What An Inverted Yield Curve Means For Investors

The yield spread between 10-year and 2-year US Treasury bonds has fallen below 0.2 percent, its lowest level since March 2020. A flattening or negative yield curve can be a bad sign for the economy.

What Is An Inverted Yield Curve?

In the yield curve, bonds of equal credit quality but different maturities are plotted. The most commonly used yield curve for US investors is a plot of 2-year and 10-year Treasury yields, which have yet to invert.

A typical yield curve has higher interest rates for future maturities. In a flat yield curve, short-term and long-term yields are similar. Inverted yield curves occur when short-term yields exceed long-term yields. Inversions of yield curves have historically occurred during recessions.

Inverted yield curves have preceded each of the past eight US recessions. The good news is they're far leading indicators, meaning a recession is likely not imminent.

Every US recession since 1955 has occurred between six and 24 months after an inversion of the two-year and 10-year Treasury yield curves, according to the San Francisco Fed. So, six months before COVID-19, the yield curve inverted in August 2019.

Looking Ahead

The spread between two-year and 10-year Treasury yields was 0.18 percent on Tuesday, the smallest since before the last US recession. If the graph above continues, a two-year/10-year yield curve inversion could occur within the next few months.

According to Bank of America analyst Stephen Suttmeier, the S&P 500 typically peaks six to seven months after the 2s-10s yield curve inverts, and the US economy enters recession six to seven months later.

Investors appear unconcerned about the flattening yield curve. This is in contrast to the iShares 20+ Year Treasury Bond ETF TLT +2.19% which was down 1% on Tuesday.

Inversion of the yield curve and rising interest rates have historically harmed stocks. Recessions in the US have historically coincided with or followed the end of a Federal Reserve rate hike cycle, not the start.

More on Economics & Investing

Sofien Kaabar, CFA

2 years ago

Innovative Trading Methods: The Catapult Indicator

Python Volatility-Based Catapult Indicator

As a catapult, this technical indicator uses three systems: Volatility (the fulcrum), Momentum (the propeller), and a Directional Filter (Acting as the support). The goal is to get a signal that predicts volatility acceleration and direction based on historical patterns. We want to know when the market will move. and where. This indicator outperforms standard indicators.

Knowledge must be accessible to everyone. This is why my new publications Contrarian Trading Strategies in Python and Trend Following Strategies in Python now include free PDF copies of my first three books (Therefore, purchasing one of the new books gets you 4 books in total). GitHub-hosted advanced indications and techniques are in the two new books above.

The Foundation: Volatility

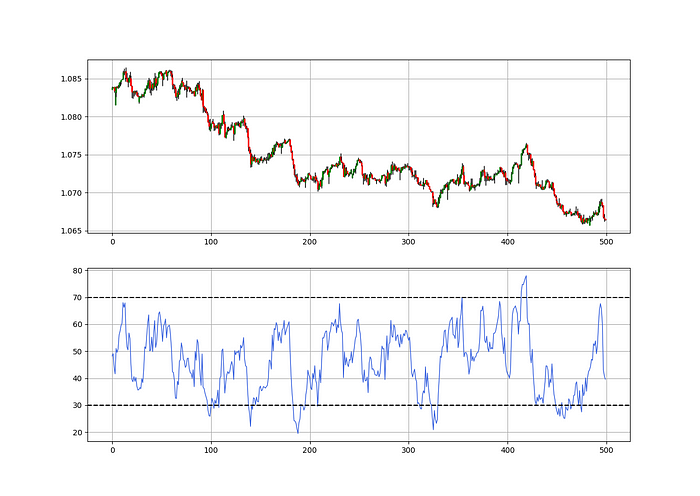

The Catapult predicts significant changes with the 21-period Relative Volatility Index.

The Average True Range, Mean Absolute Deviation, and Standard Deviation all assess volatility. Standard Deviation will construct the Relative Volatility Index.

Standard Deviation is the most basic volatility. It underpins descriptive statistics and technical indicators like Bollinger Bands. Before calculating Standard Deviation, let's define Variance.

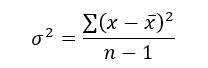

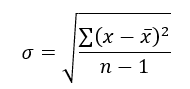

Variance is the squared deviations from the mean (a dispersion measure). We take the square deviations to compel the distance from the mean to be non-negative, then we take the square root to make the measure have the same units as the mean, comparing apples to apples (mean to standard deviation standard deviation). Variance formula:

As stated, standard deviation is:

# The function to add a number of columns inside an array

def adder(Data, times):

for i in range(1, times + 1):

new_col = np.zeros((len(Data), 1), dtype = float)

Data = np.append(Data, new_col, axis = 1)

return Data

# The function to delete a number of columns starting from an index

def deleter(Data, index, times):

for i in range(1, times + 1):

Data = np.delete(Data, index, axis = 1)

return Data

# The function to delete a number of rows from the beginning

def jump(Data, jump):

Data = Data[jump:, ]

return Data

# Example of adding 3 empty columns to an array

my_ohlc_array = adder(my_ohlc_array, 3)

# Example of deleting the 2 columns after the column indexed at 3

my_ohlc_array = deleter(my_ohlc_array, 3, 2)

# Example of deleting the first 20 rows

my_ohlc_array = jump(my_ohlc_array, 20)

# Remember, OHLC is an abbreviation of Open, High, Low, and Close and it refers to the standard historical data file

def volatility(Data, lookback, what, where):

for i in range(len(Data)):

try:

Data[i, where] = (Data[i - lookback + 1:i + 1, what].std())

except IndexError:

pass

return Data

The RSI is the most popular momentum indicator, and for good reason—it excels in range markets. Its 0–100 range simplifies interpretation. Fame boosts its potential.

The more traders and portfolio managers look at the RSI, the more people will react to its signals, pushing market prices. Technical Analysis is self-fulfilling, therefore this theory is obvious yet unproven.

RSI is determined simply. Start with one-period pricing discrepancies. We must remove each closing price from the previous one. We then divide the smoothed average of positive differences by the smoothed average of negative differences. The RSI algorithm converts the Relative Strength from the last calculation into a value between 0 and 100.

def ma(Data, lookback, close, where):

Data = adder(Data, 1)

for i in range(len(Data)):

try:

Data[i, where] = (Data[i - lookback + 1:i + 1, close].mean())

except IndexError:

pass

# Cleaning

Data = jump(Data, lookback)

return Data

def ema(Data, alpha, lookback, what, where):

alpha = alpha / (lookback + 1.0)

beta = 1 - alpha

# First value is a simple SMA

Data = ma(Data, lookback, what, where)

# Calculating first EMA

Data[lookback + 1, where] = (Data[lookback + 1, what] * alpha) + (Data[lookback, where] * beta)

# Calculating the rest of EMA

for i in range(lookback + 2, len(Data)):

try:

Data[i, where] = (Data[i, what] * alpha) + (Data[i - 1, where] * beta)

except IndexError:

pass

return Datadef rsi(Data, lookback, close, where, width = 1, genre = 'Smoothed'):

# Adding a few columns

Data = adder(Data, 7)

# Calculating Differences

for i in range(len(Data)):

