More on Personal Growth

Akshad Singi

3 years ago

Four obnoxious one-minute habits that help me save more than 30 hours each week

These four, when combined, destroy procrastination.

You're not rushed. You waste it on busywork.

You'll accept this eventually.

In 2022, the daily average usage of a user on social media is 2.5 hours.

By 2020, 6 billion hours of video were watched each month by Netflix's customers, who used the service an average of 3.2 hours per day.

When we see these numbers, we think "Wow!" People squander so much time as though they don't contribute. True. These are yours. Likewise.

We don't lack time; we just waste it. Once you realize this, you can change your habits to save time. This article explains. If you adopt ALL 4 of these simple behaviors, you'll see amazing benefits.

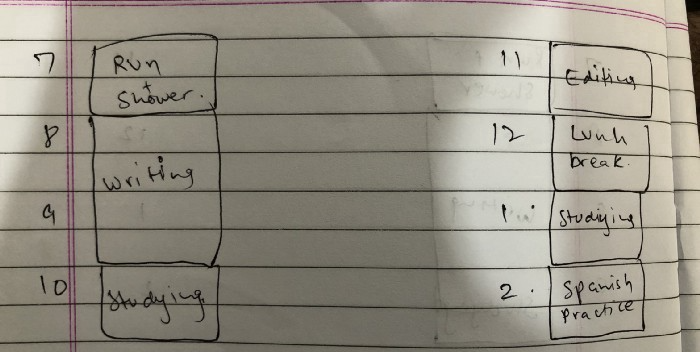

Time-blocking

Cal Newport's time-blocking trick takes a minute but improves your day's clarity.

Divide the next day into 30-minute (or 5-minute, if you're Elon Musk) segments and assign responsibilities. As seen.

Here's why:

The procrastination that results from attempting to determine when to begin working is eliminated. Procrastination is a given if you choose when to begin working in real-time. Even if you may assume you'll start working in five minutes, it won't take you long to realize that five minutes have turned into an hour. But if you've already determined to start working at 2:00 the next day, your odds of procrastinating are greatly decreased, if not eliminated altogether.

You'll also see that you have a lot of time in a day when you plan your day out on paper and assign chores to each hour. Doing this daily will permanently eliminate the lack of time mindset.

5-4-3-2-1: Have breakfast with the frog!

“If it’s your job to eat a frog, it’s best to do it first thing in the morning. And If it’s your job to eat two frogs, it’s best to eat the biggest one first.”

Eating the frog means accomplishing the day's most difficult chore. It's better to schedule it first thing in the morning when time-blocking the night before. Why?

The day's most difficult task is also the one that causes the most postponement. Because of the stress it causes, the later you schedule it, the more time you risk wasting by procrastinating.

However, if you do it right away in the morning, you'll feel good all day. This is the reason it was set for the morning.

Mel Robbins' 5-second rule can help. Start counting backward 54321 and force yourself to start at 1. If you acquire the urge to work on a goal, you must act within 5 seconds or your brain will destroy it. If you're scheduled to eat your frog at 9, eat it at 8:59. Start working.

Micro-visualisation

You've heard of visualizing to enhance the future. Visualizing a bright future won't do much if you're not prepared to focus on the now and develop the necessary habits. Alexander said:

People don’t decide their futures. They decide their habits and their habits decide their future.

I visualize the next day's schedule every morning. My day looks like this

“I’ll start writing an article at 7:30 AM. Then, I’ll get dressed up and reach the medicine outpatient department by 9:30 AM. After my duty is over, I’ll have lunch at 2 PM, followed by a nap at 3 PM. Then, I’ll go to the gym at 4…”

etc.

This reinforces the day you planned the night before. This makes following your plan easy.

Set the timer.

It's the best iPhone productivity app. A timer is incredible for increasing productivity.

Set a timer for an hour or 40 minutes before starting work. Your call. I don't believe in techniques like the Pomodoro because I can focus for varied amounts of time depending on the time of day, how fatigued I am, and how cognitively demanding the activity is.

