More on Society & Culture

The Velocipede

2 years ago

Stolen wallet

How a misplaced item may change your outlook

Losing your wallet means life stops. Money vanishes. No credit. Your identity is unverifiable. As you check your pockets for the missing object, you can't drive. You can't borrow a library book.

Last seen? intuitively. Every kid asks this, including yours. However, you know where you lost it: On the Providence River cycling trail. While pedaling vigorously, the wallet dropped out of your back pocket and onto the pavement.

A woman you know—your son's art teacher—says it will be returned. Faith.

You want that faith. Losing a wallet is all-consuming. You must presume it has been stolen and is being used to buy every diamond and non-fungible token on the market. Your identity may have been used to open bank accounts and fake passports. Because he used your license address, a ski mask-wearing man may be driving slowly past your house.

As you delete yourself by canceling cards, these images run through your head. You wait in limbo for replacements. Digital text on the DMV website promises your new license will come within 60 days and be approved by local and state law enforcement. In the following two months, your only defense is a screenshot.

Your wallet was ordinary. A worn, overstuffed leather rectangle. You understand how tenuous your existence has always been since you've never lost a wallet. You barely breathe without your documents.

Ironically, you wore a wallet-belt chain. You adored being a 1993 slacker for 15 years. Your wife just convinced you last year that your office job wasn't professional. You nodded and hid the chain.

Never lost your wallet. Until now.

Angry. Feeling stupid. How could you drop something vital? Why? Is the world cruel? No more dumb luck. You're always one pedal-stroke from death.

Then you get a call: We have your wallet.

Local post office, not cops.

The clerk said someone returned it. Due to trying to identify you, it's a chaos. It has your cards but no cash.

Your automobile screeches down the highway. You yell at the windshield, amazed. Submitted. Art teacher was right. Have some trust.

You thank the postmaster. You ramble through the story. The clerk doesn't know the customer, simply a neighborhood Good Samaritan. You wish you could thank that person for lifting your spirits.

You get home, beaming with gratitude. You thumb through your wallet, amazed that it’s all intact. Then you dig out your chain and reattach it.

Because even faith could use a little help.

Sam Warain

3 years ago

The Brilliant Idea Behind Kim Kardashian's New Private Equity Fund

Kim Kardashian created Skky Partners. Consumer products, internet & e-commerce, consumer media, hospitality, and luxury are company targets.

Some call this another Kardashian publicity gimmick.

This maneuver is brilliance upon closer inspection. Why?

1) Kim has amassed a sizable social media fan base:

Over 320 million Instagram and 70 million Twitter users follow Kim Kardashian.

Kim Kardashian's Instagram account ranks 8th. Three Kardashians in top 10 is ridiculous.

This gives her access to consumer data. She knows what people are discussing. Investment firms need this data.

Quality, not quantity, of her followers matters. Studies suggest that her following are more engaged than Selena Gomez and Beyonce's.

Kim's followers are worth roughly $500 million to her brand, according to a research. They trust her and buy what she recommends.

2) She has a special aptitude for identifying trends.

Kim Kardashian can sense trends.

She's always ahead of fashion and beauty trends. She's always trying new things, too. She doesn't mind making mistakes when trying anything new. Her desire to experiment makes her a good business prospector.

Kim has also created a lifestyle brand that followers love. Kim is an entrepreneur, mom, and role model, not just a reality TV star or model. She's established a brand around her appearance, so people want to buy her things.

Her fragrance collection has sold over $100 million since its 2009 introduction, and her Sears apparel line did over $200 million in its first year.

SKIMS is her latest $3.2bn brand. She can establish multibillion-dollar firms with her enormous distribution platform.

Early founders would kill for Kim Kardashian's network.

Making great products is hard, but distribution is more difficult. — David Sacks, All-in-Podcast

3) She can delegate the financial choices to Jay Sammons, one of the greatest in the industry.

Jay Sammons is well-suited to develop Kim Kardashian's new private equity fund.

Sammons has 16 years of consumer investing experience at Carlyle. This will help Kardashian invest in consumer-facing enterprises.

Sammons has invested in Supreme and Beats Electronics, both of which have grown significantly. Sammons' track record and competence make him the obvious choice.