Data[i, where] = Data[i, close] - Data[i - width, close]

# Calculating the Up and Down absolute values

for i in range(len(Data)):

if Data[i, where] > 0:

Data[i, where + 1] = Data[i, where]

elif Data[i, where] < 0:

Data[i, where + 2] = abs(Data[i, where])

# Calculating the Smoothed Moving Average on Up and Down

absolute values

lookback = (lookback * 2) - 1 # From exponential to smoothed

Data = ema(Data, 2, lookback, where + 1, where + 3)

Data = ema(Data, 2, lookback, where + 2, where + 4)

# Calculating the Relative Strength

Data[:, where + 5] = Data[:, where + 3] / Data[:, where + 4]

# Calculate the Relative Strength Index

Data[:, where + 6] = (100 - (100 / (1 + Data[:, where + 5])))

# Cleaning

Data = deleter(Data, where, 6)

Data = jump(Data, lookback)

return Data

def relative_volatility_index(Data, lookback, close, where):

# Calculating Volatility

Data = volatility(Data, lookback, close, where)

# Calculating the RSI on Volatility

Data = rsi(Data, lookback, where, where + 1)

# Cleaning

Data = deleter(Data, where, 1)

return DataThe Arm Section: Speed

The Catapult predicts momentum direction using the 14-period Relative Strength Index.

As a reminder, the RSI ranges from 0 to 100. Two levels give contrarian signals:

A positive response is anticipated when the market is deemed to have gone too far down at the oversold level 30, which is 30.

When the market is deemed to have gone up too much, at overbought level 70, a bearish reaction is to be expected.

Comparing the RSI to 50 is another intriguing use. RSI above 50 indicates bullish momentum, while below 50 indicates negative momentum.

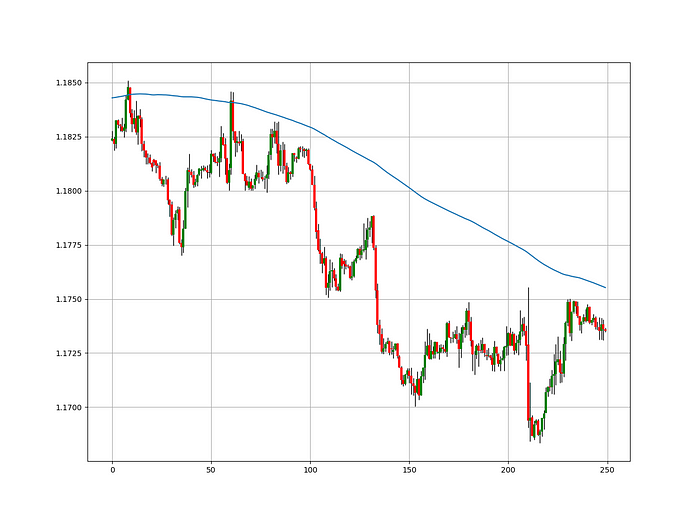

The direction-finding filter in the frame

The Catapult's directional filter uses the 200-period simple moving average to keep us trending. This keeps us sane and increases our odds.

Moving averages confirm and ride trends. Its simplicity and track record of delivering value to analysis make them the most popular technical indicator. They help us locate support and resistance, stops and targets, and the trend. Its versatility makes them essential trading tools.

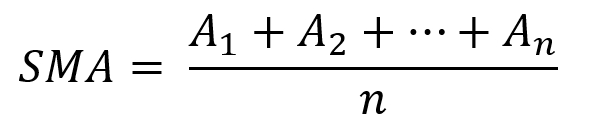

This is the plain mean, employed in statistics and everywhere else in life. Simply divide the number of observations by their total values. Mathematically, it's:

We defined the moving average function above. Create the Catapult indication now.

Indicator of the Catapult

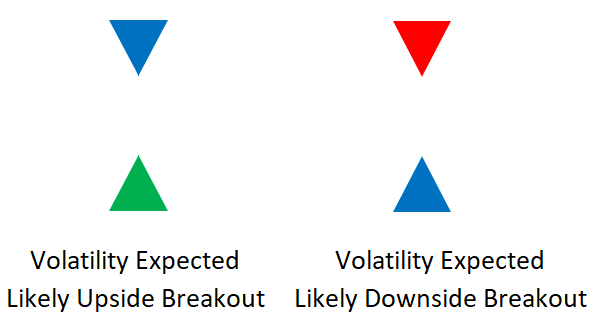

The indicator is a healthy mix of the three indicators:

The first trigger will be provided by the 21-period Relative Volatility Index, which indicates that there will now be above average volatility and, as a result, it is possible for a directional shift.

If the reading is above 50, the move is likely bullish, and if it is below 50, the move is likely bearish, according to the 14-period Relative Strength Index, which indicates the likelihood of the direction of the move.

The likelihood of the move's direction will be strengthened by the 200-period simple moving average. When the market is above the 200-period moving average, we can infer that bullish pressure is there and that the upward trend will likely continue. Similar to this, if the market falls below the 200-period moving average, we recognize that there is negative pressure and that the downside is quite likely to continue.

lookback_rvi = 21

lookback_rsi = 14

lookback_ma = 200

my_data = ma(my_data, lookback_ma, 3, 4)

my_data = rsi(my_data, lookback_rsi, 3, 5)