I work with a timer. A timer keeps you focused and prevents distractions. Your mind stays concentrated because of the timer. Timers generate accountability.

To pee, I'll pause my timer. When I sit down, I'll continue. Same goes for bottle refills. To use Twitter, I must pause the timer. This creates accountability and focuses work.

Connecting everything

If you do all 4, you won't be disappointed. Here's how:

Plan out your day's schedule the night before.

Next, envision in your mind's eye the same timetable in the morning.

Speak aloud 54321 when it's time to work: Eat the frog! In the morning, devour the largest frog.

Then set a timer to ensure that you remain focused on the task at hand.

Tim Denning

3 years ago

In this recession, according to Mark Cuban, you need to outwork everyone

Here’s why that’s baloney

Mark Cuban popularized entrepreneurship.

Shark Tank (which made Mark famous) made starting a business glamorous to attract more entrepreneurs. First off

This isn't an anti-billionaire rant.

Mark Cuban has done excellent. He's a smart, principled businessman. I enjoy his Web3 work. But Mark's work and productivity theories are absurd.

You don't need to outwork everyone in this recession to live well.

You won't be able to outwork me.

Yuck! Mark's words made me gag.

Why do boys think working is a football game where the winner wins a Super Bowl trophy? To outwork you.

Hard work doesn't equal intelligence.

Highly clever professionals spend 4 hours a day in a flow state, then go home to relax with family.

If you don't put forth the effort, someone else will.

- Mark.

He'll burn out. He's delusional and doesn't understand productivity. Boredom or disconnection spark our best thoughts.

TikTok outlaws boredom.

In a spare minute, we check our phones because we can't stand stillness.

All this work p*rn makes things worse. When is it okay to feel again? Because I can’t feel anything when I’m drowning in work and haven’t had a holiday in 2 years.

Your rivals are actively attempting to undermine you.

Ohhh please Mark…seriously.

This isn't a Tom Hanks war film. Relax. Not everyone is a rival. Only yourself is your competitor. To survive the recession, be better than a year ago.

If you get rich, great. If not, there's more to life than Lambos and angel investments.

Some want to relax and enjoy life. No competition. We witness people with lives trying to endure the recession and record-high prices.

This fictitious rival worsens life and work.

If you are truly talented, you will motivate others to work more diligently and effectively.

No Mark. Soz.

If you're a good leader, you won't brag about working hard and treating others like cogs. Treat them like humans. You'll have EQ.

Silly statements like this are caused by an out-of-control ego. No longer watch Shark Tank.

Ego over humanity.

Good leaders will urge people to keep together during the recession. Good leaders support those who are laid off and need a reference.

Not harder, quicker, better. That created my mental health problems 10 years ago.

Truth: we want to work less.

The promotion of entrepreneurship is ludicrous.

Marvel superheroes. Seriously, relax Max.

I used to write about entrepreneurship, then I quit. Many WeWork Adam Neumanns. Carelessness.

I now utilize the side hustle title when writing about online company or entrepreneurship. Humanizes.

Stop glorifying. Thinking we'll all be Elon Musks who send rockets to Mars is delusional. Most of us won't create companies employing hundreds.

OK.

The true epidemic is glorification. fewer selfies Little birdy needs less bank account screenshots. Less Uber talk.

We're exhausted.

Fun, ego-free business can transform the world. Take a relax pill.

Work as if someone were attempting to take everything from you.

I've seen people lose everything.

Myself included. My 20s startup failed. I was almost bankrupt. I thought I'd never recover. Nope.

Best thing ever.

Losing everything reveals your true self. Unintelligent entrepreneur egos perish instantly. Regaining humility revitalizes relationships.

Money's significance shifts. Stop chasing it like a puppy with a bone.

Fearing loss is unfounded.

Here is a more effective approach than outworking nobody.

(You'll thrive in the recession and become wealthy.)

Smarter work

Overworking is donkey work.

You don't want to be a career-long overworker. Instead than wasting time, write down what you do. List tasks and processes.