Kim Kardashian and Jay Sammons have joined forces to create a new business endeavor. The agreement will increase Kardashian's commercial empire. Sammons can leverage one of the world's most famous celebrities.

“Together we hope to leverage our complementary expertise to build the next generation consumer and media private equity firm” — Kim Kardashian

Kim Kardashian is a successful businesswoman. She developed an empire by leveraging social media to connect with fans. By developing a global lifestyle brand, she has sold things and experiences that have made her one of the world's richest celebrities.

She's a shrewd entrepreneur who knows how to maximize on herself and her image.

Imagine how much interest Kim K will bring to private equity and venture capital.

I'm curious about the company's growth.

Enrique Dans

2 years ago

What happens when those without morals enter the economic world?

I apologize if this sounds basic, but throughout my career, I've always been clear that a company's activities are shaped by its founder(s)' morality.

I consider Palantir, owned by PayPal founder Peter Thiel, evil. He got $5 billion tax-free by hacking a statute to help middle-class savings. That may appear clever, but I think it demonstrates a shocking lack of solidarity with society. As a result of this and other things he has said and done, I early on dismissed Peter Thiel as someone who could contribute anything positive to society, and events soon proved me right: we are talking about someone who clearly considers himself above everyone else and who does not hesitate to set up a company, Palantir, to exploit the data of the little people and sell it to the highest bidder, whoever that is and whatever the consequences.

The German courts have confirmed my warnings concerning Palantir. The problem is that politicians love its surveillance tools because they think knowing more about their constituents gives them power. These are ideal for dictatorships who want to snoop on their populace. Hence, Silicon Valley's triumphalist dialectic has seduced many governments at many levels and collected massive volumes of data to hold forever.

Dangerous company. There are many more. My analysis of the moral principles that disclose company management changed my opinion of Facebook, now Meta, and anyone with a modicum of interest might deduce when that happened, a discovery that leaves you dumbfounded. TikTok was easy because its lack of morality was revealed early when I saw the videos it encouraged minors to post and the repercussions of sharing them through its content recommendation algorithm. When you see something like this, nothing can convince you that the firm can change its morals and become good. Nothing. You know the company is awful and will fail. Speak it, announce it, and change it. It's like a fingerprint—unchangeable.

Some of you who read me frequently make its Facebook today jokes when I write about these firms, and that's fine: they're my moral standards, those of an elderly professor with thirty-five years of experience studying corporations and discussing their cases in class, but you don't have to share them. Since I'm writing this and don't have to submit to any editorial review, that's what it is: when you continuously read a person, you have to assume that they have moral standards and that sometimes you'll agree with them and sometimes you won't. Morality accepts hierarchies, nuances, and even obsessions. I know not everyone shares my opinions, but at least I can voice them. One day, one of those firms may sue me (as record companies did some years ago).

Palantir is incredibly harmful. Limit its operations. Like Meta and TikTok, its business strategy is shaped by its founders' immorality. Such a procedure can never be beneficial.

You might also like

OnChain Wizard

3 years ago

How to make a >800 million dollars in crypto attacking the once 3rd largest stablecoin, Soros style

Everyone is talking about the $UST attack right now, including Janet Yellen. But no one is talking about how much money the attacker made (or how brilliant it was). Lets dig in.

Our story starts in late March, when the Luna Foundation Guard (or LFG) starts buying BTC to help back $UST. LFG started accumulating BTC on 3/22, and by March 26th had a $1bn+ BTC position. This is leg #1 that made this trade (or attack) brilliant.

The second leg comes in the form of the 4pool Frax announcement for $UST on April 1st. This added the second leg needed to help execute the strategy in a capital efficient way (liquidity will be lower and then the attack is on).

We don't know when the attacker borrowed 100k BTC to start the position, other than that it was sold into Kwon's buying (still speculation). LFG bought 15k BTC between March 27th and April 11th, so lets just take the average price between these dates ($42k).

So you have a ~$4.2bn short position built. Over the same time, the attacker builds a $1bn OTC position in $UST. The stage is now set to create a run on the bank and get paid on your BTC short. In anticipation of the 4pool, LFG initially removes $150mm from 3pool liquidity.

The liquidity was pulled on 5/8 and then the attacker uses $350mm of UST to drain curve liquidity (and LFG pulls another $100mm of liquidity).

