Terra fiasco raises TRON's stablecoin backstop

After Terra's algorithmic stablecoin collapsed in May, TRON announced a plan to increase the capital backing its own stablecoin.

USDD, a near-carbon copy of Terra's UST, arrived on the TRON blockchain on May 5. TRON founder Justin Sun says USDD will be overcollateralized after initially being pegged algorithmically to the US dollar.

A reserve of cryptocurrencies and stablecoins will be kept at 130 percent of total USDD issuance, he said. TRON described the collateral ratio as "guaranteed" and said it would begin publishing real-time updates on June 5.

Currently, the reserve contains 14,040 bitcoin (around $418 million), 140 million USDT, 1.9 billion TRX, and 8.29 billion TRX in a burning contract.

Sun: "We want to hybridize USDD." We have an algorithmic stablecoin and TRON DAO Reserve.

algorithmic failure

USDD was designed to incentivize arbitrageurs to keep its price pegged to the US dollar by trading TRX, TRON's token, and USDD. Like Terra, TRON signaled its intent to establish a bitcoin and cryptocurrency reserve to support USDD in extreme market conditions.

Still, Terra's UST failed despite these safeguards. The stablecoin veered sharply away from its dollar peg in mid-May, bringing down Terra's LUNA and wiping out $40 billion in value in days. In a frantic attempt to restore the peg, billions of dollars in bitcoin were sold and unprecedented volumes of LUNA were issued.

Sun believes USDD, which has a total circulating supply of $667 million, can be backed up.

"Our reserve backing is diversified." Bitcoin and stablecoins are included. USDC will be a small part of Circle's reserve, he said.

TRON's news release lists the reserve's assets as bitcoin, TRX, USDC, USDT, TUSD, and USDJ.

All Bitcoin addresses will be signed so everyone knows they belong to us, Sun said.

Not giving in

Sun told that the crypto industry needs "decentralized" stablecoins that regulators can't touch.

Sun said the Luna Foundation Guard, a Singapore-based non-profit that raised billions in cryptocurrency to buttress UST, mismanaged the situation by trying to sell to panicked investors.

He said, "We must be ahead of the market." We want to stabilize the market and reduce volatility.

Currently, TRON finances most of its reserve directly, but Sun says the company hopes to add external capital soon.

Before its demise, UST holders could park the stablecoin in Terra's lending platform Anchor Protocol to earn 20% interest, which many deemed unsustainable. TRON's JustLend is similar. Sun hopes to raise annual interest rates from 17.67% to "around 30%."

This post is a summary. Read full article here

More on Web3 & Crypto

Scott Hickmann

4 years ago

Welcome

Welcome to Integrity's Web3 community!

Modern Eremite

3 years ago

The complete, easy-to-understand guide to bitcoin

Introduction

Markets rely on knowledge.

The internet provided practically endless knowledge and wisdom. Humanity has never seen such leverage. Technology's progress drives us to adapt to a changing world, changing our routines and behaviors.

In a digital age, people may struggle to live in the analogue world of their upbringing. Can those who can't adapt change their lives? I won't answer. We should teach those who are willing to learn, nevertheless. Unravel the modern world's riddles and give them wisdom.

Adapt or die . Accept the future or remain behind.

This essay will help you comprehend Bitcoin better than most market participants and the general public. Let's dig into Bitcoin.

Join me.

Ascension

Bitcoin.org was registered in August 2008. Bitcoin whitepaper was published on 31 October 2008. The document intrigued and motivated people around the world, including technical engineers and sovereignty seekers. Since then, Bitcoin's whitepaper has been read and researched to comprehend its essential concept.

I recommend reading the whitepaper yourself. You'll be able to say you read the Bitcoin whitepaper instead of simply Googling "what is Bitcoin" and reading the fundamental definition without knowing the revolution's scope. The article links to Bitcoin's whitepaper. To avoid being overwhelmed by the whitepaper, read the following article first.

Bitcoin isn't the first peer-to-peer digital currency. Hashcash or Bit Gold were once popular cryptocurrencies. These two Bitcoin precursors failed to gain traction and produce the network effect needed for general adoption. After many struggles, Bitcoin emerged as the most successful cryptocurrency, leading the way for others.

Satoshi Nakamoto, an active bitcointalk.org user, created Bitcoin. Satoshi's identity remains unknown. Satoshi's last bitcointalk.org login was 12 December 2010. Since then, he's officially disappeared. Thus, conspiracies and riddles surround Bitcoin's creators. I've heard many various theories, some insane and others well-thought-out.

It's not about who created it; it's about knowing its potential. Since its start, Satoshi's legacy has changed the world and will continue to.

Block-by-block blockchain

Bitcoin is a distributed ledger. What's the meaning?

Everyone can view all blockchain transactions, but no one can undo or delete them.

Imagine you and your friends routinely eat out, but only one pays. You're careful with money and what others owe you. How can everyone access the info without it being changed?

You'll keep a notebook of your evening's transactions. Everyone will take a page home. If one of you changed the page's data, the group would notice and reject it. The majority will establish consensus and offer official facts.

Miners add a new Bitcoin block to the main blockchain every 10 minutes. The appended block contains miner-verified transactions. Now that the next block has been added, the network will receive the next set of user transactions.