Keep doing/outsource the list. Step-by-step each task. Continuously systematize.

Then recruit a digital employee like Zapier or a virtual assistant in the same country.

Intelligent, not difficult.

If your big break could burn in hell, diversify like it will.

People err by focusing on one chance.

Chances can vanish. All-in risky. Instead of working like a Mark Cuban groupie, diversify your income.

If you're employed, your customer is your employer.

Sell the same abilities twice and add 2-3 contract clients. Reduce your hours at your main job and take on more clients.

Leave brand loyalty behind

Mark desires his employees' worship.

That's stupid. When times are bad, layoffs multiply. The problem is the false belief that companies care. No. A business maximizes profit and pays you the least.

To care or overpay is anti-capitalist (that run the world). Be honest.

I was a banker. Then the bat virus hit and jobs disappeared faster than I urinate after a night of drinking.

Start being disloyal now since your company will cheerfully replace you with a better applicant. Meet recruiters and hiring managers on LinkedIn. Whenever something goes wrong at work, act.

Loyalty to self and family. Nobody.

Outwork this instead

Mark doesn't suggest outworking inflation instead of people.

Inflation erodes your time on earth. If you ignore inflation, you'll work harder for less pay every minute.

Financial literacy beats inflation.

Get a side job and earn money online

So you can stop outworking everyone.

Internet leverages time. Same effort today yields exponential results later. There are still whole places not online.

Instead of working forever, generate money online.

Final Words

Overworking is stupid. Don't listen to wealthy football jocks.

Work isn't everything. Prioritize diversification, internet income streams, boredom, and financial knowledge throughout the recession.

That’s how to get wealthy rather than burnout-rich.

Alex Mathers

3 years ago

12 habits of the zenith individuals I know

Calmness is a vital life skill.

It aids communication. It boosts creativity and performance.

I've studied calm people's habits for years. Commonalities:

Have mastered the art of self-humor.

Protectors take their job seriously, draining the room's energy.

They are fixated on positive pursuits like making cool things, building a strong physique, and having fun with others rather than on depressing influences like the news and gossip.

Every day, spend at least 20 minutes moving, whether it's walking, yoga, or lifting weights.

Discover ways to take pleasure in life's challenges.

Since perspective is malleable, they change their view.

Set your own needs first.

Stressed people neglect themselves and wonder why they struggle.

Prioritize self-care.

Don't ruin your life to please others.

Make something.

Calm people create more than react.

They love creating beautiful things—paintings, children, relationships, and projects.

Don’t hold their breath.

If you're stressed or angry, you may be surprised how much time you spend holding your breath and tightening your belly.

Release, breathe, and relax to find calm.

Stopped rushing.

Rushing is disadvantageous.

Calm people handle life better.

Are aware of their own dietary requirements.

They avoid junk food and eat foods that keep them healthy, happy, and calm.

Don’t take anything personally.

Stressed people control everything.

Self-conscious.

Calm people put others and their work first.

Keep their surroundings neat.

Maintaining an uplifting and clutter-free environment daily calms the mind.

Minimise negative people.

Calm people are ruthless with their boundaries and avoid negative and drama-prone people.

You might also like

Jack Burns

3 years ago

Here's what to expect from NASA Artemis 1 and why it's significant.

NASA's Artemis 1 mission will help return people to the Moon after a half-century break. The mission is a shakedown cruise for NASA's Space Launch System and Orion Crew Capsule.

The spaceship will visit the Moon, deploy satellites, and enter orbit. NASA wants to practice operating the spacecraft, test the conditions people will face on the Moon, and ensure a safe return to Earth.

We asked Jack Burns, a space scientist at the University of Colorado Boulder and former member of NASA's Presidential Transition Team, to describe the mission, explain what the Artemis program promises for space exploration, and reflect on how the space program has changed in the half-century since humans last set foot on the moon.

What distinguishes Artemis 1 from other rockets?

