More on Entrepreneurship/Creators

Tim Denning

3 years ago

Elon Musk’s Rich Life Is a Nightmare

I'm sure you haven't read about Elon's other side.

Elon divorced badly.

Nobody's surprised.

Imagine you're a parent. Someone isn't home year-round. What's next?

That’s what happened to YOLO Elon.

He can do anything. He can intervene in wars, shoot his mouth off, bang anyone he wants, avoid tax, make cool tech, buy anything his ego desires, and live anywhere exotic.

Few know his billionaire backstory. I'll tell you so you don't worship his lifestyle. It’s a cult.

Only his career succeeds. His life is a nightmare otherwise.

Psychopaths' schedule

Elon has said he works 120-hour weeks.

As he told the reporter about his job, he choked up, which was unusual for him.

His crazy workload and lack of sleep forced him to scold innocent Wall Street analysts. Later, he apologized.

In the same interview, he admits he hadn't taken more than a week off since 2001, when he was bedridden with malaria. Elon stays home after a near-death experience.

He's rarely outside.

Elon says he sometimes works 3 or 4 days straight.

He admits his crazy work schedule has cost him time with his kids and friends.

Elon's a slave

Elon's birthday description made him emotional.

Elon worked his entire birthday.

"No friends, nothing," he said, stuttering.

His brother's wedding in Catalonia was 48 hours after his birthday. That meant flying there from Tesla's factory prison.

He arrived two hours before the big moment, barely enough time to eat and change, let alone see his brother.

Elon had to leave after the bouquet was tossed to a crowd of billionaire lovers. He missed his brother's first dance with his wife.

Shocking.

He went straight to Tesla's prison.

The looming health crisis

Elon was asked if overworking affected his health.

Not great. Friends are worried.

Now you know why Elon tweets dumb things. Working so hard has probably caused him mental health issues.

Mental illness removed my reality filter. You do stupid things because you're tired.

Astronauts pelted Elon

Elon's overwork isn't the first time his life has made him emotional.

When asked about Neil Armstrong and Gene Cernan criticizing his SpaceX missions, he got emotional. Elon's heroes.

They're why he started the company, and they mocked his work. In another interview, we see how Elon’s business obsession has knifed him in the heart.

Once you have a company, you must feed, nurse, and care for it, even if it destroys you.

"Yep," Elon says, tearing up.

In the same interview, he's asked how Tesla survived the 2008 recession. Elon stopped the interview because he was crying. When Tesla and SpaceX filed for bankruptcy in 2008, he nearly had a nervous breakdown. He called them his "children."

All the time, he's risking everything.

Jack Raines explains best:

Too much money makes you a slave to your net worth.

Elon's emotions are admirable. It's one of the few times he seems human, not like an alien Cyborg.

Stop idealizing Elon's lifestyle

Building a side business that becomes a billion-dollar unicorn startup is a nightmare.

"Billionaire" means financially wealthy but otherwise broke. A rich life includes more than business and money.

This post is a summary. Read full article here

SAHIL SAPRU

3 years ago

How I grew my business to a $5 million annual recurring revenue

Scaling your startup requires answering customer demands, not growth tricks.

I cofounded Freedo Rentals in 2019. I reached 50 lakh+ ARR in 6 months before quitting owing to the epidemic.

Freedo aimed to solve 2 customer pain points:

Users lacked a reliable last-mile transportation option.

The amount that Auto walas charge for unmetered services

Solution?

Effectively simple.

Build ports at high-demand spots (colleges, residential societies, metros). Electric ride-sharing can meet demand.