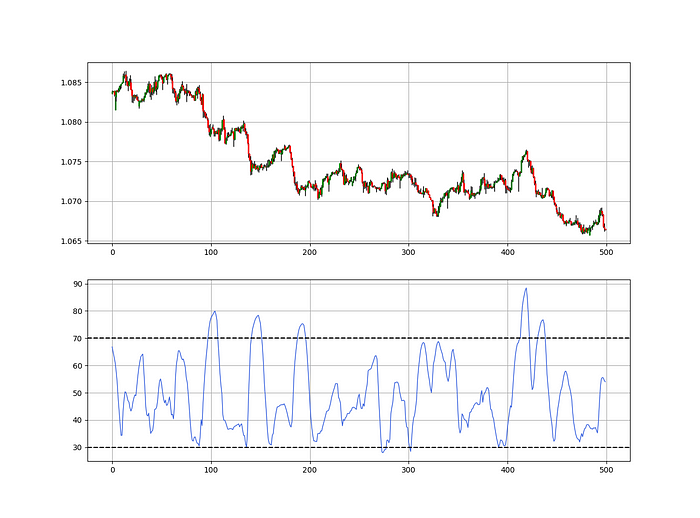

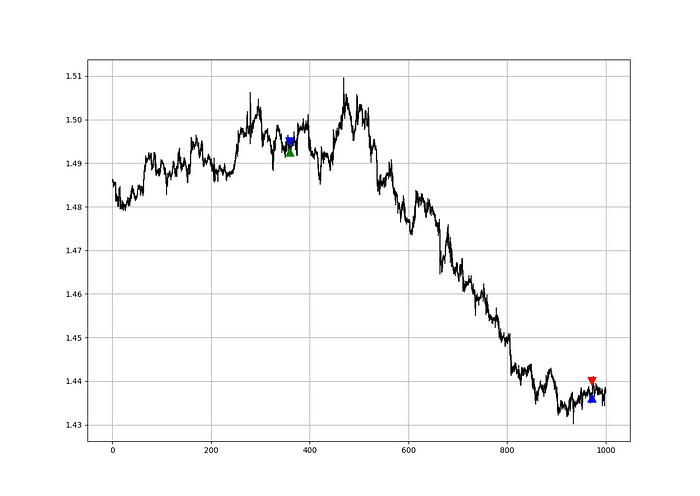

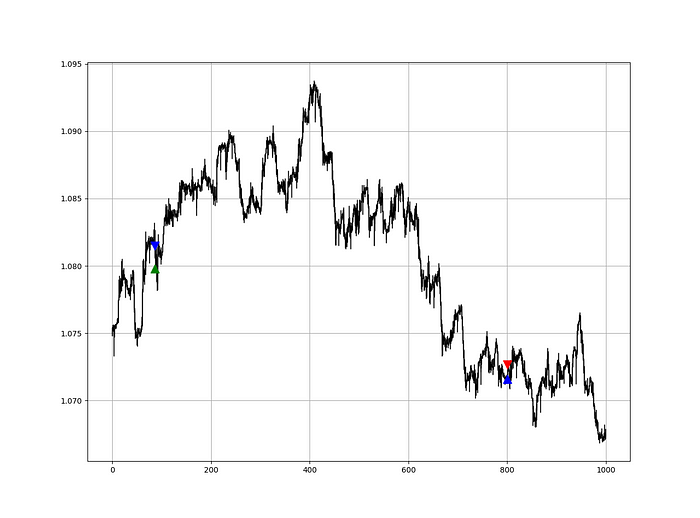

my_data = relative_volatility_index(my_data, lookback_rvi, 3, 6)Two-handled overlay indicator Catapult. The first exhibits blue and green arrows for a buy signal, and the second shows blue and red for a sell signal.

The chart below shows recent EURUSD hourly values.

def signal(Data, rvi_col, signal):

Data = adder(Data, 10)

for i in range(len(Data)):

if Data[i, rvi_col] < 30 and \

Data[i - 1, rvi_col] > 30 and \

Data[i - 2, rvi_col] > 30 and \

Data[i - 3, rvi_col] > 30 and \

Data[i - 4, rvi_col] > 30 and \

Data[i - 5, rvi_col] > 30:

Data[i, signal] = 1

return Data

Signals are straightforward. The indicator can be utilized with other methods.

my_data = signal(my_data, 6, 7)

Lumiwealth shows how to develop all kinds of algorithms. I recommend their hands-on courses in algorithmic trading, blockchain, and machine learning.

Summary

To conclude, my goal is to contribute to objective technical analysis, which promotes more transparent methods and strategies that must be back-tested before implementation. Technical analysis will lose its reputation as subjective and unscientific.

After you find a trading method or approach, follow these steps:

Put emotions aside and adopt an analytical perspective.

Test it in the past in conditions and simulations taken from real life.

Try improving it and performing a forward test if you notice any possibility.

Transaction charges and any slippage simulation should always be included in your tests.

Risk management and position sizing should always be included in your tests.

After checking the aforementioned, monitor the plan because market dynamics may change and render it unprofitable.

Theresa W. Carey

3 years ago

How Payment for Order Flow (PFOF) Works

What is PFOF?

PFOF is a brokerage firm's compensation for directing orders to different parties for trade execution. The brokerage firm receives fractions of a penny per share for directing the order to a market maker.

Each optionable stock could have thousands of contracts, so market makers dominate options trades. Order flow payments average less than $0.50 per option contract.

Order Flow Payments (PFOF) Explained

The proliferation of exchanges and electronic communication networks has complicated equity and options trading (ECNs) Ironically, Bernard Madoff, the Ponzi schemer, pioneered pay-for-order-flow.

In a December 2000 study on PFOF, the SEC said, "Payment for order flow is a method of transferring trading profits from market making to brokers who route customer orders to specialists for execution."

Given the complexity of trading thousands of stocks on multiple exchanges, market making has grown. Market makers are large firms that specialize in a set of stocks and options, maintaining an inventory of shares and contracts for buyers and sellers. Market makers are paid the bid-ask spread. Spreads have narrowed since 2001, when exchanges switched to decimals. A market maker's ability to play both sides of trades is key to profitability.

Benefits, requirements

A broker receives fees from a third party for order flow, sometimes without a client's knowledge. This invites conflicts of interest and criticism. Regulation NMS from 2005 requires brokers to disclose their policies and financial relationships with market makers.

Your broker must tell you if it's paid to send your orders to specific parties. This must be done at account opening and annually. The firm must disclose whether it participates in payment-for-order-flow and, upon request, every paid order. Brokerage clients can request payment data on specific transactions, but the response takes weeks.

Order flow payments save money. Smaller brokerage firms can benefit from routing orders through market makers and getting paid. This allows brokerage firms to send their orders to another firm to be executed with other orders, reducing costs. The market maker or exchange benefits from additional share volume, so it pays brokerage firms to direct traffic.

Retail investors, who lack bargaining power, may benefit from order-filling competition. Arrangements to steer the business in one direction invite wrongdoing, which can erode investor confidence in financial markets and their players.

Pay-for-order-flow criticism

It has always been controversial. Several firms offering zero-commission trades in the late 1990s routed orders to untrustworthy market makers. During the end of fractional pricing, the smallest stock spread was $0.125. Options spreads widened. Traders found that some of their "free" trades cost them a lot because they weren't getting the best price.

The SEC then studied the issue, focusing on options trades, and nearly decided to ban PFOF. The proliferation of options exchanges narrowed spreads because there was more competition for executing orders. Options market makers said their services provided liquidity. In its conclusion, the report said, "While increased multiple-listing produced immediate economic benefits to investors in the form of narrower quotes and effective spreads, these improvements have been muted with the spread of payment for order flow and internalization."

The SEC allowed payment for order flow to continue to prevent exchanges from gaining monopoly power. What would happen to trades if the practice was outlawed was also unclear. SEC requires brokers to disclose financial arrangements with market makers. Since then, the SEC has watched closely.

2020 Order Flow Payment

Rule 605 and Rule 606 show execution quality and order flow payment statistics on a broker's website. Despite being required by the SEC, these reports can be hard to find. The SEC mandated these reports in 2005, but the format and reporting requirements have changed over the years, most recently in 2018.

Brokers and market makers formed a working group with the Financial Information Forum (FIF) to standardize order execution quality reporting. Only one retail brokerage (Fidelity) and one market maker remain (Two Sigma Securities). FIF notes that the 605/606 reports "do not provide the level of information that allows a retail investor to gauge how well a broker-dealer fills a retail order compared to the NBBO (national best bid or offer’) at the time the order was received by the executing broker-dealer."

In the first quarter of 2020, Rule 606 reporting changed to require brokers to report net payments from market makers for S&P 500 and non-S&P 500 equity trades and options trades. Brokers must disclose payment rates per 100 shares by order type (market orders, marketable limit orders, non-marketable limit orders, and other orders).