Artemis 1 is the Space Launch System's first launch. NASA calls this a "heavy-lift" vehicle. It will be more powerful than Apollo's Saturn V, which transported people to the Moon in the 1960s and 1970s.

It's a new sort of rocket system with two strap-on solid rocket boosters from the space shuttle. It's a mix of the shuttle and Saturn V.

The Orion Crew Capsule will be tested extensively. It'll spend a month in the high-radiation Moon environment. It will also test the heat shield, which protects the capsule and its occupants at 25,000 mph. The heat shield must work well because this is the fastest capsule descent since Apollo.

This mission will also carry miniature Moon-orbiting satellites. These will undertake vital precursor science, including as examining further into permanently shadowed craters where scientists suspect there is water and measuring the radiation environment to see long-term human consequences.

Artemis 1 will launch, fly to the Moon, place satellites, orbit it, return to Earth, and splash down in the ocean. NASA.

What's Artemis's goal? What launches are next?

The mission is a first step toward Artemis 3, which will lead to the first human Moon missions since 1972. Artemis 1 is unmanned.

Artemis 2 will have astronauts a few years later. Like Apollo 8, it will be an orbital mission that circles the Moon and returns. The astronauts will orbit the Moon longer and test everything with a crew.

Eventually, Artemis 3 will meet with the SpaceX Starship on the Moon's surface and transfer people. Orion will stay in orbit while the lunar Starship lands astronauts. They'll go to the Moon's south pole to investigate the water ice there.

Artemis is reminiscent of Apollo. What's changed in 50 years?

Kennedy wanted to beat the Soviets to the Moon with Apollo. The administration didn't care much about space flight or the Moon, but the goal would place America first in space and technology.

You live and die by the sword if you do that. When the U.S. reached the Moon, it was over. Russia lost. We planted flags and did science experiments. Richard Nixon canceled the program after Apollo 11 because the political goals were attained.

Large rocket with two boosters between two gates

NASA's new Space Launch System is brought to a launchpad. NASA

50 years later... It's quite different. We're not trying to beat the Russians, Chinese, or anyone else, but to begin sustainable space exploration.

Artemis has many goals. It includes harnessing in-situ resources like water ice and lunar soil to make food, fuel, and building materials.

SpaceX is part of this first journey to the Moon's surface, therefore the initiative is also helping to develop a lunar and space economy. NASA doesn't own the Starship but is buying seats for astronauts. SpaceX will employ Starship to transport cargo, private astronauts, and foreign astronauts.

Fifty years of technology advancement has made getting to the Moon cheaper and more practical, and computer technology allows for more advanced tests. 50 years of technological progress have changed everything. Anyone with enough money can send a spacecraft to the Moon, but not humans.

Commercial Lunar Payload Services engages commercial companies to develop uncrewed Moon landers. We're sending a radio telescope to the Moon in January. Even 10 years ago, that was impossible.

Since humans last visited the Moon 50 years ago, technology has improved greatly.

What other changes does Artemis have in store?

The government says Artemis 3 will have at least one woman and likely a person of color.

I'm looking forward to seeing more diversity so young kids can say, "Hey, there's an astronaut that looks like me. I can do this. I can be part of the space program.”

Isaiah McCall

3 years ago

Is TikTok slowly destroying a new generation?

It's kids' digital crack

TikTok is a destructive social media platform.

The interface shortens attention spans and dopamine receptors.

TikTok shares more data than other apps.

Seeing an endless stream of dancing teens on my glowing box makes me feel like a Blade Runner extra.

TikTok did in one year what MTV, Hollywood, and Warner Music tried to do in 20 years. TikTok has psychotized the two-thirds of society Aldous Huxley said were hypnotizable.

Millions of people, mostly kids, are addicted to learning a new dance, lip-sync, or prank, and those who best dramatize this collective improvisation get likes, comments, and shares.

TikTok is a great app. So what?

The Commercial Magnifying Glass TikTok made me realize my generation's time was up and the teenage Zoomers were the target.

I told my 14-year-old sister, "Enjoy your time under the commercial magnifying glass."