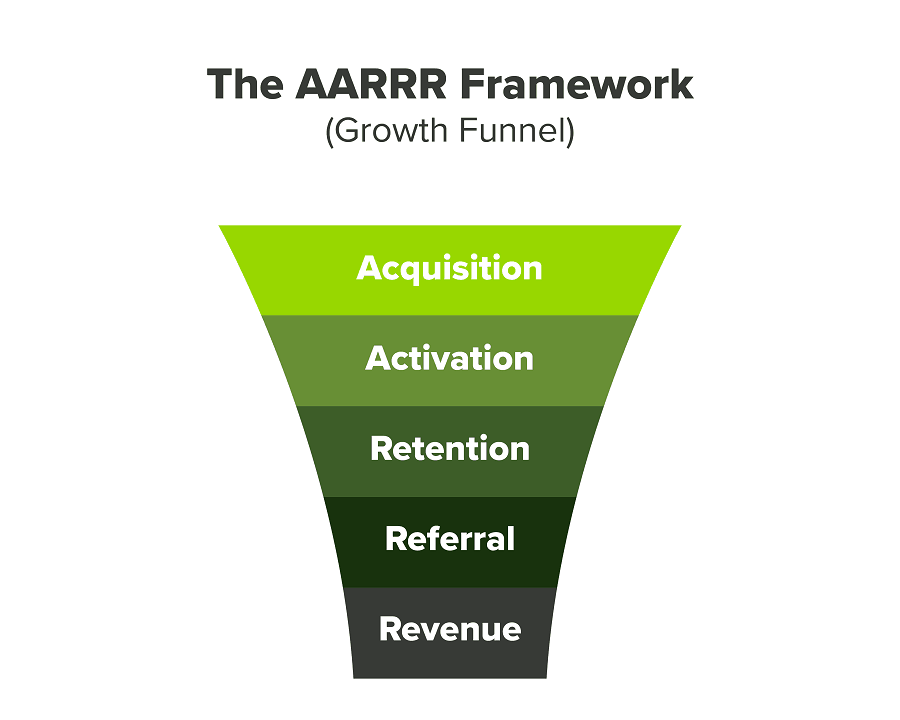

We had many problems scaling. I'll explain using the AARRR model.

Brand unfamiliarity or a novel product offering were the problems with awareness. Nobody knew what Freedo was or what it did.

Problem with awareness: Content and advertisements did a poor job of communicating the task at hand. The advertisements clashed with the white-collar part because they were too cheesy.

Retention Issue: We encountered issues, indicating that the product was insufficient. Problems with keyless entry, creating bills, stealing helmets, etc.

Retention/Revenue Issue: Costly compared to established rivals. Shared cars were 1/3 of our cost.

Referral Issue: Missing the opportunity to seize the AHA moment. After the ride, nobody remembered us.

Once you know where you're struggling with AARRR, iterative solutions are usually best.

