More on Entrepreneurship/Creators

Pat Vieljeux

3 years ago

The three-year business plan is obsolete for startups.

If asked, run.

An entrepreneur asked me about her pitch deck. A Platform as a Service (PaaS).

She told me she hadn't done her 5-year forecasts but would soon.

I said, Don't bother. I added "time-wasting."

“I've been asked”, she said.

“Who asked?”

“a VC”

“5-year forecast?”

“Yes”

“Get another VC. If he asks, it's because he doesn't understand your solution or to waste your time.”

Some VCs are lagging. They're still using steam engines.

10-years ago, 5-year forecasts were requested.

Since then, we've adopted a 3-year plan.

But It's outdated.

Max one year.

What has happened?

Revolutionary technology. NO-CODE.

Revolution's consequences?

Product viability tests are shorter. Hugely. SaaS and PaaS.

Let me explain:

Building a minimum viable product (MVP) that works only takes a few months.

1 to 2 months for practical testing.

Your company plan can be validated or rejected in 4 months as a consequence.

After validation, you can ask for VC money. Even while a prototype can generate revenue, you may not require any.

Good VCs won't ask for a 3-year business plan in that instance.

One-year, though.

If you want, establish a three-year plan, but realize that the second year will be different.

You may have changed your business model by then.

A VC isn't interested in a three-year business plan because your solution may change.

Your ability to create revenue will be key.

But also, to pivot.

They will be interested in your value proposition.

They will want to know what differentiates you from other competitors and why people will buy your product over another.

What will interest them is your resilience, your ability to bounce back.

Not to mention your mindset. The fact that you won’t get discouraged at the slightest setback.

The grit you have when facing adversity, as challenges will surely mark your journey.

The authenticity of your approach. They’ll want to know that you’re not just in it for the money, let alone to show off.

The fact that you put your guts into it and that you are passionate about it. Because entrepreneurship is a leap of faith, a leap into the void.

They’ll want to make sure you are prepared for it because it’s not going to be a walk in the park.

They’ll want to know your background and why you got into it.

They’ll also want to know your family history.

And what you’re like in real life.

So a 5-year plan…. You can bet they won’t give a damn. Like their first pair of shoes.

Caleb Naysmith

3 years ago

Ads Coming to Medium?

Could this happen?

Medium isn't like other social media giants. It wasn't a dot-com startup that became a multi-trillion-dollar social media firm. It launched in 2012 but didn't gain popularity until later. Now, it's one of the largest sites by web traffic, but it's still little compared to most. Most of Medium's traffic is external, but they don't run advertisements, so it's all about memberships.

Medium isn't profitable, but they don't disclose how terrible the problem is. Most of the $163 million they raised has been spent or used for acquisitions. If the money turns off, Medium can't stop paying its writers since the site dies. Writers must be paid, but they can't substantially slash payment without hurting the platform. The existing model needs scale to be viable and has a low ceiling. Facebook and other free social media platforms are struggling to retain users. Here, you must pay to appreciate it, and it's bad for writers AND readers. If I had the same Medium stats on YouTube, I'd make thousands of dollars a month.

Then what? Medium has tried to monetize by offering writers a cut of new members, but that's unsustainable. People-based growth is limited. Imagine recruiting non-Facebook users and getting them to pay to join. Some may, but I'd rather write.

Alternatives:

Donation buttons

Tiered subscriptions ($5, $10, $25, etc.)

Expanding content

and these may be short-term fixes, but they're not as profitable as allowing ads. Advertisements can pay several dollars per click and cents every view. If you get 40,000 views a month like me, that's several thousand instead of a few hundred. Also, Medium would have enough money to split ad revenue with writers, who would make more. I'm among the top 6% of Medium writers. Only 6% of Medium writers make more than $100, and I made $500 with 35,000 views last month. Compared to YouTube, the top 1% of Medium authors make a lot. Mr. Beast and PewDiePie make MILLIONS a month, yet top Medium writers make tens of thousands. Sure, paying 3 or 4 people a few grand, or perhaps tens of thousands, will keep them around. What if great authors leveraged their following to go huge on YouTube and abandoned Medium? If people use Medium to get successful on other platforms, Medium will be continuously cycling through authors and paying them to stay.

Ads might make writing on Medium more profitable than making videos on YouTube because they could preserve the present freemium model and pay users based on internal views. The $5 might be ad-free.