TikTok sells your every move, gesture, and thought. Data is the new oil. If you tell someone, they'll say, "Yeah, they collect data, but who cares? I have nothing to hide."

It's a George Orwell novel's beginning. Look up Big Brother Award winners to see if TikTok won.

TikTok shares your data more than any other social media app, and where it goes is unclear. TikTok uses third-party trackers to monitor your activity after you leave the app.

Consumers can't see what data is shared or how it will be used. — Genius URL

32.5 percent of Tiktok's users are 10 to 19 and 29.5% are 20 to 29.

TikTok is the greatest digital marketing opportunity in history, and they'll use it to sell you things, track you, and control your thoughts. Any of its users will tell you, "I don't care, I just want to be famous."

TikTok manufactures mental illness

TikTok's effect on dopamine and the brain is absurd. Dopamine controls the brain's pleasure and reward centers. It's like a switch that tells your brain "this feels good, repeat."

Dr. Julie Albright, a digital culture and communication sociologist, said TikTok users are "carried away by dopamine." It's hypnotic, you'll keep watching."

TikTok constantly releases dopamine. A guy on TikTok recently said he didn't like books because they were slow and boring.

The US didn't ban Tiktok.

Biden and Trump agree on bad things. Both agree that TikTok threatens national security and children's mental health.

The Chinese Communist Party owns and operates TikTok, but that's not its only problem.

There’s borderline child porn on TikTok

It's unsafe for children and violated COPPA.

It's also Chinese spyware. I'm not a Trump supporter, but I was glad he wanted TikTok regulated and disappointed when he failed.

Full-on internet censorship is rare outside of China, so banning it may be excessive. US should regulate TikTok more.

We must reject a low-quality present for a high-quality future.

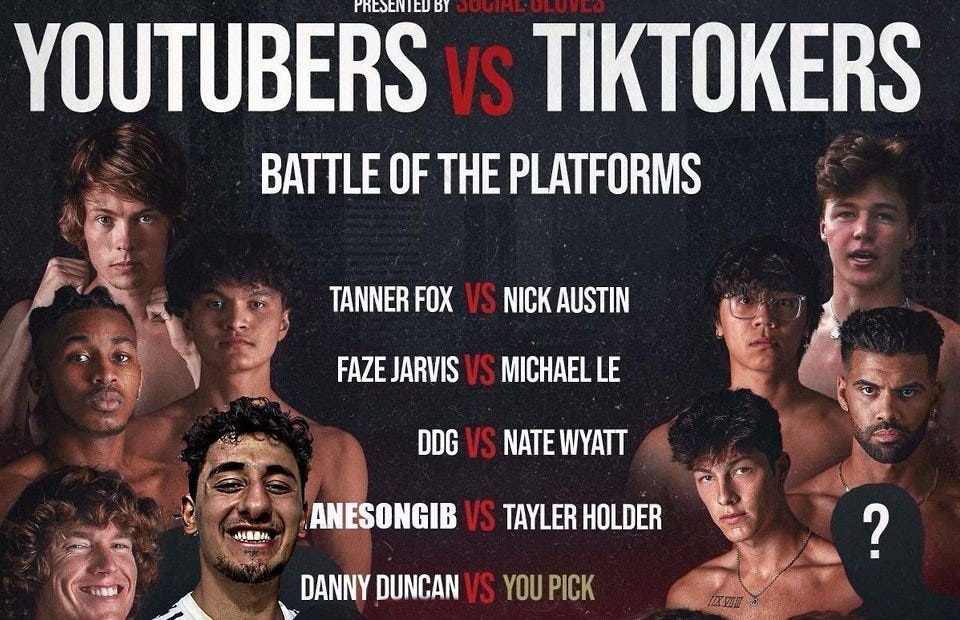

TikTok vs YouTube

People got mad when I wrote about YouTube's death.

They didn't like when I said TikTok was YouTube's first real challenger.

Indeed. TikTok is the fastest-growing social network. In three years, the Chinese social media app TikTok has gained over 1 billion active users. In the first quarter of 2020, it had the most downloads of any app in a single quarter.