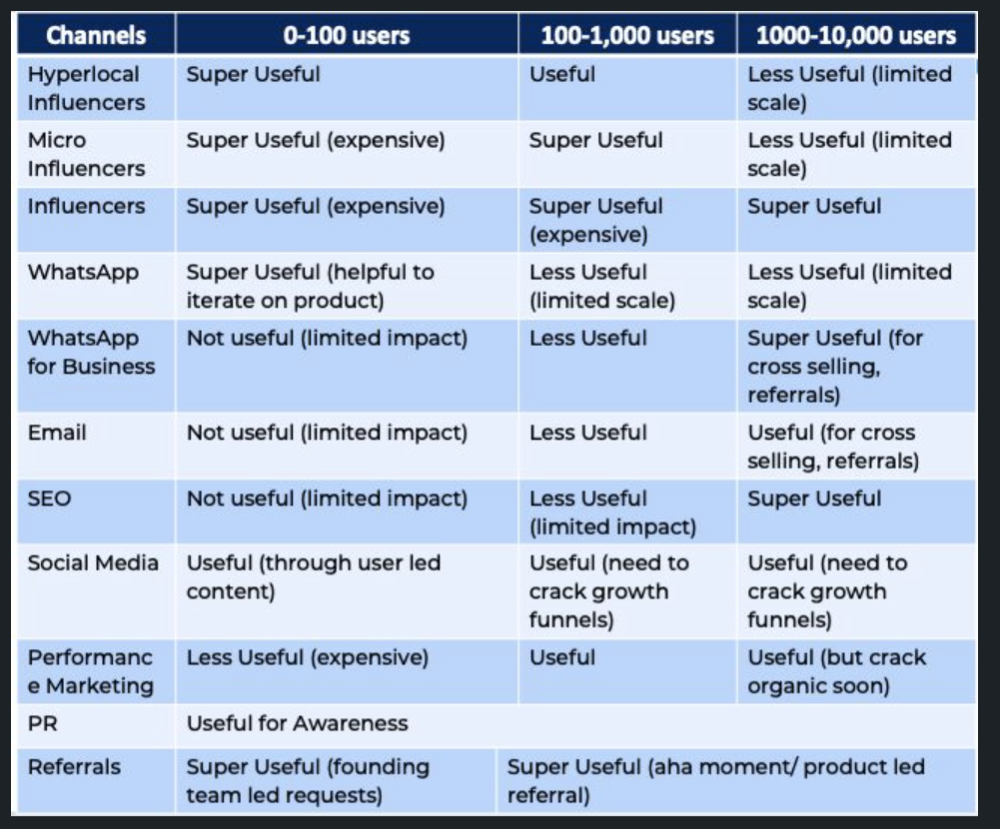

Once you have nailed the AARRR model, most startups use paid channels to scale. This dependence, on paid channels, increases with scale unless you crack your organic/inbound game.

Over-index growth loops. Growth loops increase inflow and customers as you scale.

When considering growth, ask yourself:

Who is the solution's ICP (Ideal Customer Profile)? (To whom are you selling)

What are the most important messages I should convey to customers? (This is an A/B test.)

Which marketing channels ought I prioritize? (Conduct analysis based on the startup's maturity/stage.)

Choose the important metrics to monitor for your AARRR funnel (not all metrics are equal)

Identify the Flywheel effect's growth loops (inertia matters)

My biggest mistakes:

not paying attention to consumer comments or satisfaction. It is the main cause of problems with referrals, retention, and acquisition for startups. Beyond your NPS, you should consider second-order consequences.

The tasks at hand should be quite clear.

Here's my scaling equation:

Growth = A x B x C

A = Funnel top (Traffic)

B = Product Valuation (Solving a real pain point)

C = Aha! (Emotional response)

Freedo's A, B, and C created a unique offering.

Freedo’s ABC:

A — Working or Studying population in NCR

B — Electric Vehicles provide last-mile mobility as a clean and affordable solution

C — One click booking with a no-noise scooter

Final outcome:

FWe scaled Freedo to Rs. 50 lakh MRR and were growing 60% month on month till the pandemic ceased our growth story.

How we did it?

We tried ambassadors and coupons. WhatsApp was our most successful A/B test.

We grew widespread adoption through college and society WhatsApp groups. We requested users for referrals in community groups.

What worked for us won't work for others. This scale underwent many revisions.

Every firm is different, thus you must know your customers. Needs to determine which channel to prioritize and when.

Users desired a safe, time-bound means to get there.

This (not mine) growth framework helped me a lot. You should follow suit.

Benjamin Lin

3 years ago

I sold my side project for $20,000: 6 lessons I learned

How I monetized and sold an abandoned side project for $20,000

The Origin Story

I've always wanted to be an entrepreneur but never succeeded. I often had business ideas, made a landing page, and told my buddies. Never got customers.

