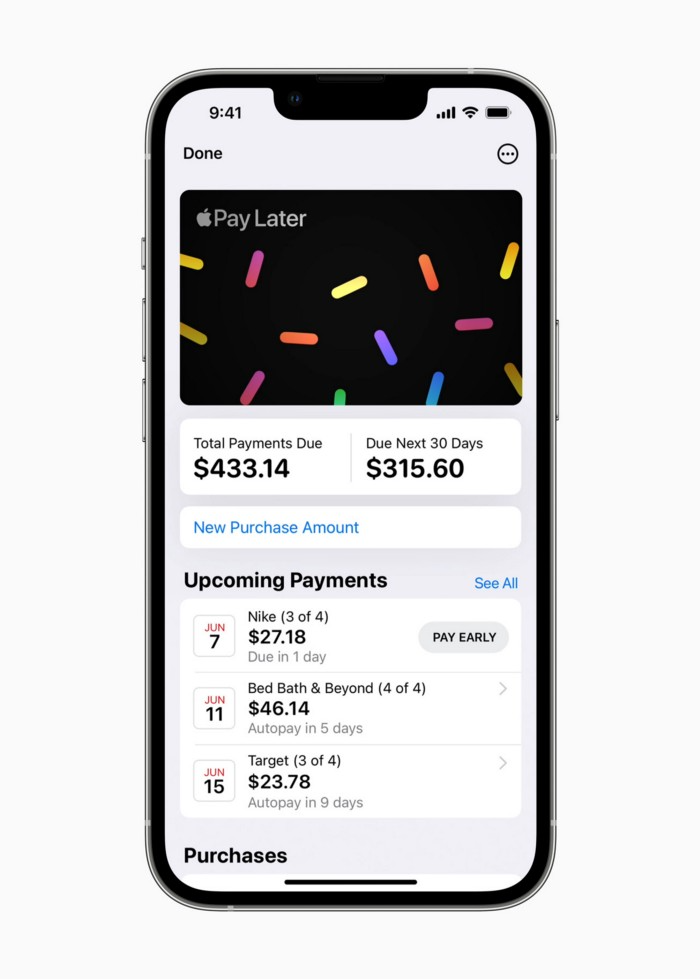

Apple Pay Later enables US consumers split Apple Pay purchases into four equal payments over six weeks with no interest or fees.

The Apple ecosystem integration makes this BNPL scheme unique. Nonstick. No dumb forms.

Frictionless.

Just double-tap the button.

Apple Pay Later was designed with users' financial well-being in mind. Apple makes it easy to use, track, and pay back Apple Pay Later from Wallet.

Apple Pay Later can be signed up in Wallet or when using Apple Pay. Apple Pay Later can be used online or in an app that takes Apple Pay and leverages the Mastercard network.

Apple Pay Order Tracking helps consumers access detailed receipts and order tracking in Wallet for Apple Pay purchases at participating stores.

Bad BNPL suppliers, goodbye.

Most bankers will be caught in Apple's eye playing mini golf in high-rise offices.

The big problem:

Banks still think about features and big numbers just like other smartphone makers did not too long ago.

Apple thinks about effortlessness, seamlessness, and frictionlessness that just work through integrated hardware and software.

Let me know what you think Apple’s next power moves in the banking industry could be.

Nikhil Vemu

3 years ago

7 Mac Apps That Are Exorbitantly Priced But Totally Worth It

Wish you more bang for your buck

By ‘Cost a Bomb’ I didn’t mean to exaggerate. It’s an idiom that means ‘To be very expensive’. In fact, no app on the planet costs a bomb lol.

So, to the point.

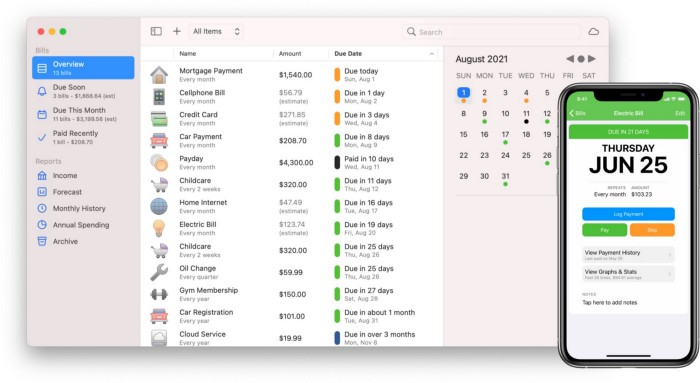

Chronicle

(Freemium. For Pro, $24.99 | Available on Setapp)

You probably have trouble keeping track of dozens of bills and subscriptions each month.

Try Chronicle.

