More on Entrepreneurship/Creators

Jenn Leach

3 years ago

I created a faceless TikTok account. Six months later.

Follower count, earnings, and more

I created my 7th TikTok account six months ago. TikTok's great. I've developed accounts for Amazon products, content creators/brand deals education, website flipping, and more.

Introverted or shy people use faceless TikTok accounts.

Maybe they don't want millions of people to see their face online, or they want to remain anonymous so relatives and friends can't locate them.

Going faceless on TikTok can help you grow a following, communicate your message, and make money online.

Here are 6 steps I took to turn my Tik Tok account into a $60,000/year side gig.

From nothing to $60K in 6 months

It's clickbait, but it’s true. Here’s what I did to get here.

Quick context:

I've used social media before. I've spent years as a social creator and brand.

I've built Instagram, TikTok, and YouTube accounts to nearly 100K.

How I did it

First, select a niche.

If you can focus on one genre on TikTok, you'll have a better chance of success, however lifestyle creators do well too.

Niching down is easier, in my opinion.

Examples:

Travel

Food

Kids

Earning cash

Finance

You can narrow these niches if you like.

During the pandemic, a travel blogger focused on Texas-only tourism and gained 1 million subscribers.

Couponing might be a finance specialization.

One of my finance TikTok accounts gives credit tips and grants and has 23K followers.

Tons of ways you can get more specific.

Consider how you'll monetize your TikTok account. I saw many enormous TikTok accounts that lose money.

Why?

They can't monetize their niche. Not impossible to commercialize, but tough enough to inhibit action.

First, determine your goal.

In this first step, consider what your end goal is.

Are you trying to promote your digital products or social media management services?

You want brand deals or e-commerce sales.

This will affect your TikTok specialty.

This is the first step to a TikTok side gig.

Step 2: Pick a content style

Next, you want to decide on your content style.

Do you do voiceover and screenshots?

You'll demonstrate a product?

Will you faceless vlog?

Step 3: Look at the competition

Find anonymous accounts and analyze what content works, where they thrive, what their audience wants, etc.

This can help you make better content.

Like the skyscraper method for TikTok.

Step 4: Create a content strategy.

Your content plan is where you sit down and decide:

How many videos will you produce each day or each week?

Which links will you highlight in your biography?

What amount of time can you commit to this project?

You may schedule when to post videos on a calendar. Make videos.

5. Create videos.

No video gear needed.

Using a phone is OK, and I think it's preferable than posting drafts from a computer or phone.

TikTok prefers genuine material.

Use their app, tools, filters, and music to make videos.

And imperfection is preferable. Tik okers like to see videos made in a bedroom, not a film studio.

Make sense?

When making videos, remember this.

I personally use my phone and tablet.

Step 6: Monetize

Lastly, it’s time to monetize How will you make money? You decided this in step 1.

Time to act!

For brand agreements

Include your email in the bio.

Share several sites and use a beacons link in your bio.

Make cold calls to your favorite companies to get them to join you in a TikTok campaign.

For e-commerce

Include a link to your store's or a product's page in your bio.

For client work

Include your email in the bio.

Use a beacons link to showcase your personal website, portfolio, and other resources.

For affiliate marketing

Include affiliate product links in your bio.

Join the Amazon Influencer program and provide a link to your storefront in your bio.

$60,000 per year from Tik Tok?

Yes, and some creators make much more.

Tori Dunlap (herfirst100K) makes $100,000/month on TikTok.

My TikTok adventure took 6 months, but by month 2 I was making $1,000/month (or $12K/year).

By year's end, I want this account to earn $100K/year.

Imagine if my 7 TikTok accounts made $100K/year.

7 Tik Tok accounts X $100K/yr = $700,000/year

Davlin Knight

3 years ago

2 pitfalls to stay away from when launching a YouTube channel

You do not want to miss these

Stop! Stop it! Two things to avoid when starting a YouTube channel. Critical. Possible channel-killers Its future revenue.

I'll tell you now, so don't say "I wish I knew."

The Notorious Copyright Allegation

My YouTube channel received a copyright claim before I sold it. This claim was on a one-minute video I thought I'd changed enough to make mine, but the original owner disagreed.

It cost me thousands in ad revenue. Original owner got the profits.

Well, it wasn't your video, you say.

Touché.

I've learned. Sorta

I couldn't stop looking at the video's views. The video got 1,000,000 views without any revenue. I made 4 more similar videos.