Bitcoin Proof of Work—prove you earned it

Any firm needs hardworking personnel to expand and serve clients. Bitcoin isn't that different.

Bitcoin's Proof of Work consensus system needs individuals to validate and create new blocks and check for malicious actors. I'll discuss Bitcoin's blockchain consensus method.

Proof of Work helps Bitcoin reach network consensus. The network is checked and safeguarded by CPU, GPU, or ASIC Bitcoin-mining machines (Application-Specific Integrated Circuit).

Every 10 minutes, miners are rewarded in Bitcoin for securing and verifying the network. It's unlikely you'll finish the block. Miners build pools to increase their chances of winning by combining their processing power.

In the early days of Bitcoin, individual mining systems were more popular due to high maintenance costs and larger earnings prospects. Over time, people created larger and larger Bitcoin mining facilities that required a lot of space and sophisticated cooling systems to keep machines from overheating.

Proof of Work is a vital part of the Bitcoin network, as network security requires the processing power of devices purchased with fiat currency. Miners must invest in mining facilities, which creates a new business branch, mining facilities ownership. Bitcoin mining is a topic for a future article.

More mining, less reward

Bitcoin is usually scarce.

Why is it rare? It all comes down to 21,000,000 Bitcoins.

Were all Bitcoins mined? Nope. Bitcoin's supply grows until it hits 21 million coins. Initially, 50BTC each block was mined, and each block took 10 minutes. Around 2140, the last Bitcoin will be mined.

But 50BTC every 10 minutes does not give me the year 2140. Indeed careful reader. So important is Bitcoin's halving process.

What is halving?

The block reward is halved every 210,000 blocks, which takes around 4 years. The initial payout was 50BTC per block and has been decreased to 25BTC after 210,000 blocks. First halving occurred on November 28, 2012, when 10,500,000 BTC (50%) had been mined. As of April 2022, the block reward is 6.25BTC and will be lowered to 3.125BTC by 19 March 2024.

The halving method is tied to Bitcoin's hashrate. Here's what "hashrate" means.

What if we increased the number of miners and hashrate they provide to produce a block every 10 minutes? Wouldn't we manufacture blocks faster?

Every 10 minutes, blocks are generated with little asymmetry. Due to the built-in adaptive difficulty algorithm, the overall hashrate does not affect block production time. With increased hashrate, it's harder to construct a block. We can estimate when the next halving will occur because 10 minutes per block is fixed.

Building with nodes and blocks

For someone new to crypto, the unusual terms and words may be overwhelming. You'll also find everyday words that are easy to guess or have a vague idea of what they mean, how they work, and what they do. Consider blockchain technology.

Nodes and blocks: Think about that for a moment. What is your first idea?

The blockchain is a chain of validated blocks added to the main chain. What's a "block"? What's inside?

The block is another page in the blockchain book that has been filled with transaction information and accepted by the majority.

We won't go into detail about what each block includes and how it's built, as long as you understand its purpose.

What about nodes?

Nodes, along with miners, verify the blockchain's state independently. But why?

To create a full blockchain node, you must download the whole Bitcoin blockchain and check every transaction against Bitcoin's consensus criteria.

What's Bitcoin's size?

In April 2022, the Bitcoin blockchain was 389.72GB.

Bitcoin's blockchain has miners and node runners.

Let's revisit the US gold rush. Miners mine gold with their own power (physical and monetary resources) and are rewarded with gold (Bitcoin). All become richer with more gold, and so does the country.

Nodes are like sheriffs, ensuring everything is done according to consensus rules and that there are no rogue miners or network users.

Lost and held bitcoin

Does the Bitcoin exchange price match each coin's price? How many coins remain after 21,000,000? 21 million or less?

Common reason suggests a 21 million-coin supply.

What if I lost 1BTC from a cold wallet?

What if I saved 1000BTC on paper in 2010 and it was damaged?

What if I mined Bitcoin in 2010 and lost the keys?

Satoshi Nakamoto's coins? Since then, those coins haven't moved.

How many BTC are truly in circulation?

Many people are trying to answer this question, and you may discover a variety of studies and individual research on the topic. Be cautious of the findings because they can't be evaluated and the statistics are hazy guesses.

On the other hand, we have long-term investors who won't sell their Bitcoin or will sell little amounts to cover mining or living needs.

The price of Bitcoin is determined by supply and demand on exchanges using liquid BTC. How many BTC are left after subtracting lost and non-custodial BTC?

We have significantly less Bitcoin in circulation than you think, thus the price may not reflect demand if we knew the exact quantity of coins available.

True HODLers and diamond-hand investors won't sell you their coins, no matter the market.

What's UTXO?

Unspent (U) Transaction (TX) Output (O)

Imagine taking a $100 bill to a store. After choosing a drink and munchies, you walk to the checkout to pay. The cashier takes your $100 bill and gives you $25.50 in change. It's in your wallet.

Is it simply 100$? No way.

The $25.50 in your wallet is unrelated to the $100 bill you used. Your wallet's $25.50 is just bills and coins. Your wallet may contain these coins and bills:

2x 10$ 1x 10$

1x 5$ or 3x 5$

1x 0.50$ 2x 0.25$

Any combination of coins and bills can equal $25.50. You don't care, and I'd wager you've never ever considered it.