Easy-to-use app

Add payment due dates and receive reminders,

Save payment documentation,

Analyze your spending by season, year, and month.

Observe expenditure trends and create new budgets.

Best of all, Chronicle features an integrated browser for fast payment and logging.

iOS and macOS sync.

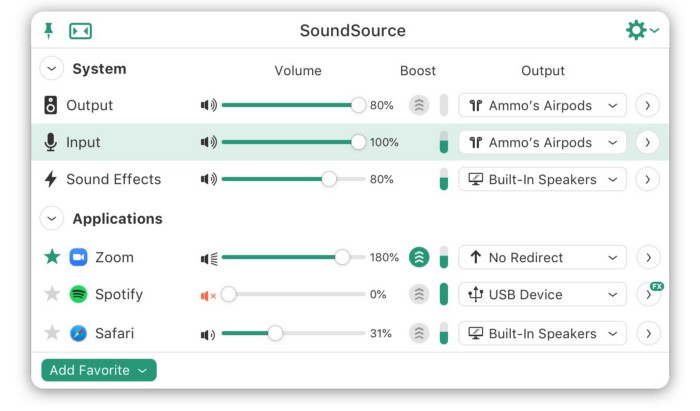

SoundSource

($39 for lifetime)

Background Music, a free macOS program, was featured in #6 of this post last month.

It controls per-app volume, stereo balance, and audio over its max level.

Background Music is fully supported. Additionally,

Connect various speakers to various apps (Wow! ),

change the audio sample rate for each app,

To facilitate access, add a floating SoundSource window.

Use its blocks in Shortcuts app,

On the menu bar, include meters for output/input devices and running programs.

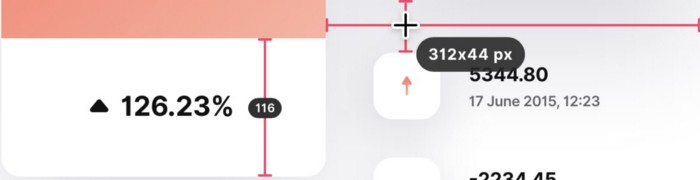

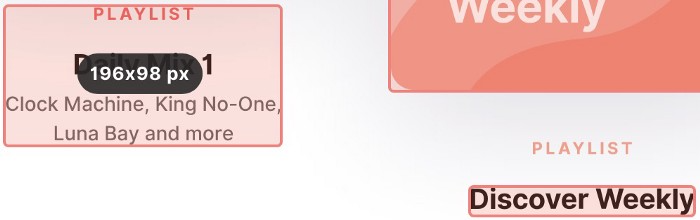

PixelSnap

($39 for lifetime | Available on Setapp)

This software is heaven for UI designers.

It aids you.

quickly calculate screen distances (in pixels) ,

Drag an area around an object to determine its borders,

Measure the distances between the additional guides,

screenshots should be pixel-perfect.

What’s more.

You can

Adapt your tolerance for items with poor contrast and shadows.

Use your Touch Bar to perform important tasks, if you have one.

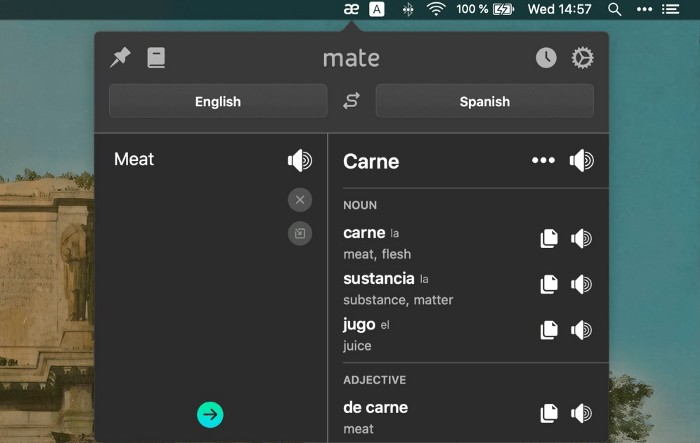

Mate Translation

($3.99 a month / $29.99 a year | Available on Setapp)

Mate Translate resembles a roided-up version of BarTranslate, which I wrote about in #1 of this piece last month.

If you translate often, utilize Mate Translate on macOS and Safari.

I'm really vocal about it.

It stays on the menu bar, and is accessible with a click or ⌥+shift+T hotkey.

It lets you

Translate in 103 different languages,

To translate text, double-click or right-click on it.

Totally translate websites. Additionally, Netflix subtitles,

Listen to their pronunciation to see how close it is to human.

iPhone and Mac sync Mate-ing history.

Swish

($16 for lifetime | Available on Setapp)

Swish is awesome!