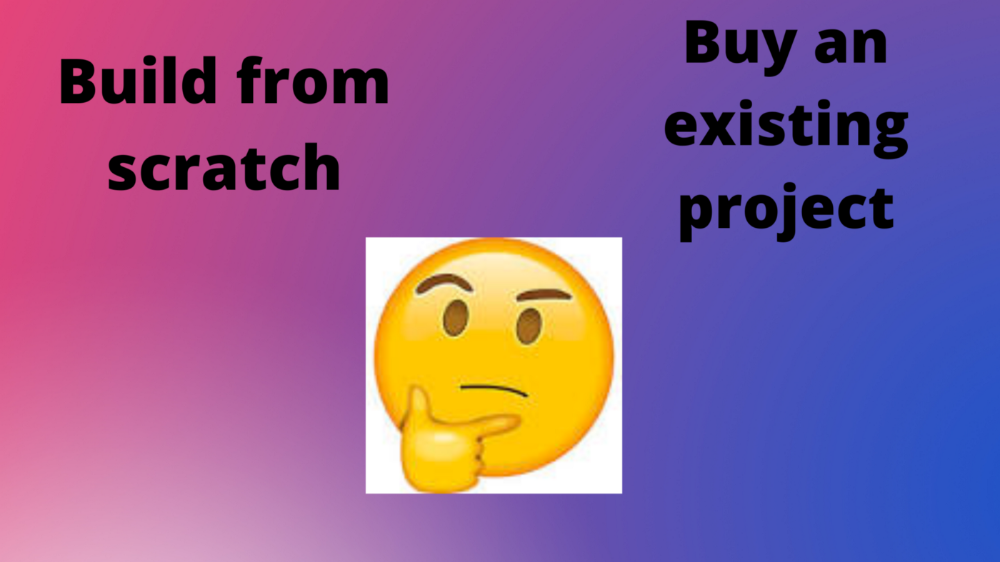

In April 2021, I decided to try again with a new strategy. I noticed that I had trouble acquiring an initial set of customers, so I wanted to start by acquiring a product that had a small user base that I could grow.

I found a SaaS marketplace called MicroAcquire.com where you could buy and sell SaaS products. I liked Shareit.video, an online Loom-like screen recorder.

Shareit.video didn't generate revenue, but 50 people visited daily to record screencasts.

Purchasing a Failed Side Project

I eventually bought Shareit.video for $12,000 from its owner.

$12,000 was probably too much for a website without revenue or registered users.

I thought time was most important. I could have recreated the website, but it would take months. $12,000 would give me an organized code base and a working product with a few users to monetize.

I considered buying a screen recording website and trying to grow it versus buying a new car or investing in crypto with the $12K.

Buying the website would make me a real entrepreneur, which I wanted more than anything.

Putting down so much money would force me to commit to the project and prevent me from quitting too soon.

A Year of Development

I rebranded the website to be called RecordJoy and worked on it with my cousin for about a year. Within a year, we made $5000 and had 3000 users.

We spent $3500 on ads, hosting, and software to run the business.

AppSumo promoted our $120 Life Time Deal in exchange for 30% of the revenue.

We put RecordJoy on maintenance mode after 6 months because we couldn't find a scalable user acquisition channel.

We improved SEO and redesigned our landing page, but nothing worked.

Despite not being able to grow RecordJoy any further, I had already learned so much from working on the project so I was fine with putting it on maintenance mode. RecordJoy still made $500 a month, which was great lunch money.

Getting Taken Over

One of our customers emailed me asking for some feature requests and I replied that we weren’t going to add any more features in the near future. They asked if we'd sell.

We got on a call with the customer and I asked if he would be interested in buying RecordJoy for 15k. The customer wanted around $8k but would consider it.

Since we were negotiating with one buyer, we put RecordJoy on MicroAcquire to see if there were other offers.

We quickly received 10+ offers. We got 18.5k. There was also about $1000 in AppSumo that we could not withdraw, so we agreed to transfer that over for $600 since about 40% of our sales on AppSumo usually end up being refunded.

Lessons Learned

First, create an acquisition channel

We couldn't discover a scalable acquisition route for RecordJoy. If I had to start another project, I'd develop a robust acquisition channel first. It might be LinkedIn, Medium, or YouTube.

Purchase Power of the Buyer Affects Acquisition Price

Some of the buyers we spoke to were individuals looking to buy side projects, as well as companies looking to launch a new product category. Individual buyers had less budgets than organizations.

Customers of AppSumo vary.

AppSumo customers value lifetime deals and low prices, which may not be a good way to build a business with recurring revenue. Designed for AppSumo users, your product may not connect with other users.

Try to increase acquisition trust

Acquisition often fails. The buyer can go cold feet, cease communicating, or run away with your stuff. Trusting the buyer ensures a smooth asset exchange. First acquisition meeting was unpleasant and price negotiation was tight. In later meetings, we spent the first few minutes trying to get to know the buyer’s motivations and background before jumping into the negotiation, which helped build trust.