Richard Repetto, Managing Director of New York-based Piper Sandler & Co., publishes a report on Rule 606 broker reports. Repetto focused on Charles Schwab, TD Ameritrade, E-TRADE, and Robinhood in Q2 2020. Repetto reported that payment for order flow was higher in the second quarter than the first due to increased trading activity, and that options paid more than equities.

Repetto says PFOF contributions rose overall. Schwab has the lowest options rates, while TD Ameritrade and Robinhood have the highest. Robinhood had the highest equity rating. Repetto assumes Robinhood's ability to charge higher PFOF reflects their order flow profitability and that they receive a fixed rate per spread (vs. a fixed rate per share by the other brokers).

Robinhood's PFOF in equities and options grew the most quarter-over-quarter of the four brokers Piper Sandler analyzed, as did their implied volumes. All four brokers saw higher PFOF rates.

TD Ameritrade took the biggest income hit when cutting trading commissions in fall 2019, and this report shows they're trying to make up the shortfall by routing orders for additional PFOF. Robinhood refuses to disclose trading statistics using the same metrics as the rest of the industry, offering only a vague explanation on their website.

Summary

Payment for order flow has become a major source of revenue as brokers offer no-commission equity (stock and ETF) orders. For retail investors, payment for order flow poses a problem because the brokerage may route orders to a market maker for its own benefit, not the investor's.

Infrequent or small-volume traders may not notice their broker's PFOF practices. Frequent traders and those who trade larger quantities should learn about their broker's order routing system to ensure they're not losing out on price improvement due to a broker prioritizing payment for order flow.

This post is a summary. Read full article here

Ray Dalio

3 years ago

The latest “bubble indicator” readings.

As you know, I like to turn my intuition into decision rules (principles) that can be back-tested and automated to create a portfolio of alpha bets. I use one for bubbles. Having seen many bubbles in my 50+ years of investing, I described what makes a bubble and how to identify them in markets—not just stocks.

A bubble market has a high degree of the following:

- High prices compared to traditional values (e.g., by taking the present value of their cash flows for the duration of the asset and comparing it with their interest rates).

- Conditons incompatible with long-term growth (e.g., extrapolating past revenue and earnings growth rates late in the cycle).

- Many new and inexperienced buyers were drawn in by the perceived hot market.

- Broad bullish sentiment.

- Debt financing a large portion of purchases.

- Lots of forward and speculative purchases to profit from price rises (e.g., inventories that are more than needed, contracted forward purchases, etc.).

I use these criteria to assess all markets for bubbles. I have periodically shown you these for stocks and the stock market.

What Was Shown in January Versus Now

I will first describe the picture in words, then show it in charts, and compare it to the last update in January.

As of January, the bubble indicator showed that a) the US equity market was in a moderate bubble, but not an extreme one (ie., 70 percent of way toward the highest bubble, which occurred in the late 1990s and late 1920s), and b) the emerging tech companies (ie. As well, the unprecedented flood of liquidity post-COVID financed other bubbly behavior (e.g. SPACs, IPO boom, big pickup in options activity), making things bubbly. I showed which stocks were in bubbles and created an index of those stocks, which I call “bubble stocks.”

Those bubble stocks have popped. They fell by a third last year, while the S&P 500 remained flat. In light of these and other market developments, it is not necessarily true that now is a good time to buy emerging tech stocks.

The fact that they aren't at a bubble extreme doesn't mean they are safe or that it's a good time to get long. Our metrics still show that US stocks are overvalued. Once popped, bubbles tend to overcorrect to the downside rather than settle at “normal” prices.

The following charts paint the picture. The first shows the US equity market bubble gauge/indicator going back to 1900, currently at the 40% percentile. The charts also zoom in on the gauge in recent years, as well as the late 1920s and late 1990s bubbles (during both of these cases the gauge reached 100 percent ).

The chart below depicts the average bubble gauge for the most bubbly companies in 2020. Those readings are down significantly.

The charts below compare the performance of a basket of emerging tech bubble stocks to the S&P 500. Prices have fallen noticeably, giving up most of their post-COVID gains.

The following charts show the price action of the bubble slice today and in the 1920s and 1990s. These charts show the same market dynamics and two key indicators. These are just two examples of how a lot of debt financing stock ownership coupled with a tightening typically leads to a bubble popping.

Everything driving the bubbles in this market segment is classic—the same drivers that drove the 1920s bubble and the 1990s bubble. For instance, in the last couple months, it was how tightening can act to prick the bubble. Review this case study of the 1920s stock bubble (starting on page 49) from my book Principles for Navigating Big Debt Crises to grasp these dynamics.

The following charts show the components of the US stock market bubble gauge. Since this is a proprietary indicator, I will only show you some of the sub-aggregate readings and some indicators.

Each of these six influences is measured using a number of stats. This is how I approach the stock market. These gauges are combined into aggregate indices by security and then for the market as a whole. The table below shows the current readings of these US equity market indicators. It compares current conditions for US equities to historical conditions. These readings suggest that we’re out of a bubble.

1. How High Are Prices Relatively?

This price gauge for US equities is currently around the 50th percentile.

2. Is price reduction unsustainable?

This measure calculates the earnings growth rate required to outperform bonds. This is calculated by adding up the readings of individual securities. This indicator is currently near the 60th percentile for the overall market, higher than some of our other readings. Profit growth discounted in stocks remains high.

Even more so in the US software sector. Analysts' earnings growth expectations for this sector have slowed, but remain high historically. P/Es have reversed COVID gains but remain high historical.

3. How many new buyers (i.e., non-existing buyers) entered the market?

Expansion of new entrants is often indicative of a bubble. According to historical accounts, this was true in the 1990s equity bubble and the 1929 bubble (though our data for this and other gauges doesn't go back that far). A flood of new retail investors into popular stocks, which by other measures appeared to be in a bubble, pushed this gauge above the 90% mark in 2020. The pace of retail activity in the markets has recently slowed to pre-COVID levels.

4. How Broadly Bullish Is Sentiment?

The more people who have invested, the less resources they have to keep investing, and the more likely they are to sell. Market sentiment is now significantly negative.

5. Are Purchases Being Financed by High Leverage?

Leveraged purchases weaken the buying foundation and expose it to forced selling in a downturn. The leverage gauge, which considers option positions as a form of leverage, is now around the 50% mark.

6. To What Extent Have Buyers Made Exceptionally Extended Forward Purchases?

Looking at future purchases can help assess whether expectations have become overly optimistic. This indicator is particularly useful in commodity and real estate markets, where forward purchases are most obvious. In the equity markets, I look at indicators like capital expenditure, or how much businesses (and governments) invest in infrastructure, factories, etc. It reflects whether businesses are projecting future demand growth. Like other gauges, this one is at the 40th percentile.

What one does with it is a tactical choice. While the reversal has been significant, future earnings discounting remains high historically. In either case, bubbles tend to overcorrect (sell off more than the fundamentals suggest) rather than simply deflate. But I wanted to share these updated readings with you in light of recent market activity.

You might also like

Jake Prins

3 years ago

What are NFTs 2.0 and what issues are they meant to address?

New standards help NFTs reach their full potential.