If they didn't get copyrighted, I'd be rolling in dough.

You've spent a week editing and are uploading to YouTube. You're thrilled as you stand and stretch your back. You see the video just before publishing.

No way!

The red exclamation point on checks.

Copyright claim!

YouTube lets you publish, but you won't make money.

Sounds fair? Well, it is.

Copyright claims mean you stole someone's work. Song, image, or video clip.

We wouldn't want our content used for money.

The only problem with this is that almost everything belongs to someone else. I doubt some of the biggest creators are sitting down and making their music for their videos. That just seems really excessive when you could make a quick search on YouTube and download a song (I definitely don’t do this because that would be stealing).

So how do you defeat a copyright defense?

Even copyright-free songs on YouTube aren't guaranteed. Some copyrighted songs claim to be free.

Use YouTube's free music library or pay for a subscription to adobe stock, epidemic sound, or artlist.io.

Most of my videos have Nintendo music. Almost all game soundtracks are copyright-free and offer a variety of songs.

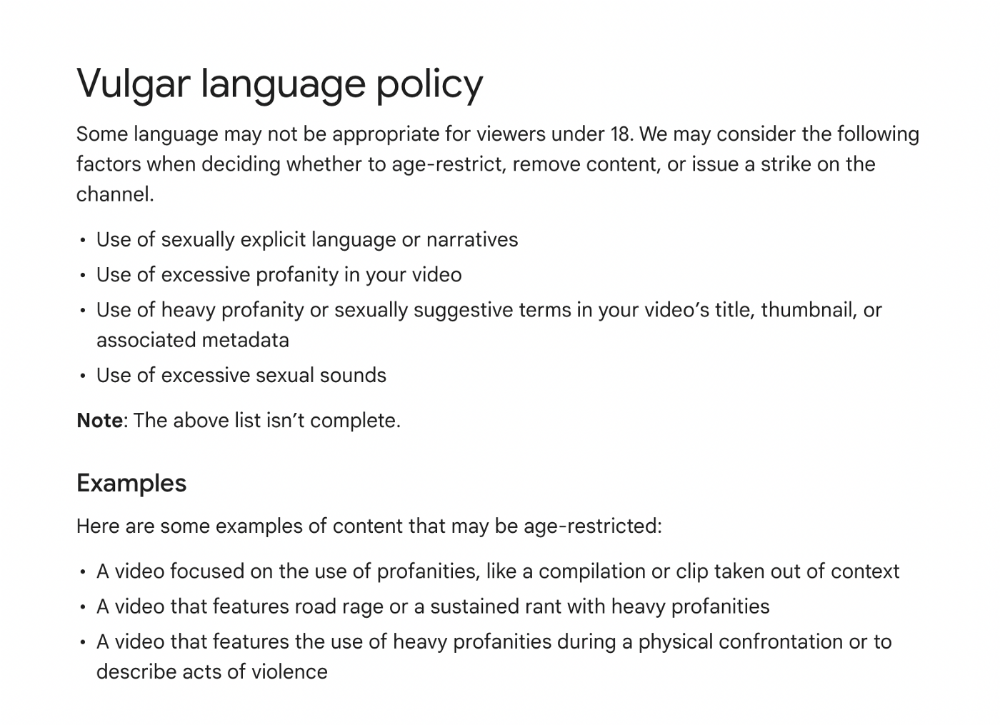

Restriction on age

Age restrictions are a must-avoid. A channel dies.

YouTube never suggests age-restricted videos.

Shadow banning means YouTube hides your content from subscribers and non-subscribers.

Keeping your channel family-friendly can help.

I hear you complaining that your channel isn't for kids. I agree. Not everyone has a clean mouth or creates content for minors.

YouTube has changed rapidly in recent years. Focusing on kids. Fewer big creators are using profanity or explicit content in videos. Not YouTube-worthy.

Youtube wants to be family-friendly. A family-friendly movie. It won't promote illegal content. Yes, it allows profanity.