Operating expenses can reduce your earnings.

Monitor operating costs. We were really happy when we withdrew the $5000 we made from AppSumo and Stripe until we realized that we had spent $3500 in operating fees. Spend money on software and consultants to help you understand what to build.

Don't overspend on advertising

We invested $1500 on Google Ads but made little money. For a side project, it’s better to focus on organic traffic from SEO rather than paid ads unless you know your ads are going to have a positive ROI.

You might also like

Recep İnanç

3 years ago

Effective Technical Book Reading Techniques

Technical books aren't like novels. We need a new approach to technical texts. I've spent years looking for a decent reading method. I tried numerous ways before finding one that worked. This post explains how I read technical books efficiently.

What Do I Mean When I Say Effective?

Effectiveness depends on the book. Effective implies I know where to find answers after reading a reference book. Effective implies I learned the book's knowledge after reading it.

I use reference books as tools in my toolkit. I won't carry all my tools; I'll merely need them. Non-reference books teach me techniques. I never have to make an effort to use them since I always have them.

Reference books I like:

Design Patterns: Elements of Reusable Object-Oriented Software

Refactoring: Improving the Design of Existing Code

You can also check My Top Takeaways from Refactoring here.

Non-reference books I like:

The Approach

Technical books might be overwhelming to read in one sitting. Especially when you have no idea what is coming next as you read. When you don't know how deep the rabbit hole goes, you feel lost as you read. This is my years-long method for overcoming this difficulty.

Whether you follow the step-by-step guide or not, remember these:

Understand the terminology. Make sure you get the meaning of any terms you come across more than once. The likelihood that a term will be significant increases as you encounter it more frequently.

Know when to stop. I've always believed that in order to truly comprehend something, I must delve as deeply as possible into it. That, however, is not usually very effective. There are moments when you have to draw the line and start putting theory into practice (if applicable).

Look over your notes. When reading technical books or documents, taking notes is a crucial habit to develop. Additionally, you must regularly examine your notes if you want to get the most out of them. This will assist you in internalizing the lessons you acquired from the book. And you'll see that the urge to review reduces with time.

Let's talk about how I read a technical book step by step.

0. Read the Foreword/Preface

These sections are crucial in technical books. They answer Who should read it, What each chapter discusses, and sometimes How to Read? This is helpful before reading the book. Who could know the ideal way to read the book better than the author, right?

1. Scanning

I scan the chapter. Fast scanning is needed.

I review the headings.

I scan the pictures quickly.

I assess the chapter's length to determine whether I might divide it into more manageable sections.

2. Skimming

Skimming is faster than reading but slower than scanning.

I focus more on the captions and subtitles for the photographs.

I read each paragraph's opening and closing sentences.

I examined the code samples.

I attempt to grasp each section's basic points without getting bogged down in the specifics.

Throughout the entire reading period, I make an effort to make mental notes of what may require additional attention and what may not. Because I don't want to spend time taking physical notes, kindly notice that I am using the term "mental" here. It is much simpler to recall. You may think that this is more significant than typing or writing “Pay attention to X.”

I move on quickly. This is something I considered crucial because, when trying to skim, it is simple to start reading the entire thing.

3. Complete reading

Previous steps pay off.

I finished reading the chapter.

I concentrate on the passages that I mentally underlined when skimming.

I put the book away and make my own notes. It is typically more difficult than it seems for me. But it's important to speak in your own words. You must choose the right words to adequately summarize what you have read. How do those words make you feel? Additionally, you must be able to summarize your notes while you are taking them. Sometimes as I'm writing my notes, I realize I have no words to convey what I'm thinking or, even worse, I start to doubt what I'm writing down. This is a good indication that I haven't internalized that idea thoroughly enough.

I jot my inquiries down. Normally, I read on while compiling my questions in the hopes that I will learn the answers as I read. I'll explore those issues more if I wasn't able to find the answers to my inquiries while reading the book.