But this only starts the de-pegging (down to 0.972 at the lows). LFG begins selling $BTC to defend the peg, causing downward pressure on BTC while the run on $UST was just getting started.

With the Curve liquidity drained, the attacker used the remainder of their $1b OTC $UST position ($650mm or so) to start offloading on Binance. As withdrawals from Anchor turned from concern into panic, this caused a real de-peg as people fled for the exits

So LFG is selling $BTC to restore the peg while the attacker is selling $UST on Binance. Eventually the chain gets congested and the CEXs suspend withdrawals of $UST, fueling the bank run panic. $UST de-pegs to 60c at the bottom, while $BTC bleeds out.

The crypto community panics as they wonder how much $BTC will be sold to keep the peg. There are liquidations across the board and LUNA pukes because of its redemption mechanism (the attacker very well could have shorted LUNA as well). BTC fell 25% from $42k on 4/11 to $31.3k

So how much did our attacker make? There aren't details on where they covered obviously, but if they are able to cover (or buy back) the entire position at ~$32k, that means they made $952mm on the short.

On the $350mm of $UST curve dumps I don't think they took much of a loss, lets assume 3% or just $11m. And lets assume that all the Binance dumps were done at 80c, thats another $125mm cost of doing business. For a grand total profit of $815mm (bf borrow cost).

BTC was the perfect playground for the trade, as the liquidity was there to pull it off. While having LFG involved in BTC, and foreseeing they would sell to keep the peg (and prevent LUNA from dying) was the kicker.

Lastly, the liquidity being low on 3pool in advance of 4pool allowed the attacker to drain it with only $350mm, causing the broader panic in both BTC and $UST. Any shorts on LUNA would've added a lot of P&L here as well, with it falling -65% since 5/7.

And for the reply guys, yes I know a lot of this involves some speculation & assumptions. But a lot of money was made here either way, and I thought it would be cool to dive into how they did it.

Jared A. Brock

3 years ago

Here is the actual reason why Russia invaded Ukraine

Democracy's demise

Our Ukrainian brothers and sisters are being attacked by a far superior force.

It's the biggest invasion since WWII.

43.3 million peaceful Ukrainians awoke this morning to tanks, mortars, and missiles. Russia is already 15 miles away.

America and the West will not deploy troops.

They're sanctioning. Except railways. And luxuries. And energy. Diamonds. Their dependence on Russian energy exports means they won't even cut Russia off from SWIFT.

Ukraine is desperate enough to hand out guns on the street.

France, Austria, Turkey, and the EU are considering military aid, but Ukraine will fall without America or NATO.

The Russian goal is likely to encircle Kyiv and topple Zelenskyy's government. A proxy power will be reinstated once Russia has total control.

“Western security services believe Putin intends to overthrow the government and install a puppet regime,” says Financial Times foreign affairs commentator Gideon Rachman. This “decapitation” strategy includes municipalities. Ukrainian officials are being targeted for arrest or death.”

Also, Putin has never lost a war.

Why is Russia attacking Ukraine?

Putin, like a snowflake college student, “feels unsafe.”

Why?

Because Ukraine is full of “Nazi ideas.”

Putin claims he has felt threatened by Ukraine since the country's pro-Putin leader was ousted and replaced by a popular Jewish comedian.

Hee hee

He fears a full-scale enemy on his doorstep if Ukraine joins NATO. But he refuses to see it both ways. NATO has never invaded Russia, but Russia has always stolen land from its neighbors. Can you blame them for joining a mutual defense alliance when a real threat exists?

Nations that feel threatened can join NATO. That doesn't justify an attack by Russia. It allows them to defend themselves. But NATO isn't attacking Moscow. They aren't.

Russian President Putin's "special operation" aims to de-Nazify the Jewish-led nation.

To keep Crimea and the other two regions he has already stolen, he wants Ukraine undefended by NATO.

(Warlords have fought for control of the strategically important Crimea for over 2,000 years.)

Putin wants to own all of Ukraine.

Why?

The Black Sea is his goal.

Ports bring money and power, and Ukraine pipelines transport Russian energy products.

Putin wants their wheat, too — with 70% crop coverage, Ukraine would be their southern breadbasket, and Russia has no qualms about starving millions of Ukrainians to death to feed its people.