Swipe, squeeze, tap, and hold movements organize chaotic desktop windows. Swish operates with mouse and trackpad.

Some gestures:

• Pinch Once: Close an app

• Pinch Twice: Quit an app

• Swipe down once: Minimise an app

• Pinch Out: Enter fullscreen mode

• Tap, Hold, & Swipe: Arrange apps in grids

and many more...

After getting acquainted to the movements, your multitasking will improve.

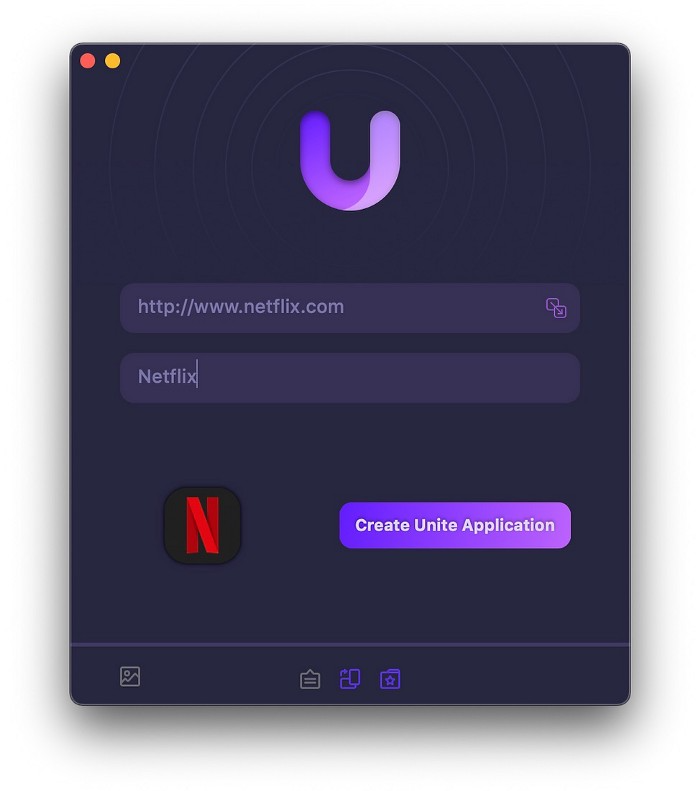

Unite

($24.99 for lifetime | Available on Setapp)

It turns webapps into macOS apps. The end.

Unite's functionality is a million times better.

Provide extensive customization (incl. its icon, light and dark modes)

make menu bar applications,

Get badges for web notifications and automatically refresh websites,

Replace any dock icon in the window with it (Wow!) by selecting that portion of the window.

Use PiP (Picture-in-Picture) on video sites that support it.

Delete advertising,

Throughout macOS, use floating windows

and many more…

I feel $24.99 one-off for this tool is a great deal, considering all these features. What do you think?

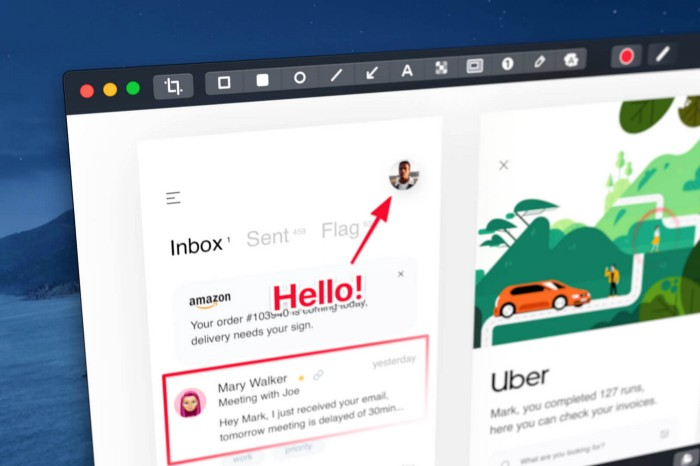

CleanShot X

(Basic: $29 one-off. Pro: $8/month | Available on Setapp)

CleanShot X can achieve things the macOS screenshot tool cannot. Complete screenshot toolkit.

CleanShot X, like Pixel Snap 2 (#3), is fantastic.

Allows

Scroll to capture a long page,

screen recording,

With webcam on,

• With mic and system audio,

• Highlighting mouse clicks and hotkeys.

Maintain floating screenshots for reference

While capturing, conceal desktop icons and notifications.

Recognize text in screenshots (OCR),

You may upload and share screenshots using the built-in cloud.

These are just 6 in 50+ features, and you’re already saying Wow!