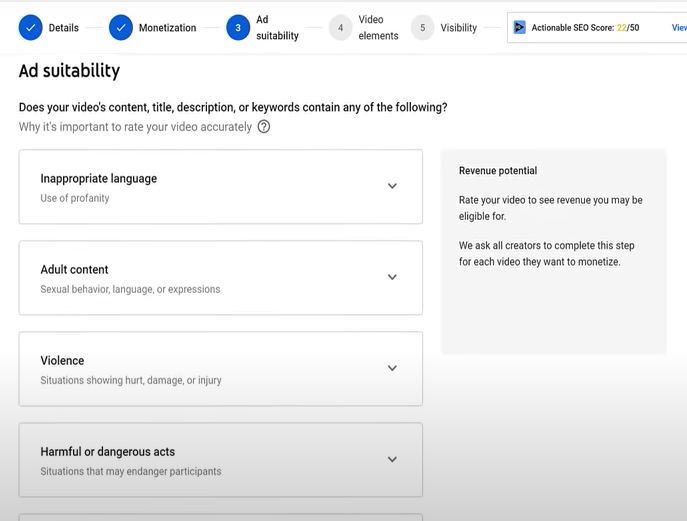

Do I recommend avoiding no-no words in videos? Never. Okay. YouTube's policies are shaky. YouTube uses video content to determine ad suitability.

No joke. If you're serious about becoming a content creator, avoid profanity and inappropriate topics.

If your channel covers 18+ topics, like crime or commentary, censor as much as possible.

YouTube can be like walking on eggshells. You never know what is gonna upset the boss. So play it safe and try to avoid getting on their bad side.

Mr. Beast, Dream, Markplier, Faze Rug, and PewDewPie are popular creators. They maintain it family-friendly while entertaining fans.

You got this.

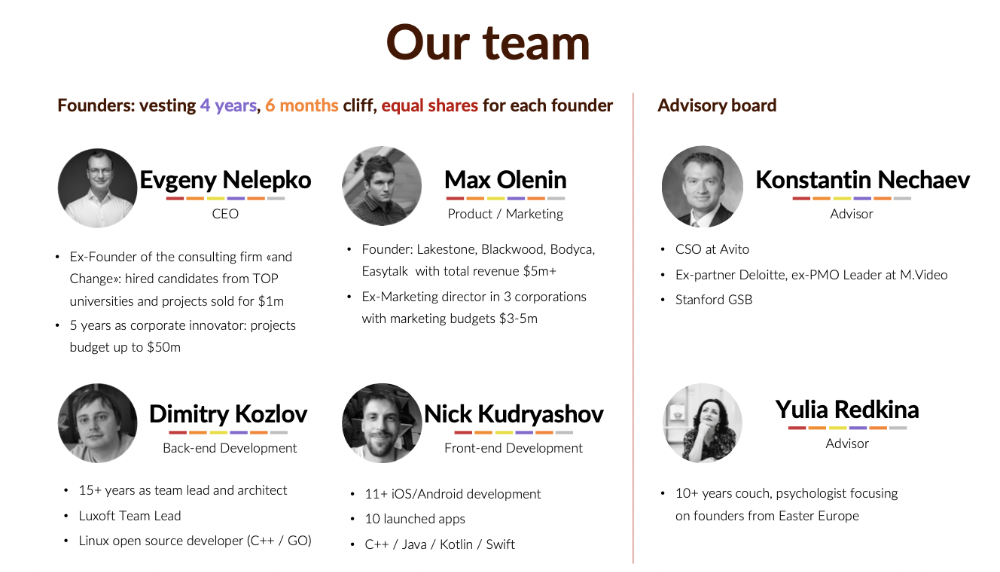

Evgenii Nelepko

3 years ago

My 3 biggest errors as a co-founder and CEO

Reflections on the closed company Hola! Dating app

I'll discuss my fuckups as an entrepreneur and CEO. All of them refer to the dating app Hola!, which I co-founded and starred in.