That is UTXO. Now, I'll detail the Bitcoin blockchain and how UTXO works, as it's crucial to know what coins you have in your (hopefully) cold wallet.

You purchased 1BTC. Is it all? No. UTXOs equal 1BTC. Then send BTC to a cold wallet. Say you pay 0.001BTC and send 0.999BTC to your cold wallet. Is it the 1BTC you got before? Well, yes and no. The UTXOs are the same or comparable as before, but the blockchain address has changed. It's like if you handed someone a wallet, they removed the coins needed for a network charge, then returned the rest of the coins and notes.

UTXO is a simple concept, but it's crucial to grasp how it works to comprehend dangers like dust attacks and how coins may be tracked.

Lightning Network: fast cash

You've probably heard of "Layer 2 blockchain" projects.

What does it mean?

Layer 2 on a blockchain is an additional layer that increases the speed and quantity of transactions per minute and reduces transaction fees.

Imagine going to an obsolete bank to transfer money to another account and having to pay a charge and wait. You can transfer funds via your bank account or a mobile app without paying a fee, or the fee is low, and the cash appear nearly quickly. Layer 1 and 2 payment systems are different.

Layer 1 is not obsolete; it merely has more essential things to focus on, including providing the blockchain with new, validated blocks, whereas Layer 2 solutions strive to offer Layer 1 with previously processed and verified transactions. The primary blockchain, Bitcoin, will only receive the wallets' final state. All channel transactions until shutting and balancing are irrelevant to the main chain.

Layer 2 and the Lightning Network's goal are now clear. Most Layer 2 solutions on multiple blockchains are created as blockchains, however Lightning Network is not. Remember the following remark, as it best describes Lightning.

Lightning Network connects public and private Bitcoin wallets.

Opening a private channel with another wallet notifies just two parties. The creation and opening of a public channel tells the network that anyone can use it.

Why create a public Lightning Network channel?

Every transaction through your channel generates fees.

Money, if you don't know.

See who benefits when in doubt.

Anonymity, huh?

Bitcoin anonymity? Bitcoin's anonymity was utilized to launder money.

Well… You've heard similar stories. When you ask why or how it permits people to remain anonymous, the conversation ends as if it were just a story someone heard.

Bitcoin isn't private. Pseudonymous.

What if someone tracks your transactions and discovers your wallet address? Where is your anonymity then?

Bitcoin is like bulletproof glass storage; you can't take or change the money. If you dig and analyze the data, you can see what's inside.

Every online action leaves a trace, and traces may be tracked. People often forget this guideline.

A tool like that can help you observe what the major players, or whales, are doing with their coins when the market is uncertain. Many people spend time analyzing on-chain data. Worth it?

Ask yourself a question. What are the big players' options? Do you think they're letting you see their wallets for a small on-chain data fee?

Instead of short-term behaviors, focus on long-term trends.

More wallet transactions leave traces. Having nothing to conceal isn't a defect. Can it lead to regulating Bitcoin so every transaction is tracked like in banks today?

But wait. How can criminals pay out Bitcoin? They're doing it, aren't they?

Mixers can anonymize your coins, letting you to utilize them freely. This is not a guide on how to make your coins anonymous; it could do more harm than good if you don't know what you're doing.

Remember, being anonymous attracts greater attention.

Bitcoin isn't the only cryptocurrency we can use to buy things. Using cryptocurrency appropriately can provide usability and anonymity. Monero (XMR), Zcash (ZEC), and Litecoin (LTC) following the Mimblewimble upgrade are examples.

Summary

Congratulations! You've reached the conclusion of the article and learned about Bitcoin and cryptocurrency. You've entered the future.

You know what Bitcoin is, how its blockchain works, and why it's not anonymous. I bet you can explain Lightning Network and UTXO to your buddies.

Markets rely on knowledge. Prepare yourself for success before taking the first step. Let your expertise be your edge.

This article is a summary of this one.

Vitalik

4 years ago

An approximate introduction to how zk-SNARKs are possible (part 2)

If tasked with the problem of coming up with a zk-SNARK protocol, many people would make their way to this point and then get stuck and give up. How can a verifier possibly check every single piece of the computation, without looking at each piece of the computation individually? But it turns out that there is a clever solution.

Polynomials

Polynomials are a special class of algebraic expressions of the form:

- x+5

- x^4

- x^3+3x^2+3x+1

- 628x^{271}+318x^{270}+530x^{269}+…+69x+381

i.e. they are a sum of any (finite!) number of terms of the form cx^k

There are many things that are fascinating about polynomials. But here we are going to zoom in on a particular one: polynomials are a single mathematical object that can contain an unbounded amount of information (think of them as a list of integers and this is obvious). The fourth example above contained 816 digits of tau, and one can easily imagine a polynomial that contains far more.