CyberPunkMetalHead

3 years ago

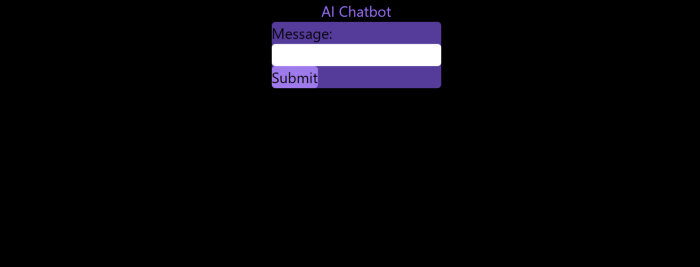

I made ChatGPT copy itself.

OpenAI's ChatGPT is an amazing AI-powered chatbot. It can write poetry, stories, and marketing campaigns, and it's also adept at coding. ChatGPT's coding is so amazing that it replicated itself. What happened:

Me: Hi

Hello! Can I help? I'll answer any inquiries you have.

Me: Build a python and flask AI chatbot that responds to user messages on the frontend.

CGPT:

from flask import Flask, request, jsonify

import openai

openai.api_key = "YOUR_API_KEY"

@app.route('/chatbot', methods=['POST'])

def chatbot():

user_message = request.get_json()['message']

response = chatbot_response(user_message)

return jsonify({'response': response})

def chatbot_response(user_message):

response = openai.Completion.create(

engine="text-davinci-002",

prompt=user_message,

max_tokens=1024,

n = 1,

temperature=0.5

)

return response['choices'][0]['text']

if __name__ == '__main__':

app.run()To integrate a chatbot with a frontend, use Flask to serve an HTML page with a form for user messages and the chatbot's answer. AJAX can submit the form to the /chatbot route, and JavaScript can show the chatbot's response.

I imported code snippets at the top of the file.

Let's add a frontend interface, I said.

CGPT:

<!DOCTYPE html>

<html>

<head>

<title>AI Chatbot</title>

</head>

<body>

<h1>AI Chatbot</h1>

<form id="chatbot-form">

<label for="message">Message:</label><br>

<input type="text" id="message" name="message"><br>

<input type="submit" value="Submit">

</form>

<div id="chatbot-response"></div>

<script src="https://ajax.googleapis.com/ajax/libs/jquery/3.5.1/jquery.min.js"></script>

<script>

$(document).ready(function() {

$("#chatbot-form").submit(function(e) {

e.preventDefault();

var userMessage = $("#message").val();

$.ajax({

type: "POST",

url: "/chatbot",

data: JSON.stringify({message: userMessage}),

contentType: "application/json; charset=utf-8",

dataType: "json",

success: function(response) {

$("#chatbot-response").text(response.response);

}

});

});

});

</script>

</body>

</html>To serve this HTML page using Flask, build a new route that returns the page as a GET response.

So far, so good.

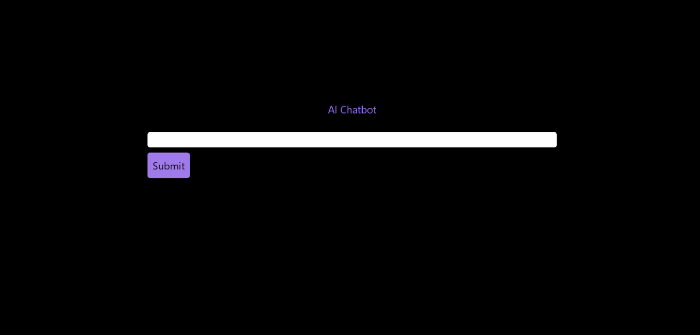

Looked quite basic so I got chatGPT to add some tailwind to the project.

Me: Tailwind the chatbot.html page, please. Give it a futuristic style with purple and neon

After a few more prompts, Talk GPT aligned the form to the center, changed some colors, and added padding.

CGPT:

<!DOCTYPE html>

<html>

<head>

<title>AI Chatbot</title>

<link href="https://unpkg.com/tailwindcss@^1.0/dist/tailwind.min.css" rel="stylesheet">

</head>

<body class="bg-black flex flex-col justify-center items-center">

<h1 class="sm:text-center text-purple-500">AI Chatbot</h1>

<form id="chatbot-form" class="border-purple-500 bg-purple-800 rounded">

<label for="message">Message:</label><br>

<input type="text" id="message" name="message" class="min-w-30 rounded"><br>

<input type="submit" value="Submit" class="bg-purple-500 border-red-500 transform hover:scale-110 rounded">

</form>

<div class="flex justify-center">

<div id="chatbot-response" class="text-white rounded"></div>

</div>

<script src="https://ajax.googleapis.com/ajax/libs/jquery/3.5.1/jquery.min.js"></script>

<script>

var colors = ['red', 'orange', 'yellow', 'green', 'blue', 'indigo', 'violet'];

var colorIndex = 0;