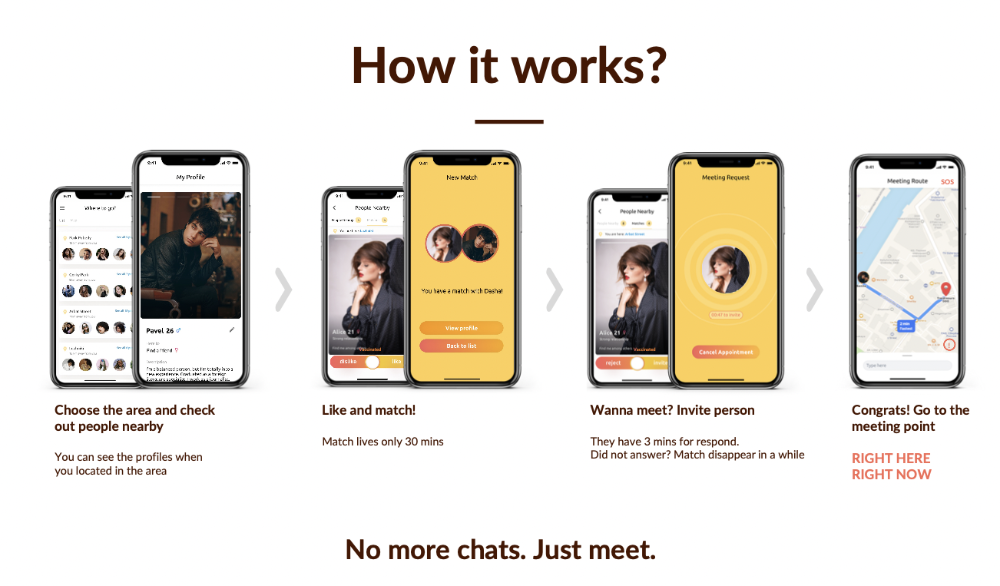

Spring 2021 was when we started. Two techies and two non-techies created a dating app. Pokemon Go and Tinder were combined.

Online dating is a business, and it takes two weeks from a like to a date. We questioned online dating app users if they met anyone offline last year.

75% replied yes, 50% sometimes, 25% usually.

Offline dating is popular, yet people have concerns.

Men are reluctant to make mistakes in front of others.

Women are curious about the background of everyone who approaches them.

We designed unique mechanics that let people date after a match. No endless chitchat. Women would be safe while men felt like cowboys.

I wish to emphasize three faults that lead to founders' estrangement.

This detachment ultimately led to us shutting down the company.

The wrong technology stack

Situation

Instead of generating a faster MVP and designing an app in a universal stack for iOS and Android, I argued we should pilot the app separately for iOS and Android. Technical founders' expertise made this possible.

Self-reflection

Mistaken strategy. We lost time and resources developing two apps at once. We chose iOS since it's more profitable. Apple took us out after the release, citing Guideline 4.3 Spam. After 4 months, we had nothing. We had a long way to go to get the app on Android and the Store.

I suggested creating a uniform platform for the company's growth. This makes parallel product development easier. The strategist's lack of experience and knowledge made it a piece of crap.

What would I have changed if I could?

We should have designed an Android universal stack. I expected Apple to have issues with a dating app.

Our approach should have been to launch something and subsequently improve it, but prejudice won.

The lesson

Discuss the IT stack with your CTO. It saves time and money. Choose the easiest MVP method.

2. A tardy search for investments

Situation

Though the universe and other founders encouraged me to locate investors first, I started pitching when we almost had an app.

When angels arrived, it was time to close. The app was banned, war broke out, I left the country, and the other co-founders stayed. We had no savings.

Self-reflection

I loved interviewing users. I'm proud of having done 1,000 interviews. I wanted to understand people's pain points and improve the product.

Interview results no longer affected the product. I was terrified to start pitching. I filled out accelerator applications and redid my presentation. You must go through that so you won't be terrified later.

What would I have changed if I could?

Get an external or internal mentor to help me with my first pitch as soon as possible. I'd be supported if criticized. He'd cheer with me if there was enthusiasm.

In 99% of cases, I'm comfortable jumping into the unknown, but there are exceptions. The mentor's encouragement would have prompted me to act sooner.

The lesson

Begin fundraising immediately. Months may pass. Show investors your pre-MVP project. Draw inferences from feedback.

3. Role ambiguity

Situation

My technical co-founders were also part-time lead developers, which produced communication issues. As co-founders, we communicated well and recognized the problems. Stakes, vesting, target markets, and approach were agreed upon.

We were behind schedule. Technical debt and strategic gap grew.

Bi-daily and weekly reviews didn't help. Each time, there were explanations. Inside, I was freaking out.

Self-reflection

I am a fairly easy person to talk to. I always try to stick to agreements; otherwise, my head gets stuffed with unnecessary information, interpretations, and emotions.

Sit down -> talk -> decide -> do -> evaluate the results. Repeat it.

If I don't get detailed comments, I start ruining everyone's mood. If there's a systematic violation of agreements without a good justification, I won't join the project or I'll end the collaboration.

What would I have done otherwise?