Consider: Would you accept Medium ads? A $5 ad-free version + pay-as-you-go, etc. What are your thoughts on this?

Original post available here

Sammy Abdullah

3 years ago

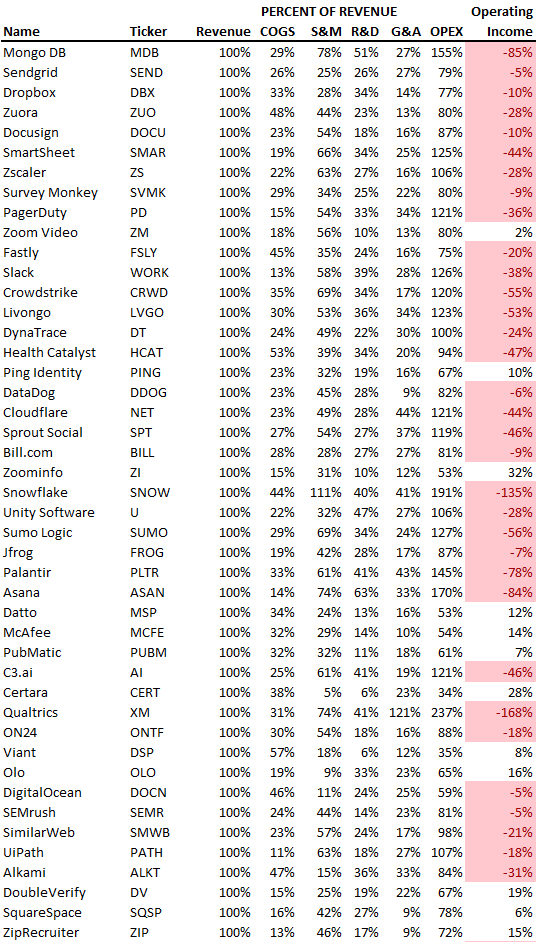

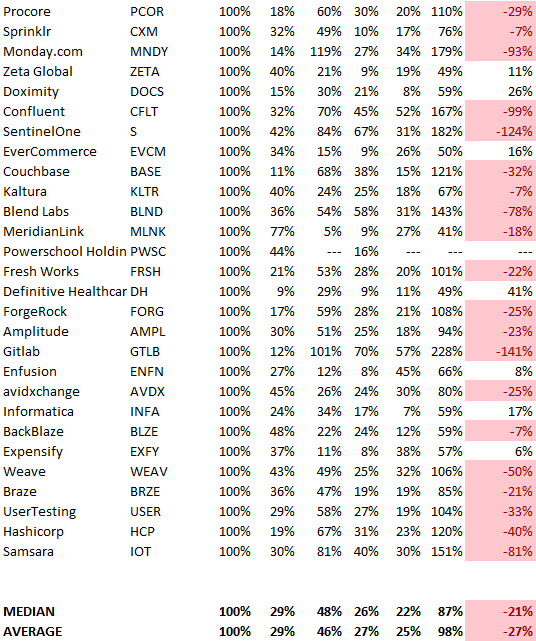

R&D, S&M, and G&A expense ratios for SaaS

SaaS spending is 40/40/20. 40% of operating expenses should be R&D, 40% sales and marketing, and 20% G&A. We wanted to see the statistics behind the rules of thumb. Since October 2017, 73 SaaS startups have gone public. Perhaps the rule of thumb should be 30/50/20. The data is below.

30/50/20. R&D accounts for 26% of opex, sales and marketing 48%, and G&A 22%. We think R&D/S&M/G&A should be 30/50/20.

There are outliers. There are exceptions to rules of thumb. Dropbox spent 45% on R&D whereas Zoom spent 13%. Zoom spent 73% on S&M, Dropbox 37%, and Bill.com 28%. Snowflake spent 130% of revenue on S&M, while their EBITDA margin is -192%.

G&A shouldn't stand out. Minimize G&A spending. Priorities should be product development and sales. Cloudflare, Sendgrid, Snowflake, and Palantir spend 36%, 34%, 37%, and 43% on G&A.

Another myth is that COGS is 20% of revenue. Median and averages are 29%.

Where is the profitability? Data-driven operating income calculations were simplified (Revenue COGS R&D S&M G&A). 20 of 73 IPO businesses reported operational income. Median and average operating income margins are -21% and -27%.

As long as you're growing fast, have outstanding retention, and marquee clients, you can burn cash since recurring income that doesn't churn is a valuable annuity.