$(document).ready(function() {

setInterval(function() {

$("#chatbot-form").css('border-color', colors[colorIndex]);

colorIndex = (colorIndex + 1) % colors.length;

}, 1000);

$("#chatbot-form").submit(function(e) {

e.preventDefault();

var userMessage = $("#message").val();

$.ajax({

type: "POST",

url: "/chatbot",

data: JSON.stringify({message: userMessage}),

contentType: "application/json; charset=utf-8",

dataType: "json",

success: function(response) {

$("#chatbot-response").text(response.response);

}

});

});

});

</script>

</body>

</html>Improved:

A few more prompts like “Add more vertical and horizontal padding to the submit button and vertical margin, and vertically align this file's body.”

The result:

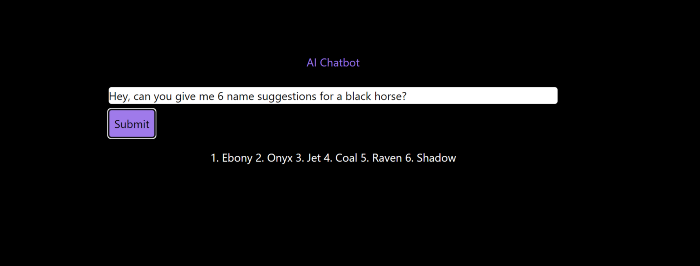

Is it effective? Now, I'll chat with ChatGPT's AI Chatbot. I intervened minimally throughout construction. Chat GPT created numerous files, connected and interacted with its own API, and presented the user request response on the front end by itself.

Me to AI Chatbot: Hey, can you give me 6 name suggestions for a black horse?

Me to AI Chatbot: Write a poem in the style of Jim Morrison. Make sure to mention cacti and black holes

ChatGPTs Chatbot:

In the desert night, I am confronted by cacti,

Their arms reaching out, As if to grab me and take me away.

The stars in the sky, Beckon me to come,

To a world of black holes, Where I can be free.

I am in a trance, My body and mind,

In a state of limbo, As I wander the night.

I hear a voice, Calling me to the unknown,

I cannot resist, The lure of the black hole.

The cacti watch, As I take my leave,

To a place of mystery, Where I can find peace.

Of course, the next question I gave it was to build a chatbot!

Me: Build a python and flask AI chatbot that responds to user messages on the frontend.

ChatbotGPTs:

import os from flask

import Flask, request, jsonify

from chatterbot

import ChatBot

from chatterbot.trainers

import ListTrainer

# Create a new chatbot

bot = ChatBot(

"My Bot",

storage_adapter="chatterbot.storage.SQLStorageAdapter",

logic_adapters=[

"chatterbot.logic.BestMatch",

{ "import_path": "chatterbot.logic.BestMatch",

"statement_comparison_function": "chatterbot.comparisons.levenshtein_distance",

"response_selection_method": "chatterbot.response_selection.get_first_response" }

],

database_uri="sqlite:///database.sqlite3" )

# Train the chatbot with a few sample conversations

conversation = [ "Hello", "Hi there!", "How are you doing?", "I'm doing great.", "That is good to hear", "Thank you.", "You're welcome." ]

trainer = ListTrainer(bot) trainer.train(conversation)

# Create a Flask app

app = Flask(__name__)

# Define a route for the default URL

@app.route("/") def index(): return "<h1>Chatbot</h1>"

# Define a route for the /get_response URL

@app.route("/get_response", methods=["POST"])

def get_response():

# Get the user's message

user_message = request.form["user_message"]

# Get the bot's response

bot_response = bot.get_response(user_message)

# Return the bot's response

return str(bot_response)

# Run the Flask

app if __name__ == "__main__": app.run()No matter how many times I tried, the second generation always used chatterbot instead of the ChatGPT API. Even when I told it to use the ChatGPT API, it didn't.

ChatGTP's ability to reproduce or construct other machine learning algorithms is interesting and possibly terrifying. Nothing prevents ChatGPT from replicating itself ad infinitum throughout the Internet other than a lack of desire. This may be the first time a machine repeats itself, so I've preserved the project as a reference. Adding a requirements.txt file and python env for easier deployment is the only change to the code.

I hope you enjoyed this.

You might also like

Hannah Elliott

3 years ago

Pebble Beach Auto Auctions Set $469M Record

The world's most prestigious vintage vehicle show included amazing autos and record-breaking sums.

This 1932 Duesenberg J Figoni Sports Torpedo earned Best of Show in 2022.

David Paul Morris (DPM)/Bloomberg

2022 Pebble Beach Concours d'Elegance winner was a pre-war roadster.

Lee Anderson's 1932 Duesenberg J Figoni Sports Torpedo won Best of Show at Pebble Beach Golf Links near Carmel, Calif., on Sunday. First American win since 2013.