This is where it’s scariest to draw conclusions. Probably the most logical thing would have been not to start the project as we started it. But that was already a completely different project. So I would not have done anything differently and would have failed again.

But I drew conclusions for the future.

The lesson

First-time founders should find an adviser or team coach for a strategic session. It helps split the roles and responsibilities.

You might also like

Ellane W

3 years ago

The Last To-Do List Template I'll Ever Need, Years in the Making

The holy grail of plain text task management is finally within reach

Plain text task management? Are you serious?? Dedicated task managers exist for a reason, you know. Sheesh.

—Oh, I know. Believe me, I know! But hear me out.

I've managed projects and tasks in plain text for more than four years. Since reorganizing my to-do list, plain text task management is within reach.

Data completely yours? One billion percent. Beef it up with coding? Be my guest.

Enter: The List

The answer? A list. That’s it!

Write down tasks. Obsidian, Notenik, Drafts, or iA Writer are good plain text note-taking apps.

List too long? Of course, it is! A large list tells you what to do. Feel the itch and friction. Then fix it.

But I want to be able to distinguish between work and personal life! List two things.

However, I need to know what should be completed first. Put those items at the top.

However, some things keep coming up, and I need to be reminded of them! Put those in your calendar and make an alarm for them.

But since individual X hasn't completed task Y, I can't proceed with this. Create a Waiting section on your list by dividing it.

But I must know what I'm supposed to be doing right now! Read your list(s). Check your calendar. Think critically.

Before I begin a new one, I remind myself that "Listory Never Repeats."

There’s no such thing as too many lists if all are needed. There is such a thing as too many lists if you make them before they’re needed. Before they complain that their previous room was small or too crowded or needed a new light.

A list that feels too long has a voice; it’s telling you what to do next.

I use one Master List. It's a control panel that tells me what to focus on short-term. If something doesn't need semi-immediate attention, it goes on my Backlog list.

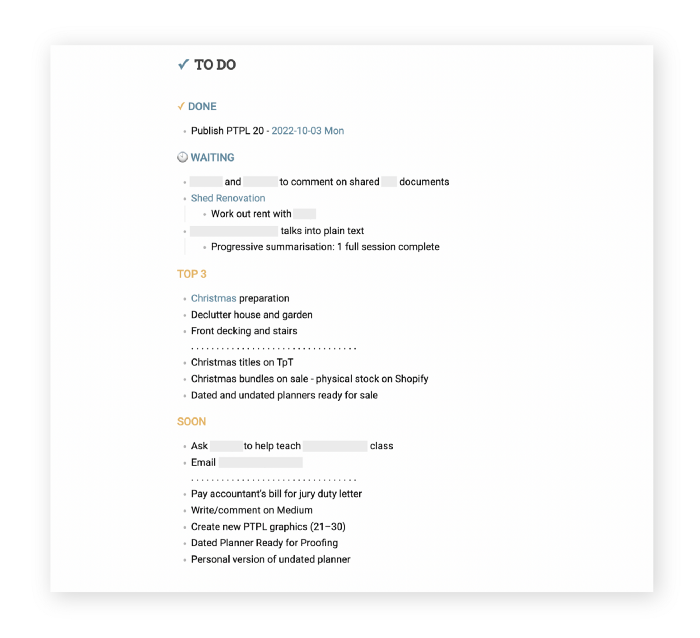

Todd Lewandowski's DWTS (Done, Waiting, Top 3, Soon) performance deserves praise. His DWTS to-do list structure has transformed my plain-text task management. I didn't realize it was upside down.

This is my take on it:

D = Done

Move finished items here. If they pile up, clear them out every week or month. I have a Done Archive folder.

W = Waiting

Things seething in the background, awaiting action. Stir them occasionally so they don't burn.

T = Top 3

Three priorities. Personal comes first, then work. There will always be a top 3 (no more than 5) in every category. Projects, not chores, usually.

S = Soon

This part is action-oriented. It's for anything you can accomplish to finish one of the Top 3. This collection includes thoughts and project lists. The sole requirement is that they should be short-term goals.

Some of you have probably concluded this isn't for you. Please read Todd's piece before throwing out the baby. Often. You shouldn't miss a newborn.

As much as Dancing With The Stars helps me recall this method, I may try switching their order. TSWD; Drilling Tunnel Seismic? Serenity After Task?

Master List Showcase

My Master List lives alone in its own file, but sometimes appears in other places. It's included in my Weekly List template. Here's a (soon-to-be-updated) demo vault of my Obsidian planning setup to download for free.