Furthermore, a single equation between polynomials can represent an unbounded number of equations between numbers. For example, consider the equation A(x)+ B(x) = C(x). If this equation is true, then it's also true that:

- A(0)+B(0)=C(0)

- A(1)+B(1)=C(1)

- A(2)+B(2)=C(2)

- A(3)+B(3)=C(3)

And so on for every possible coordinate. You can even construct polynomials to deliberately represent sets of numbers so you can check many equations all at once. For example, suppose that you wanted to check:

- 12+1=13

- 10+8=18

- 15+8=23

- 15+13=28

You can use a procedure called Lagrange interpolation to construct polynomials A(x) that give (12,10,15,15) as outputs at some specific set of coordinates (eg. (0,1,2,3)), B(x) the outputs (1,8,8,13) on thos same coordinates, and so forth. In fact, here are the polynomials:

- A(x)=-2x^3+\frac{19}{2}x^2-\frac{19}{2}x+12

- B(x)=2x^3-\frac{19}{2}x^2+\frac{29}{2}x+1

- C(x)=5x+13

Checking the equation A(x)+B(x)=C(x) with these polynomials checks all four above equations at the same time.

Comparing a polynomial to itself

You can even check relationships between a large number of adjacent evaluations of the same polynomial using a simple polynomial equation. This is slightly more advanced. Suppose that you want to check that, for a given polynomial F, F(x+2)=F(x)+F(x+1) with the integer range {0,1…89} (so if you also check F(0)=F(1)=1, then F(100) would be the 100th Fibonacci number)

As polynomials, F(x+2)-F(x+1)-F(x) would not be exactly zero, as it could give arbitrary answers outside the range x={0,1…98}. But we can do something clever. In general, there is a rule that if a polynomial P is zero across some set S=\{x_1,x_2…x_n\} then it can be expressed as P(x)=Z(x)*H(x), where Z(x)=(x-x_1)*(x-x_2)*…*(x-x_n) and H(x) is also a polynomial. In other words, any polynomial that equals zero across some set is a (polynomial) multiple of the simplest (lowest-degree) polynomial that equals zero across that same set.

Why is this the case? It is a nice corollary of polynomial long division: the factor theorem. We know that, when dividing P(x) by Z(x), we will get a quotient Q(x) and a remainder R(x) is strictly less than that of Z(x). Since we know that P is zero on all of S, it means that R has to be zero on all of S as well. So we can simply compute R(x) via polynomial interpolation, since it's a polynomial of degree at most n-1 and we know n values (the zeros at S). Interpolating a polynomial with all zeroes gives the zero polynomial, thus R(x)=0 and H(x)=Q(x).

Going back to our example, if we have a polynomial F that encodes Fibonacci numbers (so F(x+2)=F(x)+F(x+1) across x=\{0,1…98\}), then I can convince you that F actually satisfies this condition by proving that the polynomial P(x)=F(x+2)-F(x+1)-F(x) is zero over that range, by giving you the quotient:

H(x)=\frac{F(x+2)-F(x+1)-F(x)}{Z(x)}

Where Z(x) = (x-0)*(x-1)*…*(x-98).

You can calculate Z(x) yourself (ideally you would have it precomputed), check the equation, and if the check passes then F(x) satisfies the condition!

Now, step back and notice what we did here. We converted a 100-step-long computation into a single equation with polynomials. Of course, proving the N'th Fibonacci number is not an especially useful task, especially since Fibonacci numbers have a closed form. But you can use exactly the same basic technique, just with some extra polynomials and some more complicated equations, to encode arbitrary computations with an arbitrarily large number of steps.

see part 3

You might also like

James Brockbank

3 years ago

Canonical URLs for Beginners

Canonicalization and canonical URLs are essential for SEO, and improper implementation can negatively impact your site's performance.

Canonical tags were introduced in 2009 to help webmasters with duplicate or similar content on multiple URLs.

To use canonical tags properly, you must understand their purpose, operation, and implementation.

Canonical URLs and Tags

Canonical tags tell search engines that a certain URL is a page's master copy. They specify a page's canonical URL. Webmasters can avoid duplicate content by linking to the "canonical" or "preferred" version of a page.

How are canonical tags and URLs different? Can these be specified differently?

Tags

Canonical tags are found in an HTML page's head></head> section.

<link rel="canonical" href="https://www.website.com/page/" />These can be self-referencing or reference another page's URL to consolidate signals.

Canonical tags and URLs are often used interchangeably, which is incorrect.

The rel="canonical" tag is the most common way to set canonical URLs, but it's not the only way.

Canonical URLs

What's a canonical link? Canonical link is the'master' URL for duplicate pages.

In Google's own words:

A canonical URL is the page Google thinks is most representative of duplicate pages on your site.

— Google Search Console Help

You can indicate your preferred canonical URL. For various reasons, Google may choose a different page than you.

When set correctly, the canonical URL is usually your specified URL.

Canonical URLs determine which page will be shown in search results (unless a duplicate is explicitly better for a user, like a mobile version).

Canonical URLs can be on different domains.

Other ways to specify canonical URLs

Canonical tags are the most common way to specify a canonical URL.

You can also set canonicals by:

Setting the HTTP header rel=canonical.

All pages listed in a sitemap are suggested as canonicals, but Google decides which pages are duplicates.

Redirects 301.

Google recommends these methods, but they aren't all appropriate for every situation, as we'll see below. Each has its own recommended uses.

Setting canonical URLs isn't required; if you don't, Google will use other signals to determine the best page version.

To control how your site appears in search engines and to avoid duplicate content issues, you should use canonicalization effectively.

Why Duplicate Content Exists

Before we discuss why you should use canonical URLs and how to specify them in popular CMSs, we must first explain why duplicate content exists. Nobody intentionally duplicates website content.