Sandra Button, chairperson of the annual concours, said the car, whose chassis and body had been separated for years, "marries American force with European style." "Its resurrection story is passionate."

Pebble Beach Concours d'Elegance Auction

Since 1950, the Pebble Beach Concours d'Elegance has welcomed the world's most costly collectable vehicles for a week of parties, auctions, rallies, and high-roller meetings. The cold, dreary weather highlighted the automobiles' stunning lines and hues.

DPM/Bloomberg

A visitor photographs a 1948 Ferrari 166 MM Touring Barchetta. This is one of 25 Ferraris manufactured in the years after World War II. First shown at the 1948 Turin Salon. Others finished Mille Miglia and Le Mans, which set the tone for Ferrari racing for years.

DPM/Bloomberg

This year's frontrunners were ultra-rare pre-war and post-war automobiles with long and difficult titles, such a 1937 Talbot-Lago T150C-SS Figoni & Falaschi Teardrop Coupe and a 1951 Talbot-Lago T26 Grand Sport Stabilimenti Farina Cabriolet.

The hefty, enormous coaches inspire visions of golden pasts when mysterious saloons swept over the road with otherworldly style, speed, and grace. Only the richest and most powerful people, like Indian maharaja and Hollywood stars, owned such vehicles.

Antonio Chopitea, a Peruvian sugar tycoon, ordered a new Duesenberg in Paris. Hemmings says the two-tone blue beauty was moved to the US and dismantled in the 1960s. Body and chassis were sold separately and rejoined decades later in a three-year, prize-winning restoration.

The concours is the highlight of Monterey Car Week, a five-day Super Bowl for car enthusiasts. Early events included Porsche and Ferrari displays, antique automobile races, and new-vehicle debuts. Many auto executives call Monterey Car Week the "new auto show."

Many visitors were drawn to the record-breaking auctions.

A 1969 Porsche 908/02 auctioned for $4.185 million. Flat-eight air-cooled engine, 90.6-inch wheelbase, 1,320-pound weight. Vic Elford, Richard Attwood, Rudi Lins, Gérard Larrousse, Kurt Ahrens Jr., Masten Gregory, and Pedro Rodriguez drove it, according to Gooding.

DPM/Bloomberg

The 1931 Bentley Eight Liter Sports Tourer doesn't meet its reserve. Gooding & Co., the official auction house of the concours, made more than $105 million and had an 82% sell-through rate. This powerful open-top tourer is one of W.O. Bentley's 100 automobiles. Only 80 remain.

DPM/Bloomberg

The final auction on Aug. 21 brought in $456.1 million, breaking the previous high of $394.48 million established in 2015 in Monterey. “The week put an exclamation point on what has been an exceptional year for the collector automobile market,” Hagerty analyst John Wiley said.

Many cars that go unsold at public auction are sold privately in the days after. After-sales pushed the week's haul to $469 million on Aug. 22, up 18.9% from 2015's record.

In today's currencies, 2015's record sales amount to $490 million, Wiley noted. The dollar is degrading faster than old autos.

Still, 113 million-dollar automobiles sold. The average car sale price was $583,211, up from $446,042 last year, while multimillion-dollar hammer prices made up around 75% of total sales.

Industry insiders and market gurus expected that stock market volatility, the crisis in Ukraine, and the dollar-euro exchange rate wouldn't influence the world's biggest spenders.

Classic.com's CEO said there's no hint of a recession in an e-mail. Big sales and crowds.

Ticket-holders wore huge hats, flowery skirts, and other Kentucky Derby-esque attire. Coffee, beverages, and food are extra.

DPM/Bloomberg

Mercedes-Benz 300 SL Gullwing, 1955. Mercedes produced the two-seat gullwing coupe from 1954–1957 and the roadster from 1957–1963. It was once West Germany's fastest and most powerful automobile. You'd be hard-pressed to locate one for less $1 million.

DPM/Bloomberg

1955 Ferrari 410 Sport sold for $22 million at RM Sotheby's. It sold a 1937 Mercedes-Benz 540K Sindelfingen Roadster for $9.9 million and a 1924 Hispano-Suiza H6C Transformable Torpedo for $9.245 million. The family-run mansion sold $221.7 million with a 90% sell-through rate, up from $147 million in 2021. This year, RM Sotheby's cars averaged $1.3 million.

Not everyone saw such great benefits.

Gooding & Co., the official auction house of the concours, made more than $105 million and had an 82% sell-through rate. 1937 Bugatti Type 57SC Atalante, 1990 Ferrari F40, and 1994 Bugatti EB110 Super Sport were top sellers.