Here's the code behind my weekly screenshot:

## [[Master List - 2022|✓]] TO DO

![[Master List - 2022]]FYI, I use the Minimal Theme in Obsidian, with a few tweaks.

You may note I'm utilizing a checkmark as a link. For me, that's easier than locating the proper spot to click on the embed.

Blue headings for Done and Waiting are links. Done links to the Done Archive page and Waiting to a general waiting page.

Read my full article here.

Francesca Furchtgott

3 years ago

Giving customers what they want or betraying the values of the brand?

A J.Crew collaboration for fashion label Eveliina Vintage is not a paradox; it is a solution.

Eveliina Vintage's capsule collection debuted yesterday at J.Crew. This J.Crew partnership stopped me in my tracks.

Eveliina Vintage sells vintage goods. Eeva Musacchia founded the shop in Finland in the 1970s. It's recognized for its one-of-a-kind slip dresses from the 1930s and 1940s.

I wondered why a vintage brand would partner with a mass shop. Fast fashion against vintage shopping? Will Eveliina Vintages customers be turned off?

But Eveliina Vintages customers don't care about sustainability. They want Eveliina's Instagram look. Eveliina Vintage collaborated with J.Crew to give customers what they wanted: more Eveliina at a lower price.

Vintage: A Fashion Option That Is Eco-Conscious

Secondhand shopping is a trendy response to quick fashion. J.Crew releases hundreds of styles annually. Waste and environmental damage have been criticized. A pair of jeans requires 1,800 gallons of water. J.Crew's limited-time deals promote more purchases. J.Crew items are likely among those Americans wear 7 times before discarding.

Consumers and designers have emphasized sustainability in recent years. Stella McCartney and Eileen Fisher are popular eco-friendly brands. They've also flocked to ThredUp and similar sites.

Gap, Levis, and Allbirds have listened to consumer requests. They promote recycling, ethical sourcing, and secondhand shopping.

Secondhand shoppers feel good about reusing and recycling clothing that might have ended up in a landfill.

Eco-conscious fashionistas shop vintage. These shoppers enjoy the thrill of the hunt (that limited-edition Chanel bag!) and showing off a unique piece (nobody will have my look!). They also reduce their environmental impact.

Is Eveliina Vintage capitalizing on an aesthetic or is it a sustainable brand?

Eveliina Vintage emphasizes environmental responsibility. Vogue's Amanda Musacchia emphasized sustainability. Amanda, founder Eeva's daughter, is a company leader.

But Eveliina's press message doesn't address sustainability, unlike Instagram. Scarcity and fame rule.

Eveliina Vintages Instagram has see-through dresses and lace-trimmed slip dresses. Celebrities and influencers are often photographed in Eveliina's apparel, which has 53,000+ followers. Vogue appreciates Eveliina's style. Multiple publications discuss Alexa Chung's Eveliina dress.

Eveliina Vintage markets its one-of-a-kind goods. It teases future content, encouraging visitors to return. Scarcity drives demand and raises clothing prices. One dress is $1,600+, but most are $500-$1,000.

The catch: Eveliina can't monetize its expanding popularity due to exorbitant prices and limited quantity. Why?

Most people struggle to pay for their clothing. But Eveliina Vintage lacks those more affordable entry-level products, in contrast to other luxury labels that sell accessories or perfume.

Many people have trouble fitting into their clothing. The bodies of most women in the past were different from those for which vintage clothing was designed. Each Eveliina dress's specific measurements are mentioned alongside it. Be careful, you can fall in love with an ill-fitting dress.

No matter how many people can afford it and fit into it, there is only one item to sell. To get the item before someone else does, those people must be on the Eveliina Vintage website as soon as it becomes available.

A Way for Eveliina Vintage to Make Money (and Expand) with J.Crew Its following

Eveliina Vintages' cooperation with J.Crew makes commercial sense.

This partnership spreads Eveliina's style. Slightly better pricing The $390 outfits have multicolored slips and gauzy cotton gowns. Sizes range from 00 to 24, which is wider than vintage racks.

Eveliina Vintage customers like the combination. Excited comments flood the brand's Instagram launch post. Nobody is mocking the 50-year-old vintage brand's fast-fashion partnership.

Vintage may be a sustainable fashion trend, but that's not why Eveliina's clients love the brand. They only care about the old look.