The data was compelling overall. 30/50/20 is the new 40/40/20 for more established SaaS enterprises, unprofitability is alright as long as your business is expanding, and COGS can be somewhat more than 20% of revenue.

You might also like

Aldric Chen

3 years ago

Jack Dorsey's Meeting Best Practice was something I tried. It Performs Exceptionally Well in Consulting Engagements.

Yes, client meetings are difficult. Especially when I'm alone.

Clients must tell us their problems so we can help.

In-meeting challenges contribute nothing to our work. Consider this:

Clients are unprepared.

Clients are distracted.

Clients are confused.

Introducing Jack Dorsey's Google Doc approach

I endorse his approach to meetings.

Not Google Doc-related. Jack uses it for meetings.

This is what his meetings look like.

Prior to the meeting, the Chair creates the agenda, structure, and information using Google Doc.

Participants in the meeting would have 5-10 minutes to read the Google Doc.

They have 5-10 minutes to type their comments on the document.

In-depth discussion begins

There is elegance in simplicity. Here's how Jack's approach is fantastic.

Unprepared clients are given time to read.

During the meeting, they think and work on it.

They can see real-time remarks from others.

Discussion ensues.

Three months ago, I fell for this strategy. After trying it with a client, I got good results.

I conducted social control experiments in a few client workshops.

Context matters.

I am sure Jack Dorsey’s method works well in meetings. What about client workshops?

So, I tested Enterprise of the Future with a consulting client.

I sent multiple emails to client stakeholders describing the new approach.

No PowerPoints that day. I spent the night setting up the Google Doc with conversation topics, critical thinking questions, and a Before and After section.

The client was shocked. First, a Google Doc was projected. Second surprise was a verbal feedback.

“No pre-meeting materials?”

“Don’t worry. I know you are not reading it before our meeting, anyway.”

We laughed. The experiment started.

Observations throughout a 90-minute engagement workshop from beginning to end

For 10 minutes, the workshop was silent.

People read the Google Doc. For some, the silence was unnerving.

“Are you not going to present anything to us?”

I said everything's in Google Doc. I asked them to read, remark, and add relevant paragraphs.

As they unlocked their laptops, they were annoyed.

Ten client stakeholders are typing on the Google Doc. My laptop displays comment bubbles, red lines, new paragraphs, and strikethroughs.

The first 10 minutes were productive. Everyone has seen and contributed to the document.

I was silent.

The move to a classical workshop was smooth. I didn't stimulate dialogue. They did.

Stephanie asked Joe why a blended workforce hinders company productivity. She questioned his comments and additional paragraphs.

That is when a light bulb hit my head. Yes, you want to speak to the right person to resolve issues!

Not only that was discussed. Others discussed their remark bubbles with neighbors. Debate circles sprung up one after the other.

The best part? I asked everyone to add their post-discussion thoughts on a Google Doc.

After the workshop, I have:

An agreement-based working document

A post-discussion minutes that are prepared for publication

A record of the discussion points that were brought up, argued, and evaluated critically

It showed me how stakeholders viewed their Enterprise of the Future. It allowed me to align with them.

Finale Keynotes

Client meetings are a hit-or-miss. I know that.

Jack Dorsey's meeting strategy works for consulting. It promotes session alignment.

It relieves clients of preparation.

I get the necessary information to advance this consulting engagement.

It is brilliant.

Sukhad Anand

3 years ago

How Do Discord's Trillions Of Messages Get Indexed?

They depend heavily on open source..

Discord users send billions of messages daily. Users wish to search these messages. How do we index these to search by message keywords?

Let’s find out.

Discord utilizes Elasticsearch. Elasticsearch is a free, open search engine for textual, numerical, geographical, structured, and unstructured data. Apache Lucene powers Elasticsearch.

How does elastic search store data? It stores it as numerous key-value pairs in JSON documents.

How does elastic search index? Elastic search's index is inverted. An inverted index lists every unique word in every page and where it appears.

4. Elasticsearch indexes documents and generates an inverted index to make data searchable in near real-time. The index API adds or updates JSON documents in a given index.

Let's examine how discord uses Elastic Search. Elasticsearch prefers bulk indexing. Discord couldn't index real-time messages. You can't search posted messages. You want outdated messages.

6. Let's check what bulk indexing requires.

1. A temporary queue for incoming communications.

2. Indexer workers that index messages into elastic search.

Discord's queue is Celery. The queue is open-source. Elastic search won't run on a single server. It's clustered. Where should a message go? Where?