TikTok is the perfect social media app in many ways. It's brief and direct.

Can you believe they had a YouTube vs TikTok boxing match? We are doomed as a species.

YouTube hosts my favorite videos. That’s why I use it. That’s why you use it. New users expect more. They want something quicker, more addictive.

TikTok's impact on other social media platforms frustrates me. YouTube copied TikTok to compete.

It's all about short, addictive content.

I'll admit I'm probably wrong about TikTok. My friend says his feed is full of videos about food, cute animals, book recommendations, and hot lesbians.

Whatever.

TikTok makes us bad

TikTok is the opposite of what the Ancient Greeks believed about wisdom.

It encourages people to be fake. It's like a never-ending costume party where everyone competes.

It does not mean that Gen Z is doomed.

They could be the saviors of the world for all I know.

TikTok feels like a step towards Mike Judge's "Idiocracy," where the average person is a pleasure-seeking moron.

Alex Bentley

3 years ago

Why Bill Gates thinks Bitcoin, crypto, and NFTs are foolish

Microsoft co-founder Bill Gates assesses digital assets while the bull is caged.

Bill Gates is well-respected.

Reasonably. He co-founded and led Microsoft during its 1980s and 1990s revolution.

After leaving Microsoft, Bill Gates pursued other interests. He and his wife founded one of the world's largest philanthropic organizations, Bill & Melinda Gates Foundation. He also supports immunizations, population control, and other global health programs.

When Gates criticized Bitcoin, cryptocurrencies, and NFTs, it made news.

Bill Gates said at the 58th Munich Security Conference...

“You have an asset class that’s 100% based on some sort of greater fool theory that somebody’s going to pay more for it than I do.”

Gates means digital assets. Like many bitcoin critics, he says digital coins and tokens are speculative.

And he's not alone. Financial experts have dubbed Bitcoin and other digital assets a "bubble" for a decade.

Gates also made fun of Bored Ape Yacht Club and NFTs, saying, "Obviously pricey digital photographs of monkeys will help the world."

Why does Bill Gates dislike digital assets?

According to Gates' latest comments, Bitcoin, cryptos, and NFTs aren't good ways to hold value.

Bill Gates is a better investor than Elon Musk.

“I’m used to asset classes, like a farm where they have output, or like a company where they make products,” Gates said.

The Guardian claimed in April 2021 that Bill and Melinda Gates owned the most U.S. farms. Over 242,000 acres of farmland.

The Gates couple has enough farmland to cover Hong Kong.

Bill Gates is a classic investor. He wants companies with an excellent track record, strong fundamentals, and good management. Or tangible assets like land and property.

Gates prefers the "old economy" over the "new economy"

Gates' criticism of Bitcoin and cryptocurrency ventures isn't surprising. These digital assets lack all of Gates's investing criteria.

Volatile digital assets include Bitcoin. Their costs might change dramatically in a day. Volatility scares risk-averse investors like Gates.

Gates has a stake in the old financial system. As Microsoft's co-founder, Gates helped develop a dominant tech company.

Because of his business, he's one of the world's richest men.

Bill Gates is invested in protecting the current paradigm.

He won't invest in anything that could destroy the global economy.

When Gates criticizes Bitcoin, cryptocurrencies, and NFTs, he's suggesting they're a hoax. These soapbox speeches are one way he protects his interests.

Digital assets aren't a bad investment, though. Many think they're the future.

Changpeng Zhao and Brian Armstrong are two digital asset billionaires. Two crypto exchange CEOs. Binance/Coinbase.

Digital asset revolution won't end soon.

If you disagree with Bill Gates and plan to invest in Bitcoin, cryptocurrencies, or NFTs, do your own research and understand the risks.

But don’t take Bill Gates’ word for it.

He’s just an old rich guy with a lot of farmland.

He has a lot to lose if Bitcoin and other digital assets gain global popularity.

This post is a summary. Read the full article here.