In the end, it's all about greed and power.

Putin wants to own everything Russia has ever owned. This year he turns 70, and he wants to be remembered like his hero Peter the Great.

In order to get it, he's willing to kill thousands of Ukrainians

Art imitates life

This story began when a Jewish TV comedian portrayed a teacher elected President after ranting about corruption.

Servant of the People, the hit sitcom, is now the leading centrist political party.

Right, President Zelenskyy won the hearts and minds of Ukrainians by imagining a fairer world.

A fair fight is something dictators, corporatists, monopolists, and warlords despise.

Now Zelenskyy and his people will die, allowing one of history's most corrupt leaders to amass even more power.

The poor always lose

Meanwhile, the West will impose economic sanctions on Russia.

China is likely to step in to help Russia — or at least the wealthy.

The poor and working class in Russia will suffer greatly if there is a hard crash or long-term depression.

Putin's friends will continue to drink champagne and eat caviar.

Russia cutting off oil, gas, and fertilizer could cause more inflation and possibly a recession if it cuts off supplies to the West. This causes more suffering and hardship for the Western poor and working class.

Why? a billionaire sociopath gets his dirt.

Yes, Russia is simply copying America. Some of us think all war is morally wrong, regardless of who does it.

But let's not kid ourselves right now.

The markets rallied after the biggest invasion in Europe since WWII.

Investors hope Ukraine collapses and Russian oil flows.

Unbridled capitalists value lifeless.

What we can do about Ukraine

When the Russian army invaded eastern Finland, my wife's grandmother fled as a child. 80 years later, Russia still has Karelia.

Russia invaded Ukraine today to retake two eastern provinces.

History has taught us nothing.

Past mistakes won't fix the future.

Instead, we should try:

- Pray and/or meditate on our actions with our families.

- Stop buying Russian products (vodka, obviously, but also pay more for hydro/solar/geothermal/etc.)

- Stop wasting money on frivolous items and donate it to Ukrainian charities.

Here are 35+ places to donate.

- To protest, gather a few friends, contact the media, and shake signs in front of the Russian embassy.

- Prepare to welcome refugees.

More war won't save the planet or change hearts.

Only love can work.

obimy.app

3 years ago

How TikTok helped us grow to 6 million users

This resulted to obimy's new audience.

Hi! obimy's official account. Here, we'll teach app developers and marketers. In 2022, our downloads increased dramatically, so we'll share what we learned.

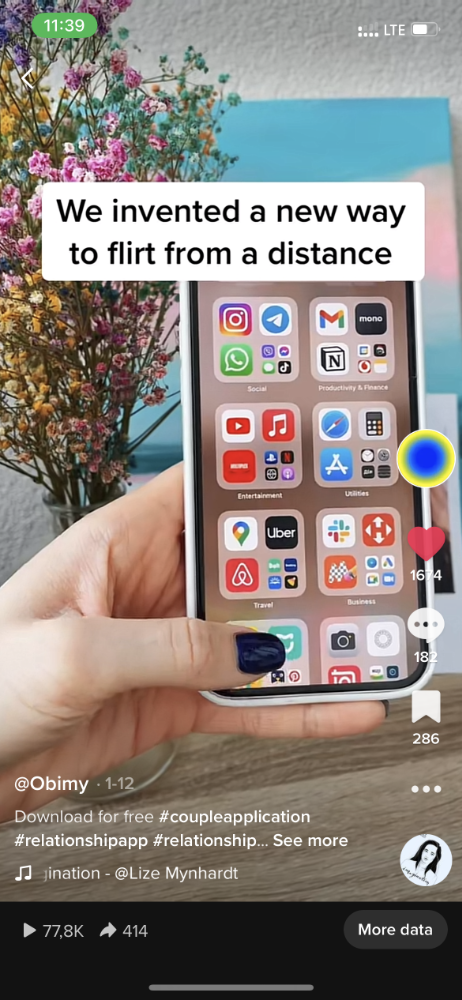

obimy is what we call a ‘senseger’. It's a new method to communicate digitally. Instead of text, obimy users connect through senses and moods. Feeling playful? Flirt with your partner, pat a pal, or dump water on a classmate. Each feeling is an interactive animation with vibration. It's a wordless app. App Store and Google Play have obimy.