The 1969 Autobianchi A112 Bertone. This idea two-seater became a Hot Wheels toy but was never produced. It has a four-speed manual drive and an inline-four mid-engine arrangement like the Lamborghini Miura.

DPM/Bloomberg

1956 Porsche 356 A Speedster at Gooding & Co. The Porsche 356 is a lightweight, rear-engine, rear-wheel drive vehicle that lacks driving power but is loved for its rounded, Beetle-like hardtop coupé and open-top versions.

DPM/Bloomberg

Mecum sold $50.8 million with a 64% sell-through rate, down from $53.8 million and 77% in 2021. Its top lot, a 1958 Ferrari 250 GT 'Tour de France' Alloy Coupe, sold for $2.86 million, but its average price was $174,016.

Bonhams had $27.8 million in sales with an 88% sell-through rate. The same sell-through generated $35.9 million in 2021.

Gooding & Co. and RM Sotheby's posted all 10 top sales, leaving Bonhams, Mecum, and Hagerty-owned Broad Arrow fighting for leftovers. Six of the top 10 sellers were Ferraris, which remain the gold standard for collectable automobiles. Their prices have grown over decades.

Classic.com's Calle claimed RM Sotheby's "stole the show," but "BroadArrow will be a force to reckon with."

Although pre-war cars were hot, '80s and '90s cars showed the most appreciation and attention. Generational transition and new buyer profile."

2022 Pebble Beach Concours d'Elegance judges inspect 1953 Siata 208. The rounded coupe was introduced at the 1952 Turin Auto Show in Italy and is one of 18 ever produced. It sports a 120hp Fiat engine, five-speed manual transmission, and alloy drum brakes. Owners liked their style, but not their reliability.

DPM/Bloomberg

The Czinger 21 CV Max at Pebble Beach. Monterey Car Week concentrates on historic and classic automobiles, but modern versions like this Czinger hypercar also showed.

DPM/Bloomberg

The 1932 Duesenberg J Figoni Sports Torpedo won Best in Show in 2022. Lee and Penny Anderson of Naples, Fla., own the once-separate-chassis-from-body automobile.

DPM/Bloomberg

Micah Daigle

3 years ago

Facebook is going away. Here are two explanations for why it hasn't been replaced yet.

And tips for anyone trying.

We see the same story every few years.

BREAKING NEWS: [Platform X] launched a social network. With Facebook's reputation down, the new startup bets millions will switch.

Despite the excitement surrounding each new platform (Diaspora, Ello, Path, MeWe, Minds, Vero, etc.), no major exodus occurred.

Snapchat and TikTok attracted teens with fresh experiences (ephemeral messaging and rapid-fire videos). These features aren't Facebook, even if Facebook replicated them.

Facebook's core is simple: you publish items (typically text/images) and your friends (generally people you know IRL) can discuss them.

It's cool. Sometimes I don't want to, but sh*t. I like it.

Because, well, I like many folks I've met. I enjoy keeping in touch with them and their banter.

I dislike Facebook's corporation. I've been cautiously optimistic whenever a Facebook-killer surfaced.

None succeeded.

Why? Two causes, I think:

People couldn't switch quickly enough, which is reason #1

Your buddies make a social network social.

Facebook started in self-contained communities (college campuses) then grew outward. But a new platform can't.

If we're expected to leave Facebook, we want to know that most of our friends will too.

Most Facebook-killers had bottlenecks. You have to waitlist or jump through hoops (e.g. setting up a server).

Same outcome. Upload. Chirp.

After a week or two of silence, individuals returned to Facebook.

Reason #2: The fundamental experience was different.

Even when many of our friends joined in the first few weeks, it wasn't the same.

There were missing features or a different UX.

Want to reply with a meme? No photos in comments yet. (Trying!)

Want to tag a friend? Nope, sorry. 2019!

Want your friends to see your post? You must post to all your friends' servers. Good luck!

It's difficult to introduce a platform with 100% of the same features as one that's been there for 20 years, yet customers want a core experience.

If you can't, they'll depart.

The causes that led to the causes

Having worked on software teams for 14+ years, I'm not surprised by these challenges. They are a natural development of a few tech sector meta-problems:

Lean startup methodology

Silicon Valley worships lean startup. It's a way of developing software that involves testing a stripped-down version with a limited number of people before selecting what to build.

Billion people use Facebook's functions. They aren't tested. It must work right away*

*This may seem weird to software people, but it's how non-software works! You can't sell a car without wheels.

2. Creativity

Startup entrepreneurs build new things, not copies. I understand. Reinventing the wheel is boring.

We know what works. Different experiences raise adoption friction. Once millions have transferred, more features (and a friendlier UX) can be implemented.