NFTs lack interoperability and functionality. They have great potential but are mostly speculative. To maximize NFTs, we need flexible smart contracts.

Current requirements are too restrictive.

Most NFTs are based on ERC-721, which makes exchanging them easy. CryptoKitties, a popular online game, used the 2017 standard to demonstrate NFTs' potential.

This simple standard includes a base URI and incremental IDs for tokens. Add the tokenID to the base URI to get the token's metadata.

This let creators collect NFTs. Many NFT projects store metadata on IPFS, a distributed storage network, but others use Google Drive. NFT buyers often don't realize that if the creators delete or move the files, their NFT is just a pointer.

This isn't the standard's biggest issue. There's no way to validate NFT projects.

Creators are one of the most important aspects of art, but nothing is stored on-chain.

ERC-721 contracts only have a name and symbol.

Most of the data on OpenSea's collection pages isn't from the NFT's smart contract. It was added through a platform input field, so it's in the marketplace's database. Other websites may have different NFT information.

In five years, your NFT will be just a name, symbol, and ID.

Your NFT doesn't mention its creators. Although the smart contract has a public key, it doesn't reveal who created it.

The NFT's creators and their reputation are crucial to its value. Think digital fashion and big brands working with well-known designers when more professionals use NFTs. Don't you want them in your NFT?

Would paintings be as valuable if their artists were unknown? Would you believe it's real?

Buying directly from an on-chain artist would reduce scams. Current standards don't allow this data.

Most creator profiles live on centralized marketplaces and could disappear. Current platforms have outpaced underlying standards. The industry's standards are lagging.

For NFTs to grow beyond pointers to a monkey picture file, we may need to use new Web3-based standards.

Introducing NFTs 2.0

Fabian Vogelsteller, creator of ERC-20, developed new web3 standards. He proposed LSP7 Digital Asset and LSP8 Identifiable Digital Asset, also called NFT 2.0.

NFT and token metadata inputs are extendable. Changes to on-chain metadata inputs allow NFTs to evolve. Instead of public keys, the contract can have Universal Profile addresses attached. These profiles show creators' faces and reputations. NFTs can notify asset receivers, automating smart contracts.

LSP7 and LSP8 use ERC725Y. Using a generic data key-value store gives contracts much-needed features:

The asset can be customized and made to stand out more by allowing for unlimited data attachment.

Recognizing changes to the metadata

using a hash reference for metadata rather than a URL reference

This base will allow more metadata customization and upgradeability. These guidelines are:

Genuine and Verifiable Now, the creation of an NFT by a specific Universal Profile can be confirmed by smart contracts.

Dynamic NFTs can update Flexible & Updatable Metadata, allowing certain things to evolve over time.

Protected metadata Now, secure metadata that is readable by smart contracts can be added indefinitely.

Better NFTS prevent the locking of NFTs by only being sent to Universal Profiles or a smart contract that can interact with them.

Summary

NFTS standards lack standardization and powering features, limiting the industry.

ERC-721 is the most popular NFT standard, but it only represents incremental tokenIDs without metadata or asset representation. No standard sender-receiver interaction or security measures ensure safe asset transfers.

NFT 2.0 refers to the new LSP7-DigitalAsset and LSP8-IdentifiableDigitalAsset standards.

They have new standards for flexible metadata, secure transfers, asset representation, and interactive transfer.

With NFTs 2.0 and Universal Profiles, creators could build on-chain reputations.

NFTs 2.0 could bring the industry's needed innovation if it wants to move beyond trading profile pictures for speculation.

Alex Mathers

3 years ago

8 guidelines to help you achieve your objectives 5x fast

If you waste time every day, even though you're ambitious, you're not alone.

Many of us could use some new time-management strategies, like these:

Focus on the following three.

You're thinking about everything at once.

You're overpowered.

It's mental. We just have what's in front of us. So savor the moment's beauty.

Prioritize 1-3 things.

To be one of the most productive people you and I know, follow these steps.

Get along with boredom.

Many of us grow bored, sweat, and turn on Netflix.

We shout, "I'm rarely bored!" Look at me! I'm happy.

Shut it, Sally.

You're not making wonderful things for the world. Boredom matters.

If you can sit with it for a second, you'll get insight. Boredom? Breathe.

Go blank.

Then watch your creativity grow.

Check your MacroVision once more.

We don't know what to do with our time, which contributes to time-wasting.

Nobody does, either. Jeff Bezos won't hand-deliver that crap to you.

Daily vision checks are required.

Also:

What are 5 things you'd love to create in the next 5 years?

You're soul-searching. It's food.

Return here regularly, and you'll adore the high you get from doing valuable work.

Improve your thinking.

What's Alex's latest nonsense?

I'm talking about overcoming our own thoughts. Worrying wastes so much time.

Too many of us are assaulted by lies, myths, and insecurity.

Stop letting your worries massage you into a worried coma like a Thai woman.

Optimizing your thoughts requires accepting what you can't control.

It means letting go of unhelpful thoughts and returning to the moment.

Keep your blood sugar level.

I gave up gluten, donuts, and sweets.

This has really boosted my energy.

Blood-sugar-spiking carbs make us irritable and tired.

These day-to-day ups and downs aren't productive. It's crucial.

Know how your diet affects insulin levels. Now I have more energy and can do more without clenching my teeth.

Reduce harmful carbs to boost energy.

Create a focused setting for yourself.

When we optimize the mind, we have more energy and use our time better because we're not tense.

Changing our environment can also help us focus. Disabling alerts is one example.

Too hot makes me procrastinate and irritable.

List five items that hinder your productivity.

You may be amazed at how much you may improve by removing distractions.

Be responsible.

Accountability is a time-saver.

Creating an emotional pull to finish things.

Writing down our goals makes us accountable.

We can engage a coach or work with an accountability partner to feel horrible if we don't show up and finish on time.

‘Hey Jake, I’m going to write 1000 words every day for 30 days — you need to make sure I do.’ ‘Sure thing, Nathan, I’ll be making sure you check in daily with me.’

Tick.

You might also blog about your ambitions to show your dedication.

Now you can't hide when you promised to appear.

Acquire a liking for bravery.

Boldness changes everything.

I sometimes feel lazy and wonder why. If my food and sleep are in order, I should assess my footing.

Most of us live backward. Doubtful. Uncertain. Feelings govern us.

Backfooting isn't living. It's lame, and you'll soon melt. Live boldly now.

Be assertive.

Get disgustingly into everything. Expand.

Even if it's hard, stop being a b*tch.

Those that make Mr. Bold Bear their spirit animal benefit. Save time to maximize your effect.

Samer Buna

2 years ago

The Errors I Committed As a Novice Programmer

Learn to identify them, make habits to avoid them

First, a clarification. This article is aimed to make new programmers aware of their mistakes, train them to detect them, and remind them to prevent them.

I learned from all these blunders. I'm glad I have coding habits to avoid them. Do too.

These mistakes are not ordered.

1) Writing code haphazardly

Writing good content is hard. It takes planning and investigation. Quality programs don't differ.

Think. Research. Plan. Write. Validate. Modify. Unfortunately, no good acronym exists. Create a habit of doing the proper quantity of these activities.