We had 20,000 users in 2022. Two to five thousand of them opened the app monthly. Our DAU metric was 500.

We have 6 million users after 6 months. 500,000 individuals use obimy daily. obimy was the top lifestyle app this week in the U.S.

And TikTok helped.

TikTok fuels obimys' growth. It's why our app exploded. How and what did we learn? Our Head of Marketing, Anastasia Avramenko, knows.

our actions prior to TikTok

We wanted to achieve product-market fit through organic expansion. Quora, Reddit, Facebook Groups, Facebook Ads, Google Ads, Apple Search Ads, and social media activity were tested. Nothing worked. Our CPI was sometimes $4, so unit economics didn't work.

We studied our markets and made audience hypotheses. We promoted our goods and studied our audience through social media quizzes. Our target demographic was Americans in long-distance relationships. I designed quizzes like Test the Strength of Your Relationship to better understand the user base. After each quiz, we encouraged users to download the app to enhance their connection and bridge the distance.

We got 1,000 responses for $50. This helped us comprehend the audience's grief and coping strategies (aka our rivals). I based action items on answers given. If you can't embrace a loved one, use obimy.

We also tried Facebook and Google ads. From the start, we knew it wouldn't work.

We were desperate to discover a free way to get more users.

Our journey to TikTok

TikTok is a great venue for emerging creators. It also helped reach people. Before obimy, my TikTok videos garnered 12 million views without sponsored promotion.

We had to act. TikTok was required.

I wasn't a TikTok user before obimy. Initially, I uploaded promotional content. Call-to-actions appear strange next to dancing challenges and my money don't jiggle jiggle. I learned TikTok. Watch TikTok for an hour was on my to-do list. What a dream job!

Our most popular movies presented the app alongside text outlining what it does. We started promoting them in Europe and the U.S. and got a 16% CTR and $1 CPI, an improvement over our previous efforts.

Somehow, we were expanding. So we came up with new hypotheses, calls to action, and content.

Four months passed, yet we saw no organic growth.

Russia attacked Ukraine.

Our app aimed to be helpful. For now, we're focusing on our Ukrainian audience. I posted sloppy TikToks illustrating how obimy can help during shelling or air raids.

In two hours, Kostia sent me our visitor count. Our servers crashed.

Initially, we had several thousand daily users. Over 200,000 users joined obimy in a week. They posted obimy videos on TikTok, drawing additional users. We've also resumed U.S. video promotion.

We gained 2,000,000 new members with less than $100 in ads, primarily in the U.S. and U.K.

TikTok helped.

The figures

We were confident we'd chosen the ideal tool for organic growth.

Over 45 million people have viewed our own videos plus a ton of user-generated content with the hashtag #obimy.

About 375 thousand people have liked all of our individual videos.

The number of downloads and the virality of videos are directly correlated.

Where are we now?

TikTok fuels our organic growth. We post 56 videos every week and pay to promote viral content.

We use UGC and influencers. We worked with Universal Music Italy on Eurovision. They offered to promote us through their million-follower TikTok influencers. We thought their followers would improve our audience, but it didn't matter. Integration didn't help us. Users that share obimy videos with their followers can reach several million views, which affects our download rate.

After the dust settled, we determined our key audience was 13-18-year-olds. They want to express themselves, but it's sometimes difficult. We're searching for methods to better engage with our users. We opened a Discord server to discuss anime and video games and gather app and content feedback.

TikTok helps us test product updates and hypotheses. Example: I once thought we might raise MAU by prompting users to add strangers as friends. Instead of asking our team to construct it, I made a TikTok urging users to share invite URLs. Users share links under every video we upload, embracing people worldwide.

Key lessons

Don't direct-sell. TikTok isn't for Instagram, Facebook, or YouTube promo videos. Conventional advertisements don't fit. Most users will swipe up and watch humorous doggos.

More product videos are better. Finally. So what?

Encourage interaction. Tagging friends in comments or making videos with the app promotes it more than any marketing spend.

Be odd and risqué. A user mistakenly sent a French kiss to their mom in one of our most popular videos.

TikTok helps test hypotheses and build your user base. It also helps develop apps. In our upcoming blog, we'll guide you through obimy's design revisions based on TikTok. Follow us on Twitter, Instagram, and TikTok.