Content management systems create multiple URLs when you launch a page, have indexable versions of your site, or use dynamic URLs.

Assume the following URLs display the same content to a user:

A search engine sees eight duplicate pages, not one.

URLs #1 and #2: the CMS saves product URLs with and without the category name.

#3, #4, and #5 result from the site being accessible via HTTP, HTTPS, www, and non-www.

#6 is a subdomain mobile-friendly URL.

URL #7 lacks URL #2's trailing slash.

URL #8 uses a capital "A" instead of a lowercase one.

Duplicate content may also exist in URLs like:

https://www.website.com

https://www.website.com/index.php

Duplicate content is easy to create.

Canonical URLs help search engines identify different page variations as a single URL on many sites.

SEO Canonical URLs

Canonical URLs help you manage duplicate content that could affect site performance.

Canonical URLs are a technical SEO focus area for many reasons.

Specify URL for search results

When you set a canonical URL, you tell Google which page version to display.

Which would you click?

https://www.domain.com/page-1/

https://www.domain.com/index.php?id=2

First, probably.

Canonicals tell search engines which URL to rank.

Consolidate link signals on similar pages

When you have duplicate or nearly identical pages on your site, the URLs may get external links.

Canonical URLs consolidate multiple pages' link signals into a single URL.

This helps your site rank because signals from multiple URLs are consolidated into one.

Syndication management

Content is often syndicated to reach new audiences.

Canonical URLs consolidate ranking signals to prevent duplicate pages from ranking and ensure the original content ranks.

Avoid Googlebot duplicate page crawling

Canonical URLs ensure that Googlebot crawls your new pages rather than duplicated versions of the same one across mobile and desktop versions, for example.

Crawl budgets aren't an issue for most sites unless they have 100,000+ pages.

How to Correctly Implement the rel=canonical Tag

Using the header tag rel="canonical" is the most common way to specify canonical URLs.

Adding tags and HTML code may seem daunting if you're not a developer, but most CMS platforms allow canonicals out-of-the-box.

These URLs each have one product.

How to Correctly Implement a rel="canonical" HTTP Header

A rel="canonical" HTTP header can replace canonical tags.

This is how to implement a canonical URL for PDFs or non-HTML documents.

You can specify a canonical URL in your site's.htaccess file using the code below.

<Files "file-to-canonicalize.pdf"> Header add Link "< http://www.website.com/canonical-page/>; rel=\"canonical\"" </Files>301 redirects for canonical URLs

Google says 301 redirects can specify canonical URLs.

Only the canonical URL will exist if you use 301 redirects. This will redirect duplicates.

This is the best way to fix duplicate content across:

HTTPS and HTTP

Non-WWW and WWW

Trailing-Slash and Non-Trailing Slash URLs

On a single page, you should use canonical tags unless you can confidently delete and redirect the page.

Sitemaps' canonical URLs

Google assumes sitemap URLs are canonical, so don't include non-canonical URLs.

This does not guarantee canonical URLs, but is a best practice for sitemaps.

Best-practice Canonical Tag

Once you understand a few simple best practices for canonical tags, spotting and cleaning up duplicate content becomes much easier.

Always include:

One canonical URL per page

If you specify multiple canonical URLs per page, they will likely be ignored.

Correct Domain Protocol

If your site uses HTTPS, use this as the canonical URL. It's easy to reference the wrong protocol, so check for it to catch it early.

Trailing slash or non-trailing slash URLs

Be sure to include trailing slashes in your canonical URL if your site uses them.

Specify URLs other than WWW

Search engines see non-WWW and WWW URLs as duplicate pages, so use the correct one.

Absolute URLs

To ensure proper interpretation, canonical tags should use absolute URLs.

So use:

<link rel="canonical" href="https://www.website.com/page-a/" />And not:

<link rel="canonical" href="/page-a/" />If not canonicalizing, use self-referential canonical URLs.

When a page isn't canonicalizing to another URL, use self-referencing canonical URLs.

Canonical tags refer to themselves here.

Common Canonical Tags Mistakes

Here are some common canonical tag mistakes.

301 Canonicalization

Set the canonical URL as the redirect target, not a redirected URL.

Incorrect Domain Canonicalization

If your site uses HTTPS, don't set canonical URLs to HTTP.

Irrelevant Canonicalization

Canonicalize URLs to duplicate or near-identical content only.

SEOs sometimes try to pass link signals via canonical tags from unrelated content to increase rank. This isn't how canonicalization should be used and should be avoided.

Multiple Canonical URLs

Only use one canonical tag or URL per page; otherwise, they may all be ignored.

When overriding defaults in some CMSs, you may accidentally include two canonical tags in your page's <head>.

Pagination vs. Canonicalization

Incorrect pagination can cause duplicate content. Canonicalizing URLs to the first page isn't always the best solution.

Canonicalize to a 'view all' page.

How to Audit Canonical Tags (and Fix Issues)

Audit your site's canonical tags to find canonicalization issues.

SEMrush Site Audit can help. You'll find canonical tag checks in your website's site audit report.

Let's examine these issues and their solutions.

No Canonical Tag on AMP

Site Audit will flag AMP pages without canonical tags.

Canonicalization between AMP and non-AMP pages is important.

Add a rel="canonical" tag to each AMP page's head>.