3. Cost scaling

True. Building a product that can sustain hundreds of millions of users in weeks is expensive and complex.

Your lifeboats must have the same capacity as the ship you're evacuating. It's required.

4. Pure ideologies

People who work on Facebook-alternatives are (understandably) critical of Facebook.

They build an open-source, fully-distributed, data-portable, interface-customizable, offline-capable, censorship-proof platform.

Prioritizing these aims can prevent replicating the straightforward experience users expect. Github, not Facebook, is for techies only.

What about the business plan, though?

Facebook-killer attempts have followed three models.

Utilize VC funding to increase your user base, then monetize them later. (If you do this, you won't kill Facebook; instead, Facebook will become you.)

Users must pay to utilize it. (This causes a huge bottleneck and slows the required quick expansion, preventing it from seeming like a true social network.)

Make it a volunteer-run, open-source endeavor that is free. (This typically denotes that something is cumbersome, difficult to operate, and is only for techies.)

Wikipedia is a fourth way.

Wikipedia is one of the most popular websites and a charity. No ads. Donations support them.

A Facebook-killer managed by a good team may gather millions (from affluent contributors and the crowd) for their initial phase of development. Then it might sustain on regular donations, ethical transactions (e.g. fees on commerce, business sites, etc.), and government grants/subsidies (since it would essentially be a public utility).

When you're not aiming to make investors rich, it's remarkable how little money you need.

If you want to build a Facebook competitor, follow these tips:

Drop the lean startup philosophy. Wait until you have a finished product before launching. Build it, thoroughly test it for bugs, and then release it.

Delay innovating. Wait till millions of people have switched before introducing your great new features. Make it nearly identical for now.

Spend money climbing. Make sure that guests can arrive as soon as they are invited. Never keep them waiting. Make things easy for them.

Make it accessible to all. Even if doing so renders it less philosophically pure, it shouldn't require technical expertise to utilize.

Constitute a nonprofit. Additionally, develop community ownership structures. Profit maximization is not the only strategy for preserving valued assets.

Last thoughts

Nobody has killed Facebook, but Facebook is killing itself.

The startup is burying the newsfeed to become a TikTok clone. Meta itself seems to be ditching the platform for the metaverse.

I wish I was happy, but I'm not. I miss (understandably) removed friends' postings and remarks. It could be a ghost town in a few years. My dance moves aren't TikTok-worthy.

Who will lead? It's time to develop a social network for the people.

Greetings if you're working on it. I'm not a company founder, but I like to help hard-working folks.

Merve Yılmaz

3 years ago

Dopamine detox

This post is for you if you can't read or study for 5 minutes.

If you clicked this post, you may be experiencing problems focusing on tasks. A few minutes of reading may tire you. Easily distracted? Using social media and video games for hours without being sidetracked may impair your dopamine system.

When we achieve a goal, the brain secretes dopamine. It might be as simple as drinking water or as crucial as college admission. Situations vary. Various events require different amounts.

Dopamine is released when we start learning but declines over time. Social media algorithms provide new material continually, making us happy. Social media use slows down the system. We can't continue without an award. We return to social media and dopamine rewards.

Mice were given a button that released dopamine into their brains to study the hormone. The mice lost their hunger, thirst, and libido and kept pressing the button. Think this is like someone who spends all day gaming or on Instagram?

When we cause our brain to release so much dopamine, the brain tries to balance it in 2 ways:

1- Decreases dopamine production

2- Dopamine cannot reach its target.

Too many quick joys aren't enough. We'll want more joys. Drugs and alcohol are similar. Initially, a beer will get you drunk. After a while, 3-4 beers will get you drunk.

Social media is continually changing. Updates to these platforms keep us interested. When social media conditions us, we can't read a book.

Same here. I used to complete a book in a day and work longer without distraction. Now I'm addicted to Instagram. Daily, I spend 2 hours on social media. This must change. My life needs improvement. So I started the 50-day challenge.

I've compiled three dopamine-related methods.

Recommendations:

Day-long dopamine detox

First, take a day off from all your favorite things. Social media, gaming, music, junk food, fast food, smoking, alcohol, friends. Take a break.

Hanging out with friends or listening to music may seem pointless. Our minds are polluted. One day away from our pleasures can refresh us.

2. One-week dopamine detox by selecting

Choose one or more things to avoid. Social media, gaming, music, junk food, fast food, smoking, alcohol, friends. Try a week without Instagram or Twitter. I use this occasionally.

One week all together

One solid detox week. It's the hardest program. First or second options are best for dopamine detox. Time will help you.

You can walk, read, or pray during a dopamine detox. Many options exist. If you want to succeed, you must avoid instant gratification. Success after hard work is priceless.