As a newbie programmer, my biggest error was writing code without thinking or researching. This works for small stand-alone apps but hurts larger ones.

Like saying anything you might regret, you should think before coding something you could regret. Coding expresses your thoughts.

When angry, count to 10 before you speak. If very angry, a hundred. — Thomas Jefferson.

My quote:

When reviewing code, count to 10 before you refactor a line. If the code does not have tests, a hundred. — Samer Buna

Programming is primarily about reviewing prior code, investigating what is needed and how it fits into the current system, and developing small, testable features. Only 10% of the process involves writing code.

Programming is not writing code. Programming need nurturing.

2) Making excessive plans prior to writing code

Yes. Planning before writing code is good, but too much of it is bad. Water poisons.

Avoid perfect plans. Programming does not have that. Find a good starting plan. Your plan will change, but it helped you structure your code for clarity. Overplanning wastes time.

Only planning small features. All-feature planning should be illegal! The Waterfall Approach is a step-by-step system. That strategy requires extensive planning. This is not planning. Most software projects fail with waterfall. Implementing anything sophisticated requires agile changes to reality.

Programming requires responsiveness. You'll add waterfall plan-unthinkable features. You will eliminate functionality for reasons you never considered in a waterfall plan. Fix bugs and adjust. Be agile.

Plan your future features, though. Do it cautiously since too little or too much planning can affect code quality, which you must risk.

3) Underestimating the Value of Good Code

Readability should be your code's exclusive goal. Unintelligible code stinks. Non-recyclable.

Never undervalue code quality. Coding communicates implementations. Coders must explicitly communicate solution implementations.

Programming quote I like:

Always code as if the guy who ends up maintaining your code will be a violent psychopath who knows where you live. — John Woods

John, great advice!

Small things matter. If your indentation and capitalization are inconsistent, you should lose your coding license.

Long queues are also simple. Readability decreases after 80 characters. To highlight an if-statement block, you might put a long condition on the same line. No. Just never exceed 80 characters.

Linting and formatting tools fix many basic issues like this. ESLint and Prettier work great together in JavaScript. Use them.

Code quality errors:

Multiple lines in a function or file. Break long code into manageable bits. My rule of thumb is that any function with more than 10 lines is excessively long.

Double-negatives. Don't.

Using double negatives is just very not not wrong

Short, generic, or type-based variable names. Name variables clearly.

There are only two hard things in Computer Science: cache invalidation and naming things. — Phil Karlton

Hard-coding primitive strings and numbers without descriptions. If your logic relies on a constant primitive string or numeric value, identify it.

Avoiding simple difficulties with sloppy shortcuts and workarounds. Avoid evasion. Take stock.

Considering lengthier code better. Shorter code is usually preferable. Only write lengthier versions if they improve code readability. For instance, don't utilize clever one-liners and nested ternary statements just to make the code shorter. In any application, removing unneeded code is better.

Measuring programming progress by lines of code is like measuring aircraft building progress by weight. — Bill Gates

Excessive conditional logic. Conditional logic is unnecessary for most tasks. Choose based on readability. Measure performance before optimizing. Avoid Yoda conditions and conditional assignments.

4) Selecting the First Approach

When I started programming, I would solve an issue and move on. I would apply my initial solution without considering its intricacies and probable shortcomings.

After questioning all the solutions, the best ones usually emerge. If you can't think of several answers, you don't grasp the problem.

Programmers do not solve problems. Find the easiest solution. The solution must work well and be easy to read, comprehend, and maintain.

There are two ways of constructing a software design. One way is to make it so simple that there are obviously no deficiencies, and the other way is to make it so complicated that there are no obvious deficiencies. — C.A.R. Hoare

5) Not Giving Up

I generally stick with the original solution even though it may not be the best. The not-quitting mentality may explain this. This mindset is helpful for most things, but not programming. Program writers should fail early and often.

If you doubt a solution, toss it and rethink the situation. No matter how much you put in that solution. GIT lets you branch off and try various solutions. Use it.

Do not be attached to code because of how much effort you put into it. Bad code needs to be discarded.

6) Avoiding Google

I've wasted time solving problems when I should have researched them first.

Unless you're employing cutting-edge technology, someone else has probably solved your problem. Google It First.

Googling may discover that what you think is an issue isn't and that you should embrace it. Do not presume you know everything needed to choose a solution. Google surprises.

But Google carefully. Newbies also copy code without knowing it. Use only code you understand, even if it solves your problem.

Never assume you know how to code creatively.

The most dangerous thought that you can have as a creative person is to think that you know what you’re doing. — Bret Victor

7) Failing to Use Encapsulation

Not about object-oriented paradigm. Encapsulation is always useful. Unencapsulated systems are difficult to maintain.

An application should only handle a feature once. One object handles that. The application's other objects should only see what's essential. Reducing application dependencies is not about secrecy. Following these guidelines lets you safely update class, object, and function internals without breaking things.

Classify logic and state concepts. Class means blueprint template. Class or Function objects are possible. It could be a Module or Package.

Self-contained tasks need methods in a logic class. Methods should accomplish one thing well. Similar classes should share method names.

As a rookie programmer, I didn't always establish a new class for a conceptual unit or recognize self-contained units. Newbie code has a Util class full of unrelated code. Another symptom of novice code is when a small change cascades and requires numerous other adjustments.

Think before adding a method or new responsibilities to a method. Time's needed. Avoid skipping or refactoring. Start right.

High Cohesion and Low Coupling involves grouping relevant code in a class and reducing class dependencies.

8) Arranging for Uncertainty

Thinking beyond your solution is appealing. Every line of code will bring up what-ifs. This is excellent for edge cases but not for foreseeable needs.

Your what-ifs must fall into one of these two categories. Write only code you need today. Avoid future planning.

Writing a feature for future use is improper. No.

Write only the code you need today for your solution. Handle edge-cases, but don't introduce edge-features.

Growth for the sake of growth is the ideology of the cancer cell. — Edward Abbey

9) Making the incorrect data structure choices

Beginner programmers often overemphasize algorithms when preparing for interviews. Good algorithms should be identified and used when needed, but memorizing them won't make you a programming genius.

However, learning your language's data structures' strengths and shortcomings will make you a better developer.

The improper data structure shouts "newbie coding" here.

Let me give you a few instances of data structures without teaching you:

Managing records with arrays instead of maps (objects).

Most data structure mistakes include using lists instead of maps to manage records. Use a map to organize a list of records.

This list of records has an identifier to look up each entry. Lists for scalar values are OK and frequently superior, especially if the focus is pushing values to the list.

Arrays and objects are the most common JavaScript list and map structures, respectively (there is also a map structure in modern JavaScript).

Lists over maps for record management often fail. I recommend always using this point, even though it only applies to huge collections. This is crucial because maps are faster than lists in looking up records by identifier.

Stackless

Simple recursive functions are often tempting when writing recursive programming. In single-threaded settings, optimizing recursive code is difficult.

Recursive function returns determine code optimization. Optimizing a recursive function that returns two or more calls to itself is harder than optimizing a single call.