No HTTPS redirect or canonical from HTTP homepage

Duplicate content issues will be flagged in the Site Audit if your site is accessible via HTTPS and HTTP.

You can fix this by 301 redirecting or adding a canonical tag to HTTP pages that references HTTPS.

Broken canonical links

Broken canonical links won't be considered canonical URLs.

This error could mean your canonical links point to non-existent pages, complicating crawling and indexing.

Update broken canonical links to the correct URLs.

Multiple canonical URLs

This error occurs when a page has multiple canonical URLs.

Remove duplicate tags and leave one.

Canonicalization is a key SEO concept, and using it incorrectly can hurt your site's performance.

Once you understand how it works, what it does, and how to find and fix issues, you can use it effectively to remove duplicate content from your site.

Canonicalization SEO Myths

Simone Basso

3 years ago

How I set up my teams to be successful

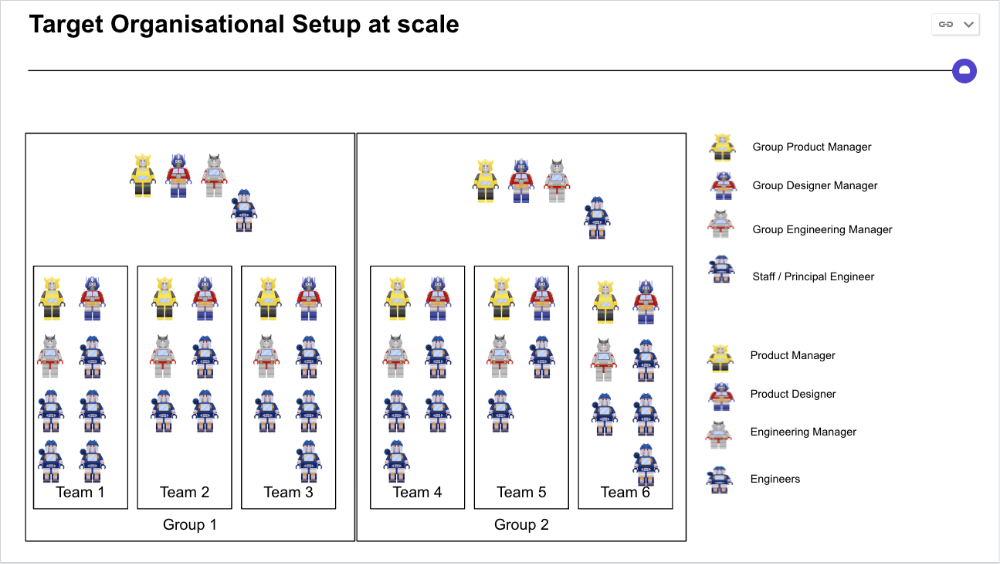

After 10 years of working in scale-ups, I've embraced a few concepts for scaling Tech and Product teams.

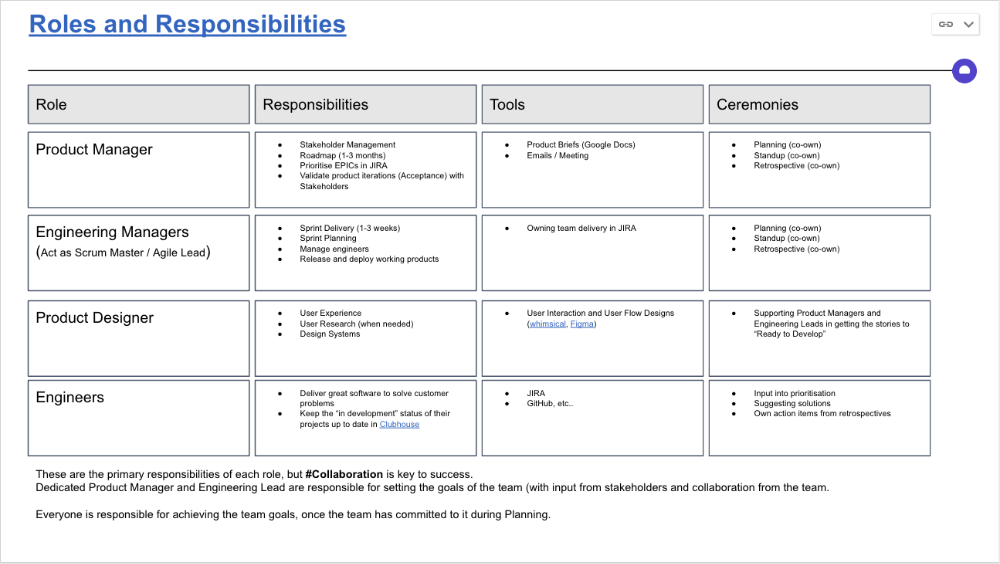

First, cross-functionalize teams. Product Managers represent the business, Product Designers the consumer, and Engineers build.

I organize teams of 5-10 individuals, following AWS's two pizza teams guidelines, with a Product Trio guiding each.

If more individuals are needed to reach a goal, I group teams under a Product Trio.

With Engineering being the biggest group, Staff/Principal Engineers often support the Trio on cross-team technical decisions.

Product Managers, Engineering Managers, or Engineers in the team may manage projects (depending on the project or aim), but the trio is collectively responsible for the team's output and outcome.