Bonus!

Best part: If you take lovely notes like I do, you can publish them as a blog post with a few tweaks.

Conclusion

This is my learning journey. I wanted to show you. This post may help someone with a similar learning style. You can alter the principles above for any technical material.

Katharine Valentino

3 years ago

A Gun-toting Teacher Is Like a Cook With Rat Poison

Pink or blue AR-15s?

A teacher teaches; a gun kills. Killing isn't teaching. Killing is opposite of teaching.

Without 27 school shootings this year, we wouldn't be talking about arming teachers. Gun makers, distributors, and the NRA cause most school shootings. Gun makers, distributors, and the NRA wouldn't be huge business if weapons weren't profitable.

Guns, ammo, body armor, holsters, concealed carriers, bore sights, cleaner kits, spare magazines and speed loaders, gun safes, and ear protection are sold. And more guns.

And lots more profit.

Guns aren't bread. You eat a loaf of bread in a week or so and then must buy more. Bread makers will make money. Winchester 94.30–30 1899 Lever Action Rifle from 1894 still kills. (For safety, I won't link to the ad.) Gun makers don't object if you collect antique weapons, but they need you to buy the latest, in-style killing machine. The youngster who killed 19 students and 2 teachers at Robb Elementary School in Uvalde, Texas, used an AR-15. Better yet, two.

Salvador Ramos, the Robb Elementary shooter, is a "killing influencer" He pushes consumers to buy items, which benefits manufacturers and distributors. Like every previous AR-15 influencer, he profits Colt, the rifle's manufacturer, and 52,779 gun dealers in the U.S. Ramos and other AR-15 influences make us fear for our safety and our children's. Fearing for our safety, we acquire 20 million firearms a year and live in a gun culture.

So now at school, we want to arm teachers.

Consider. Which of your teachers would you have preferred in body armor with a gun drawn?

Miss Summers? Remember her bringing daisies from her yard to second grade? She handed each student a beautiful flower. Miss Summers loved everyone, even those with AR-15s. She can't shoot.

Frasier? Mr. Frasier turned a youngster over down to explain "invert." Mr. Frasier's hands shook when he wasn't flipping fifth-graders and fractions. He may have shot wrong.

Mrs. Barkley barked in high school English class when anyone started an essay with "But." Mrs. Barkley dubbed Abie a "Jewboy" and gave him terrible grades. Arming Miss Barkley is like poisoning the chef.

Think back. Do you remember a teacher with a gun? No. Arming teachers so the gun industry can make more money is the craziest idea ever.

Or maybe you agree with Ted Cruz, the gun lobby-bought senator, that more guns reduce gun violence. After the next school shooting, you'll undoubtedly talk about arming teachers and pupils. Colt will likely develop a backpack-sized, lighter version of its popular killing machine in pink and blue for kids and boys. The MAR-15? (M for mini).

This post is a summary. Read the full one here.

Tom Smykowski

3 years ago

CSS Scroll-linked Animations Will Transform The Web's User Experience

We may never tap again in ten years.

I discussed styling websites and web apps on smartwatches in my earlier article on W3C standardization.

The Parallax Chronicles

Section containing examples and flying objects

Another intriguing Working Draft I found applies to all devices, including smartphones.

These pages may have something intriguing. Take your time. Return after scrolling:

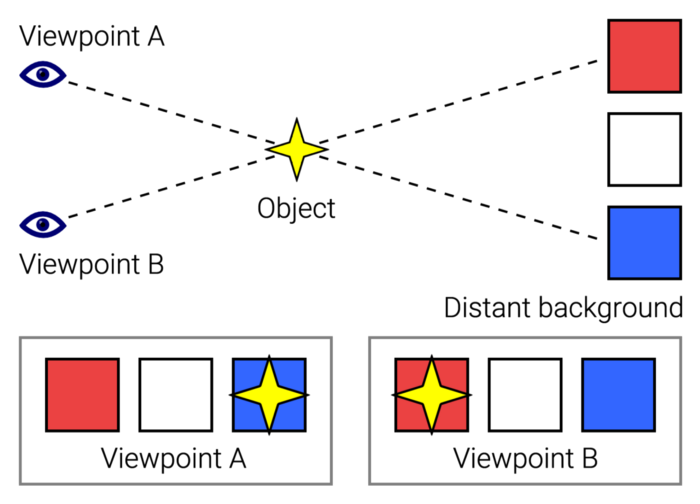

What connects these three pages?