Beginners overlook the alternative to recursive functions. Use Stack. Push function calls to a stack and start popping them out to traverse them back.

10) Worsening the current code

Imagine this:

Add an item to that room. You might want to store that object anywhere as it's a mess. You can finish in seconds.

Not with messy code. Do not worsen! Keep the code cleaner than when you started.

Clean the room above to place the new object. If the item is clothing, clear a route to the closet. That's proper execution.

The following bad habits frequently make code worse:

code duplication You are merely duplicating code and creating more chaos if you copy/paste a code block and then alter just the line after that. This would be equivalent to adding another chair with a lower base rather than purchasing a new chair with a height-adjustable seat in the context of the aforementioned dirty room example. Always keep abstraction in mind, and use it when appropriate.

utilizing configuration files not at all. A configuration file should contain the value you need to utilize if it may differ in certain circumstances or at different times. A configuration file should contain a value if you need to use it across numerous lines of code. Every time you add a new value to the code, simply ask yourself: "Does this value belong in a configuration file?" The most likely response is "yes."

using temporary variables and pointless conditional statements. Every if-statement represents a logic branch that should at the very least be tested twice. When avoiding conditionals doesn't compromise readability, it should be done. The main issue with this is that branch logic is being used to extend an existing function rather than creating a new function. Are you altering the code at the appropriate level, or should you go think about the issue at a higher level every time you feel you need an if-statement or a new function variable?

This code illustrates superfluous if-statements:

function isOdd(number) {

if (number % 2 === 1) {

return true;

} else {

return false;

}

}Can you spot the biggest issue with the isOdd function above?

Unnecessary if-statement. Similar code:

function isOdd(number) {

return (number % 2 === 1);

};11) Making remarks on things that are obvious

I've learnt to avoid comments. Most code comments can be renamed.

instead of:

// This function sums only odd numbers in an array

const sum = (val) => {

return val.reduce((a, b) => {

if (b % 2 === 1) { // If the current number is odd

a+=b; // Add current number to accumulator

}

return a; // The accumulator

}, 0);

};Commentless code looks like this:

const sumOddValues = (array) => {

return array.reduce((accumulator, currentNumber) => {

if (isOdd(currentNumber)) {

return accumulator + currentNumber;

}

return accumulator;

}, 0);

};Better function and argument names eliminate most comments. Remember that before commenting.

Sometimes you have to use comments to clarify the code. This is when your comments should answer WHY this code rather than WHAT it does.

Do not write a WHAT remark to clarify the code. Here are some unnecessary comments that clutter code:

// create a variable and initialize it to 0

let sum = 0;

// Loop over array

array.forEach(

// For each number in the array

(number) => {

// Add the current number to the sum variable

sum += number;

}

);Avoid that programmer. Reject that code. Remove such comments if necessary. Most importantly, teach programmers how awful these remarks are. Tell programmers who publish remarks like this that they may lose their jobs. That terrible.

12) Skipping tests

I'll simplify. If you develop code without tests because you think you're an excellent programmer, you're a rookie.

If you're not writing tests in code, you're probably testing manually. Every few lines of code in a web application will be refreshed and interacted with. Also. Manual code testing is fine. To learn how to automatically test your code, manually test it. After testing your application, return to your code editor and write code to automatically perform the same interaction the next time you add code.

Human. After each code update, you will forget to test all successful validations. Automate it!

Before writing code to fulfill validations, guess or design them. TDD is real. It improves your feature design thinking.

If you can use TDD, even partially, do so.

13) Making the assumption that if something is working, it must be right.

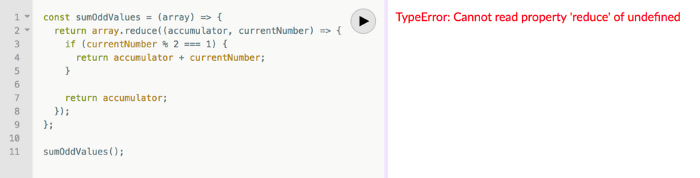

See this sumOddValues function. Is it flawed?

const sumOddValues = (array) => {

return array.reduce((accumulator, currentNumber) => {

if (currentNumber % 2 === 1) {

return accumulator + currentNumber;

}

return accumulator;

});

};

console.assert(

sumOddValues([1, 2, 3, 4, 5]) === 9

);Verified. Good life. Correct?

Code above is incomplete. It handles some scenarios correctly, including the assumption used, but it has many other issues. I'll list some:

#1: No empty input handling. What happens when the function is called without arguments? That results in an error revealing the function's implementation:

TypeError: Cannot read property 'reduce' of undefined.

Two main factors indicate faulty code.

Your function's users shouldn't come across implementation-related information.

The user cannot benefit from the error. Simply said, they were unable to use your function. They would be aware that they misused the function if the error was more obvious about the usage issue. You might decide to make the function throw a custom exception, for instance:

TypeError: Cannot execute function for empty list.Instead of returning an error, your method should disregard empty input and return a sum of 0. This case requires action.

Problem #2: No input validation. What happens if the function is invoked with a text, integer, or object instead of an array?

The function now throws:

sumOddValues(42);

TypeError: array.reduce is not a functionUnfortunately, array. cut's a function!

The function labels anything you call it with (42 in the example above) as array because we named the argument array. The error says 42.reduce is not a function.

See how that error confuses? An mistake like:

TypeError: 42 is not an array, dude.Edge-cases are #1 and #2. These edge-cases are typical, but you should also consider less obvious ones. Negative numbers—what happens?

sumOddValues([1, 2, 3, 4, 5, -13]) // => still 9-13's unusual. Is this the desired function behavior? Error? Should it sum negative numbers? Should it keep ignoring negative numbers? You may notice the function should have been titled sumPositiveOddNumbers.

This decision is simple. The more essential point is that if you don't write a test case to document your decision, future function maintainers won't know if you ignored negative values intentionally or accidentally.

It’s not a bug. It’s a feature. — Someone who forgot a test case

#3: Valid cases are not tested. Forget edge-cases, this function mishandles a straightforward case:

sumOddValues([2, 1, 3, 4, 5]) // => 11The 2 above was wrongly included in sum.

The solution is simple: reduce accepts a second input to initialize the accumulator. Reduce will use the first value in the collection as the accumulator if that argument is not provided, like in the code above. The sum included the test case's first even value.

This test case should have been included in the tests along with many others, such as all-even numbers, a list with 0 in it, and an empty list.

Newbie code also has rudimentary tests that disregard edge-cases.

14) Adhering to Current Law

Unless you're a lone supercoder, you'll encounter stupid code. Beginners don't identify it and assume it's decent code because it works and has been in the codebase for a while.

Worse, if the terrible code uses bad practices, the newbie may be enticed to use them elsewhere in the codebase since they learnt them from good code.

A unique condition may have pushed the developer to write faulty code. This is a nice spot for a thorough note that informs newbies about that condition and why the code is written that way.

Beginners should presume that undocumented code they don't understand is bad. Ask. Enquire. Blame it!

If the code's author is dead or can't remember it, research and understand it. Only after understanding the code can you judge its quality. Before that, presume nothing.