Once the Product Trio model is created, roles, duties, team ceremonies, and cooperation models must be clarified.

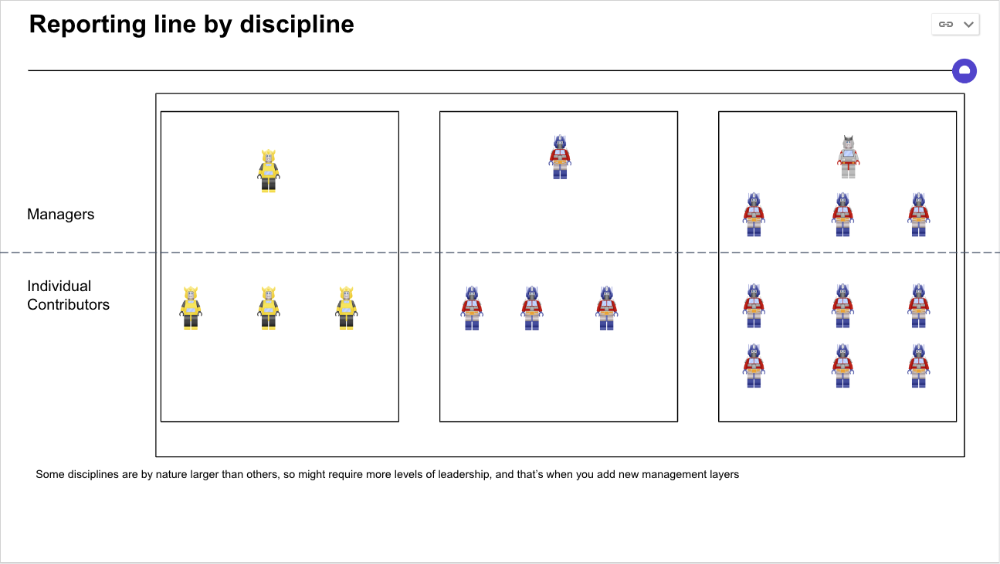

Keep reporting lines by discipline. Line managers are accountable for each individual's advancement, thus it's crucial that they know the work in detail.

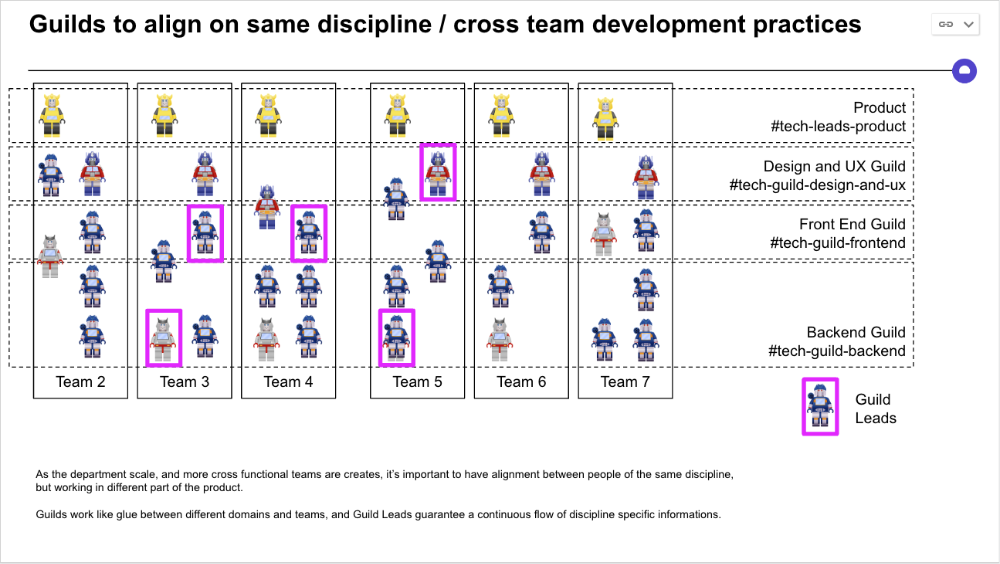

Cross-team collaboration becomes more important after 3 teams (15-30 people). Teams can easily diverge in how they write code, run ceremonies, and build products.

Establishing groups of people that are cross-team, but grouped by discipline and skills, sharing and agreeing on working practices becomes critical.

The “Spotify Guild” model has been where I’ve taken a lot of my inspiration from.