JustinWick at English Wikipedia • CC-BY-SA-3.0

Scroll-linked animation, commonly called parallax, is the effect.

WordPress theme developers' quick setup and low-code tools made the effect popular around 2014.

Parallax: Why Designers Love It

The chapter that your designer shouldn't read

Online video playback required searching, scrolling, and clicking ten years ago. Scroll and click four years ago.

Some video sites let you swipe to autoplay the next video from an endless list.

UI designers create scrollable pages and apps to accommodate the behavioral change.

Web interactivity used to be mouse-based. Clicking a button opened a help drawer, and hovering animated it.

However, a large page with more material requires fewer buttons and less interactiveness.

Designers choose scroll-based effects. Design and frontend developers must fight the trend but prepare for the worst.

How to Create Parallax

The component that you might want to show the designer

JavaScript-based effects track page scrolling and apply animations.

Javascript libraries like lax.js simplify it.

Using it needs a lot of human mathematical and physical computations.

Your asset library must also be prepared to display your website on a laptop, television, smartphone, tablet, foldable smartphone, and possibly even a microwave.

Overall, scroll-based animations can be solved better.

CSS Scroll-linked Animations

CSS makes sense since it's presentational. A Working Draft has been laying the groundwork for the next generation of interactiveness.

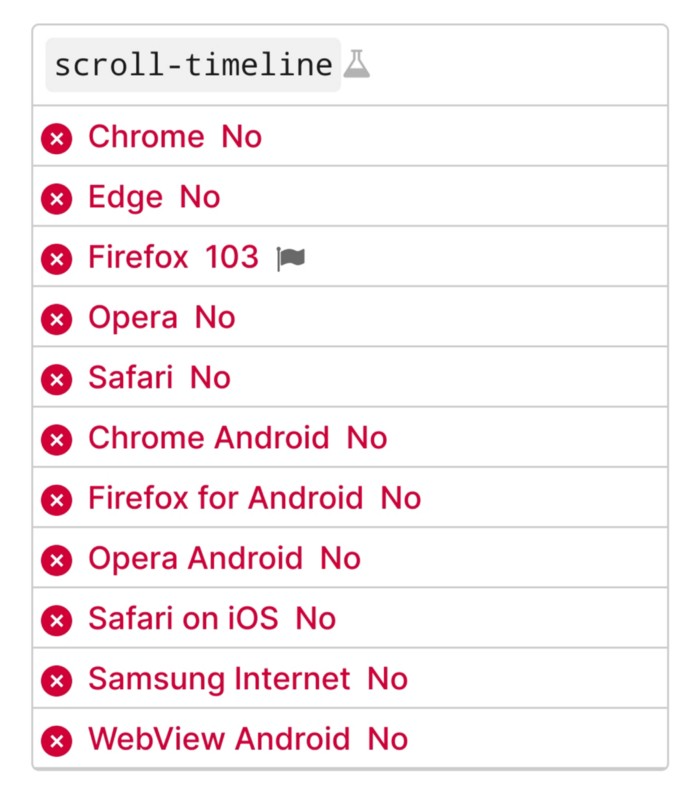

The new CSS property scroll-timeline powers the feature, which MDN describes well.

Before testing it, you should realize it is poorly supported:

Firefox 103 currently supports it.

There is also a polyfill, with some demo examples to explore.

Summary

Web design was a protracted process. Started with pages with static backdrop images and scrollable text. Artists and designers may use the scroll-based animation CSS API to completely revamp our web experience.

It's a promising frontier. This post may attract a future scrollable web designer.

Ps. I have created flashcards for HTML, Javascript etc. Check them out!