8. A shard allocator decides where to put the message. Nevertheless. Shattered? A shard combines elastic search and index on. So, these two form a shard which is used as a unit by discord. The elastic search itself has some shards. But this is different, so don’t get confused.

Now, the final part is service discovery — to discover the elastic search clusters and the hosts within that cluster. This, they do with the help of etcd another open source tool.

A great thing to notice here is that discord relies heavily on open source systems and their base implementations which is very different from a lot of other products.

Francesca Furchtgott

3 years ago

Giving customers what they want or betraying the values of the brand?

A J.Crew collaboration for fashion label Eveliina Vintage is not a paradox; it is a solution.

Eveliina Vintage's capsule collection debuted yesterday at J.Crew. This J.Crew partnership stopped me in my tracks.

Eveliina Vintage sells vintage goods. Eeva Musacchia founded the shop in Finland in the 1970s. It's recognized for its one-of-a-kind slip dresses from the 1930s and 1940s.

I wondered why a vintage brand would partner with a mass shop. Fast fashion against vintage shopping? Will Eveliina Vintages customers be turned off?

But Eveliina Vintages customers don't care about sustainability. They want Eveliina's Instagram look. Eveliina Vintage collaborated with J.Crew to give customers what they wanted: more Eveliina at a lower price.

Vintage: A Fashion Option That Is Eco-Conscious

Secondhand shopping is a trendy response to quick fashion. J.Crew releases hundreds of styles annually. Waste and environmental damage have been criticized. A pair of jeans requires 1,800 gallons of water. J.Crew's limited-time deals promote more purchases. J.Crew items are likely among those Americans wear 7 times before discarding.

Consumers and designers have emphasized sustainability in recent years. Stella McCartney and Eileen Fisher are popular eco-friendly brands. They've also flocked to ThredUp and similar sites.

Gap, Levis, and Allbirds have listened to consumer requests. They promote recycling, ethical sourcing, and secondhand shopping.

Secondhand shoppers feel good about reusing and recycling clothing that might have ended up in a landfill.

Eco-conscious fashionistas shop vintage. These shoppers enjoy the thrill of the hunt (that limited-edition Chanel bag!) and showing off a unique piece (nobody will have my look!). They also reduce their environmental impact.

Is Eveliina Vintage capitalizing on an aesthetic or is it a sustainable brand?

Eveliina Vintage emphasizes environmental responsibility. Vogue's Amanda Musacchia emphasized sustainability. Amanda, founder Eeva's daughter, is a company leader.

But Eveliina's press message doesn't address sustainability, unlike Instagram. Scarcity and fame rule.

Eveliina Vintages Instagram has see-through dresses and lace-trimmed slip dresses. Celebrities and influencers are often photographed in Eveliina's apparel, which has 53,000+ followers. Vogue appreciates Eveliina's style. Multiple publications discuss Alexa Chung's Eveliina dress.

Eveliina Vintage markets its one-of-a-kind goods. It teases future content, encouraging visitors to return. Scarcity drives demand and raises clothing prices. One dress is $1,600+, but most are $500-$1,000.

The catch: Eveliina can't monetize its expanding popularity due to exorbitant prices and limited quantity. Why?

Most people struggle to pay for their clothing. But Eveliina Vintage lacks those more affordable entry-level products, in contrast to other luxury labels that sell accessories or perfume.

Many people have trouble fitting into their clothing. The bodies of most women in the past were different from those for which vintage clothing was designed. Each Eveliina dress's specific measurements are mentioned alongside it. Be careful, you can fall in love with an ill-fitting dress.

No matter how many people can afford it and fit into it, there is only one item to sell. To get the item before someone else does, those people must be on the Eveliina Vintage website as soon as it becomes available.

A Way for Eveliina Vintage to Make Money (and Expand) with J.Crew Its following

Eveliina Vintages' cooperation with J.Crew makes commercial sense.

This partnership spreads Eveliina's style. Slightly better pricing The $390 outfits have multicolored slips and gauzy cotton gowns. Sizes range from 00 to 24, which is wider than vintage racks.

Eveliina Vintage customers like the combination. Excited comments flood the brand's Instagram launch post. Nobody is mocking the 50-year-old vintage brand's fast-fashion partnership.

Vintage may be a sustainable fashion trend, but that's not why Eveliina's clients love the brand. They only care about the old look.

And that is a tale as old as fashion.