15) Being fixated on best practices

Best practices damage. It suggests no further research. Best practice ever. No doubts!

No best practices. Today's programming language may have good practices.

Programming best practices are now considered bad practices.

Time will reveal better methods. Focus on your strengths, not best practices.

Do not do anything because you read a quote, saw someone else do it, or heard it is a recommended practice. This contains all my article advice! Ask questions, challenge theories, know your options, and make informed decisions.

16) Being preoccupied with performance

Premature optimization is the root of all evil (or at least most of it) in programming — Donald Knuth (1974)

I think Donald Knuth's advice is still relevant today, even though programming has changed.

Do not optimize code if you cannot measure the suspected performance problem.

Optimizing before code execution is likely premature. You may possibly be wasting time optimizing.

There are obvious optimizations to consider when writing new code. You must not flood the event loop or block the call stack in Node.js. Remember this early optimization. Will this code block the call stack?

Avoid non-obvious code optimization without measurements. If done, your performance boost may cause new issues.

Stop optimizing unmeasured performance issues.

17) Missing the End-User Experience as a Goal

How can an app add a feature easily? Look at it from your perspective or in the existing User Interface. Right? Add it to the form if the feature captures user input. Add it to your nested menu of links if it adds a link to a page.

Avoid that developer. Be a professional who empathizes with customers. They imagine this feature's consumers' needs and behavior. They focus on making the feature easy to find and use, not just adding it to the software.

18) Choosing the incorrect tool for the task

Every programmer has their preferred tools. Most tools are good for one thing and bad for others.

The worst tool for screwing in a screw is a hammer. Do not use your favorite hammer on a screw. Don't use Amazon's most popular hammer on a screw.

A true beginner relies on tool popularity rather than problem fit.

You may not know the best tools for a project. You may know the best tool. However, it wouldn't rank high. You must learn your tools and be open to new ones.

Some coders shun new tools. They like their tools and don't want to learn new ones. I can relate, but it's wrong.

You can build a house slowly with basic tools or rapidly with superior tools. You must learn and use new tools.

19) Failing to recognize that data issues are caused by code issues

Programs commonly manage data. The software will add, delete, and change records.

Even the simplest programming errors can make data unpredictable. Especially if the same defective application validates all data.

Code-data relationships may be confusing for beginners. They may employ broken code in production since feature X is not critical. Buggy coding may cause hidden data integrity issues.

Worse, deploying code that corrected flaws without fixing minor data problems caused by these defects will only collect more data problems that take the situation into the unrecoverable-level category.

How do you avoid these issues? Simply employ numerous data integrity validation levels. Use several interfaces. Front-end, back-end, network, and database validations. If not, apply database constraints.

Use all database constraints when adding columns and tables:

If a column has a NOT NULL constraint, null values will be rejected for that column. If your application expects that field has a value, your database should designate its source as not null.

If a column has a UNIQUE constraint, the entire table cannot include duplicate values for that column. This is ideal for a username or email field on a Users table, for instance.

For the data to be accepted, a CHECK constraint, or custom expression, must evaluate to true. For instance, you can apply a check constraint to ensure that the values of a normal % column must fall within the range of 0 and 100.

With a PRIMARY KEY constraint, the values of the columns must be both distinct and not null. This one is presumably what you're utilizing. To distinguish the records in each table, the database needs have a primary key.

A FOREIGN KEY constraint requires that the values in one database column, typically a primary key, match those in another table column.

Transaction apathy is another data integrity issue for newbies. If numerous actions affect the same data source and depend on each other, they must be wrapped in a transaction that can be rolled back if one fails.

20) Reinventing the Wheel

Tricky. Some programming wheels need reinvention. Programming is undefined. New requirements and changes happen faster than any team can handle.

Instead of modifying the wheel we all adore, maybe we should rethink it if you need a wheel that spins at varied speeds depending on the time of day. If you don't require a non-standard wheel, don't reinvent it. Use the darn wheel.

Wheel brands can be hard to choose from. Research and test before buying! Most software wheels are free and transparent. Internal design quality lets you evaluate coding wheels. Try open-source wheels. Debug and fix open-source software simply. They're easily replaceable. In-house support is also easy.

If you need a wheel, don't buy a new automobile and put your maintained car on top. Do not include a library to use a few functions. Lodash in JavaScript is the finest example. Import shuffle to shuffle an array. Don't import lodash.

21) Adopting the incorrect perspective on code reviews

Beginners often see code reviews as criticism. Dislike them. Not appreciated. Even fear them.

Incorrect. If so, modify your mindset immediately. Learn from every code review. Salute them. Observe. Most crucial, thank reviewers who teach you.

Always learning code. Accept it. Most code reviews teach something new. Use these for learning.

You may need to correct the reviewer. If your code didn't make that evident, it may need to be changed. If you must teach your reviewer, remember that teaching is one of the most enjoyable things a programmer can do.

22) Not Using Source Control

Newbies often underestimate Git's capabilities.

Source control is more than sharing your modifications. It's much bigger. Clear history is source control. The history of coding will assist address complex problems. Commit messages matter. They are another way to communicate your implementations, and utilizing them with modest commits helps future maintainers understand how the code got where it is.

Commit early and often with present-tense verbs. Summarize your messages but be detailed. If you need more than a few lines, your commit is too long. Rebase!

Avoid needless commit messages. Commit summaries should not list new, changed, or deleted files. Git commands can display that list from the commit object. The summary message would be noise. I think a big commit has many summaries per file altered.

Source control involves discoverability. You can discover the commit that introduced a function and see its context if you doubt its need or design. Commits can even pinpoint which code caused a bug. Git has a binary search within commits (bisect) to find the bug-causing commit.

Source control can be used before commits to great effect. Staging changes, patching selectively, resetting, stashing, editing, applying, diffing, reversing, and others enrich your coding flow. Know, use, and enjoy them.

I consider a Git rookie someone who knows less functionalities.

23) Excessive Use of Shared State

Again, this is not about functional programming vs. other paradigms. That's another article.

Shared state is problematic and should be avoided if feasible. If not, use shared state as little as possible.

As a new programmer, I didn't know that all variables represent shared states. All variables in the same scope can change its data. Global scope reduces shared state span. Keep new states in limited scopes and avoid upward leakage.

When numerous resources modify common state in the same event loop tick, the situation becomes severe (in event-loop-based environments). Races happen.

This shared state race condition problem may encourage a rookie to utilize a timer, especially if they have a data lock issue. Red flag. No. Never accept it.

24) Adopting the Wrong Mentality Toward Errors

Errors are good. Progress. They indicate a simple way to improve.

Expert programmers enjoy errors. Newbies detest them.

If these lovely red error warnings irritate you, modify your mindset. Consider them helpers. Handle them. Use them to advance.

Some errors need exceptions. Plan for user-defined exceptions. Ignore some mistakes. Crash and exit the app.

25) Ignoring rest periods

Humans require mental breaks. Take breaks. In the zone, you'll forget breaks. Another symptom of beginners. No compromises. Make breaks mandatory in your process. Take frequent pauses. Take a little walk to plan your next move. Reread the code.

This has been a long post. You deserve a break.