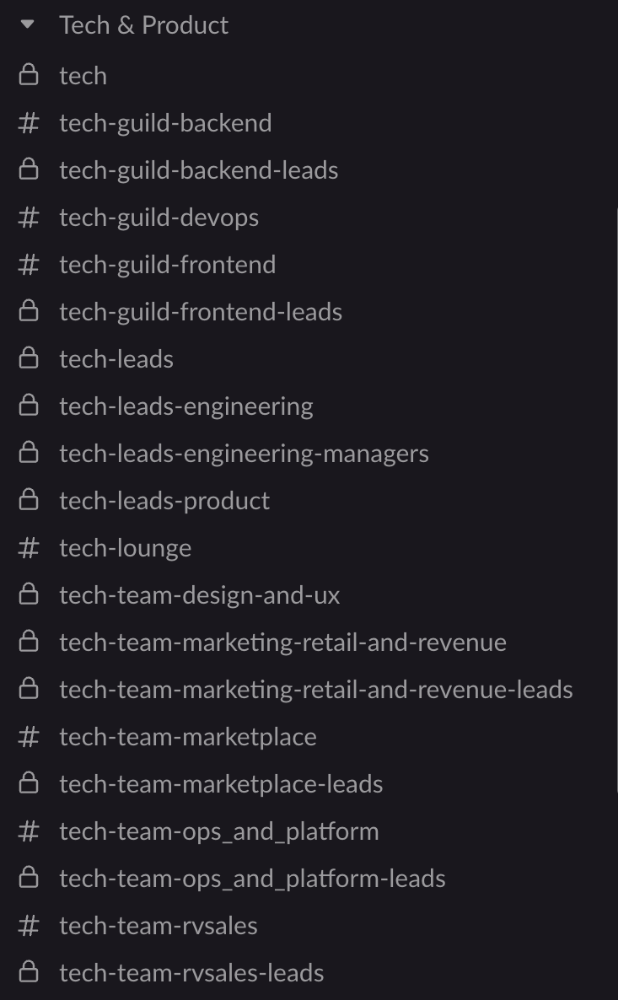

Last, establish a taxonomy for communication channels.

In Slack, I create one channel per team and one per guild (and one for me to have discussions with the team leads).

These are just some of the basic principles I follow to organize teams.

A book I particularly like about team types and how they interact with each other is https://teamtopologies.com/.

Darshak Rana

3 years ago

17 Google Secrets 99 Percent of People Don't Know

What can't Google do?

Seriously, nothing! Google rocks.

Google is a major player in online tools and services. We use it for everything, from research to entertainment.

Did I say entertain yourself?

Yes, with so many features and options, it can be difficult to fully utilize Google.

#1. Drive Google Mad

You can make Google's homepage dance if you want to be silly.

Just type “Google Gravity” into Google.com. Then select I'm lucky.

See the page unstick before your eyes!

#2 Play With Google Image

Google isn't just for work.

Then have fun with it!

You can play games right in your search results. When you need a break, google “Solitaire” or “Tic Tac Toe”.

#3. Do a Barrel Roll

Need a little more excitement in your life? Want to see Google dance?

Type “Do a barrel roll” into the Google search bar.

Then relax and watch your screen do a 360.

#4 No Internet? No issue!

This is a fun trick to use when you have no internet.

If your browser shows a “No Internet” page, simply press Space.

Boom!

We have dinosaurs! Now use arrow keys to save your pixelated T-Rex from extinction.

#5 Google Can Help

Play this Google coin flip game to see if you're lucky.

Enter “Flip a coin” into the search engine.

You'll see a coin flipping animation. If you get heads or tails, click it.

#6. Think with Google

My favorite Google find so far is the “Think with Google” website.

Think with Google is a website that offers marketing insights, research, and case studies.

I highly recommend it to entrepreneurs, small business owners, and anyone interested in online marketing.

#7. Google Can Read Images!

This is a cool Google trick that few know about.

You can search for images by keyword or upload your own by clicking the camera icon on Google Images.

Google will then show you all of its similar images.

Caution: You should be fine with your uploaded images being public.

#8. Modify the Google Logo!

Clicking on the “I'm Feeling Lucky” button on Google.com takes you to a random Google Doodle.

Each year, Google creates a Doodle to commemorate holidays, anniversaries, and other occasions.

#9. What is my IP?

Simply type “What is my IP” into Google to find out.

Your IP address will appear on the results page.

#10. Send a Self-Destructing Email With Gmail,

Create a new message in Gmail. Find an icon that resembles a lock and a clock near the SEND button. That's where the Confidential Mode is.

By clicking it, you can set an expiration date for your email. Expiring emails are automatically deleted from both your and the recipient's inbox.

#11. Blink, Google Blink!

This is a unique Google trick.

Type “blink HTML” into Google. The words “blink HTML” will appear and then disappear.

The text is displayed for a split second before being deleted.

To make this work, Google reads the HTML code and executes the “blink” command.

#12. The Answer To Everything

This is for all Douglas Adams fans.

The answer to life, the universe, and everything is 42, according to Google.

An allusion to Douglas Adams' Hitchhiker's Guide to the Galaxy, in which Ford Prefect seeks to understand life, the universe, and everything.

#13. Google in 1998

It's a blast!

Type “Google in 1998” into Google. "I'm feeling lucky"

You'll be taken to an old-school Google homepage.

It's a nostalgic trip for long-time Google users.

#14. Scholarships and Internships

Google can help you find college funding!

Type “scholarships” or “internships” into Google.

The number of results will surprise you.

#15. OK, Google. Dice!

To roll a die, simply type “Roll a die” into Google.

On the results page is a virtual dice that you can click to roll.

#16. Google has secret codes!

Hit the nine squares on the right side of your Google homepage to go to My Account. Then Personal Info.

You can add your favorite language to the “General preferences for the web” tab.

#17. Google Terminal

You can feel like a true hacker.

Just type “Google Terminal” into Google.com. "I'm feeling lucky"

Voila~!

You'll be taken to an old-school computer terminal-style page.

You can then type commands to see what happens.

Have you tried any of these activities? Tell me in the comments.

Read full article here