And that is a tale as old as fashion.

Simon Ash

2 years ago

The Three Most Effective Questions for Ongoing Development

The Traffic Light Approach to Reviewing Personal, Team and Project Development

What needs improvement? If you want to improve, you need to practice your sport, musical instrument, habit, or work project. You need to assess your progress.

Continuous improvement is the foundation of focused practice and a growth mentality. Not just individually. High-performing teams pursue improvement. Right? Why is it hard?

As a leadership coach, senior manager, and high-level athlete, I've found three key questions that may unlock high performance in individuals and teams.

Problems with Reviews

Reviewing and improving performance is crucial, however I hate seeing review sessions in my diary. I rarely respond to questionnaire pop-ups or emails. Why?

Time constrains. Requests to fill out questionnaires often state they will take 10–15 minutes, but I can think of a million other things to do with that time. Next, review overload. Businesses can easily request comments online. No matter what you buy, someone will ask for your opinion. This bombardment might make feedback seem bad, which is bad.

The problem is that we might feel that way about important things like personal growth and work performance. Managers and team leaders face a greater challenge.

When to Conduct a Review

We must be wise about reviewing things that matter to us. Timing and duration matter. Reviewing the experience as quickly as possible preserves information and sentiments. Time must be brief. The review's importance and size will determine its length. We might only take a few seconds to review our morning coffee, but we might require more time for that six-month work project.

These post-event reviews should be supplemented by periodic reflection. Journaling can help with daily reflections, but I also like to undertake personal reviews every six months on vacation or at a retreat.

As an employee or line manager, you don't want to wait a year for a performance assessment. Little and frequently is best, with a more formal and in-depth assessment (typically with a written report) in 6 and 12 months.

The Easiest Method to Conduct a Review Session

I follow Einstein's review process:

“Make things as simple as possible but no simpler.”

Thus, it should be brief but deliver the necessary feedback. Quality critique is hard to receive if the process is overly complicated or long.

I have led or participated in many review processes, from strategic overhauls of big organizations to personal goal coaching. Three key questions guide the process at either end:

What ought to stop being done?

What should we do going forward?

What should we do first?

Following the Rule of 3, I compare it to traffic lights. Red, amber, and green lights:

Red What ought should we stop?

Amber What ought to we keep up?

Green Where should we begin?

This approach is easy to understand and self-explanatory, however below are some examples under each area.

Red What ought should we stop?

As a team or individually, we must stop doing things to improve.

Sometimes they're bad. If we want to lose weight, we should avoid sweets. If a team culture is bad, we may need to stop unpleasant behavior like gossiping instead of having difficult conversations.

Not all things we should stop are wrong. Time matters. Since it is finite, we sometimes have to stop nice things to focus on the most important. Good to Great author Jim Collins famously said:

“Don’t let the good be the enemy of the great.”

Prioritizing requires this idea. Thus, decide what to stop to prioritize.

Amber What ought to we keep up?

Should we continue with the amber light? It helps us decide what to keep doing during review. Many items fall into this category, so focus on those that make the most progress.

Which activities have the most impact? Which behaviors create the best culture? Success-building habits?

Use these questions to find positive momentum. These are the fly-wheel motions, according to Jim Collins. The Compound Effect author Darren Hardy says:

“Consistency is the key to achieving and maintaining momentum.”

What can you do consistently to reach your goal?

Green Where should we begin?

Finally, green lights indicate new beginnings. Red/amber difficulties may be involved. Stopping a red issue may give you more time to do something helpful (in the amber).

This green space inspires creativity. Kolbs learning cycle requires active exploration to progress. Thus, it's crucial to think of new approaches, try them out, and fail if required.

This notion underpins lean start-build, up's measure, learn approach and agile's trying, testing, and reviewing. Try new things until you find what works. Thomas Edison, the lighting legend, exclaimed:

“There is a way to do it better — find it!”

Failure is acceptable, but if you want to fail forward, look back on what you've done.

John Maxwell concurred with Edison:

“Fail early, fail often, but always fail forward”

A good review procedure lets us accomplish that. To avoid failure, we must act, experiment, and reflect.

Use the traffic light system to prioritize queries. Ask:

Red What needs to stop?

Amber What should continue to occur?

Green What might be initiated?

Take a moment to reflect on your day. Check your priorities with these three questions. Even if merely to confirm your direction, it's a terrific exercise!